Global Smart Infrastructure Market

Market Size in USD Billion

CAGR :

%

USD

686.36 Billion

USD

2,758.26 Billion

2024

2032

USD

686.36 Billion

USD

2,758.26 Billion

2024

2032

| 2025 –2032 | |

| USD 686.36 Billion | |

| USD 2,758.26 Billion | |

|

|

|

|

Smart Infrastructure Market Size

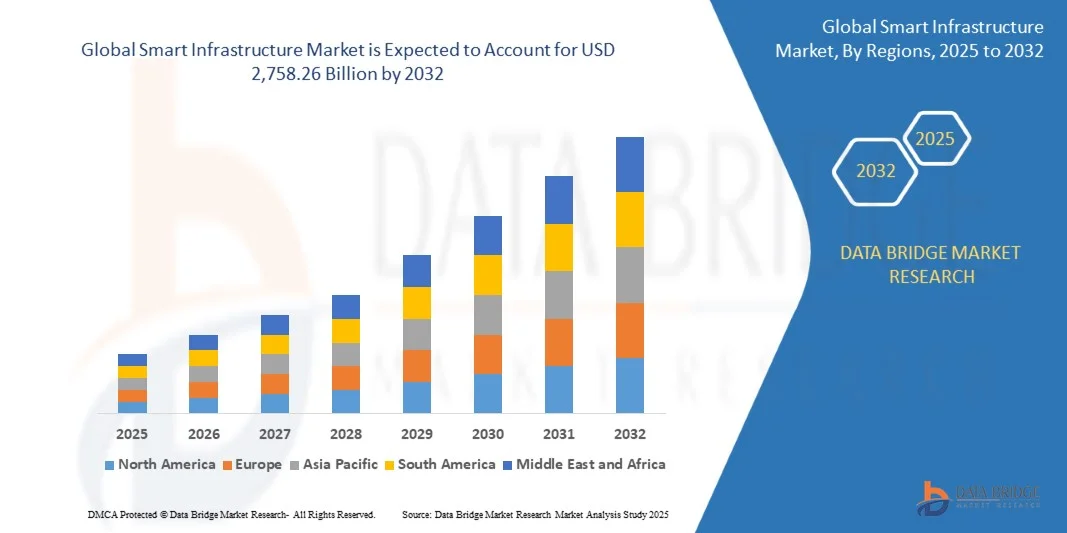

- The global smart infrastructure market size was valued at USD 686.36 billion in 2024 and is expected to reach USD 2,758.26 billion by 2032, at a CAGR of 18.99% during the forecast period

- The market growth is largely fuelled by the increasing adoption of IoT-enabled solutions, rising urbanization, and the need for energy-efficient and sustainable infrastructure

- Growing government initiatives for smart city development and investments in intelligent transportation, utilities, and building management systems are further accelerating market expansion

Smart Infrastructure Market Analysis

- The integration of connected devices, sensors, and advanced analytics is transforming traditional infrastructure into intelligent, responsive, and sustainable systems, improving resource management and quality of life

- Rising demand for automation in transportation, energy grids, water management, and public safety is driving investment in smart infrastructure solutions, creating new revenue opportunities for solution providers

- North America dominated the smart infrastructure market with the largest revenue share 31.34% in 2024, driven by increasing investments in connected urban systems, smart utilities, and energy-efficient infrastructure projects

- Asia-Pacific region is expected to witness the highest growth rate in the global smart infrastructure market, driven by

- Asia-Pacific region is expected to witness the highest growth rate in the global smart infrastructure market, driven by rapid industrialization, expanding urban populations, government-backed smart city programs, and growing investments in IoT, AI, and cloud-enabled infrastructure technologies

- The Products segment held the largest market revenue share in 2024, driven by the rising deployment of IoT-enabled devices, sensors, and smart equipment for monitoring and automation across urban, industrial, and commercial infrastructure. These solutions provide real-time data insights, enhanced operational efficiency, and predictive maintenance capabilities, making them highly sought after by municipal authorities and private operators

Report Scope and Smart Infrastructure Market Segmentation

|

Attributes |

Smart Infrastructure Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Smart Infrastructure Market Trends

“Increasing Adoption of IoT and Connected Systems in Smart Infrastructure”

- The growing deployment of IoT-enabled devices is transforming the smart infrastructure landscape by enabling real-time monitoring and management of urban, industrial, and commercial assets. Connected sensors and systems allow immediate operational adjustments, enhancing efficiency, reducing energy and maintenance costs, and improving overall infrastructure resilience. Stakeholders can also leverage predictive analytics to anticipate failures before they occur, minimizing downtime and resource wastage

- Rising demand for data-driven infrastructure solutions in smart cities, industrial facilities, and transportation networks is accelerating adoption of integrated platforms. These systems improve safety, traffic management, and energy distribution, while supporting predictive maintenance and resource optimization. The increasing need for remote monitoring and automated decision-making is further driving investment in scalable, interoperable smart infrastructure solutions across regions

- Advanced analytics, cloud computing, and AI integration are improving operational intelligence, reliability, and scalability of infrastructure systems. These innovations help stakeholders optimize performance, reduce downtime, and enable sustainable urban development. In addition, AI-driven systems can identify patterns and trends for future urban planning, assisting in resource allocation and improving citizen services efficiency

- For instance, in 2023, a leading European city implemented an AI-driven traffic and energy management system, improving urban mobility, reducing energy consumption, and lowering operational costs across municipal services. The system also enabled predictive maintenance alerts, helping city officials reduce operational disruptions and ensure consistent service delivery. Such deployments demonstrate the measurable benefits of connected smart infrastructure technologies

- While IoT and digital integration are driving market expansion, continued investment in cybersecurity, interoperability standards, and workforce training is critical for long-term growth. The increasing interconnectivity of infrastructure systems also necessitates robust security measures to prevent breaches, ensuring data integrity and operational safety across public and private utilities

Smart Infrastructure Market Dynamics

Driver

“Rising Investments in Sustainable, Smart, and Energy-Efficient Infrastructure Projects”

- Governments and private players are increasingly investing in smart buildings, energy-efficient utilities, and connected transport systems, driving demand for integrated smart infrastructure solutions. Projects focusing on sustainability and reduced carbon footprint are accelerating adoption. Moreover, long-term operational cost savings and environmental compliance regulations are motivating stakeholders to prioritize smart infrastructure projects

- Growing urbanization, population density, and the need for resilient infrastructure are pushing municipalities to implement connected systems for traffic, utilities, and public safety. This trend is fueling demand for real-time monitoring, analytics, and automated management solutions. The increasing importance of emergency preparedness and disaster response capabilities further supports adoption of intelligent infrastructure systems

- Technological advancements in IoT sensors, AI, edge computing, and cloud-based platforms enhance operational efficiency, predictive maintenance, and decision-making, attracting broad adoption across urban, industrial, and commercial sectors. These innovations enable more accurate forecasting of demand patterns and reduce energy consumption, while improving asset lifecycle management and minimizing unplanned outages

- For instance, in 2022, a major U.S. metropolitan city deployed smart water and energy monitoring systems, reducing resource wastage, improving service reliability, and enabling efficient urban planning. The project also leveraged AI-driven optimization to manage peak load demands, resulting in significant cost savings and improved citizen satisfaction. Similar initiatives across North America and Europe are expected to stimulate continued growth

- While investments in connected and sustainable infrastructure are driving market growth, ongoing innovation, regulatory support, and integration across sectors remain essential for maximizing benefits. Stakeholders must ensure seamless interoperability, maintain cybersecurity, and train personnel to fully utilize intelligent infrastructure solutions and future-proof urban ecosystems

Restraint/Challenge

“High Implementation Costs and Complex Integration Requirements”

- The deployment of advanced smart infrastructure solutions involves significant capital expenditure, limiting adoption among smaller municipalities and private operators. Budget constraints often delay or restrict large-scale rollouts, and high upfront costs can deter private investment despite long-term savings. Cost-benefit analyses and financing mechanisms are critical to overcoming adoption barriers

- Integrating multiple legacy systems with new IoT, AI, and cloud-based platforms presents technical challenges. Compatibility issues, data standardization, and interoperability barriers may reduce operational efficiency and slow adoption. In addition, retrofitting older infrastructure with smart devices requires careful planning to avoid service disruptions and maintain consistent performance

- Skilled workforce shortages and limited expertise in managing complex smart systems hinder full utilization and optimization of infrastructure technologies. This can lead to suboptimal performance and increased operational risks. Training programs, certification courses, and knowledge-sharing platforms are essential to develop a capable workforce and bridge the technical gap

- For instance, in 2023, several cities in Southeast Asia faced delays in implementing integrated traffic and energy management solutions due to high costs and technical integration challenges, impacting service quality. Challenges included configuring real-time data flows, ensuring platform compatibility, and establishing maintenance protocols for multi-vendor devices

- While smart infrastructure technologies continue to advance, addressing cost, integration complexity, and technical skills gaps is crucial. Stakeholders are focusing on modular solutions, public-private partnerships, and workforce training to enable broader adoption and sustainable growth. In addition, scalable deployment strategies and flexible financing options are being explored to increase accessibility and ROI for both small- and large-scale projects

Smart Infrastructure Market Scope

The market is segmented on the basis of offering, type, and end-user.

• By Offering

On the basis of offering, the smart infrastructure market is segmented into Products and Services. The Products segment held the largest market revenue share in 2024, driven by the rising deployment of IoT-enabled devices, sensors, and smart equipment for monitoring and automation across urban, industrial, and commercial infrastructure. These solutions provide real-time data insights, enhanced operational efficiency, and predictive maintenance capabilities, making them highly sought after by municipal authorities and private operators.

The Services segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing demand for installation, integration, consulting, and maintenance of smart infrastructure systems. Service providers are enabling seamless implementation of complex solutions, ensuring system interoperability, cybersecurity, and optimized performance, which is driving adoption across both new and existing infrastructure projects.

• By Type

On the basis of type, the smart infrastructure market is segmented into Smart Transportation System, Smart Energy Management System, Smart Safety & Security Systems, Smart Waste Management Solutions, and Others. The Smart Transportation System segment held the largest market revenue share in 2024, fueled by growing demand for intelligent traffic management, connected public transport, and autonomous mobility solutions that enhance urban mobility and reduce congestion.

The Smart Energy Management System segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising adoption of energy-efficient solutions, smart grids, and renewable energy integration in residential, commercial, and industrial sectors. Advanced energy monitoring and automated optimization help reduce consumption, lower costs, and support sustainability initiatives, further boosting market expansion.

• By End-User

On the basis of end-user, the smart infrastructure market is segmented into Residential and Non-residential. The Non-residential segment held the largest market revenue share in 2024, driven by widespread adoption of smart infrastructure solutions in commercial buildings, industrial facilities, and public utilities to enhance operational efficiency, safety, and sustainability.

The Residential segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing consumer demand for smart homes, automated energy management, and connected security systems. Rising urbanization, disposable income, and government incentives for energy-efficient and safe housing are supporting the accelerated adoption of smart infrastructure in residential applications.

Smart Infrastructure Market Regional Analysis

- North America dominated the smart infrastructure market with the largest revenue share 31.34% in 2024, driven by increasing investments in connected urban systems, smart utilities, and energy-efficient infrastructure projects

- Municipalities and industrial operators in the region highly value the efficiency, automation, and real-time monitoring capabilities offered by smart infrastructure solutions, supporting operational optimization and sustainability goals

- This widespread adoption is further supported by robust technological ecosystems, high disposable incomes, and government incentives for smart city initiatives, establishing smart infrastructure as a critical component of urban and industrial development

U.S. Smart Infrastructure Market Insight

The U.S. smart infrastructure market captured the largest revenue share in North America in 2024, fueled by rapid deployment of smart grids, intelligent transportation systems, and IoT-enabled utilities. Cities and industries are increasingly prioritizing connected and energy-efficient solutions to improve operational efficiency, reduce downtime, and support sustainability goals. The integration of AI, cloud computing, and edge analytics with existing infrastructure is accelerating adoption, while public-private partnerships and government programs further propel market growth.

Europe Smart Infrastructure Market Insight

The Europe smart infrastructure market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent regulations on energy efficiency, environmental sustainability, and urban resilience. Rising urbanization, coupled with demand for connected public services and industrial automation, is fostering widespread adoption of smart infrastructure solutions. European cities are increasingly implementing smart energy management, transportation, and safety systems, with emphasis on reducing operational costs and carbon footprint.

U.K. Smart Infrastructure Market Insight

The U.K. smart infrastructure market is expected to witness the fastest growth rate from 2025 to 2032, driven by government-led smart city initiatives and the increasing demand for efficient urban services. Investments in connected transportation networks, intelligent energy systems, and safety solutions are supporting modernization efforts in both public and private sectors. In addition, the country’s advanced technological infrastructure and digital readiness are fostering adoption of scalable, interoperable smart infrastructure platforms.

Germany Smart Infrastructure Market Insight

The Germany smart infrastructure market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing emphasis on sustainable urban development and industrial automation. Germany’s focus on energy efficiency, IoT integration, and green building technologies is promoting adoption of smart infrastructure solutions in cities, industrial complexes, and transportation networks. Integration of advanced analytics, AI, and cloud-based platforms is also becoming prevalent, supporting real-time monitoring, predictive maintenance, and operational optimization.

Asia-Pacific Smart Infrastructure Market Insight

The Asia-Pacific smart infrastructure market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising investments in smart city projects, and technological advancements in countries such as China, Japan, and India. Government initiatives promoting digitalization, smart utilities, and energy efficiency are boosting adoption. Moreover, the region is emerging as a manufacturing and deployment hub for smart infrastructure components, increasing affordability and accessibility to a wider consumer and industrial base.

Japan Smart Infrastructure Market Insight

The Japan smart infrastructure market is expected to witness the fastest growth rate from 2025 to 2032, owing to the country’s high-tech industrial base, aging urban population, and focus on resilient, energy-efficient infrastructure. Adoption of intelligent transportation systems, smart energy grids, and automated safety solutions is increasing, supported by the government’s push for connected cities and industrial automation. Integration with IoT, AI, and cloud computing enhances operational efficiency and predictive maintenance capabilities.

China Smart Infrastructure Market Insight

The China smart infrastructure market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapid urbanization, expanding middle class, and high technological adoption. China is heavily investing in smart city initiatives, intelligent transportation, and energy-efficient industrial systems. The availability of affordable smart infrastructure solutions, alongside strong domestic manufacturers and government support, is further propelling growth across residential, commercial, and industrial applications.

Smart Infrastructure Market Share

The Smart Infrastructure industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Aclara Technologies LLC (Hubbell Incorporated) (U.S.)

- Broadcom, Inc. (VMware) (U.S.)

- Cisco Systems, Inc. (U.S.)

- Dynamic Ratings (U.K.)

- Honeywell International Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Huawei Technologies Co., Ltd. (China)

- International Business Machines Corporation (U.S.)

- L&T Technology Services Limited (India)

- Panamax Infotech (India)

- Schneider Electric (France)

- Siemens (Germany)

- Wipro (India)

- Xylem (Sensus) (U.S.)

Latest Developments in Smart Infrastructure Market

- In September 2023, Huawei Technologies Co., Ltd. launched new smart infrastructure solutions, including Intelligent DC OptiX, an ultra-broadband solution, and the CloudEngine XH AI Computing DCN Switch Series. These solutions aim to help enterprises digitize business operations, enhance network efficiency, and support AI-driven data management, boosting adoption of advanced smart infrastructure technologies in enterprise markets

- In August 2023, Honeywell International Inc. introduced its City Suite Software for a smart city project managed by Atlanta BeltLine, covering the redevelopment of 22 miles of railroad. The software enables centralized monitoring of data from multiple points across the city, improving urban planning, operational efficiency, and real-time decision-making, strengthening Honeywell’s position in the smart city solutions market

- In June 2023, ABB expanded its smart home portfolio through the acquisition of Eve Systems GmbH, a smart home solution provider. The acquisition enhances ABB’s product offerings in North America and Europe, improves brand recognition, and supports growth in the connected home market by enabling more integrated and automated smart home solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.