Global Smart Grid Market

Market Size in USD Billion

CAGR :

%

USD

50.17 Billion

USD

198.01 Billion

2024

2032

USD

50.17 Billion

USD

198.01 Billion

2024

2032

| 2025 –2032 | |

| USD 50.17 Billion | |

| USD 198.01 Billion | |

|

|

|

|

Smart Grid Market Size

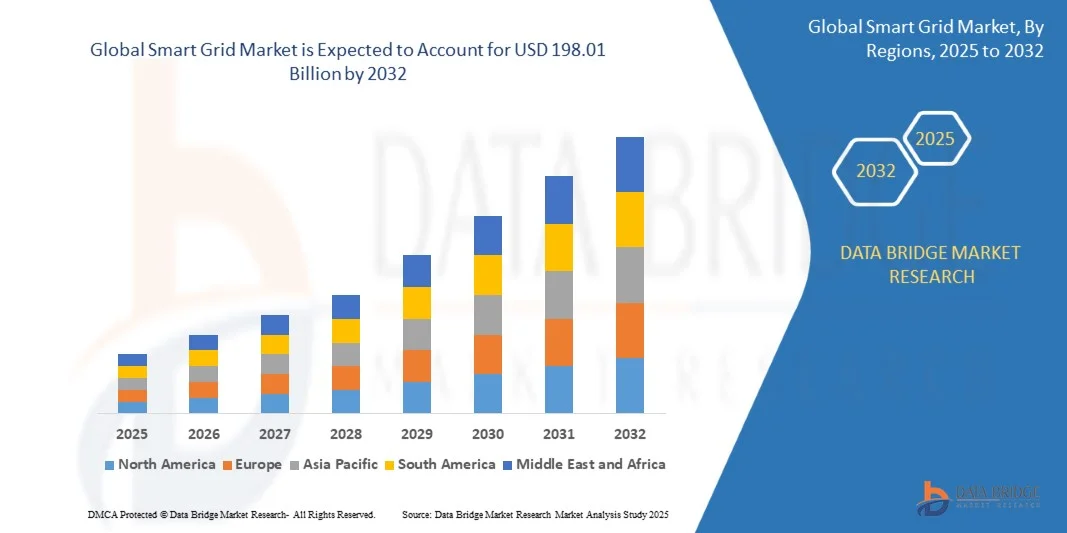

- The global Smart Lock Market size was valued at USD 50.17 billion in 2024 and is expected to reach USD 198.01 billion by 2032, at a CAGR of 18.72% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing smart locks as the modern access control system of choice. These converging factors are accelerating the uptake of smart lock solutions, thereby significantly boosting the industry's growth

Smart Grid Market Analysis

- Smart grids, incorporating advanced metering infrastructure, real-time communication, and automated control systems, are becoming essential for modernizing energy infrastructure in both developed and emerging economies due to their ability to enhance energy efficiency, reduce transmission losses, and support renewable energy integration

- The rising demand for smart grids is primarily fueled by increasing electricity consumption, the global shift toward cleaner energy sources, and growing investments in grid modernization projects by governments and utility providers

- North America dominated the Smart Grid Market with the largest revenue share of 36.01% in 2024, driven by early deployment of smart grid technologies, strong regulatory support, and significant investments in advanced energy infrastructure, particularly in the U.S., where utilities are accelerating smart meter rollouts and grid automation projects

- Asia-Pacific is expected to be the fastest growing region in the Smart Grid Market during the forecast period, owing to rapid urbanization, government-led smart city initiatives, and expanding energy demands in countries like China, India, and South Korea

- The software segment dominated the Smart Grid Market with a market share of 43.8% in 2024, propelled by increasing reliance on data analytics, demand response systems, and grid management software to ensure optimized, reliable, and real-time power distribution across vast and complex networks

Report Scope and Smart Grid Market Segmentation

|

Attributes |

Smart Grid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Grid Market Trends

“Enhanced Efficiency Through AI and IoT Integration”

- A significant and accelerating trend in the Smart Grid Market is the deepening integration of artificial intelligence (AI) and Internet of Things (IoT) technologies into grid infrastructure, enabling utilities to optimize energy distribution, enhance reliability, and respond dynamically to fluctuations in demand and supply.

- For instance, AI-powered grid management platforms can predict energy consumption patterns, detect faults in real-time, and automate load balancing. Companies like Siemens and ABB are deploying advanced AI-driven systems that support predictive maintenance and self-healing grid capabilities, reducing downtime and operational costs.

- IoT integration allows millions of smart sensors and connected devices—such as smart meters and transformers—to continuously monitor grid performance and communicate data back to centralized platforms. This real-time data flow empowers utilities to make informed decisions, automate responses, and identify energy theft or leakage efficiently.

- The convergence of AI and IoT in smart grids also supports demand response programs, where utilities can automatically adjust electricity usage during peak periods by communicating with smart appliances, EV chargers, or industrial systems. This not only stabilizes the grid but also reduces strain and minimizes the need for fossil-fuel-based peaker plants

- This transformative trend is leading to a more intelligent, responsive, and sustainable energy ecosystem. Companies like Itron and Oracle are actively developing platforms that utilize machine learning to provide actionable insights from massive datasets generated by smart grids across urban and rural environments.

- The growing demand for real-time, automated, and intelligent grid management solutions is driving widespread adoption across developed and emerging markets alike, as energy providers and governments prioritize grid modernization, energy efficiency, and climate resilience.

Smart Grid Market Dynamics

Driver

“Growing Need Due to Rising Energy Demand and Grid Modernization Initiatives”

- The increasing global demand for electricity, combined with the aging and inefficient nature of traditional grid infrastructure, is driving the widespread adoption of smart grid technologies across both developed and emerging markets

- For instance, in March 2024, Siemens announced a strategic partnership with several European utilities to deploy AI-enabled smart grid solutions aimed at improving grid stability, enhancing energy efficiency, and integrating renewable energy sources. Such initiatives are expected to accelerate smart grid deployment during the forecast period

- As governments and utilities strive to reduce carbon emissions and improve energy reliability, smart grids offer essential features such as real-time monitoring, automated fault detection, and two-way energy communication, making them indispensable for modern energy systems

- Furthermore, the rapid growth of renewable energy sources, such as solar and wind, and the increasing penetration of electric vehicles (EVs) necessitate a more responsive and adaptive grid infrastructure. Smart grids support this transition by enabling distributed energy resource (DER) integration, dynamic pricing models, and advanced demand response capabilities

- Smart grid adoption is also being fueled by the push for smart cities, where interconnected infrastructure relies on intelligent energy management systems. The convenience of data-driven decision-making, predictive maintenance, and grid automation are key drivers for utility providers to invest in smart grid technologies. Government-backed funding programs and policy incentives are further accelerating adoption across the globe

Restraint/Challenge

“Concerns Over Data Privacy, Infrastructure Complexity, and High Deployment Costs”

- Despite the clear advantages, several challenges hinder the broader adoption of smart grid systems, most notably data privacy concerns, integration complexities, and high initial investment costs

- Smart grids rely heavily on vast volumes of real-time data collected from smart meters, sensors, and connected devices. This raises privacy issues around how consumer energy usage data is collected, stored, and potentially shared, leading to hesitation among stakeholders

- For instance, in regions with less mature regulatory frameworks, the lack of clear data governance policies can slow down smart grid rollouts. Furthermore, integrating smart grid technologies with existing legacy systems often involves complex, time-consuming upgrades and retraining, particularly for utilities with outdated infrastructure

- Companies such as Oracle and IBM are addressing these concerns by offering secure, cloud-based platforms with end-to-end encryption, identity access management, and compliance with global data protection standards. However, the cost of deploying full-scale smart grid systems—including smart meters, control systems, and communication networks—remains a significant barrier, especially in developing nations

- Although the long-term operational savings and energy efficiency benefits are well-documented, the upfront capital required can deter adoption among smaller utilities and municipalities. This financial burden is often compounded by regulatory hurdles and inconsistent policy support across regions

- Overcoming these challenges will require a combination of international policy alignment, public-private partnerships, consumer education on data security, and the development of cost-effective, modular smart grid solutions tailored to specific regional needs

Smart Grid Market Scope

The Smart Grid Market is segmented on the basis of component, technology, applications, communication network and end user.

• By Components

On the basis of component, the Smart Grid Market is segmented into hardware, software, and services. The software segment dominated the market with the largest revenue share of 43.8% in 2024, driven by the increasing reliance on advanced analytics, real-time monitoring, and energy management platforms. Smart grid software enables grid operators to gain actionable insights, automate processes, and improve load forecasting and demand response. It plays a critical role in managing distributed energy resources (DERs), grid stability, and fault detection.

The services segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by the growing demand for system integration, consulting, and maintenance services. Utilities and governments increasingly seek expert support in planning, deploying, and upgrading smart grid infrastructure. Service providers offer customized solutions to meet regional compliance, ensuring secure and efficient operations, particularly in developing markets transitioning from conventional to digital grid systems.

• By Technology

On the basis of technology, the Smart Grid Market is segmented into wired and wireless. The wired segment held the largest market share in 2024, attributed to its reliability, data integrity, and widespread use in legacy grid systems and urban infrastructure. Wired technologies, including fiber optics and Ethernet, are preferred in high-density areas where uninterrupted communication is critical for grid operations and where existing infrastructure can be upgraded with minimal disruption.

The wireless segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the scalability, cost-effectiveness, and ease of deployment in remote or rural areas. Wireless communication—using technologies such as RF mesh, Zigbee, and LoRaWAN—enables flexible deployment of smart meters and sensors without extensive civil work. The increasing use of mobile networks (4G/5G) for smart grid applications also supports the growth of wireless technologies in grid modernization efforts.

• By Application

On the basis of application, the Smart Grid Market is segmented into meter hardware, COMMUNICATIONS and networking, and power quality equipment and technologies. The meter Hardware segment dominated the market in 2024, holding the largest revenue share, due to widespread deployment of smart meters that enable accurate billing, real-time usage tracking, and demand-side management. Utilities across North America, Europe, and Asia are aggressively rolling out smart meters as part of grid modernization and digital transformation initiatives.

The Communications and Networking segment is projected to be the fastest-growing from 2025 to 2032, propelled by increasing investment in establishing two-way communication infrastructure. The need for secure and reliable data exchange between grid components and control centers is central to smart grid operations. Advancements in IoT, 5G, and edge computing further fuel the demand for intelligent communication networks within the power distribution landscape.

• By Communication Network

On the basis of communication network, the Smart Grid Market is segmented into Wide Area Network (WAN) and Home Area Network (HAN). The Wide Area Network (WAN) segment dominated the market in 2024, capturing the largest revenue share, owing to its critical role in long-distance data transmission between substations, control centers, and utility providers. WAN facilitates centralized control and monitoring across vast regions, essential for large-scale utilities and grid operators.

The Home Area Network (HAN) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the proliferation of smart home devices, prosumer energy generation, and demand response initiatives. HAN allows end-users to monitor and manage their energy usage in real-time via smart appliances, thermostats, and in-home displays. The integration of HAN with consumer-facing platforms encourages energy-efficient behavior and improves load balancing at the household level.

• By End-User

On the basis of end-user, the Smart Grid Market is segmented into residential, commercial, government, and industrial. The government segment held the largest revenue share in 2024, reflecting substantial investments and policy support for smart grid development. Many governments globally are launching large-scale initiatives to modernize grid infrastructure, reduce carbon emissions, and enhance energy security. Projects funded through public-private partnerships and national energy strategies dominate this segment’s growth.

The commercial segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the increasing need for energy efficiency, automation, and peak demand management in commercial buildings and data centers. Smart grid technologies enable businesses to optimize power usage, lower operational costs, and meet regulatory compliance related to sustainability goals. Integration of EV charging stations and energy storage further boosts adoption in this segment.

Smart Grid Market Regional Analysis

- North America dominated the Smart Grid Market with the largest revenue share of 36.01% in 2024, driven by substantial investments in grid modernization, advanced metering infrastructure (AMI), and the integration of renewable energy sources

- Utilities in the region are increasingly deploying smart meters, automated distribution systems, and demand response technologies to enhance grid efficiency and reliability. The U.S. and Canada have implemented strong regulatory support and funding initiatives to accelerate the adoption of smart grid technologies

- This widespread implementation is further supported by a mature digital infrastructure, high consumer awareness, and the presence of major technology providers such as General Electric, IBM, and Cisco. Additionally, the push toward energy sustainability and carbon neutrality is encouraging utilities and municipalities to invest in intelligent grid solutions, establishing smart grids as a core component of the region’s long-term energy strategy across both residential and commercial sectors

U.S. Smart Grid Market Insight

The U.S. Smart Grid Market captured the largest revenue share of 78% in 2024 within North America, driven by aggressive investments in grid modernization, deployment of advanced metering infrastructure (AMI), and strong regulatory support. The U.S. Department of Energy continues to fund smart grid initiatives, while utilities across states are adopting AI, IoT, and cloud technologies to improve grid reliability and enable two-way power flow. Additionally, the integration of distributed energy resources (DERs), including rooftop solar and EVs, is accelerating the need for intelligent, adaptive grid systems. Private sector innovation, combined with federal policy mandates, positions the U.S. as the dominant force in smart grid adoption across residential, commercial, and industrial applications.

Europe Smart Grid Market Insight

The Europe Smart Grid Market is projected to expand at a substantial CAGR throughout the forecast period, supported by the European Union’s climate targets and investments in digital energy infrastructure. Initiatives such as the European Green Deal and Horizon Europe are promoting smart grid deployment to integrate renewables, reduce carbon emissions, and enhance energy efficiency. Smart grid adoption is also driven by urbanization and aging grid systems requiring modernization. Countries across the region are deploying smart meters, energy storage systems, and demand response technologies to improve grid performance and ensure energy security. Utilities and governments in Europe are increasingly embracing interoperability and open standards for seamless grid connectivity.

U.K. Smart Grid Market Insight

The U.K. Smart Grid Market is expected to grow at a noteworthy CAGR during the forecast period, spurred by nationwide smart meter rollouts and commitments to achieving net-zero carbon emissions by 2050. Government-backed programs like the Smart Metering Implementation Programme are significantly expanding grid intelligence and energy efficiency. Furthermore, the rise in electric vehicle adoption and renewable energy generation requires enhanced grid flexibility, which smart grids enable through real-time energy management and advanced analytics. The U.K.'s strong digital infrastructure and supportive energy policies are encouraging both utilities and consumers to embrace smart grid solutions across the residential and commercial sectors.

Germany Smart Grid Market Insight

The Germany Smart Grid Market is poised for considerable growth over the forecast period, fueled by the country's Energiewende (energy transition) strategy and its commitment to sustainability. The integration of decentralized renewable energy sources such as wind and solar requires smart grid technologies for stable power distribution. Germany’s focus on energy independence and grid resilience is prompting widespread adoption of smart metering, automated distribution systems, and real-time data analytics. The presence of key players and a strong R&D ecosystem further supports innovation in smart grid deployment. Additionally, regulatory support for digital infrastructure upgrades is helping utilities modernize aging grid systems efficiently.

Asia-Pacific Smart Grid Market Insight

The Asia-Pacific Smart Grid Market is projected to grow at the fastest CAGR of 24% from 2025 to 2032, driven by rapid urbanization, rising energy demand, and favorable government policies in countries like China, India, Japan, and South Korea. Massive infrastructure investments and smart city initiatives are accelerating the deployment of smart grid systems across the region. Governments are promoting the adoption of renewable energy and grid automation to ensure stable electricity supply amid growing urban populations. Additionally, APAC's position as a global manufacturing hub for smart grid components ensures cost-effective solutions, increasing accessibility and adoption across both developed and developing economies.

Japan Smart Grid Market Insight

The Japan Smart Grid Market is gaining momentum, underpinned by the country’s technological advancement, energy security concerns, and a strong push toward renewable energy integration. Japan's focus on automation, along with its vulnerability to natural disasters, has accelerated the development of resilient, self-healing smart grids. Utilities are leveraging AI, IoT, and energy storage systems to enhance grid flexibility and real-time response. Government initiatives, such as the Society 5.0 vision, aim to digitally transform infrastructure, including power grids. Japan's rapidly aging population also increases the demand for stable and reliable energy delivery, further boosting smart grid adoption in residential and healthcare sectors.

China Smart Grid Market Insight

The China Smart Grid Market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by extensive investments in grid modernization, urban development, and smart city projects. China’s aggressive rollout of smart meters and deployment of advanced power distribution systems have positioned it as a global leader in smart grid adoption. State Grid Corporation of China and other major utilities are implementing digital substations, AI-driven energy management, and IoT-enabled grid monitoring. The country’s strong manufacturing capabilities and commitment to decarbonization, along with favorable government regulations and large-scale infrastructure projects, are fueling continued smart grid expansion across both urban and rural regions.

Smart Grid Market Share

Some of the major players operating in the Smart Grid Market are:

- ABB (Switzerland)

- General Electric (U.S.)

- ABB (Switzerland)

- Siemens (Germany)

- Schneider Electric (France)

- Itron (U.S.)

- Cisco Systems, Inc. (U.S.)

- IBM (U.S.)

- Oracle (U.S.)

- Honeywell International (U.S.)

- Eaton (US.)

- Tech Mahindra Limited. (India)

- TANTALUS SYSTEMS CORP (Canada)

- Mitsubishi Electric Corporation (Japan)

- SAP (Germany)

- Wipro (India)

- Trilliant Holdings Inc. (U.S.)

- Globema (Poland)

- Kamstrup (Denmark)

- Xylem. (U.S.)

- Enel X S.r.l. (Italy)

- eSMART (Norway)

- Esyasoft (India)

- Grid4C (U.S.)

- C3.ai, Inc. (U.S.)

- Networked Energy Services (U.S.)

What are the Recent Developments in Smart Grid Market?

- In April 2023, Siemens AG, a global leader in energy and automation, launched a major smart grid modernization initiative in Brazil, aimed at improving the reliability and efficiency of the country’s aging power infrastructure. This project includes the deployment of AI-powered grid management software and real-time monitoring systems to address outages, optimize load distribution, and integrate renewable energy sources. The initiative reinforces Siemens' commitment to driving digital transformation in emerging energy markets and highlights its pivotal role in shaping the future of the Smart Grid Market.

- In March 2023, Itron Inc., a U.S.-based technology company specializing in utility solutions, partnered with Singapore Power Group to deploy an advanced smart metering and data analytics platform. This collaboration supports Singapore's energy transition goals by enhancing real-time energy monitoring and consumer engagement. The project exemplifies Itron’s mission to create more resourceful and sustainable communities through intelligent grid technologies and further cements its influence in the Asia-Pacific smart grid ecosystem.

- In March 2023, ABB announced the successful implementation of its digital substation solutions across several urban districts in Poland, improving grid visibility and accelerating the integration of renewable energy. Leveraging fiber-optic communication and IEC 61850 standards, ABB’s solution reduces energy losses and supports predictive maintenance. This milestone highlights ABB’s expertise in delivering scalable and future-ready smart grid infrastructure to support Europe’s ambitious decarbonization and energy efficiency targets.

- In February 2023, Schneider Electric launched a strategic partnership with India Smart Grid Forum (ISGF) to support pilot projects focused on microgrids, DER integration, and AI-based grid optimization. The initiative is designed to empower utilities in India to transition to smarter, more resilient energy systems while addressing challenges related to peak load management and grid instability. This collaboration underscores Schneider Electric’s vision of advancing digital energy management in high-growth markets.

- In January 2023, General Electric (GE) Vernova announced the rollout of its GridOS™ platform across North American utilities, offering a unified software suite for grid orchestration. This solution integrates data from across the grid to enable real-time decision-making, renewable forecasting, and automated demand response. The GridOS™ launch represents GE’s commitment to building next-generation digital grids capable of meeting the evolving demands of decarbonization and distributed energy resource management.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.