Global Smart Home Water Sensor And Controller Market

Market Size in USD Million

CAGR :

%

USD

712.48 Million

USD

1,013.22 Million

2025

2033

USD

712.48 Million

USD

1,013.22 Million

2025

2033

| 2026 –2033 | |

| USD 712.48 Million | |

| USD 1,013.22 Million | |

|

|

|

|

What is the Global Smart Home Water Sensor and Controller Market Size and Growth Rate?

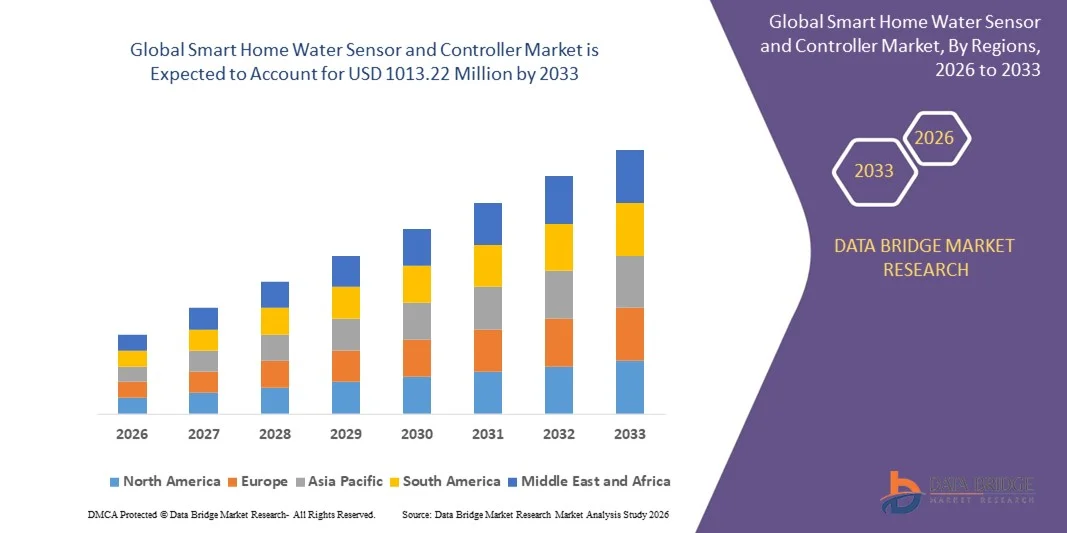

- The global smart home water sensor and controller market size was valued at USD 712.48 million in 2025 and is expected to reach USD 1013.22 million by 2033, at a CAGR of 4.50% during the forecast period

- The growing need for equipment to reduce the wastage of water across the globe, rising demand of smart home water sensors and controllers due to their advanced features such as easy setup, alarm system, personalization, Wi-Fi direct connect, increasing number of developments in smart home water sensor and controller technology and compatibility with internet of things and big data technology, these detectors are battery operated and can monitor the quality and amount of water consumed are some of the major as well as vital factors which will likely to augment the growth of the smart home water sensor and controller market

What are the Major Takeaways of Smart Home Water Sensor and Controller Market?

- Installation of product in new and old residential construction along with rising usages of product to monitor humidity and temperature changes which will further contribute by generating massive opportunities that will lead to the growth of the smart home water sensor and controller market

- High cost associated with the usage of product along with limited adoption of product by the middle and low income level population which will likely to act as market restraints factor for the growth of the smart home water sensor and controller

- North America dominated the smart home water sensor and controller market with the largest revenue share of 41.6% in 2025, driven by the high adoption of smart home technologies, increasing household automation, and rising concerns about water leakage and property damage across the U.S. and Canada

- Asia-Pacific is projected to witness the fastest growth rate of 10.97% during 2026–2033, fueled by rapid smart home penetration across China, Japan, South Korea, and India

- The Smart Home Water Sensor segment dominated the market with a revenue share of 57.4% in 2025, driven by rising adoption of leak detection devices, increasing awareness of home safety, and growing integration of sensors into smart home ecosystems

Report Scope and Smart Home Water Sensor and Controller Market Segmentation

|

Attributes |

Smart Home Water Sensor and Controller Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Smart Home Water Sensor and Controller Market?

Increasing Integration of IoT, AI, and Wireless Connectivity for Real-Time Water Monitoring and Automated Control

- The smart home water sensor and controller market is witnessing a major trend toward the integration of IoT-enabled sensors, AI-driven analytics, and wireless connectivity (Wi-Fi, Zigbee, Z-Wave) to enable real-time leak detection, water usage monitoring, and automated shut-off systems. These technologies enhance home safety and support growing demand for smart home automation

- For instance, leading companies such as Honeywell International Inc. and Samsung SmartThings are introducing AI-powered water sensors capable of predicting leaks, optimizing water usage, and sending instant alerts through mobile apps, improving home efficiency and safety

- The rising adoption of smart home ecosystems, growing consumer awareness of water wastage, and the need for proactive leak prevention are accelerating the shift toward intelligent, connected water management solutions

- Manufacturers are increasingly integrating voice assistants (Alexa, Google Assistant) and cloud-based monitoring platforms, enabling seamless automation and remote control for homeowners

- The growing focus on sustainability, water conservation, and predictive maintenance is driving companies to adopt eco-friendly designs, low-power consumption components, and self-calibrating sensors

- As smart home technology becomes more mainstream globally, the adoption of advanced IoT-enabled water sensors and controllers will continue to shape future market growth and innovation

What are the Key Drivers of Smart Home Water Sensor and Controller Market?

- The increasing demand for smart home automation, coupled with rising concerns about water leakage, flooding, and water wastage, is a major driver of the Smart Home Water Sensor and Controller market. Homeowners are prioritizing safety and efficiency through automated water monitoring

- For instance, in 2024, Moen expanded its Flo Smart Water Security System, integrating whole-home sensing and automatic shut-off mechanisms to prevent leaks before they cause major damage

- The rapid adoption of IoT devices, smart plumbing systems, and remote water management tools is accelerating the deployment of water sensors to reduce insurance claims and enhance property protection

- Advancements in wireless connectivity, mobile app integration, and cloud analytics allow manufacturers to design more accurate, responsive, and user-friendly systems

- The growing construction of smart homes, rising disposable incomes, and increasing awareness of water conservation globally are boosting market demand for intelligent water sensing solutions

- As consumers shift toward connected home ecosystems, the Smart Home Water Sensor and Controller market is expected to grow steadily, driven by innovations in automation, sustainability, and real-time monitoring

Which Factor is Challenging the Growth of the Smart Home Water Sensor and Controller Market?

- Fluctuations in raw material prices for electronic components, sensors, and semiconductors pose a major challenge for smart home water sensor and controller manufacturers, affecting overall production costs

- For instance, during 2024–2025, global shortages in sensor chips and wireless modules led to increased manufacturing delays, affecting product availability across major smart home brands

- Intense competition among IoT device providers and smart home system integrators has created pricing pressure, reducing profit margins, especially for small and mid-sized companies

- High installation costs, compatibility issues with legacy plumbing systems, and limited consumer awareness in developing economies hinder market penetration

- Strict regulatory requirements for water safety and electronic device compliance add to development and certification costs, delaying product launches

- To overcome these challenges, companies are focusing on cost-efficient sensors, IoT interoperability standards, and strategic collaborations with home builders and insurance companies to expand adoption and ensure long-term market sustainability

How is the Smart Home Water Sensor and Controller Market Segmented?

The market is segmented on the basis of type, technology, distribution channel, product, and application.

- By Type

On the basis of type, the smart home water sensor and controller market is segmented into Smart Home Water Sensor and Smart Home Water Controller. The Smart Home Water Sensor segment dominated the market with a revenue share of 57.4% in 2025, driven by rising adoption of leak detection devices, increasing awareness of home safety, and growing integration of sensors into smart home ecosystems. Consumers prefer sensors due to their affordability, ease of installation, and compatibility with IoT platforms such as Samsung SmartThings and Amazon Alexa.

The Smart Home Water Controller segment is projected to record the fastest CAGR during 2026–2033, supported by increasing demand for automated shut-off systems that prevent water damage and reduce insurance claims. Growing integration of controllers with real-time monitoring, mobile app connectivity, and predictive analytics is further accelerating adoption across residential and commercial infrastructures.

- By Technology

On the basis of technology, the smart home water sensor and controller market is segmented into Wi-Fi and Others (Z-Wave, ZigBee, Bluetooth). The Wi-Fi segment dominated the market with a 62.1% share in 2025, driven by its widespread availability, strong connectivity, and seamless integration with smart home routers and cloud-based platforms. Wi-Fi water sensors offer long-range communication, real-time monitoring, and easy mobile app pairing, making them the preferred choice for modern households.

The Others segment is expected to grow at the fastest CAGR from 2026–2033, fueled by increasing adoption of low-power communication technologies such as ZigBee, which provide extended battery life, mesh networking, and reliable performance in large home automation systems. Rising demand for interoperable devices and multi-protocol smart hubs is further boosting growth in this segment.

- By Distribution Channel

Based on distribution channel, the smart home water sensor and controller market is segmented into Online and Offline. The Online segment dominated the market with a 55.9% share in 2025, supported by the rapid expansion of e-commerce platforms, availability of product variety, competitive pricing, and increased consumer preference for doorstep delivery. Growing sales through Amazon, Walmart Online, and brand-owned portals continue to influence the segment's expansion globally.

The Offline segment is anticipated to grow at the fastest CAGR from 2026–2033, driven by rising consumer inclination toward product demonstrations, professional installation services, and in-store technical support offered by specialty smart home retailers. The increased presence of water management solutions in home improvement stores such as Home Depot and Lowe’s further strengthens offline distribution growth.

- By Application

On the basis of application, the smart home water sensor and controller market is categorized into Residential and Commercial. The Residential segment dominated the market with a market share of 64.8% in 2025, driven by the rising incidence of household water leaks, growing smart home adoption, and increasing insurance incentives for installing leak detection systems. Homeowners increasingly prefer connected water monitoring solutions to prevent costly damage and improve water conservation.

The Commercial segment is projected to record the fastest CAGR from 2026–2033, fueled by increased deployment of automated water management systems in offices, hotels, industrial facilities, and smart buildings. Growing investments in building automation, predictive maintenance, and sustainability certifications (LEED, WELL) further accelerate adoption of advanced water controllers in commercial infrastructure.

- By Product

Based on product, the smart home water sensor and controller market is segmented into Hardware Device and Software System. The Hardware Device segment dominated the market with a 71.2% share in 2025, owing to strong demand for leak detection sensors, shut-off valves, and monitoring devices integrated with IoT gateways. The need for immediate physical response during leaks drives consistent hardware adoption across both residential and commercial segments.

The Software System segment is expected to grow at the fastest CAGR during 2026–2033, driven by advancements in cloud-based monitoring, AI-powered predictive analytics, real-time alerts, and integration with water usage dashboards. Increasing demand for subscription-based analytics services and smart home ecosystem synchronization is further enhancing growth prospects of this segment.

Which Region Holds the Largest Share of the Smart Home Water Sensor and Controller Market?

- North America dominated the smart home water sensor and controller market with the largest revenue share of 41.6% in 2025, driven by the high adoption of smart home technologies, increasing household automation, and rising concerns about water leakage and property damage across the U.S. and Canada. Growing integration of IoT-enabled leak detectors, smart shutoff valves, and connected home platforms has significantly strengthened market penetration in the region

- Strong presence of leading smart home solution providers, advancements in wireless connectivity, and rising consumer awareness about water conservation are accelerating the adoption of smart home water management systems. Rapid growth of home insurance incentives and rising smart home renovation activities continue to fuel demand

- Supportive government initiatives promoting sustainable water usage, coupled with increasing residential spending on smart safety devices, further position North America as the global leader in the Smart Home Water Sensor and Controller market

U.S. Smart Home Water Sensor and Controller Market Insight

The U.S. represents the largest share of the North American market, supported by high smart home adoption rates and strong consumer demand for connected leak detection systems. Major players such as Honeywell, Johnson Controls, and Samsung SmartThings are integrating advanced IoT sensors, real-time monitoring, and AI-driven alert systems. Rising water wastage concerns, frequent pipe leak incidents, and increasing smart home insurance partnerships are boosting adoption. The growing penetration of Wi-Fi-enabled shutoff valves and ecosystem-based home management platforms is expected to support sustained market expansion.

Canada Smart Home Water Sensor and Controller Market Insight

Canada continues to contribute significantly to the regional market, driven by rising urbanization, growing adoption of home automation technologies, and increasing basement flooding incidents. Government programs promoting water efficiency and smart building standards are encouraging consumers to invest in leak detection solutions. Expanding availability of DIY smart sensor kits and increased partnerships between home insurance providers and IoT companies are further accelerating market demand.

Asia-Pacific Smart Home Water Sensor and Controller Market Insight (Fastest Growing Region)

Asia-Pacific is projected to witness the fastest growth rate of 10.97% during 2026–2033, fueled by rapid smart home penetration across China, Japan, South Korea, and India. Rising disposable incomes, increasing concerns about water wastage, and growing adoption of IoT-enabled home devices are driving market expansion. Government initiatives promoting smart cities and water efficiency are further accelerating the use of intelligent water monitoring systems. Expanding e-commerce channels, strong growth of residential construction, and rising consumer preference for home safety devices strengthen the region’s growth outlook.

China Smart Home Water Sensor and Controller Market Insight

China leads the Asia-Pacific market due to its large-scale smart home ecosystem, strong manufacturing base, and rapid adoption of connected home appliances. Domestic players are integrating AI-enabled detection, cloud connectivity, and real-time smartphone alerts. Government-backed smart city and water conservation initiatives are fueling widespread installation in residential and commercial buildings. Growing investment in IoT infrastructure and rising consumer awareness of home safety further support market dominance.

India Smart Home Water Sensor and Controller Market Insight

India is emerging as one of the fastest-growing markets in the region, driven by increasing smart home adoption, rising residential construction, and heightened awareness about water damage risks. Government initiatives such as “Digital India” and smart city programs are promoting connected home device integration. Availability of affordable smart sensors, expanding urban middle-class households, and increased penetration of wireless leak detection devices continue to drive strong market growth.

Europe Smart Home Water Sensor and Controller Market Insight

Europe holds a significant share in the global market, supported by strong adoption of smart home technologies and strict regulatory standards for water conservation and building safety. Countries such as Germany, France, and the U.K. are witnessing increased installations of advanced leak detection systems in both residential and commercial buildings. The region’s high focus on sustainability, energy-efficient homes, and integration of IoT-based building automation systems continues to boost demand.

Germany Smart Home Water Sensor and Controller Market Insight

Germany leads the European market due to its advanced home automation infrastructure and emphasis on high-quality building safety systems. Strong adoption of smart building technologies, rising consumer awareness of water efficiency, and widespread availability of premium IoT solutions support the country’s leadership. Continuous innovation in wireless sensors, cloud connectivity, and integrated home control platforms is further strengthening market growth.

U.K. Smart Home Water Sensor and Controller Market Insight

The U.K. market continues to expand, driven by rising demand for smart home upgrades, increasing awareness about water leakage risks, and growing adoption of connected home management systems. Domestic and international smart home providers are offering innovative DIY-based water sensors, smart valves, and app-connected monitoring solutions. The country’s strong push toward sustainable homes and digital transformation is expected to maintain steady market expansion.

Which are the Top Companies in Smart Home Water Sensor and Controller Market?

The smart home water sensor and controller industry is primarily led by well-established companies, including:

- EcoNet Controls, Inc. (Canada)

- FIBAR GROUP S.A. (Poland)

- Hitachi, Ltd. (Japan)

- LIXIL Corporation (Japan)

- Samsung (South Korea)

- Winland Electronics, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Siemens (Germany)

- Johnson Controls. (U.S.)

- Schneider Electric (France)

- ABB (Switzerland)

- BuildingIQ. (U.S.)

- Delta Electronics, Inc. (Taiwan)

- Wirepath Home Systems, LLC (U.S.)

- Comcast (U.S.)

- Vivint, Inc. (U.S.)

- SimpliSafe, Inc. (U.S.)

- Armorax. (U.S.)

- Scout Security Inc (U.S.)

- Robert Bosch GmbH (Germany)

What are the Recent Developments in Global Smart Home Water Sensor and Controller Market?

- In November 2025, IKEA, known primarily for its furniture innovations, launched 21 new Matter-compatible smart home devices designed for seamless integration with HomeKit, Alexa, SmartThings, Google Home, and Home Assistant, with the lineup focusing on lighting, sensors, and control solutions. This introduction strengthens IKEA’s position in interoperable smart home technology

- In June 2025, Drayton enhanced its Wiser system by adding new smart home devices that merge advanced smart heating features with broader automation and energy-efficiency capabilities to create a unified home control ecosystem. This expansion reinforces Wiser’s role as an all-in-one automation platform

- In January 2025, Shelly Group unveiled its Gen4 series of smart home devices, highlighting the X2 — its first smart home control panel — while also introducing support for the LoRa network protocol to expand communication flexibility. This launch marks a significant step in Shelly’s advancement toward next-generation smart home connectivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.