Global Smart Grid Technology Market

Market Size in USD Billion

CAGR :

%

USD

49.38 Billion

USD

208.15 Billion

2024

2032

USD

49.38 Billion

USD

208.15 Billion

2024

2032

| 2025 –2032 | |

| USD 49.38 Billion | |

| USD 208.15 Billion | |

|

|

|

|

Smart Grid Technology Market Size

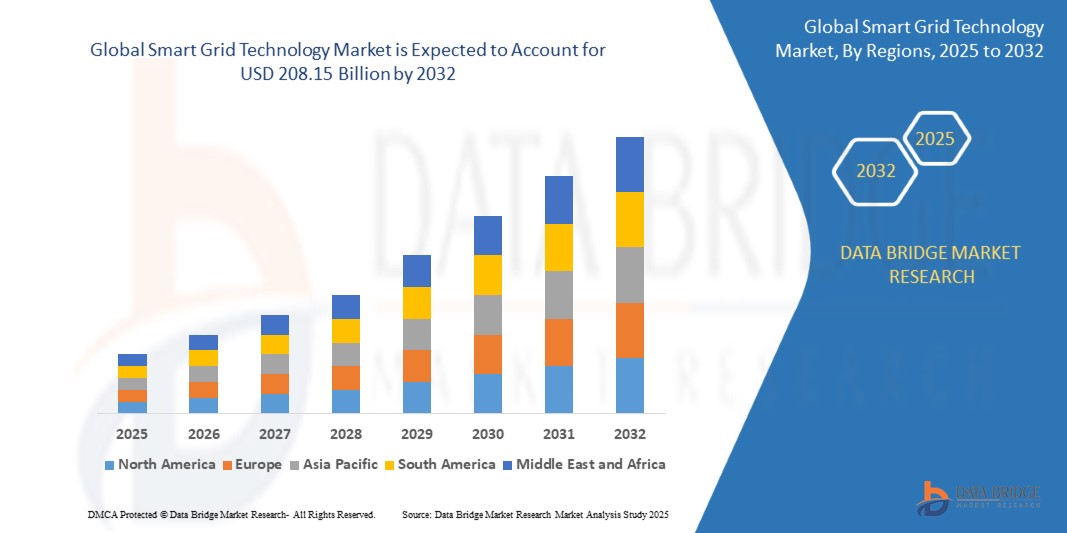

- The global smart grid technology market size was valued at USD 49.38 billion in 2024 and is expected to reach USD 208.15 billion by 2032, at a CAGR of 19.70% during the forecast period

- The market growth is largely fuelled by the increasing demand for efficient energy management systems, rising government investments in smart city infrastructure, and growing adoption of renewable energy sources

- Rapid urbanization, coupled with the modernization of aging grid infrastructure, is further contributing to the expansion of the smart grid technology market

Smart Grid Technology Market Analysis

- The smart grid technology market is experiencing robust expansion as utility providers shift toward digitalized energy distribution and consumption monitoring systems

- Integration of advanced metering infrastructure, real-time data analytics, and demand response solutions is enhancing operational efficiency and minimizing transmission losses

- Asia-Pacific dominated the smart grid technology market with the largest revenue share of 41.3% in 2024, driven by rapid urbanization, large-scale grid modernization projects, and increased government investments in smart energy infrastructure

- Asia-Pacific is expected to be the fastest growing region in the smart grid technology market during the forecast period due to

- The hardware segment dominated the market with the largest revenue share in 2024, driven by widespread deployment of smart meters, sensors, control systems, and related physical infrastructure. The need for robust grid reliability and real-time data acquisition has led to substantial investments in advanced metering and monitoring devices across utilities worldwide. Hardware continues to be a critical foundation for enabling effective grid automation, fault detection, and system optimization

Report Scope and Smart Grid Technology Market Segmentation

|

Attributes |

Smart Grid Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Smart Grid Technology Market Trends

“Growing Adoption Of Advanced Metering Infrastructure (AMI)”

- Utility companies are increasingly deploying Advanced Metering Infrastructure (AMI) to enable real-time energy consumption monitoring and two-way communication between providers and consumers

- AMI helps reduce manual errors, improves billing accuracy, and supports dynamic pricing models based on actual energy usage patterns

- Governments across various regions are promoting AMI adoption through national programs and regulatory mandates

- The technology enhances grid resilience by enabling faster outage detection, remote disconnection, and predictive maintenance capabilities

- For instance, the U.S. Department of Energy reported the deployment of over 100 million smart meters by 2023, while India’s Smart Meter National Programme (SMNP) targets 250 million installations by 2025 to reduce aggregate technical and commercial losses

Smart Grid Technology Market Dynamics

Driver

“Rising Investments In Renewable Energy Integration”

- Increasing global focus on decarbonization is driving demand for smart grid systems that can handle intermittent renewable energy sources

- Governments and utilities are investing heavily in solar, wind, and hydro integration, requiring advanced load balancing and predictive analytics

- Smart grid solutions enable real-time monitoring, efficient energy distribution, and better demand-response mechanisms

- Integration of decentralized renewable sources and energy storage systems is boosting the adoption of smart grids

- For instance, Germany’s “Energiewende” initiative uses smart grid technology to stabilize a power grid with over 40% of its electricity coming from renewable sources

Restraint/Challenge

“High Initial Costs And Infrastructure Complexity”

- High capital expenditure is required to deploy smart meters, sensors, communication systems, and data analytics platforms

- Utilities face added costs for training, system upgrades, and ensuring compliance with cybersecurity and regulatory standards

- Infrastructure compatibility issues between legacy systems and new technologies create additional technical hurdles

- Financial constraints, especially in developing nations, restrict large-scale adoption of smart grid technologies

- For instance, several utilities in sub-Saharan Africa struggle to implement smart grids due to funding gaps and lack of technical expertise

Smart Grid Technology Market Scope

The market is segmented on the basis of components, technology, applications, communication network, and end-user.

• By Components

On the basis of components, the smart grid technology market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest revenue share in 2024, driven by widespread deployment of smart meters, sensors, control systems, and related physical infrastructure. The need for robust grid reliability and real-time data acquisition has led to substantial investments in advanced metering and monitoring devices across utilities worldwide. Hardware continues to be a critical foundation for enabling effective grid automation, fault detection, and system optimization.

The software segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing reliance on predictive analytics, cloud computing, and machine learning for grid management. The rising demand for real-time monitoring, energy forecasting, and cybersecurity solutions is prompting utilities to invest in sophisticated software platforms that ensure grid resilience and operational efficiency.

• By Technology

On the basis of technology, the market is segmented into wired and wireless. The wired segment held the largest market revenue share in 2024 due to its reliability, security, and uninterrupted data transmission, making it suitable for core utility infrastructure. Wired systems are preferred in dense urban environments and critical nodes where stable connections are essential.

The wireless segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of IoT-based smart grid solutions and the flexibility of deploying wireless sensors across remote or difficult terrains. Wireless technology supports cost-effective scalability and simplifies integration of distributed energy resources and mobile assets into the grid.

• By Applications

On the basis of applications, the market is segmented into meter hardware, communications and networking, power quality equipment, and technologies. The meter hardware segment led the market in 2024, supported by large-scale rollouts of smart metering systems aimed at enhancing billing accuracy and consumer energy management. The integration of advanced metering infrastructure (AMI) plays a key role in reducing energy theft, load imbalances, and operational costs.

The communications and networking segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for real-time, high-speed data exchange between grid components. Investments in wireless mesh networks, fiber optics, and cellular communication systems are accelerating this growth, especially in advanced grid modernization programs.

• By Communication Network

On the basis of communication network, the smart grid technology market is segmented into wide area network (WAN) and home area network (HAN). The WAN segment accounted for the largest market share in 2024, owing to its role in connecting distributed grid assets over large geographic areas, ensuring centralized control, fault diagnostics, and secure energy transmission. WANs are crucial for utilities managing transmission and distribution infrastructure across cities and regions.

The HAN segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by rising consumer adoption of smart appliances, home energy management systems, and in-home displays. HANs enable real-time consumption tracking and empower users to make informed energy usage decisions, enhancing grid responsiveness and efficiency at the residential level.

• By End-User

On the basis of end-user, the market is segmented into residential, commercial, government, and industrial. The residential segment dominated the market in 2024, driven by growing deployment of smart meters, energy monitoring tools, and demand response solutions in households. Rising awareness of energy efficiency and favorable government incentives for smart home integration further boost residential adoption.

The industrial segment is expected to witness the fastest growth rate from 2025 to 2032, due to increasing need for energy optimization, grid stability, and uninterrupted power supply in manufacturing and heavy industries. Industrial users benefit from smart grid technologies through reduced downtime, energy cost savings, and enhanced power quality monitoring.

Smart Grid Technology Market Regional Analysis

- Asia-Pacific dominated the smart grid technology market with the largest revenue share of 41.3% in 2024, driven by rapid urbanization, large-scale grid modernization projects, and increased government investments in smart energy infrastructure

- Countries across the region are implementing digital grid solutions to improve electricity access, integrate renewable sources, and reduce energy losses through advanced monitoring and automation

- High population density, rising electricity consumption, and proactive support for clean energy transitions are also contributing to the widespread deployment of smart grid technologies across residential, commercial, and industrial applications

China Smart Grid Technology Market Insight

The China smart grid technology market accounted for the largest revenue share within Asia-Pacific in 2024, driven by the country’s substantial investments in ultra-high-voltage transmission lines, smart metering, and renewable integration. China’s push for grid digitalization under national policies such as the “New Infrastructure Plan” is accelerating adoption. The presence of strong domestic manufacturers, ongoing pilot programs, and the construction of smart cities are further strengthening China’s position as a global smart grid leader.

Japan Smart Grid Technology Market Insight

The Japan smart grid technology market is expected to witness the fastest growth rate from 2025 to 2032, due to its strong focus on energy security, disaster resilience, and efficient resource utilization. High-tech infrastructure and government-led initiatives to decarbonize the energy sector are key market drivers. The integration of smart meters, AI-based demand forecasting, and IoT-enabled monitoring systems is rising steadily. Japan’s aging population and high urban density also create a demand for intelligent, automated grid solutions that ensure reliability and efficiency.

North America Smart Grid Technology Market Insight

The North America smart grid technology market is expected to witness the fastest growth rate from 2025 to 2032, driven by widespread upgrades to aging infrastructure, government funding, and strong adoption of renewable energy sources. The region is seeing rapid deployment of smart meters, energy storage systems, and demand response technologies. Utilities are focusing on grid resilience, cybersecurity, and distributed energy integration to meet growing energy demands.

U.S. Smart Grid Technology Market Insight

The U.S. smart grid technology market is expected to witness the fastest growth rate from 2025 to 2032, supported by federal initiatives such as the Grid Modernization Initiative and significant investments in digital infrastructure. The rising penetration of electric vehicles, increasing power outages, and consumer demand for real-time monitoring are accelerating adoption. Integration with smart home devices and the expansion of utility-scale renewable projects are also shaping the market landscape.

Europe Smart Grid Technology Market Insight

The Europe smart grid technology market is expected to witness the fastest growth rate from 2025 to 2032, driven by strict energy efficiency regulations and the EU’s commitment to achieving climate neutrality. Investments in smart metering, energy storage, and flexible grid systems are expanding across the region. Countries such as Germany, the U.K., and France are integrating distributed renewable energy while supporting intelligent infrastructure for smart cities and homes.

Germany Smart Grid Technology Market Insight

The Germany smart grid technology market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s “Energiewende” energy transition strategy, which emphasizes decarbonization, renewable integration, and energy autonomy. Germany’s well-developed utility sector is adopting digital substations, smart inverters, and AI-driven analytics to manage an increasingly complex and decentralized grid. The focus on sustainable, secure, and consumer-oriented power supply is accelerating smart grid investments.

U.K. Smart Grid Technology Market Insight

The U.K. smart grid technology market is expected to witness the fastest growth rate from 2025 to 2032, due to growing demand for electrification, smart meters, and grid modernization. The government's Net Zero Strategy and the mandatory rollout of smart meters are encouraging utilities to invest in digital technologies. Integration with renewable sources and the rise of flexible, decentralized generation systems are also creating opportunities for smart grid expansion across urban and suburban regions.

Smart Grid Technology Market Share

The Smart Grid Technology industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- ABB (Switzerland)

- Siemens (Germany)

- Schneider Electric (France)

- Itron Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- IBM (U.S.)

- Oracle (U.S.)

- Honeywell International (U.S.)

- Eaton (US.)

- Tech Mahindra Limited (India)

- Tantalus (Canada)

- Mitsubishi Electric Corporation (Japan)

- SAP (Germany)

- Wipro (India)

- Trilliant Holdings INC. (U.S.)

- Globema (Poland)

- Kamstrup (Denmark)

- Xylem (U.S.)

- Enel X S.r.l. (Italy)

- eSMART Technologies SA (Norway)

- Esyasoft (India)

- Grid4C (U.S.)

- C3.ai, Inc. (U.S.)

- Networked Energy Services (U.S.)

Latest Developments in Global Smart Grid Technology Market

- In 2021, Impact Solar, a Thailand-based energy company, collaborated with Hitachi ABB Power Grids to deploy an energy storage system within Thailand's largest owned microgrid, enhancing energy management and reliability for the region's infrastructure

- In 2021, Schneider Electric completed the acquisition of DC Systems BV, a leading provider of smart systems. This strategic move enables Schneider Electric to integrate advanced innovations in electrical systems, strengthening its position in the evolving energy market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.