Global Smart Learning Market

Market Size in USD Billion

CAGR :

%

USD

42.50 Billion

USD

156.44 Billion

2025

2033

USD

42.50 Billion

USD

156.44 Billion

2025

2033

| 2026 –2033 | |

| USD 42.50 Billion | |

| USD 156.44 Billion | |

|

|

|

|

What is the Global Smart Learning Market Size and Growth Rate?

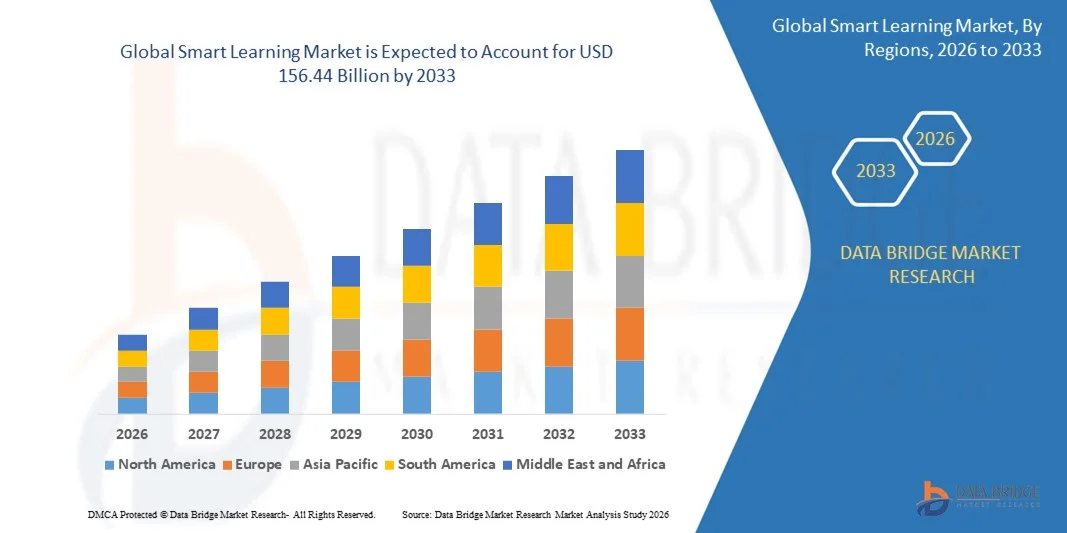

- The global smart learning market size was valued at USD 42.50 billion in 2025 and is expected to reach USD 156.44 billion by 2033, at a CAGR of 17.69% during the forecast period

- Increasing adoption of digital education platforms, rapid integration of AI-powered personalized learning, growing penetration of smartphones and high-speed internet, rising demand for remote and hybrid learning models, expansion of cloud-based learning management systems (LMS), and continuous advancements in immersive technologies such as AR and VR are some of the major as well as vital factors which will such asly augment the growth of the smart learning market

What are the Major Takeaways of Smart Learning Market?

- Growing demand for e-learning solutions across developing economies along with increasing investments in EdTech infrastructure and government-led digital education initiatives will further contribute by generating massive opportunities that will lead to the growth of the Smart Learning market

- Data privacy concerns, high initial implementation costs, lack of digital literacy in certain regions, and integration challenges with legacy systems are some of the key factors which will such asly act as market restraints for the growth of the Smart Learning market

- North America dominated the smart learning market with a 41.8% revenue share in 2025, driven by rapid adoption of digital education platforms, strong presence of leading EdTech companies, and widespread implementation of AI-powered learning management systems across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.87% from 2026 to 2033, driven by rapid digitalization of education systems, expanding internet connectivity, and growing smartphone penetration across China, Japan, India, South Korea, and Southeast Asia

- The Software segment dominated the market with a 48.6% share in 2025, driven by increasing adoption of cloud-based learning management systems (LMS), AI-powered adaptive learning platforms, analytics dashboards, and mobile learning applications

Report Scope and Smart Learning Market Segmentation

|

Attributes |

Smart Learning Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Smart Learning Market?

Rising Adoption of AI-Driven, Cloud-Based, and Personalized Learning Platforms

- The Smart Learning market is witnessing strong adoption of AI-powered platforms designed to support personalized content delivery, adaptive assessments, real-time performance tracking, and intelligent tutoring systems across K–12, higher education, and corporate training

- Providers are introducing cloud-native learning management systems (LMS), mobile-first applications, and immersive tools integrating AR/VR to enhance engagement, collaboration, and remote accessibility

- Growing demand for flexible, self-paced, and hybrid learning models is driving implementation across universities, enterprises, government institutions, and professional certification programs

- For instance, companies such as Coursera, Udemy, Pearson, and BYJU’S have upgraded their platforms with AI-based recommendations, multilingual content libraries, micro-credential programs, and analytics dashboards

- Increasing need for continuous skill development, remote workforce training, and data-driven academic monitoring is accelerating the shift toward scalable, subscription-based digital learning ecosystems

- As education becomes more technology-driven and outcome-focused, Smart Learning solutions will remain vital for improving learner engagement, accessibility, and measurable performance outcomes

What are the Key Drivers of Smart Learning Market?

- Rising demand for cost-effective, accessible, and scalable digital education solutions to support remote learning, workforce upskilling, and lifelong education initiatives

- For instance, in 2025, leading companies such as Coursera, Duolingo, and Instructure expanded their AI-enabled features, certification partnerships, and enterprise learning solutions to strengthen platform capabilities

- Growing adoption of smartphones, tablets, high-speed internet, and cloud infrastructure across the U.S., Europe, and Asia-Pacific is boosting digital content consumption and virtual classroom participation

- Advancements in big data analytics, AI algorithms, gamification techniques, and interactive multimedia content have enhanced learner engagement and completion rates

- Rising focus on STEM education, digital literacy programs, and corporate reskilling initiatives is creating strong demand for adaptive and competency-based learning platforms

- Supported by continuous investments in EdTech innovation, public-private partnerships, and digital infrastructure development, the Smart Learning market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Smart Learning Market?

- High initial implementation costs for advanced LMS platforms, AR/VR-enabled solutions, and enterprise-grade digital learning systems restrict adoption among small institutions and budget-constrained organizations

- For instance, during 2024–2025, cybersecurity concerns, regulatory compliance requirements, and data protection mandates increased operational complexity for several global EdTech providers

- Digital divide issues, limited internet access in rural regions, and lack of adequate teacher training hinder effective technology integration in certain markets

- Concerns regarding data privacy, content standardization, and learner engagement in fully virtual environments slow large-scale institutional adoption

- Competition from free online resources, open educational platforms, and traditional offline coaching models creates pricing pressure and affects monetization strategies

- To address these challenges, companies are focusing on affordable subscription models, localized content development, enhanced cybersecurity frameworks, and teacher training programs to strengthen global adoption of smart learning solutions

How is the Smart Learning Market Segmented?

The market is segmented on the basis of offering, application, and end use.

- By Offering

On the basis of offering, the smart learning market is segmented into Hardware, Software, and Solution. The Software segment dominated the market with a 48.6% share in 2025, driven by increasing adoption of cloud-based learning management systems (LMS), AI-powered adaptive learning platforms, analytics dashboards, and mobile learning applications. Institutions and enterprises prefer software-driven platforms due to scalability, subscription-based pricing, real-time performance tracking, and seamless integration with digital content libraries. Continuous upgrades, AI-based personalization, and SaaS deployment models further strengthen software demand across global education ecosystems.

The Solution segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for end-to-end integrated learning ecosystems combining content, analytics, cloud infrastructure, cybersecurity, and support services. Increasing institutional digitization initiatives and enterprise-wide training transformation programs are accelerating adoption of comprehensive smart learning solutions.

- By Application

On the basis of application, the market is segmented into Asynchronous Learning and Synchronous Learning. The Asynchronous Learning segment dominated the market with a 55.2% share in 2025, as it offers self-paced modules, recorded lectures, AI-based assessments, and flexible access across devices. Growing demand for remote education, professional certifications, and on-demand corporate training significantly supports this segment. Learners benefit from schedule flexibility, personalized content delivery, and cost-effective course structures, making asynchronous models highly scalable across regions.

The Synchronous Learning segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of virtual classrooms, live instructor-led sessions, real-time collaboration tools, and hybrid learning environments. Rising demand for interactive engagement, real-time doubt resolution, and structured digital classrooms is accelerating growth in synchronous learning platforms globally.

- By End Use

On the basis of end use, the smart learning market is segmented into Academics, Enterprises, Government, and Others. The Academics segment dominated the market with a 44.7% share in 2025, driven by widespread digital transformation across K–12 schools, universities, and higher education institutions. Government-led digital education initiatives, rising enrollment in online degree programs, and integration of AI-driven learning tools have strengthened adoption across academic institutions worldwide.

The Enterprises segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing focus on workforce upskilling, compliance training, remote employee onboarding, and continuous professional development. Rapid digitalization of corporate training ecosystems and rising investment in learning analytics platforms are fueling enterprise adoption of smart learning solutions.

Which Region Holds the Largest Share of the Smart Learning Market?

- North America dominated the smart learning market with a 41.8% revenue share in 2025, driven by rapid adoption of digital education platforms, strong presence of leading EdTech companies, and widespread implementation of AI-powered learning management systems across the U.S. and Canada. High internet penetration, advanced cloud infrastructure, and strong investments in virtual classrooms, corporate e-learning, and higher education technology continue to fuel demand for Smart Learning solutions across academic institutions, enterprises, and government bodies

- Leading companies in North America are introducing AI-driven personalization tools, advanced analytics dashboards, immersive AR/VR-based learning modules, and secure cloud-based LMS platforms, strengthening the region’s technological leadership. Continuous investments in digital transformation, workforce reskilling, and remote education initiatives drive long-term market expansion

- Strong regulatory frameworks, high digital literacy rates, established innovation ecosystems, and sustained investments in EdTech startups further reinforce regional market dominance

U.S. Smart Learning Market Insight

The U.S. is the largest contributor in North America, supported by extensive deployment of online degree programs, enterprise training platforms, and AI-enabled adaptive learning systems. Increasing demand for upskilling, hybrid classrooms, professional certification courses, and remote workforce training accelerates adoption. Strong venture capital funding, partnerships between universities and EdTech firms, and widespread integration of analytics-driven performance tracking tools further drive Smart Learning market growth across education and corporate sectors.

Canada Smart Learning Market Insight

Canada contributes significantly to regional growth, driven by government-supported digital education initiatives, expanding online higher education enrollment, and rising enterprise learning investments. Universities and training institutions increasingly utilize cloud-based LMS platforms and AI-assisted tutoring systems. Strong broadband penetration, focus on inclusive education, and support for bilingual digital content strengthen Smart Learning adoption across the country.

Asia-Pacific Smart Learning Market

Asia-Pacific is projected to register the fastest CAGR of 9.87% from 2026 to 2033, driven by rapid digitalization of education systems, expanding internet connectivity, and growing smartphone penetration across China, Japan, India, South Korea, and Southeast Asia. Rising government investments in digital classrooms, e-learning platforms, and skill development programs significantly boost regional demand. Growth in online certifications, competitive exam preparation platforms, and enterprise upskilling solutions continues to accelerate Smart Learning adoption across emerging economies.

China Smart Learning Market Insight

China is the largest contributor to Asia-Pacific due to strong government support for digital education, expanding online tutoring platforms, and rapid integration of AI-based learning systems. Large student populations, growing EdTech startups, and increasing demand for remote learning solutions drive significant market expansion.

Japan Smart Learning Market Insight

Japan shows steady growth supported by advanced digital infrastructure, high technology adoption rates, and integration of smart classrooms across universities and corporate sectors. Focus on robotics, AI-based education tools, and lifelong learning programs strengthens Smart Learning demand.

India Smart Learning Market Insight

India is emerging as a major growth hub, driven by rising smartphone usage, expanding online education platforms, and government-backed digital literacy initiatives. Growing demand for competitive exam preparation, skill-based certifications, and affordable e-learning solutions accelerates adoption nationwide.

South Korea Smart Learning Market Insight

South Korea contributes significantly due to strong broadband connectivity, advanced ICT infrastructure, and high student engagement in digital learning platforms. Increasing investment in AI-powered tutoring, virtual classrooms, and enterprise training ecosystems supports sustained market growth.

Which are the Top Companies in Smart Learning Market?

The smart learning industry is primarily led by well-established companies, including:

- BYJU’S (India)

- Coursera, Inc. (U.S.)

- Duolingo, Inc. (U.S.)

- Edmodo, Inc. (U.S.)

- Instructure, Inc. (U.S.)

- Khan Academy, Inc. (U.S.)

- Knewton, Inc. (John Wiley & Sons, Inc.) (U.S.)

- Pearson plc (U.K.)

- SMART Technologies ULC (Canada)

- Udemy, Inc. (U.S.)

What are the Recent Developments in Global Smart Learning Market?

- In July 2025, Instructure partnered with OpenAI to embed advanced AI capabilities directly into the Canvas Learning Management System (LMS) under its IgniteAI initiative, enabling educators to design “LLM-enabled assignments” that function as customized GPT-style learning experiences, thereby significantly enhancing personalized and interactive digital education delivery

- In June 2025, Pearson entered a multi-year collaboration with Google Cloud to accelerate the creation of AI-driven educational solutions, utilizing Google’s advanced AI models including Gemini to deliver personalized K–12 learning experiences and actionable data insights for educators, thereby strengthening adaptive learning and intelligent classroom support systems

- In October 2024, Transact Campus formed a strategic alliance with Anthology to streamline higher education operations by integrating advanced payment processing and credentialing systems with Anthology Student and Anthology Reach platforms, thereby improving administrative efficiency and enhancing the overall student lifecycle management experience

- In September 2024, Cisco Philippines collaborated with Mapúa University to introduce the country’s first AI-enabled digital classrooms, equipped with Cisco Webex Boards and intelligent collaboration features to support the university’s flexible “Tri-x” hybrid teaching framework, thereby redefining interactive, synchronous, and asynchronous learning environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.