Global Smart Electric Meter Market

Market Size in USD Billion

CAGR :

%

USD

28.87 Billion

USD

53.72 Billion

2024

2032

USD

28.87 Billion

USD

53.72 Billion

2024

2032

| 2025 –2032 | |

| USD 28.87 Billion | |

| USD 53.72 Billion | |

|

|

|

|

Smart Electric Meter Market Size

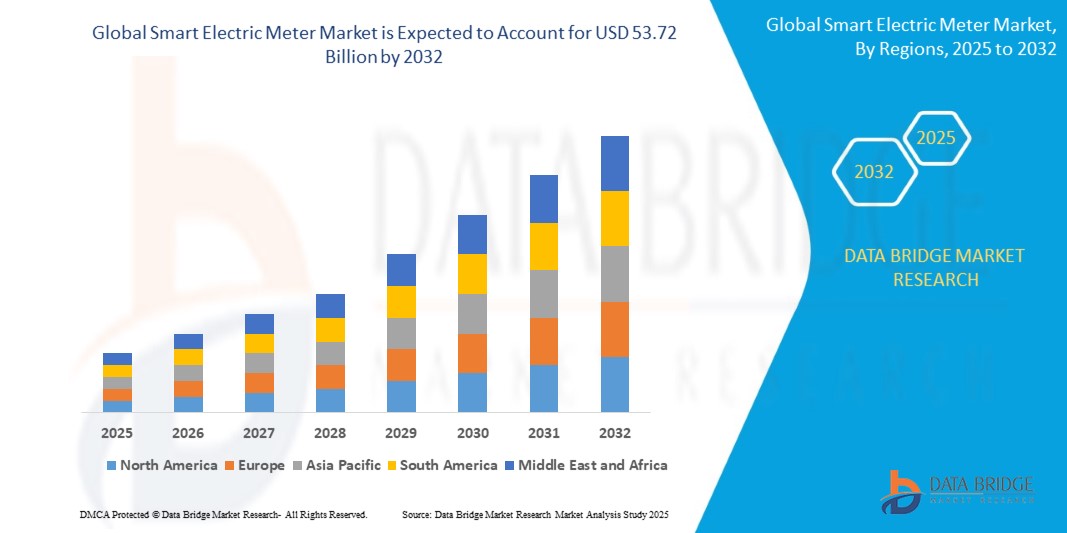

- The Global Smart Electric Meter Market was valued at USD 28.87 billion in 2024 and is projected to reach USD 53.72 billion by 2032, growing at a CAGR of 9.27% during the forecast period.

- This strong growth is driven by increasing global demand for real-time energy monitoring, grid modernization, and automated billing systems, supported by growing investments in smart grid infrastructure and clean energy policies.

Smart Electric Meter Market Analysis

- Smart electric meters enable two-way communication between utilities and consumers, allowing real-time data tracking, dynamic pricing, remote disconnection, and efficient energy management. Their integration supports the digital transformation of utilities and facilitates demand-side management and renewable energy integration.

- Government mandates for energy efficiency, combined with rising concerns over energy theft, carbon emissions, and aging electrical infrastructure, are accelerating smart meter rollouts in both developed and developing regions. Programs like AMI (Advanced Metering Infrastructure) are being expanded globally to improve utility service delivery and billing transparency.

- The widespread use of cloud-connected smart meters, IoT-based home energy management systems, and AI-powered grid analytics is transforming how electricity consumption is measured, billed, and optimized. These systems are integral to managing load patterns, improving outage detection, and enabling grid decentralization.

- While Asia-Pacific leads in deployment volume due to large-scale national rollouts in China, India, and Japan, North America and Europe are focusing on upgrading legacy infrastructure with next-gen smart meters that support distributed generation, electric vehicle (EV) charging, and real-time load balancing.

Report Scope and Smart Electric Meter Market Segmentation

|

Attributes |

Smart Electric Meter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Electric Meter Market Trends

“Advanced Metering Infrastructure, Grid Decentralization, and AI-Driven Energy Management”

- A major trend driving the smart electric meter market is the global shift from traditional metering to Advanced Metering Infrastructure (AMI). AMI enables two-way communication between utilities and customers, allowing real-time consumption tracking, outage detection, and load forecasting. This data-centric approach empowers both utilities and end users to optimize energy usage and reduce costs.

- Another accelerating trend is the integration of AI and machine learning in meter data analytics. Utilities are adopting smart meter platforms embedded with predictive algorithms to detect anomalies, forecast demand, and support dynamic pricing strategies. These tools enhance energy efficiency, reliability, and customer engagement across all segments.

- The rise of microgrids, distributed generation (DG), and virtual power plants (VPPs) is also transforming the role of smart meters. Meters now support bi-directional energy flow, enabling net metering, peer-to-peer trading, and the monitoring of renewable energy inputs from rooftop solar and small wind systems.

- Cybersecurity and data privacy have become key considerations in meter design. Vendors are increasingly embedding encryption protocols, secure firmware, and OTA (over-the-air) update capabilities to meet regulatory requirements and prevent tampering or energy theft.

- Lastly, the emergence of smart meter-as-a-service (SMaaS) models and utility cloud platforms is lowering the cost barrier for municipalities and utilities in developing regions, allowing widespread adoption with minimal capital expenditure.

Smart Electric Meter Market Dynamics

Driver

“Global Push for Energy Efficiency and Grid Modernization”

- The need to modernize outdated utility infrastructure is a primary driver of the smart electric meter market. Countries are launching large-scale smart grid initiatives to improve energy reliability, reduce losses, and integrate renewables.

- Regulatory support for real-time billing, time-of-use tariffs, and energy theft detection is incentivizing utilities to replace legacy meters with digital, communication-enabled devices.

- The global focus on carbon reduction targets under initiatives like the Paris Agreement, REPowerEU, and India’s Energy Conservation Act amendments is boosting smart meter deployments as part of broader decarbonization strategies.

- Additionally, urbanization and electrification of transportation are increasing demand for load visibility and distributed grid control, both of which are enabled by smart meters.

Restraint/Challenge

“High Initial Costs, Interoperability Issues, and Consumer Resistance”

- Despite long-term cost savings, the upfront cost of smart meter infrastructure (including installation, communication networks, and IT systems) can be prohibitive, especially for utilities in low-income or rural areas.

- Data privacy concerns, especially regarding user consumption patterns and location-based tracking, have led to resistance in some consumer markets. Ensuring compliance with GDPR, NIST, and other data protection frameworks adds to implementation complexity.

- Interoperability challenges between legacy systems, proprietary platforms, and various meter standards hinder seamless integration across utility territories. Vendors and regulators are working toward open standards to improve cross-platform functionality.

- In regions with unstable communication infrastructure (e.g., remote areas), the reliability of smart meter data transmission is a significant challenge that impacts billing accuracy and system responsiveness.

Smart Electric Meter Market Market Scope

The market is segmented on the battery type, vehicle type, engine type, functions and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Phase |

|

|

By Communication Technology |

|

|

By Component: |

|

|

By End Use |

|

Smart Electric Meter Market Scope

The market is segmented on the basis of phase, communication technology, component, and end use.

• By Phase

On the basis of phase, the smart electric meter market is segmented into single phase and three phase. The single phase segment held the largest market revenue share in 2025. This dominance is driven by its widespread usage in residential buildings, ease of installation, and cost-effectiveness. Increasing urbanization and smart grid integration in residential areas are further boosting demand. The three phase segment is expected to witness the fastest CAGR from 2025 to 2032. Growth is driven by industrial and commercial energy monitoring needs, where high-load operations require more advanced, accurate, and durable metering solutions, thereby fueling adoption in this segment.

• By Communication Technology

On the basis of communication technology, the smart electric meter market is segmented into RF (Radio Frequency), PLC (Power Line Communication), and Cellular. the RF segment accounted for the largest market revenue share in 2025. RF technology is favored for its cost-effectiveness, flexibility, and ability to support mesh networking in dense urban areas, enabling efficient and scalable smart metering solutions.

The cellular segment is expected to witness the fastest CAGR from 2025 to 2032. Driven by increasing deployment in remote and rural areas, cellular smart meters offer reliable connectivity, reduce infrastructure dependency, and support real-time data analytics, making them ideal for modern utility operations.

• By Component

On the basis of component, the market is segmented into hardware, software, and services. the hardware segment dominated the market in 2025. Hardware components such as sensors, microcontrollers, and communication modules are essential for smart meter functionality, and demand is driven by large-scale smart grid infrastructure investments.

The software segment is expected to witness the fastest growth from 2025 to 2032. This growth is fueled by rising demand for data analytics, remote monitoring, and billing accuracy, with utility companies increasingly adopting smart meter management software for operational efficiency.

• By End Use

On the basis of end use, the market is segmented into residential, commercial, and industrial. The residential segment held the largest market share in 2025. Growth is supported by increasing consumer awareness about energy conservation, utility-driven rollouts of smart meters, and regulatory mandates across developed and emerging economies.

The industrial segment is projected to grow at the fastest CAGR from 2025 to 2032. The industrial sector demands advanced metering infrastructure to monitor energy usage, improve energy efficiency, and reduce downtime, driving the adoption of three-phase smart electric meters.

Smart Electric Meter Market Regional Analysis

- North America (U.S. and Canada) are at the forefront of AMI implementation, with smart meter penetration exceeding 60% in residential buildings. U.S. utilities are deploying advanced data analytics, cloud-based MDMS, and grid-responsive pricing. Ongoing upgrades are focused on resilience, cybersecurity, and EV integration.

- Europe’s smart metering adoption is driven by the EU’s Clean Energy for All Europeans package, with national mandates in countries like the UK, France, Germany, and Italy. Focus areas include real-time energy monitoring, integration with DERs, and smart building retrofits. The region is also investing in interoperability frameworks and consumer engagement tools.

- Asia-Pacific dominates by volume, led by China, where over 500 million smart meters have been deployed. India, under its RDSS scheme, is targeting universal smart metering by 2026, while Japan, South Korea, and Australia are innovating with IoT-embedded metering infrastructure. Urban expansion and industrial growth drive strong market momentum.

- Middle East & Africa is witnessing steady growth through government-led digitalization programs in countries like UAE, Saudi Arabia, and South Africa. National utilities are piloting smart metering to combat non-technical losses, improve revenue collection, and enable dynamic pricing for large-scale users.

- South America such as Brazil, Mexico, and Chile are adopting smart meters to modernize power grids, reduce energy theft, and meet sustainability goals. Regional efforts focus on smart city initiatives, often supported by development banks and technology partnerships.

United States Smart Electric Meter Market Insight

The United States holds a dominant position in the global smart electric meter market, supported by robust investments in grid modernization, AMI deployment, and federal energy efficiency mandates.

Smart meters have already reached over 60% penetration in U.S. residential homes, driven by programs from major utilities such as Duke Energy, PG&E, and Con Edison. The country is witnessing rapid advancements in real-time energy analytics, cyber-secure metering platforms, and demand response integration, all of which contribute to a highly mature and scalable market environment.

Europe Smart Electric Meter Market Insight

Europe continues to expand its smart meter infrastructure under EU directives such as the Clean Energy for All Europeans Package, which requires 80% smart meter penetration in member states by 2030. Countries like France, the United Kingdom, Italy, and Germany are leading in deployment volumes, particularly in residential and low-voltage commercial sectors. European utilities are focusing on interoperability, sustainability reporting, and renewable integration, with strong regulatory backing and public support. The market is also evolving to support prosumer energy models and dynamic pricing.

India Smart Electric Meter Market Insight

India is one of the fastest-growing markets for smart electric meters, driven by the government’s Revamped Distribution Sector Scheme (RDSS), which targets universal smart metering by 2026.

Public sector units and state utilities are deploying smart meters across urban and semi-urban areas to reduce AT&C losses, curb energy theft, and enable real-time billing. Partnerships with companies like Genus Power, Iskraemeco, and Intellismart are expanding the ecosystem. The residential and small commercial segments represent high-growth opportunities due to subsidized rollouts and digital infrastructure upgrades.

Brazil Smart Electric Meter Market Insight

Brazil is steadily adopting smart metering systems to modernize its aging grid infrastructure and combat high levels of non-technical energy losses. The national energy agency ANEEL has mandated large-scale smart meter deployments, especially among high-consumption industrial and commercial users.

Utilities are integrating smart meters with solar net metering, outage management systems, and cloud-based billing, which has improved energy delivery in major cities such as São Paulo and Rio de Janeiro. Increasing renewable energy generation is also accelerating the need for real-time metering infrastructure.

China Smart Electric Meter Market Insight

China leads in terms of smart meter production and deployment volume, with over 500 million smart meters already installed through State Grid Corporation of China (SGCC) and China Southern Power Grid.

The country’s emphasis on digital energy transformation, urbanization, and smart city initiatives is fueling widespread smart meter adoption across both residential and industrial sectors. Chinese manufacturers like Wasion Group, Hexing, and Sanxing dominate the domestic market, while exports to Southeast Asia and Africa are rising. Integration with AI, blockchain, and edge computing is pushing China toward next-generation smart grid capabilities.

Smart Electric Meter Market Share

The smart electric meter industry is primarily led by well-established companies, including:

- Itron Inc.

- Landis+Gyr Group AG

- Siemens AG

- Schneider Electric SE

- Aclara Technologies LLC (Hubbell Inc.)

- Sensus (Xylem Inc.)

- Honeywell International Inc.

- Osaki Electric Co., Ltd.

- EDMI Limited

- Iskraemeco d.d.

- Kamstrup A/S

- Wasion Group Holdings Limited

- General Electric Company

Latest Developments in Global Smart Electric Meter Market

- In April 2025, Itron Inc. launched its next-generation AMI solution integrating distributed intelligence and real-time voltage optimization, enabling utilities to enhance outage detection and demand-side management across residential networks.

- In March 2025, Landis+Gyr introduced its Gridstream® Connect 2.0 platform with integrated 5G and NB-IoT communication capabilities, offering scalable, high-speed smart metering for urban utilities and high-density buildings.

- In February 2025, Siemens AG rolled out a cyber-secure metering module compliant with the EU’s evolving NIS2 directives, equipped with encrypted firmware, tamper detection, and OTA update functionality to protect consumer energy data.

- In January 2025, EDMI Limited announced a major smart meter deployment project in Southeast Asia, delivering over 1 million meters with cloud-based energy monitoring portals and AI-assisted demand forecasting features.

- In December 2024, Schneider Electric released EcoStruxure™ Metering Expert 2025, a software-enabled smart metering platform that supports sustainability tracking, ESG reporting, and real-time energy optimization for commercial buildings.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Electric Meter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Electric Meter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Electric Meter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.