Global Smart Indoor Farming Market

Market Size in USD Billion

CAGR :

%

USD

10.25 Billion

USD

20.57 Billion

2025

2033

USD

10.25 Billion

USD

20.57 Billion

2025

2033

| 2026 –2033 | |

| USD 10.25 Billion | |

| USD 20.57 Billion | |

|

|

|

|

Smart Indoor Farming Market Size

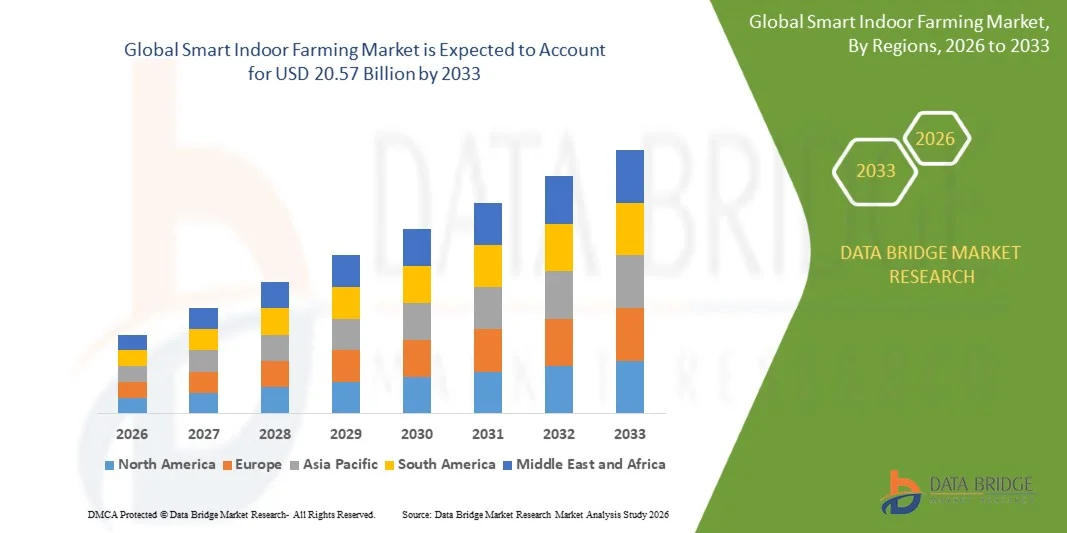

- The global smart indoor farming market size was valued at USD 10.25 billion in 2025 and is expected to reach USD 20.57 billion by 2033, at a CAGR of 9.1% during the forecast period

- The market growth is largely driven by the rising adoption of controlled-environment agriculture and rapid technological advancements in automation, IoT sensors, and data-driven farming systems, enabling precise control over climate, nutrients, and lighting across indoor farms

- Furthermore, increasing pressure to ensure year-round food production, optimize resource usage, and reduce dependency on traditional agriculture is positioning smart indoor farming as a preferred solution for sustainable and resilient food systems. These combined factors are accelerating adoption across commercial growers, urban farms, and institutional facilities, thereby strengthening overall market growth

Smart Indoor Farming Market Analysis

- Smart indoor farming, which integrates advanced hardware, software, and automation to grow crops in controlled environments, is becoming a critical component of modern agriculture due to its ability to deliver consistent yields, improved crop quality, and efficient land and water utilization

- The growing demand for smart indoor farming is primarily supported by increasing urbanization, rising food security concerns, climate variability, and strong investments in agri-technology solutions aimed at improving productivity, sustainability, and supply chain stability

- Europe dominated the smart indoor farming market with a share of 35.8% in 2025, due to strong emphasis on sustainable agriculture, food security, and efficient resource utilization across urban and peri-urban areas

- Asia-Pacific is expected to be the fastest growing region in the smart indoor farming market during the forecast period due to rapid urbanization, population growth, and increasing pressure on arable land

- Hydroponics segment dominated the market with a market share of 45.5% in 2025, due to its proven reliability, relatively lower setup complexity, and wide suitability across leafy greens, herbs, and fruiting crops. Hydroponic systems allow precise nutrient control, faster crop cycles, and higher yields per square foot, making them attractive for both commercial vertical farms and greenhouse operators. Their compatibility with automation, sensors, and AI-based monitoring further supports large-scale adoption. Established supplier ecosystems and standardized system designs have also reduced operational risks for new entrants

Report Scope and Smart Indoor Farming Market Segmentation

|

Attributes |

Smart Indoor Farming Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Indoor Farming Market Trends

Increasing Adoption of Automation and AI-Driven Crop Management

- A major trend in the smart indoor farming market is the growing adoption of automation and AI-driven crop management systems, driven by the need for consistent yields, labor efficiency, and precision control across controlled-environment agriculture. Automated systems enable real-time monitoring of climate, nutrients, and lighting, improving operational accuracy and reducing human dependency

- For instance, companies such as Urban Crop Solutions and Signify Holding provide integrated automation platforms and smart lighting solutions that support data-driven decision-making in indoor farms. These technologies enhance crop consistency and allow growers to optimize production cycles while minimizing resource waste

- The use of AI-based analytics is increasing as indoor farms seek predictive insights related to plant health, yield forecasting, and energy consumption. This is improving scalability and helping operators manage large multi-layer farming facilities more effectively

- Automation is also supporting standardization across indoor farming operations, enabling replication of successful growing recipes across multiple locations. This trend is strengthening commercial viability and encouraging expansion of vertical farming and smart greenhouse projects

- As urban farming gains traction, the reliance on automated systems is becoming critical to maintain productivity in space-constrained environments. This growing emphasis on intelligent crop management is reinforcing smart indoor farming as a technology-driven agricultural model

- Overall, the integration of automation and AI is shaping a more efficient, scalable, and resilient indoor farming ecosystem, supporting long-term market growth

Smart Indoor Farming Market Dynamics

Driver

Rising Demand for Year-Round and Climate-Resilient Food Production

- The increasing demand for year-round food production independent of external climate conditions is a key driver for the smart indoor farming market. Indoor farming systems allow consistent cultivation regardless of seasonal variability, extreme weather, or climate disruptions

- For instance, companies such as Green Sense Farms operate indoor facilities that deliver stable supplies of leafy greens to retailers throughout the year. This capability helps reduce supply chain volatility and supports food availability in urban regions

- Climate change and unpredictable weather patterns are encouraging growers to shift toward controlled environments that protect crops from droughts, floods, and temperature fluctuations. Smart indoor farming addresses these challenges by offering stable growing conditions

- Rising urbanization and population growth are increasing pressure on traditional agriculture to deliver fresh produce close to consumption centers. Indoor farming meets this demand by enabling localized production with reduced transportation dependency

- The focus on consistent quality, predictable output, and reduced agricultural risk is positioning smart indoor farming as a preferred solution for modern food systems

Restraint/Challenge

High Initial Capital Investment and Energy Costs

- The smart indoor farming market faces challenges related to high upfront capital requirements for infrastructure, automation systems, and advanced lighting technologies. Establishing fully controlled indoor farms requires significant investment, which can limit adoption among small and mid-sized growers

- For instance, the installation of LED lighting, climate control systems, and automation platforms substantially increases setup costs for vertical farms. These investments often require longer payback periods, impacting financial feasibility

- Energy consumption remains a critical challenge as indoor farms rely heavily on artificial lighting and climate regulation. Rising energy prices can directly affect operational margins and profitability

- The need for skilled technical expertise to manage advanced systems further adds to operational complexity and costs. This creates barriers for regions with limited access to trained workforce

- Scaling operations while maintaining energy efficiency and cost control remains a persistent challenge for market participants. Addressing these cost-related constraints is essential for wider adoption and sustainable growth of smart indoor farming systems

Smart Indoor Farming Market Scope

The market is segmented on the basis of growing system, facility type, component, and crop type.

- By Growing System

On the basis of growing system, the smart indoor farming market is segmented into aeroponics, hydroponics, aquaponics, and soil-based and hybrid systems. The hydroponics segment dominated the market with the largest share of 45.5% in 2025, driven by its proven reliability, relatively lower setup complexity, and wide suitability across leafy greens, herbs, and fruiting crops. Hydroponic systems allow precise nutrient control, faster crop cycles, and higher yields per square foot, making them attractive for both commercial vertical farms and greenhouse operators. Their compatibility with automation, sensors, and AI-based monitoring further supports large-scale adoption. Established supplier ecosystems and standardized system designs have also reduced operational risks for new entrants.

The aeroponics segment is expected to witness the fastest growth from 2026 to 2033, supported by rising demand for water-efficient and high-yield farming solutions. Aeroponics uses minimal water while maximizing oxygen exposure to plant roots, resulting in faster growth and superior crop quality. Increasing investment in advanced indoor farming technologies and premium produce production is accelerating adoption. Its growing use in urban vertical farms and R&D-driven agriculture projects further fuels market expansion.

- By Facility Type

On the basis of facility type, the smart indoor farming market is segmented into glass or poly greenhouses, indoor vertical farms, container farms, and indoor deep water culture (DWC) systems. The glass or poly greenhouse segment held the largest revenue share in 2025, owing to its scalability, cost efficiency, and long-standing use in controlled-environment agriculture. These facilities enable effective integration of smart climate control, lighting, and irrigation technologies while leveraging natural sunlight. Greenhouses remain a preferred choice for large-scale vegetable and fruit production due to lower energy costs compared to fully enclosed systems. Their adaptability across diverse climates also strengthens dominance.

The indoor vertical farms segment is projected to grow at the fastest rate during the forecast period, driven by rapid urbanization and the need for local food production near consumption centers. Vertical farms maximize space utilization and enable year-round production independent of external weather conditions. Growing investments from agri-tech startups and retailers focused on fresh, pesticide-free produce are accelerating adoption. Advancements in LED lighting and automation further improve economic viability.

- By Component

On the basis of component, the market is segmented into hardware and software and services. The hardware segment dominated the market in 2025, supported by high demand for LED grow lights, sensors, climate control systems, and automated irrigation equipment. Hardware forms the backbone of smart indoor farming operations, enabling precise control over environmental parameters. Continuous upgrades and replacement cycles for lighting and monitoring equipment also contribute to higher revenue share. Increasing adoption of modular and scalable hardware solutions across farms strengthens this segment’s position.

The software and services segment is anticipated to register the fastest growth from 2026 to 2033, driven by rising reliance on data analytics, AI-based crop monitoring, and farm management platforms. Software solutions enable real-time decision-making, predictive maintenance, and yield optimization. Growing demand for subscription-based analytics, remote monitoring, and technical support services is accelerating growth. As farms scale operations, the need for integrated digital ecosystems becomes increasingly critical.

- By Crop Type

On the basis of crop type, the smart indoor farming market is segmented into fruits and vegetables, herbs and microgreens, flowers and ornamentals, and others. The fruits and vegetables segment accounted for the largest market share in 2025, driven by strong global demand for fresh, high-quality produce and shorter supply chains. Indoor farming allows consistent production of leafy greens, tomatoes, peppers, and cucumbers with reduced pesticide use. High consumption volumes and stable pricing make this segment commercially attractive for large operators. Retail and foodservice partnerships further reinforce dominance.

The herbs and microgreens segment is expected to grow at the fastest pace during the forecast period, supported by rising consumer preference for nutrient-dense, fresh, and premium produce. These crops offer short growth cycles, high margins, and suitability for vertical farming setups. Increasing use in gourmet cooking, health foods, and functional nutrition drives demand. Their compatibility with compact indoor systems also encourages adoption among urban and small-scale producers.

Smart Indoor Farming Market Regional Analysis

- Europe dominated the smart indoor farming market with the largest revenue share of 35.8% in 2025, driven by strong emphasis on sustainable agriculture, food security, and efficient resource utilization across urban and peri-urban areas

- Producers across the region increasingly adopt smart indoor farming to address climate variability, reduce dependency on imports, and comply with strict environmental and pesticide regulations

- This dominance is further supported by advanced greenhouse infrastructure, high adoption of automation and precision farming technologies, and strong government support for controlled-environment agriculture, positioning Europe as a technologically mature and innovation-focused market

Germany Smart Indoor Farming Market Insight

The Germany smart indoor farming market accounted for the largest share within Europe in 2025, supported by the country’s strong focus on agri-technology innovation and sustainability-driven food production. German growers emphasize energy efficiency, automation, and data-driven crop management to enhance yield consistency and reduce operational costs. The presence of advanced greenhouse operators and technology providers further accelerates market expansion.

U.K. Smart Indoor Farming Market Insight

The U.K. smart indoor farming market is projected to grow at a steady CAGR during the forecast period, driven by rising demand for locally produced fresh food and increasing adoption of vertical farming systems. Urban farming initiatives and retailer partnerships encourage year-round production of leafy greens and herbs. Concerns around supply chain resilience and food miles further support market growth.

North America Smart Indoor Farming Market Insight

The North America smart indoor farming market holds a significant market share, supported by strong investment in vertical farming startups and widespread adoption of automation and AI-based farm management systems. Growers in the region focus on high-value crops, yield optimization, and labor cost reduction. Advanced digital infrastructure and access to venture funding strengthen large-scale commercial deployment.

Asia-Pacific Smart Indoor Farming Market Insight

The Asia-Pacific smart indoor farming market is expected to witness the fastest CAGR from 2026 to 2033, driven by rapid urbanization, population growth, and increasing pressure on arable land. Countries across the region adopt indoor farming to ensure stable food supply and reduce water usage. Government initiatives promoting smart agriculture and technology adoption further accelerate growth.

China Smart Indoor Farming Market Insight

China dominated the Asia-Pacific smart indoor farming market in 2025, supported by its large population base, food security priorities, and rapid deployment of smart greenhouse and vertical farming projects. The integration of automation, IoT, and AI in farming operations drives efficiency and scalability. Strong government backing for modern agriculture and controlled-environment farming further fuels market expansion.

Smart Indoor Farming Market Share

The smart indoor farming industry is primarily led by well-established companies, including:

- LOGIQS B.V. (Netherlands)

- Illumitex, Inc. (U.S.)

- Vertical Farm Systems (Australia)

- Hydrodynamics International, Inc. (U.S.)

- General Hydroponics, Inc. (U.S.)

- Certhon Group (Netherlands)

- Dalsem Greenhouse Projects (Netherlands)

- Richel Group (France)

- AMHYDRO (U.S.)

- Harnois Industries Inc. (Canada)

- Urban Crop Solutions (Belgium)

- Agrilution GmbH (Germany)

- Green Sense Farms Holdings, Inc. (U.S.)

- Signify Holding B.V. (Netherlands)

- EVERLIGHT ELECTRONICS CO., LTD. (Taiwan)

- Argus Control Systems Limited (Canada)

- NETAFIM Ltd. (Israel)

- LumiGrow, Inc. (U.S.)

- The Scotts Miracle-Gro Company (U.S.)

- Advanced Nutrients Ltd. (Canada)

Latest Developments in Global Smart Indoor Farming Market

- In October 2025, Agroz partnered with Harvest Today to launch the Agroz Groz Wall, a modular indoor vertical farming system aimed at space-efficient and pesticide-free cultivation. This development strengthens the adoption of compact and scalable indoor farming solutions, particularly in urban and semi-urban environments where space and water efficiency are critical. The launch supports market expansion by lowering entry barriers for commercial growers, institutions, and community farming initiatives seeking smart, localized food production

- In August 2025, 80 Acres Farms completed its merger with Soli Organic, creating one of the largest controlled-environment agriculture operators globally. This consolidation enhances operational scale, retail penetration, and production reliability, signaling increasing market maturity. The combined entity improves supply consistency for large retailers and accelerates commercialization of smart indoor farming through integrated automation, data analytics, and expanded distribution networks

- In April 2025, 80 Acres Farms acquired three indoor vertical farming facilities and associated intellectual property from Kalera across multiple U.S. states. This acquisition accelerates capacity expansion while repurposing existing infrastructure with advanced smart farming technologies. The move highlights a trend toward consolidation and asset optimization in the market, enabling faster scaling and cost efficiencies without greenfield investments

- In January 2024, Neatleaf secured USD 4 million in funding to scale its AI-driven cultivation intelligence platform and autonomous crop monitoring robotics. This investment reinforces the growing role of artificial intelligence and automation in improving yield predictability, labor efficiency, and operational transparency. Such advancements support wider adoption of smart indoor farming by reducing manual dependency and enhancing decision-making accuracy

- In late 2023, Square Roots introduced Sage, an AI-powered assistant integrated into its farm management operating system to support real-time grower guidance. This product launch emphasizes the market shift toward software-led optimization and data-centric farming operations. By simplifying complex cultivation decisions, the solution improves scalability and consistency across indoor farms, strengthening the value proposition of smart indoor farming platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.