Global Smart Glasses Market

Market Size in USD Billion

CAGR :

%

USD

2.72 Billion

USD

6.73 Billion

2025

2033

USD

2.72 Billion

USD

6.73 Billion

2025

2033

| 2026 –2033 | |

| USD 2.72 Billion | |

| USD 6.73 Billion | |

|

|

|

|

Smart Glasses Market Size

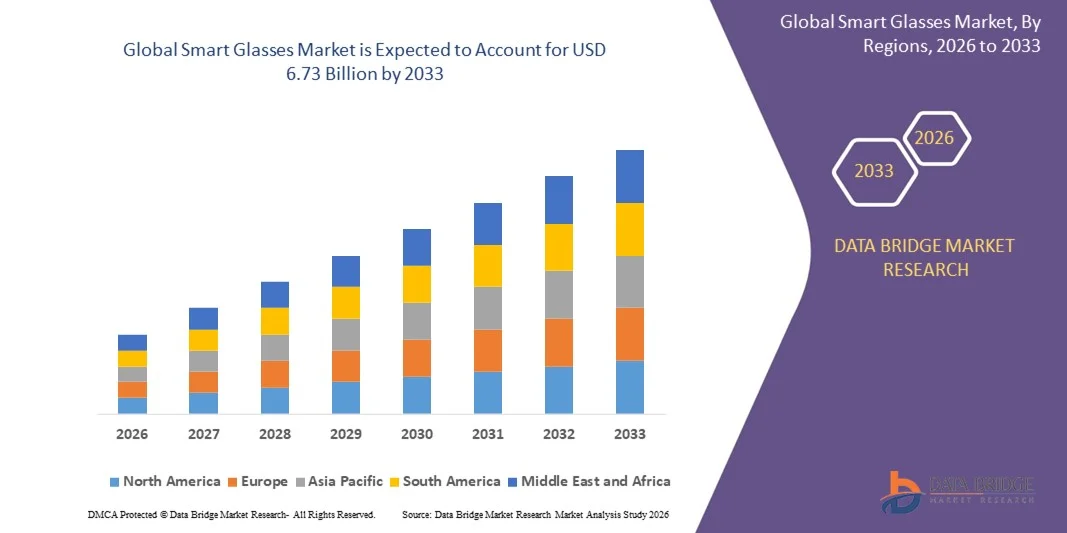

- The global smart glasses market size was valued at USD 2.72 billion in 2025 and is expected to reach USD 6.73 billion by 2033, at a CAGR of 12.00% during the forecast period

- The market growth is largely fueled by the increasing adoption and technological advancements in smart building solutions, automotive applications, and consumer electronics, leading to enhanced energy efficiency, visual comfort, and connectivity across residential, commercial, and industrial settings

- Furthermore, rising consumer and enterprise demand for adaptive, multifunctional, and user-friendly eyewear solutions is establishing smart glasses as an essential tool for professional, industrial, and lifestyle applications. These converging factors are accelerating the adoption of smart glasses, thereby significantly boosting the industry’s growth

Smart Glasses Market Analysis

- Smart glasses, offering adaptive visual control, augmented reality (AR), and immersive display capabilities, are becoming increasingly vital in construction, automotive, industrial, and consumer applications due to their enhanced functionality, energy efficiency, and seamless integration with connected systems

- The escalating demand for smart glasses is primarily fueled by growing awareness of energy-efficient and smart building technologies, increasing use in enterprise AR applications, rising focus on employee productivity and safety in industrial settings, and a growing preference for multifunctional wearable devices in everyday life

- North America dominated smart glasses market with a share of 35.89% in 2025, due to increasing demand for energy-efficient, adaptive glazing solutions and rising adoption of advanced building technologies

- Asia-Pacific is expected to be the fastest growing region in the smart glasses market during the forecast period due to increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India

- Architectural and construction segment dominated the market with a market share of 41.7% in 2025, due to the rising integration of smart glasses in smart building projects for energy efficiency and visual comfort. Architects and builders increasingly prefer these technologies to enhance daylight management, reduce glare, and improve occupant productivity. Leading construction firms incorporate smart glasses for façades, skylights, and window installations to comply with green building standards. The segment also benefits from strong governmental incentives and sustainability initiatives promoting energy-efficient solutions in urban infrastructure

Report Scope and Smart Glasses Market Segmentation

|

Attributes |

Smart Glasses Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Glasses Market Trends

Growing Use of AR-Enabled Smart Glasses in Enterprise Applications

- The smart glasses market is experiencing rapid growth driven by the increasing adoption of augmented reality (AR)-enabled smart glasses in enterprise and industrial applications. These devices offer hands-free access to data, real-time collaboration, and workflow assistance in sectors including manufacturing, healthcare, logistics, and field service

- For instance, Microsoft’s HoloLens and Google Glass Enterprise Edition continue to lead adoption in industries such as automotive assembly and healthcare, where their AR features streamline processes such as remote diagnostics and guided repairs. Similarly, Vuzix and RealWear focus on ruggedized smart glasses that support voice-controlled interaction in hazardous or hands-busy environments, indicating growing industrial site deployment

- Beyond industrial use, consumer-targeted smart glasses with embedded AI assistants and smart sensors are emerging but adoption remains limited due to technological maturity and price sensitivity. Continued R&D efforts focus on enhancing battery life, display quality, and ergonomics to broaden smart glasses’ applicability and user comfort

- The ability to overlay digital information onto the physical environment enhances productivity, reduces errors, and improves training effectiveness for workers in complex environments. The trend reflects a shift toward intelligent wearable technologies that integrate AR, AI, and IoT capabilities to meet evolving enterprise needs

- Integration with 5G connectivity and cloud services is further enabling real-time data streaming and edge computation, critical for latency-sensitive enterprise applications. Software ecosystems are also evolving to support specialized apps tailored for specific professional workflows and collaborative environments

- Sustainability and miniaturization are driving product innovation, with lightweight designs and eco-friendly materials becoming priorities to improve wearability and reduce environmental impact. Market expansion is expected as AR-enabled smart glasses embed deeper into enterprise digital transformation strategies

Smart Glasses Market Dynamics

Driver

Rising Demand for Adaptive and Multifunctional Wearable Solutions

- The growing preference for adaptive, multifunctional wearable devices is a key driver for smart glasses market growth. Enterprises seek wearable solutions that provide seamless access to diverse digital tools—ranging from real-time data visualization to communication and sensor integration—thereby enhancing operational efficiency and worker safety

- For instance, companies such as Vuzix, Microsoft, and RealWear offer smart glasses optimized for rugged industrial environments, integrating voice commands, AR overlays, and IoT connectivity. Such products exemplify how adaptive wearables address the need for multitasking capabilities without impeding mobility or dexterity in demanding workplaces

- The demand extends beyond hardware to include software platforms and apps that enable remote assistance, inventory management, and quality assurance in real time. These multifunctional capabilities make smart glasses attractive to sectors undergoing digital transformation, including logistics, healthcare, and field services

- Increasing integration with enterprise resource planning (ERP) systems and AI-powered analytics enhances the value of wearable smart glasses by providing context-aware insights and predictive maintenance prompts. This adaptability supports diverse user roles and dynamic operational needs

- Consumer awareness of wearable tech benefits, driven by fitness trackers and smartwatches, is indirectly boosting acceptance in professional use cases. The overlap of smart glasses functionalities with broader wearable ecosystems reinforces market prospects and innovation potential

Restraint/Challenge

High Cost Limiting Mass Consumer Adoption

- The relatively high cost of smart glasses remains a significant restraint limiting widespread consumer adoption despite promising enterprise uptake. Advanced AR displays, sensors, and embedded computing technology contribute to premium pricing, restricting access primarily to commercial and professional segments

- For instance, flagship models such as Microsoft HoloLens 2 and Google Glass Enterprise Edition command prices several times higher than typical consumer electronics, deterring individual consumers from purchasing for everyday use. This price premium is compounded by development costs related to software ecosystems and specialized applications

- Limited battery life and design constraints that affect comfort and aesthetics further challenge appeal to mainstream consumers, who often prioritize convenience, style, and affordability over cutting-edge features. Privacy concerns and social resistance to wearing conspicuous wearable tech also impact adoption rates in public and social settings

- Addressing cost barriers requires advances in component miniaturization, hardware integration, and volume manufacturing to reduce prices without sacrificing performance. Emerging players focusing on mid-range and niche segments may broaden market reach and stimulate consumer interest

- As technology matures and production scales, cost reductions and product diversification are expected to gradually expand smart glasses beyond enterprise use to gain meaningful consumer penetration

Smart Glasses Market Scope

The market is segmented on the basis of technology and application.

- By Technology

On the basis of technology, the smart glasses market is segmented into electrochromic technology, PDLC, SPD, photochromic, and others. The electrochromic technology segment dominated the market with the largest market revenue share of 38.5% in 2025, driven by its high efficiency in controlling light transmission and enhancing visual comfort. Electrochromic smart glasses are widely adopted in both architectural and automotive applications due to their precise tinting capabilities and energy-saving benefits. Consumers and businesses prefer electrochromic solutions for their durability, low maintenance, and integration with existing smart systems. The technology also supports customizable light adjustments, which enhances user experience across different lighting conditions. Strong R&D investments and collaborations by leading companies further reinforce its market dominance.

The PDLC (Polymer Dispersed Liquid Crystal) segment is anticipated to witness the fastest growth rate of 23.1% from 2026 to 2033, fueled by rising demand in automotive and consumer electronics sectors. PDLC smart glasses offer rapid switching between opaque and transparent states, making them ideal for privacy control and adaptive shading. For instance, companies such as View, Inc. are innovating PDLC solutions for large-scale architectural applications and vehicle windows. The technology’s aesthetic flexibility and energy-efficient operation drive adoption in modern smart buildings and advanced vehicles. Increased awareness regarding privacy, comfort, and energy conservation further accelerates the PDLC segment’s growth.

- By Application

On the basis of application, the smart glasses market is segmented into architectural and construction, transportation, automotive, aircraft, marine, consumer goods, and power generation. The architectural and construction segment dominated the market with the largest revenue share of 41.7% in 2025, driven by the rising integration of smart glasses in smart building projects for energy efficiency and visual comfort. Architects and builders increasingly prefer these technologies to enhance daylight management, reduce glare, and improve occupant productivity. Leading construction firms incorporate smart glasses for façades, skylights, and window installations to comply with green building standards. The segment also benefits from strong governmental incentives and sustainability initiatives promoting energy-efficient solutions in urban infrastructure.

The automotive segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by growing adoption of smart glasses in passenger vehicles and commercial fleets for adaptive tinting and driver safety. For instance, companies such as Gentex Corporation are deploying advanced smart glass technologies in car sunroofs and windshields to improve comfort and reduce heat gain. The integration of smart glasses with vehicle infotainment systems and autonomous driving technologies further boosts their appeal. Rising consumer preference for luxury and energy-efficient vehicles drives the adoption of automotive smart glasses. Enhanced user experience, combined with regulatory support for energy-saving vehicle technologies, strengthens growth in this segment.

Smart Glasses Market Regional Analysis

- North America dominated the smart glasses market with the largest revenue share of 35.89% in 2025, driven by increasing demand for energy-efficient, adaptive glazing solutions and rising adoption of advanced building technologies

- Consumers in the region highly value the convenience, visual comfort, and enhanced energy savings offered by smart glasses in both residential and commercial applications

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and growing awareness of sustainable building solutions, establishing smart glasses as a preferred solution in construction, automotive, and consumer applications

U.S. Smart Glasses Market Insight

The U.S. smart glasses market captured the largest revenue share in 2025 within North America, fueled by rapid integration of smart glazing in architectural projects and the expanding trend of adaptive and energy-efficient buildings. Consumers and commercial enterprises increasingly prioritize visual comfort, glare reduction, and aesthetic appeal offered by smart glasses. The rising preference for smart, automated window solutions, combined with integration in automotive and consumer electronics applications, further propels market growth. Moreover, government incentives promoting energy-efficient construction and sustainability initiatives are significantly contributing to the market expansion.

Europe Smart Glasses Market Insight

The Europe smart glasses market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent energy efficiency regulations and growing adoption of intelligent glazing in construction and automotive sectors. Urbanization, coupled with increasing demand for modern, sustainable building solutions, is fostering adoption of smart glasses. European consumers and businesses are drawn to enhanced comfort, reduced energy consumption, and improved aesthetics. The market is witnessing significant growth across residential, commercial, and automotive applications, with smart glasses being incorporated into both new projects and renovations.

U.K. Smart Glasses Market Insight

The U.K. smart glasses market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing adoption of smart building technologies and growing demand for energy-efficient, comfortable, and aesthetically appealing glazing solutions. In addition, rising awareness regarding sustainability and environmental regulations is encouraging adoption in residential and commercial projects. The U.K.’s robust construction and automotive sectors, alongside technological advancements, are expected to continue to stimulate market growth.

Germany Smart Glasses Market Insight

The Germany smart glasses market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of sustainable and smart construction solutions and demand for technologically advanced glazing options. Germany’s emphasis on energy efficiency, innovation, and sustainability promotes adoption of smart glasses, particularly in residential, commercial, and automotive sectors. Integration of smart glasses with building management and vehicle systems is increasingly prevalent, with strong consumer preference for advanced, privacy-focused, and eco-conscious solutions.

Asia-Pacific Smart Glasses Market Insight

The Asia-Pacific smart glasses market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region’s growing focus on smart buildings, energy efficiency, and high-tech automotive solutions is driving adoption of smart glasses. Furthermore, APAC emerging as a manufacturing hub for advanced glazing technologies is expanding affordability and accessibility to a wider consumer and commercial base.

Japan Smart Glasses Market Insight

The Japan smart glasses market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and demand for visual comfort and energy-efficient building solutions. Adoption is driven by increasing smart building projects, connected automotive applications, and integration with IoT-enabled systems. Moreover, the aging population is likely to spur demand for easier-to-use, adaptive glazing solutions in residential and commercial sectors.

China Smart Glasses Market Insight

The China smart glasses market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid urbanization, growing middle class, and high technological adoption rates. China is a leading market for smart building technologies, and smart glasses are increasingly incorporated in residential, commercial, and automotive projects. Government initiatives promoting smart cities, sustainability, and domestic manufacturing of advanced glazing solutions are key factors propelling the market in China.

Smart Glasses Market Share

The smart glasses industry is primarily led by well-established companies, including:

- Saint-Gobain (France)

- AGC Inc (Japan)

- Nippon Sheet Glass Co., Ltd (Japan)

- Research Frontiers (U.S.)

- GENTEX Corporation (U.S.)

- Polytronix, Inc. (U.S.)

- Pleotint LLC (U.S.)

- Smartglass International Limited (U.K.)

- AGP America S.A (U.S.)

- INNOVATIVE GLASS CORPORATION (U.S.)

- Showa Denko Materials Co., Ltd (Japan)

- SPD Control Systems Corporation (U.S.)

- Fuyao Group (China)

- Taiwan Glass IND. CORP. (Taiwan)

- Central Glass Co., Ltd (Japan)

- Glass Apps LLC (U.S.)

- NeoView KOLON Co., Ltd (South Korea)

- ChromoGenics (Sweden)

- Velux Danmark A/S (Denmark)

- DuPont (U.S.)

- Guardian Industries (U.S.)

- Glassonweb (Netherlands)

Latest Developments in Global Smart Glasses Market

- In March 2025, Hitachi Construction Machinery Co., Ltd., together with HMS Co., Ltd. and Holo-Light GmbH, unveiled a new XR smart glasses solution designed for harsh environments. The watertight and dust-proof device enables technicians to receive remote support through visual aids. This development expands the market into demanding industrial applications, demonstrates wearables’ reliability in extreme conditions, and broadens adoption in construction, maintenance, and field service sectors

- In November 2024, RealWear, Inc. acquired Almer Technologies, a Swiss pioneer in ultra-compact AR headsets, supported by TeamViewer AG. This strategic move accelerates the adoption of industrial-grade AR wearables, expands enterprise offerings, and allows scalable, flexible deployment through subscription-based hardware models, strengthening the market presence of professional smart glasses and driving enterprise growth

- In August 2024, Vuzix Corporation launched the M400 Xtreme smart glasses, an upgraded kit over its predecessor, the M400. The new Xtreme Weather power bank is IP67-rated, lightweight, and long-lasting, operating at temperatures from -20°C to 45°C. This development strengthens the market by offering all-day usability in harsh environments, particularly benefiting cold storage warehouses and remote field service operations, thereby boosting enterprise adoption and market penetration in industrial applications

- In September 2023, Amazon.com, Inc. introduced the next generation of Echo Frames smart glasses, featuring enhanced audio quality, improved Alexa performance, and fashionable designs by Carrera. The glasses provide multiple lens options including UV protection, prescription, and blue light filters. This launch impacts the market by expanding consumer adoption through lifestyle-oriented, multifunctional smart glasses, blending fashion with smart technology and increasing mainstream appeal

- In April 2023, Magic Leap, Inc. collaborated with NVIDIA Corporation to enable enterprise users to render and stream full-scale, immersive digital twins from the NVIDIA Omniverse platform to Magic Leap 2 AR headsets without compromising visual quality. This advancement drives market growth by enhancing enterprise applications for simulation, training, and remote collaboration, reinforcing smart glasses as critical tools in industrial and professional environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.