Global Smart Mattress Market

Market Size in USD Billion

CAGR :

%

USD

2.28 Billion

USD

5.31 Billion

2024

2032

USD

2.28 Billion

USD

5.31 Billion

2024

2032

| 2025 –2032 | |

| USD 2.28 Billion | |

| USD 5.31 Billion | |

|

|

|

|

Smart Mattress Market Size

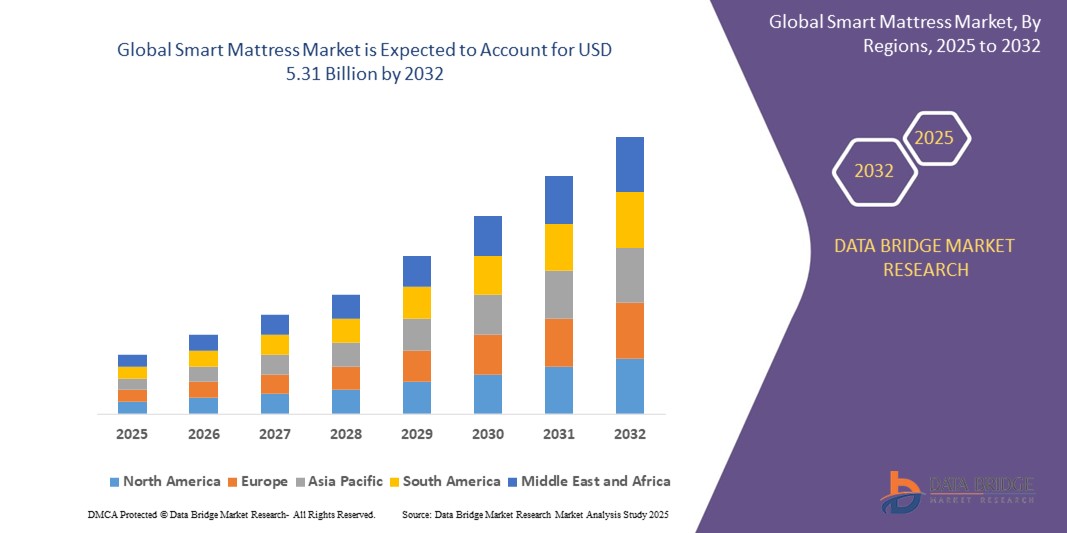

- The global smart mattress market size was valued at USD 2.28 billion in 2024 and is expected to reach USD 5.31 billion by 2032, at a CAGR of 11.10% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home ecosystems and health-monitoring technologies, leading to increased digitalization of personal wellness and sleep environments in both residential and commercial spaces

- Furthermore, rising consumer demand for personalized, user-friendly, and integrated sleep solutions is positioning smart mattresses as essential components of modern smart homes. These converging factors are accelerating the adoption of smart bedding systems, thereby significantly boosting the industry's growth

Smart Mattress Market Analysis

- Smart mattresses are sensor-embedded bedding systems designed to monitor sleep patterns, regulate temperature, adjust firmness, and provide data-driven insights to improve sleep quality. These systems often integrate with smartphones, wearables, and smart home platforms, offering users enhanced comfort, personalization, and wellness tracking

- The increasing demand for smart mattresses is driven by heightened awareness of sleep health, the proliferation of IoT-enabled devices, and a growing preference for tech-integrated lifestyle solutions. Consumers are seeking mattresses that deliver not just rest, but actionable feedback and adaptive support for better long-term health outcomes

- North America dominated smart mattress market with a share of 67.2% in 2024, due to strong consumer awareness of sleep health, wellness-focused lifestyles, and high adoption of smart home technologies

- Asia-Pacific is expected to be the fastest growing region in the smart mattress market during the forecast period due to rising disposable incomes, increasing urbanization, and growing health awareness in countries such as China, Japan, and India

- Household segment dominated the market with a market share of 66.7% in 2024, due to increasing awareness of sleep health and rising investments in wellness-oriented home products. Consumers are increasingly adopting smart mattresses for their personalized comfort, health monitoring, and sleep quality improvement features, particularly in urban and semi-urban households

Report Scope and Smart Mattress Market Segmentation

|

Attributes |

Smart Mattress Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Mattress Market Trends

“Integration of Sleep Tracking Technology”

- The smart mattress market is rapidly expanding due to the integration of advanced sleep tracking technologies that record sleep cycles, movement, heart rate, and more, providing users with actionable insights to enhance sleep quality. These mattresses often pair with mobile apps for real-time feedback and customized recommendations, fueling their appeal among health-focused and tech-savvy consumers

- For instance, leading brands such as Sleep Number and Eight Sleep offer smart mattresses with built-in sensors that track detailed sleep metrics and automatically adjust firmness and temperature based on individual patterns, helping users optimize sleep conditions

- Temperature regulation features are in high demand, with manufacturers introducing mattresses that use active cooling systems or phase change materials to help users maintain an ideal sleep temperature, particularly valuable in regions with extreme climates

- Hybrid mattress options—combining foam, latex, and coils—now often incorporate smart technologies, catering to consumers seeking both physical comfort and digital benefits

- AI-driven monitoring and personalized analytics are emerging as differentiators, with smart mattresses offering tailored insights that can help address issues such as insomnia, restlessness, or poor posture

- The adoption of smart home integration, where mattresses connect to Internet of Things (IoT) ecosystems for voice commands or syncing with lighting and climate control, is increasingly popular and shaping the next generation of sleep products

Smart Mattress Market Dynamics

Driver

“Increasing Focus on Health and Wellness”

- Health and wellness trends continue to drive consumer demand for solutions that promote better sleep, with a sharpened focus on products that contribute to long-term well-being and quality of life

- For instance, the National Sleep Foundation highlights growing awareness of sleep’s impact on overall health, spurring consumers to invest in smart mattresses with features such as sleep data tracking, posture correction, and custom comfort settings to address personal health goals and conditions

- The aging population is increasingly turning to smart mattresses as ergonomic solutions for chronic pain and posture issues, fueling demand among elderly and health-compromised demographics

- Smart mattresses are gaining traction in hospitality and healthcare, where enhanced comfort, hygiene, and monitoring can improve the guest or patient experience

- Enhanced capabilities such as automatic firmness adjustment, anti-snore technology, and stress-reduction features are aligning with consumer wellness initiatives and holistic health trends. The trend toward home automation and connected lifestyles is making smart mattresses more attractive to buyers who seek a fully integrated and personalized living environment

Restraint/Challenge

“High Cost of Smart Mattresses”

- The premium price tag associated with smart mattresses—with embedded electronics, sensors, and digital features—remains a significant barrier to mass adoption, especially in price-sensitive markets

- For instance, advanced offerings from companies such as Eight Sleep and Sleep Number routinely cost several times more than conventional mattresses, limiting accessibility to affluent and early adopter segments despite rising interest

- Manufacturing and R&D costs for integrating new technologies, coupled with shorter product lifecycles and frequent need for updates, keep overall prices elevated relative to traditional alternatives

- Limited awareness in emerging economies, compounded by distribution challenges and lower purchasing power, restricts substantial market penetration outside developed regions

- Market players face the ongoing challenge of balancing technological advancement and affordability, with intense competition spurring investments in cost reduction and mass-market feature sets

Smart Mattress Market Scope

The market is segmented on the basis of product, application, size, and distribution channel.

• By Product

On the basis of product, the smart mattress market is segmented into foam, hybrid, innerspring, latex, water bed, air bed, adjustable bases, and others. The innerspring segment dominated the largest market revenue share of 33.1% in 2024, driven by its long-standing consumer familiarity, widespread availability, and competitive pricing. Its responsive support and durability continue to appeal to a broad customer base, while manufacturers increasingly integrate basic smart features such as sleep tracking and pressure sensors into innerspring designs to enhance functionality without significantly increasing cost.

The hybrid segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for premium comfort combined with advanced sleep technologies. Hybrid smart mattresses, which combine memory foam and innerspring systems, appeal to users desiring both support and technological enhancement. Their ability to balance firmness, motion isolation, and smart features such as dual-zone climate control and sleep tracking has made them a preferred choice among tech-savvy consumers.

• By Application

On the basis of application, the smart mattress market is segmented into household and commercial. The household segment held the largest market share of 66.7% in 2024, driven by increasing awareness of sleep health and rising investments in wellness-oriented home products. Consumers are increasingly adopting smart mattresses for their personalized comfort, health monitoring, and sleep quality improvement features, particularly in urban and semi-urban households.

The commercial segment is expected to register the fastest CAGR from 2025 to 2032, owing to rising demand in the hospitality and healthcare industries. Hotels are integrating smart beds to enhance guest experience with features such as automatic firmness adjustment and sleep analytics, while hospitals and senior living centers are adopting smart mattresses for patient monitoring, fall detection, and pressure ulcer prevention.

• By Size

On the basis of size, the market is segmented into twin or single size, twin XL size, full or double size, queen size, and others. The queen size segment dominated the market in 2024 due to its broad appeal among couples and families, offering a balance between comfort, space, and affordability. Queen-sized smart mattresses are a preferred standard in both homes and hotel rooms, and are widely available across brands and models, often bundled with advanced features such as smart alarm systems and sleep coaching.

The twin XL size segment is expected to grow at the fastest pace through 2032, driven by increased adoption in student housing, dormitories, and compact urban living spaces. These mattresses offer sufficient length for adults and are increasingly being chosen in multi-unit residential and hospitality developments focusing on space efficiency without compromising on smart functionality.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into offline retail, online retail, independent retailers/exclusive stores, and specialty stores. The online retail segment held the largest revenue share in 2024, fueled by growing consumer preference for convenience, broader product selection, and access to detailed reviews. The ability to compare features, read customer feedback, and benefit from home delivery and trial policies has made online platforms the go-to choice for purchasing smart mattresses.

Specialty stores are projected to grow at the fastest CAGR from 2025 to 2032, as consumers increasingly seek expert guidance and hands-on experience before investing in high-tech sleep solutions. These stores often provide personalized consultations, sleep diagnostics, and demonstrations, making them key drivers for brand engagement and high-ticket purchases.

Smart Mattress Market Regional Analysis

- North America dominated the smart mattress market with the largest revenue share of 67.2% in 2024, driven by strong consumer awareness of sleep health, wellness-focused lifestyles, and high adoption of smart home technologies

- Consumers in the region are increasingly investing in smart mattresses that offer sleep tracking, temperature control, and connectivity with mobile apps and smart home systems

- The market growth is further supported by high disposable income, a tech-savvy population, and the presence of leading smart mattress brands, making North America a mature and innovation-driven market

U.S. Smart Mattress Market Insight

The U.S. smart mattress market captured the largest revenue share in 2024 within North America, supported by the rising trend of health monitoring and personalized sleep solutions. Consumers are increasingly opting for mattresses integrated with sensors, adjustable firmness, and app-based insights to improve sleep quality. The strong influence of wellness trends, combined with increasing penetration of IoT-enabled home devices and wearables, continues to drive demand across residential and hospitality segments.

Europe Smart Mattress Market Insight

The Europe smart mattress market is expected to grow at a notable CAGR during the forecast period, driven by heightened awareness of sleep-related disorders and growing demand for comfort-oriented home furnishings. Regulatory support for healthcare technology and increased consumer interest in smart living solutions are boosting adoption. Europe’s aging population and preference for health-optimized sleep systems are also contributing to sustained growth across households and medical settings.

U.K. Smart Mattress Market Insight

The U.K. smart mattress market is anticipated to witness healthy growth over the forecast period, fueled by increasing health consciousness and the expansion of smart home ecosystems. Rising demand for tech-integrated bedding solutions, particularly among millennials and aging consumers, is driving adoption. The market also benefits from a robust e-commerce infrastructure and the popularity of direct-to-consumer sleep product brands offering trial-based purchases and personalized features.

Germany Smart Mattress Market Insight

The Germany smart mattress market is expected to expand at a steady CAGR, supported by rising innovation in sleep technology and growing consumer interest in wellness-oriented lifestyle products. German consumers place high value on product quality, durability, and sustainability, which aligns well with smart mattresses offering eco-friendly materials, sleep diagnostics, and adjustable bases. The integration of health-monitoring features is also appealing to the country’s aging demographic.

Asia-Pacific Smart Mattress Market Insight

The Asia-Pacific smart mattress market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising disposable incomes, increasing urbanization, and growing health awareness in countries such as China, Japan, and India. Government efforts promoting digitalization and smart infrastructure are fostering adoption. The region’s position as a global manufacturing hub also allows for the development and availability of affordable smart mattress options for a broader consumer base.

Japan Smart Mattress Market Insight

The Japan smart mattress market is gaining traction due to high technology acceptance and an aging population seeking better sleep health solutions. Japanese consumers show strong interest in smart home integration, and smart mattresses that offer automated comfort adjustments, AI-driven sleep analysis, and thermal control are becoming increasingly popular. The country’s emphasis on innovation and quality further supports market expansion.

China Smart Mattress Market Insight

The China smart mattress market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rising middle-class income, expanding urban housing, and high penetration of smart home products. Demand is growing rapidly across residential and hospitality sectors, with consumers attracted to features such as sleep tracking, app control, and smart bed positioning. The presence of domestic brands offering cost-effective solutions and the push toward smart living ecosystems are key drivers of market growth.

Smart Mattress Market Share

The smart mattress industry is primarily led by well-established companies, including:

- Serta Simmons Bedding, LLC (U.S.)

- Sleep Number Corporation (U.S.)

- Eight Sleep, Inc. (U.S.)

- Kingsdown, Inc. (U.S.)

- ReST (U.S.)

- Tempur Sealy International, Inc. (U.S.)

- Leggett & Platt, Incorporated (U.S.)

- Hilding Anders (Sweden)

- DeRucci Inc. (China)

- Recticel (Belgium)

- Sleemon (China)

- Naturaliterie (France)

- Variowell-Development GmbH (Germany)

- Al Mattress (U.S.)

- PARAMOUNT BED CO., LTD. (Japan)

- Spring Air International (U.S.)

- Southerland Sleep (U.S.)

Latest Developments in Global Smart Mattress Market

- In November 2023, The DeRUCCI Group launched the DeRUCCI T11 Pro Smart Mattress, an AI-powered sleep solution. Developed with research from international institutions, this mattress adjusts to the user’s health in real time, offering optimal sleep and early warnings about potential health issues

- In May 2023, Nectar Sleep acquired Bedgear, known for its smart mattresses and sleep accessories. This acquisition will enable Nectar Sleep to enhance its product range with Bedgear’s advanced technology, expanding its selection of smart mattresses and related sleep products

- In April 2023, Purple Innovation acquired Sleepace, a company specializing in smart sleep products. This acquisition allows Purple Innovation to broaden its product lineup and enter the smart sleep sector. Sleepace’s offerings include a smart mattress pad, sleep mask, and smartwatch that monitor and analyze sleep data

- In March 2023, Tempur Sealy and Eight Sleep announced a partnership to integrate Eight Sleep’s smart mattress technology into Tempur Sealy’s products. This collaboration aims to enhance Tempur Sealy’s offerings by providing smart mattresses that track sleep patterns, offer personalized insights, and improve overall sleep quality

- In January 2023, Tempur-Pedic introduced a new line of smart mattresses as part of its premium bedding portfolio, featuring advanced technologies such as sleep tracking, automatic firmness adjustments, and climate control. This launch significantly impacted the smart mattress market by setting a new benchmark for innovation and user-centric design in the premium segment. Tempur-Pedic’s strong brand reputation and widespread distribution helped accelerate consumer awareness and adoption of smart sleep solutions. The move also intensified competition among key players, prompting further investment in R&D and the expansion of high-tech offerings across various price segments, ultimately contributing to the overall growth and technological evolution of the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.