Global Smart Doorbell Market

Market Size in USD Billion

CAGR :

%

USD

8.69 Billion

USD

338.85 Billion

2024

2032

USD

8.69 Billion

USD

338.85 Billion

2024

2032

| 2025 –2032 | |

| USD 8.69 Billion | |

| USD 338.85 Billion | |

|

|

|

|

Smart Doorbell Market Size

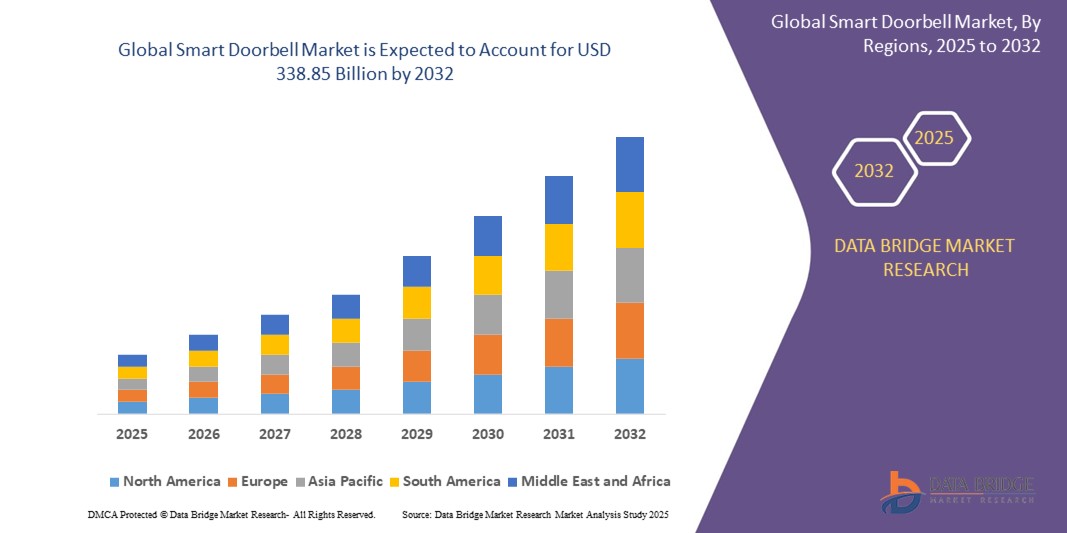

- The global smart doorbell market size was valued at USD 8.69 billion in 2024 and is expected to reach USD 338.85 billion by 2032, at a CAGR of 58.07% during the forecast period

- The market growth is driven by increasing adoption of smart home technologies, heightened consumer focus on home security, and advancements in connected devices facilitating seamless integration with home automation systems

- Growing demand for convenient, remotely accessible security solutions in residential and corporate settings is positioning smart doorbells as a preferred choice for modern access monitoring, significantly contributing to market expansion

Smart Doorbell Market Analysis

- Smart doorbells, equipped with cameras, motion sensors, and two-way communication, are becoming essential components of home security and automation systems, offering remote monitoring, real-time alerts, and integration with smart home ecosystems

- The surge in demand is propelled by rising security concerns, the convenience of wireless and app-based controls, and the growing penetration of IoT-enabled devices in households and businesses

- North America held the largest market share of 38.5% in 2024, driven by early adoption of smart home technologies, high consumer purchasing power, and the presence of leading market players

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, fueled by rapid urbanization, increasing disposable incomes, and growing awareness of smart security solutions

- The wireless segment dominated the largest market revenue share of 65.0% in 2024, driven by its ease of installation, flexibility, and compatibility with various receivers, eliminating the need for complex wiring

Report Scope and Smart Doorbell Market Segmentation

|

Attributes |

Smart Doorbell Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Doorbell Market Trends

“Increasing Integration of AI and IoT Technologies”

- The global smart doorbell market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies

- These technologies enable advanced features such as facial recognition, motion detection, and real-time alerts, providing enhanced security and convenience for users

- AI-powered smart doorbells can analyze visitor patterns, detect suspicious activities, and offer personalized notifications based on user preferences or recognized individuals

- For instance, companies are developing AI-driven platforms that integrate with smart home ecosystems, allowing seamless control of doorbells alongside other devices such as smart locks and security cameras

- IoT connectivity enhances remote monitoring capabilities, enabling homeowners to view live feeds and communicate with visitors via smartphones, regardless of their location

- This trend is increasing the appeal of smart doorbells for both residential and commercial users, driving market growth by offering sophisticated, user-friendly solutions

Smart Doorbell Market Dynamics

Driver

“Rising Demand for Smart Home Security and Automation”

- Growing consumer demand for smart home solutions, including enhanced security, remote access, and automation, is a key driver for the global smart doorbell market

- Smart doorbells provide advanced features such as two-way audio, high-definition video, night vision, and motion detection, improving safety and user convenience

- Government initiatives promoting smart city development, particularly in regions such as Asia-Pacific and North America, are encouraging the adoption of smart home devices, including doorbells

- The widespread availability of high-speed internet and advancements in 5G technology are enabling faster data transmission and more reliable connectivity for smart doorbell applications

- Manufacturers are increasingly offering integrated smart doorbells as standard features in new residential and commercial properties to meet consumer expectations and enhance property value

Restraint/Challenge

“High Initial Costs and Data Privacy Concerns”

- The high initial costs associated with the hardware, software, and installation of smart doorbell systems can be a significant barrier to adoption, particularly in cost-sensitive markets

- Retrofitting existing homes or buildings with smart doorbells can be complex and expensive, deterring potential buyers

- Data privacy and security concerns are a major challenge, as smart doorbells collect sensitive data, including video footage and visitor information, raising risks of breaches or misuse

- Compliance with varying data protection regulations across countries, such as GDPR in Europe, adds complexity for manufacturers and service providers operating globally

- These factors may limit market growth in regions with high privacy awareness or where consumers prioritize affordability over advanced features

Smart Doorbell market Scope

The market is segmented on the basis of connectivity, product, component, end user, and sales channel.

- By Connectivity

On the basis of connectivity, the market is segmented into wired and wireless. The wireless segment dominated the largest market revenue share of 65.0% in 2024, driven by its ease of installation, flexibility, and compatibility with various receivers, eliminating the need for complex wiring. Wireless smart doorbells are widely adopted due to their versatility and advanced features such as Wi-Fi connectivity, night vision, and integration with smart home ecosystems.

The wired segment is anticipated to witness significant growth from 2025 to 2032, with a projected CAGR of 16.8%. This growth is fueled by the reliability and consistent power supply of wired systems, making them suitable for high-traffic environments and consumers seeking robust, uninterrupted connectivity.

- By Product

On the basis of product, the market is segmented into stand-alone and integrated. The integrated smart doorbell segment dominated with a market revenue share of 60.2% in 2024, driven by consumer preference for seamless integration with broader smart home systems, offering centralized control for security and automation. These systems are favored by tech-savvy homeowners and those with existing home automation setups.

The stand-alone smart doorbell segment is projected to experience the fastest growth rate of 18.5% from 2025 to 2032, attributed to its simplicity, affordability, and appeal to renters or consumers new to smart home technology who seek straightforward, budget-friendly solutions without requiring extensive integration.

- By Component

On the basis of component, the market is segmented into hardware, software, and services. The hardware segment dominated the largest market revenue share of 58.7% in 2024, driven by the critical role of physical components such as cameras, motion sensors, and microphones in enabling core functionalities such as video surveillance and visitor communication. Advancements in hardware, including high-resolution cameras and AI-driven features, further boost this segment.

The software segment is anticipated to witness the fastest growth from 2025 to 2032, with a CAGR of 19.2%. This growth is propelled by increasing demand for user-friendly apps and AI-powered features such as facial recognition and real-time alerts, enhancing remote monitoring and control via smartphones and tablets.

- By End User

On the basis of end user, the market is segmented into corporate, residential, and industrial. The residential segment dominated with a market revenue share of 70.8% in 2024, fueled by rising consumer awareness of home security, increasing adoption of smart home technologies, and the need for convenience in managing deliveries and visitors.

The commercial segment is projected to experience the fastest growth rate of 31.9% from 2025 to 2032, driven by the growing need for enhanced security and access control in offices, hotels, and commercial spaces. Smart doorbells facilitate real-time monitoring and visitor management, supporting high-traffic environments.

- By Sales Channel

On the basis of sales channel, the market is segmented into organized retailers and online/e-commerce. The online/e-commerce segment dominated the largest market revenue share of 62.3% in 2024, driven by the convenience of online purchasing, access to a wide range of products, and competitive pricing from global manufacturers. The rise in e-commerce adoption, particularly post-COVID, further accelerates this segment's dominance.

The organized retailers segment is anticipated to witness robust growth from 2025 to 2032, with a CAGR of 17.4%. This growth is supported by consumers seeking in-person product knowledge and installation support from specialty retail stores, despite competition from e-commerce platforms.

Smart Doorbell Market Regional Analysis

- North America held the largest market share of 38.5% in 2024, driven by early adoption of smart home technologies, high consumer purchasing power, and the presence of leading market players

- Consumers prioritize smart doorbells for enhanced security, remote monitoring, and integration with smart home ecosystems, particularly in regions with high crime rates and tech-savvy populations

U.S. Smart Doorbell Market Insight

The U.S. smart doorbell market captured the largest revenue share of 83.5% in 2024 within North America, fueled by strong demand in both OEM and aftermarket segments and growing consumer awareness of security and convenience benefits. The trend towards smart home integration and increasing regulations promoting data privacy and safety standards further boost market expansion. The preference for wireless doorbells, advanced hardware such as high-resolution cameras, and online/e-commerce sales channels drives market growth.

Europe Smart Doorbell Market Insight

The Europe smart doorbell market is expected to witness a significant growth rate, supported by regulatory emphasis on home security and consumer comfort. Consumers seek wireless and integrated smart doorbells that enhance visibility and offer remote communication, with hardware components such as cameras and motion sensors being key drivers. Growth is prominent in both residential and corporate installations, with countries such as Germany and France showing notable uptake due to rising smart city initiatives and urban security concerns.

U.K. Smart Doorbell Market Insight

The U.K. market for smart doorbells is expected to witness rapid growth, driven by demand for enhanced residential security and convenience in urban and suburban settings. Increased interest in integrated smart doorbells with features such as two-way audio and AI-driven facial recognition encourages adoption. Evolving regulations balancing privacy with security influence consumer choices, with online/e-commerce platforms emerging as a dominant sales channel.

Germany Smart Doorbell Market Insight

Germany is expected to witness a high growth rate in the smart doorbell market, attributed to its advanced technological infrastructure and strong consumer focus on security and smart home integration. German consumers prefer integrated smart doorbells with advanced hardware, such as high-definition cameras and motion sensors, to enhance safety and convenience. The integration of these devices in premium residential and corporate settings, along with strong online/e-commerce sales, supports sustained market growth.

Asia-Pacific Smart Doorbell Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding smart home adoption and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of security, remote monitoring, and aesthetic benefits boosts demand for wireless and integrated smart doorbells. Government initiatives promoting smart cities and IoT integration further encourage the use of advanced hardware and software components across residential and industrial end users.

Japan Smart Doorbell Market Insight

Japan’s smart doorbell market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced wireless doorbells that enhance security and convenience. The presence of major smart home solution providers and integration of stand-alone and integrated doorbells in OEM vehicles accelerate market penetration. Rising interest in aftermarket customization and online/e-commerce sales also contributes to growth.

China Smart Doorbell Market Insight

China holds the largest share of the Asia-Pacific smart doorbell market, propelled by rapid urbanization, rising smart home ownership, and increasing demand for security and remote monitoring solutions. The country’s growing middle class and focus on IoT-enabled devices support the adoption of wireless smart doorbells with advanced hardware and software components. Strong domestic manufacturing capabilities and competitive pricing through online/e-commerce channels enhance market accessibility.

Smart Doorbell Market Share

The smart doorbell industry is primarily led by well-established companies, including:

- August Home (U.S.)

- dbell Inc. (Canada)

- Google (U.S.)

- SkyBell Technologies, Inc. (U.S.)

- Vivint, Inc. (U.S.)

- Zmodo (U.S.)

- EquesHome (U.S.)

- VTech Communications, Inc. (Hong Kong)

- Simplisafe, Inc. (U.S.)

- Arlo (U.S.)

- ADT (U.S.)

- Owlet Home LLC (U.S.)

- Netvue, INC. (U.S.)

- VOXX International Corp. (U.S.)

- LaView Eagle-Eye Technology Inc. (U.S.)

- Night Owl Security Products (U.S.)

What are the Recent Developments in Global Smart Doorbell Market?

- In January 2025, Apple is expected to launch its first smart doorbell camera, marking a significant expansion of its smart home product line. Reports suggest the device will feature Face ID technology, allowing users to unlock doors seamlessly upon recognition. Apple has reportedly developed a proprietary Proxima wireless chip to ensure secure local processing of Face ID data. The smart doorbell may integrate with HomeKit-compatible smart locks, enhancing security and convenience. This move positions Apple as a major competitor in the smart home market.

- In May 2024, Xiaomi unveiled the Smart Maoyan 2, a next-generation smart doorbell camera designed for enhanced home security. Featuring an 8000 mAh battery, it offers up to 300 days of operation in long-life mode. The 3-megapixel high-definition camera delivers 2048 x 1536 resolution with HDR support, ensuring clear and detailed images even in challenging lighting conditions. Equipped with infrared night vision, a 180-degree wide-angle lens, and dual PIR motion sensors, it provides comprehensive entryway monitoring

- In April 2024, Qubo, a leading smart device provider in India, launched Qubo InstaView, a next-generation video door phone that combines the Qubo Video Doorbell Pro with the Qubo Home Tab. This innovative bundle enhances home security by allowing users to see, talk, and unlock doors remotely via a portable display unit or smartphone. Featuring a 3MP 2K resolution camera, dual-band Wi-Fi, and PoE connectivity, InstaView offers seamless integration for modern homes. This marks a shift toward smart, connected security solutions

- In August 2024, Ring (Amazon) introduced its next-generation Battery Doorbell, featuring extended battery life, color night vision, and a 150-degree field of view for enhanced surveillance. The head-to-toe video capability provides a 66% taller view than previous models, ensuring better package monitoring and visitor identification. A new push-pin mounting system simplifies installation and battery recharging, making it more user-friendly. This innovation aligns with Ring’s commitment to smart home security, offering real-time alerts, motion detection, and two-way communication

- In August 2024, TP-Link introduced its Tapo smart video doorbell lineup, featuring cost-efficient models. The flagship Tapo D225 offers dual-powered operation, supporting battery and wired connections for 24/7 continuous recording. The budget-friendly Tapo D210 provides AI-based detection, color night vision, and two-way audio, ensuring enhanced security without subscription fees. Both models support microSD storage up to 512 GB, eliminating reliance on cloud storage. Designed for smart home integration, they are compatible with Amazon Alexa and Google Assistant

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.