Global Smart Meters Wireless Smart Ubiquitous Network Wi Sun Technology Market

Market Size in USD Billion

CAGR :

%

USD

3.74 Billion

USD

28.88 Billion

2025

2033

USD

3.74 Billion

USD

28.88 Billion

2025

2033

| 2026 –2033 | |

| USD 3.74 Billion | |

| USD 28.88 Billion | |

|

|

|

|

Smart Meters Wireless Smart Ubiquitous Network (Wi-SUN) Technology Market Size

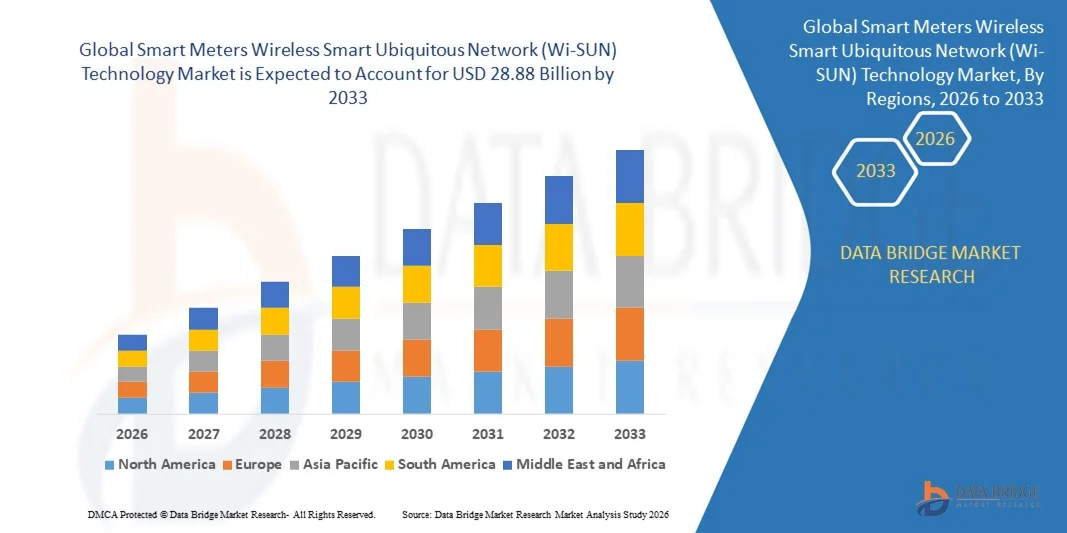

- The global smart meters wireless smart ubiquitous network (Wi-SUN) technology market size was valued at USD 3.74 billion in 2025 and is expected to reach USD 28.88 billion by 2033, at a CAGR of 29.10% during the forecast period

- The market growth is largely fuelled by the increasing adoption of smart grid infrastructure, growing demand for real-time energy monitoring, and rising implementation of IoT-enabled metering solutions in residential, commercial, and industrial sectors

- The shift toward energy-efficient and sustainable power management solutions is further propelling the adoption of Wi-SUN technology in smart meters, enabling utilities to optimize distribution and reduce operational costs

Smart Meters Wireless Smart Ubiquitous Network (Wi-SUN) Technology Market Analysis

- The market is witnessing robust growth due to technological advancements in communication protocols and network interoperability, facilitating seamless integration of smart meters with existing grid systems

- Increased focus on energy conservation, demand-side management, and improved billing accuracy is encouraging utilities to adopt Wi-SUN-enabled smart meters, enhancing operational efficiency and customer satisfaction

- North America dominated the smart meters wireless smart ubiquitous network (Wi-SUN) technology market with the largest revenue share in 2025, driven by rising investments in smart grids, advanced energy infrastructure, and supportive government policies for energy efficiency and digitalization

- Asia-Pacific region is expected to witness the highest growth rate in the global smart meters wireless smart ubiquitous network (Wi-SUN) technology market, driven by rapid urbanization, government policies supporting smart grids, and rising investments in energy-efficient and automated metering systems across countries such as China, Japan, and Australia

- The hardware products segment held the largest market revenue share in 2025, driven by the widespread deployment of smart meters, communication modules, and network devices across residential, commercial, and industrial sectors. Hardware investments are crucial for enabling reliable data transmission, real-time monitoring, and energy management

Report Scope and Smart Meters Wireless Smart Ubiquitous Network (Wi-SUN) Technology Market Segmentation

|

Attributes |

Smart Meters Wireless Smart Ubiquitous Network (Wi-SUN) Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Smart Meters Wireless Smart Ubiquitous Network (Wi-SUN) Technology Market Trends

Rise of Wireless Connectivity and Smart Meter Integration

- The increasing deployment of Wi-SUN enabled smart meters is transforming the energy management landscape by enabling real-time, reliable, and secure data communication. The wireless connectivity allows for immediate monitoring of energy consumption, improving grid efficiency and reducing operational costs

- The high demand for advanced metering infrastructure in urban and remote areas is accelerating the adoption of Wi-SUN based solutions. These systems are particularly effective in regions with complex grid networks, helping reduce energy losses and ensuring accurate billing and load management

- The scalability and interoperability of Wi-SUN technology are making it attractive for utilities and smart city projects, leading to enhanced energy efficiency and reduced downtime. Operators benefit from better network management and predictive maintenance capabilities, improving service reliability

- For instance, in 2023, several European utilities reported improved demand response and real-time energy monitoring after deploying Wi-SUN enabled smart meters across residential and commercial areas. These implementations allowed accurate data collection, optimizing grid performance and energy savings

- While Wi-SUN smart meters are accelerating connectivity and operational efficiency, their impact depends on continued innovation, standardization, and integration with existing grid infrastructure. Manufacturers and utilities must focus on secure communication protocols, network expansion, and system compatibility to fully capitalize on this growing demand

Smart Meters Wireless Smart Ubiquitous Network (Wi-SUN) Technology Market Dynamics

Driver

Growing Demand for Smart Grids and Real-Time Energy Management

- The push toward smart grids and intelligent energy distribution systems is driving the adoption of Wi-SUN enabled smart meters. Real-time monitoring and control enable utilities to optimize energy delivery, reduce losses, and improve overall grid reliability. This also allows for better demand response management and reduces the likelihood of blackouts, supporting grid stability

- Utilities are increasingly aware of the benefits offered by Wi-SUN networks, including low-power operation, extended communication range, and mesh network capabilities. This awareness has led to higher investments in pilot deployments and full-scale smart meter rollouts across multiple regions. Enhanced network visibility enables predictive maintenance and efficient energy distribution, lowering operational costs

- Government initiatives promoting renewable energy integration and smart city infrastructure further support Wi-SUN adoption. Regulatory frameworks encouraging energy efficiency, load management, and automated metering create a favorable environment for market growth. These policies are also driving innovation in energy analytics and utility management systems

- For instance, in 2022, several North American and European energy providers launched programs incentivizing smart meter installations, driving the deployment of Wi-SUN enabled devices in residential and commercial sectors. The result has been improved energy efficiency, accurate billing, and enhanced consumer engagement in energy-saving initiatives

- While demand and policy support are fueling market growth, utilities must address challenges such as network security, device interoperability, and integration with legacy systems to ensure seamless adoption and long-term efficiency. Focused investments in robust cybersecurity, standard protocols, and workforce training will be crucial to fully realize the potential of Wi-SUN technology

Restraint/Challenge

High Implementation Costs and Network Complexity

- The high capital investment required for Wi-SUN enabled smart meters and supporting communication infrastructure limits adoption among smaller utilities. Cost remains a major barrier to large-scale deployment, particularly in developing regions. Utilities may struggle with initial ROI, making it harder to justify large-scale installations without financial incentives

- Many regions face challenges in deploying and maintaining large-scale Wi-SUN networks, including technical expertise requirements, interoperability issues, and security protocols. These challenges can hinder adoption and delay project timelines. Maintenance of mesh networks also requires specialized software and trained personnel to ensure reliable data transmission

- Market growth is also impacted by the need for standardization and compatibility with existing grid management systems. Utilities must invest in network planning, system integration, and staff training to maximize operational efficiency. Fragmented deployment strategies can result in inefficiencies and reduce the overall benefits of smart metering

- For instance, in 2023, several smart grid projects in Asia-Pacific experienced deployment delays due to complex network integration and high installation costs, highlighting the importance of robust planning and support infrastructure. Such delays can affect energy management, regulatory compliance, and consumer satisfaction

- While Wi-SUN smart meters continue to advance, addressing cost, technical complexity, and system integration challenges remains critical. Stakeholders must focus on modular solutions, scalable deployment strategies, secure network management, and innovative financing options to unlock long-term market potential and accelerate smart grid adoption

Smart Meters Wireless Smart Ubiquitous Network (Wi-SUN) Technology Market Scope

The market is segmented on the basis of component and application.

- By Component

On the basis of component, the smart meters wireless smart ubiquitous network (Wi-SUN) technology market is segmented into hardware products, software solutions, and services. The hardware products segment held the largest market revenue share in 2025, driven by the widespread deployment of smart meters, communication modules, and network devices across residential, commercial, and industrial sectors. Hardware investments are crucial for enabling reliable data transmission, real-time monitoring, and energy management.

The software solutions segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing need for advanced data analytics, grid management platforms, and predictive maintenance tools. Wi-SUN software solutions facilitate seamless integration with existing utility systems, enhance operational efficiency, and enable utilities to optimize energy distribution while reducing operational costs.

- By Application

On the basis of application, the market is segmented into advanced metering infrastructure (AMI), automatic meter reading (AMR), and distribution management systems. The AMI segment held the largest revenue share in 2025 due to its comprehensive capabilities for two-way communication, real-time energy monitoring, and efficient load management, which are critical for modern smart grid deployments.

The distribution management systems segment is expected to register the fastest growth during the forecast period, driven by the increasing focus on automated grid operations, fault detection, and energy loss reduction. Wi-SUN-enabled DMS solutions support utilities in optimizing energy delivery, enhancing grid reliability, and enabling smart city initiatives.

Smart Meters Wireless Smart Ubiquitous Network (Wi-SUN) Technology Market Regional Analysis

- North America dominated the smart meters wireless smart ubiquitous network (Wi-SUN) technology market with the largest revenue share in 2025, driven by rising investments in smart grids, advanced energy infrastructure, and supportive government policies for energy efficiency and digitalization

- Utilities and energy providers in the region highly value the benefits of Wi-SUN-enabled smart meters, including real-time energy monitoring, demand response management, and reduced operational losses

- This widespread adoption is further supported by strong regulatory frameworks, high infrastructure readiness, and increasing consumer awareness of energy management solutions, establishing Wi-SUN smart meters as a preferred choice for both residential and commercial energy management

U.S. Smart Meters Wi-SUN Technology Market Insight

The U.S. smart meters Wi-SUN technology market captured the largest revenue share in 2025 within North America, fueled by rapid deployment of smart grids and advanced metering infrastructure (AMI). Utilities are increasingly prioritizing real-time energy monitoring, automated meter reading, and efficient load management. The growing adoption of renewable energy sources and demand for smart city initiatives further drives market expansion. In addition, integration with IoT and energy management platforms enhances operational efficiency and consumer engagement, contributing significantly to the market’s growth.

Europe Smart Meters Wi-SUN Technology Market Insight

The Europe Wi-SUN smart meters market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent energy efficiency regulations and government mandates for smart meter rollouts. Increasing urbanization, digitization of utilities, and rising consumer awareness about energy conservation are fostering adoption. European energy providers are implementing Wi-SUN networks to support AMI, automated meter reading (AMR), and grid management solutions. The region is experiencing growth across residential, commercial, and industrial energy management applications, with Wi-SUN-enabled devices becoming a key component of smart energy infrastructure.

U.K. Smart Meters Wi-SUN Technology Market Insight

The U.K. Wi-SUN smart meters market is expected to witness significant growth from 2026 to 2033, driven by national smart grid initiatives and the push for energy efficiency and sustainability. The government’s focus on modernizing the energy infrastructure encourages utilities to adopt Wi-SUN-enabled smart meters. In addition, growing concerns over energy optimization and cost management are motivating both residential and commercial users to implement smart metering solutions. The U.K.’s well-established utility networks and policy incentives are expected to accelerate market growth.

Germany Smart Meters Wi-SUN Technology Market Insight

The Germany Wi-SUN smart meters market is expected to witness robust growth from 2026 to 2033, fueled by increasing energy efficiency awareness, smart grid investments, and the transition toward renewable energy integration. Germany’s advanced energy infrastructure and emphasis on technological innovation promote Wi-SUN adoption, particularly for AMI and distribution management systems (DMS). Utilities are increasingly integrating Wi-SUN-enabled meters with energy management platforms to enhance monitoring, reduce losses, and optimize grid performance, further propelling market expansion.

Asia-Pacific Smart Meters Wi-SUN Technology Market Insight

The Asia-Pacific Wi-SUN smart meters market is expected to witness the highest growth rate from 2026 to 2033, driven by rapid urbanization, rising energy demand, and technological advancements in countries such as China, Japan, and India. Government initiatives supporting smart grids, energy efficiency, and smart city projects are driving adoption. Furthermore, as APAC emerges as a hub for smart meter manufacturing and deployment, affordability and accessibility are expanding to a wider consumer base. The region is witnessing significant growth across residential, commercial, and industrial energy applications.

Japan Smart Meters Wi-SUN Technology Market Insight

The Japan Wi-SUN smart meters market is expected to witness strong growth from 2026 to 2033 due to the country’s focus on energy efficiency, smart grid implementation, and advanced infrastructure development. Japanese utilities prioritize real-time energy monitoring, automated reading, and integration with IoT platforms for optimized consumption and grid management. The growing number of smart buildings and renewable energy initiatives further accelerates adoption. Japan’s commitment to technological innovation in energy solutions supports the increasing deployment of Wi-SUN-enabled smart meters.

China Smart Meters Wi-SUN Technology Market Insight

The China Wi-SUN smart meters market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising energy consumption, and strong government support for smart grids and energy efficiency initiatives. China stands as one of the largest markets for advanced energy management solutions, and Wi-SUN smart meters are becoming increasingly popular across residential, commercial, and industrial sectors. The push toward smart cities, integration with renewable energy sources, and availability of cost-effective Wi-SUN-enabled devices are key factors driving the market in China.

Smart Meters Wireless Smart Ubiquitous Network (Wi-SUN) Technology Market Share

The Smart Meters Wireless Smart Ubiquitous Network (Wi-SUN) Technology industry is primarily led by well-established companies, including:

- Cisco (U.S.)

- TOSHIBA CORPORATION (Japan)

- Renesas Electronics Corporation (Japan)

- OMRON Corporation (Japan)

- Itron Inc. (U.S.)

- Landis+Gyr (Switzerland)

- Trilliant Holdings Inc. (U.S.)

- ROHM CO., LTD. (Japan)

- Analog Devices, Inc. (U.S.)

- Murata Manufacturing Co., Ltd. (Japan)

- PT Fuji Electric Indonesia (Indonesia)

- OSAKI ELECTRIC CO., LTD (Japan)

- Wi-SUN Alliance (U.S.)

- TÜV Rheinland (Germany)

- Exegin Technologies Limited (U.K.)

- Neoenergia (Brazil)

- Kalki Communication Technologies Private Limited (India)

- Allion Labs, Inc (U.S.)

- EnerNex (U.S.)

- Texas Instruments Incorporated (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.