Global Smart Pill Boxes And Bottles Market

Market Size in USD Million

CAGR :

%

USD

119.20 Million

USD

385.42 Million

2024

2032

USD

119.20 Million

USD

385.42 Million

2024

2032

| 2025 –2032 | |

| USD 119.20 Million | |

| USD 385.42 Million | |

|

|

|

|

Smart Pill Boxes and Bottles Market Size

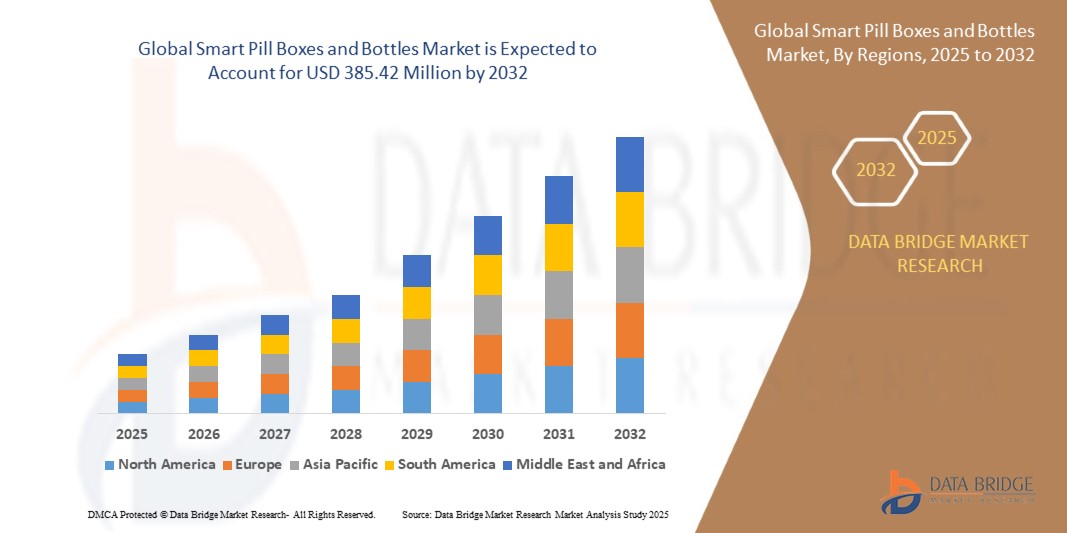

- The global smart pill boxes & bottles market size was valued at USD 119.2 million in 2024 and is expected to reach USD 385.42 million by 2032, at a CAGR of 15.8% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, aging populations, and the rising need for medication adherence solutions, which are driving demand for smart pill boxes and bottles in both home care and institutional settings

- Furthermore, growing consumer awareness of digital health technologies, the integration of mobile apps for reminders and tracking, and the desire for user-friendly, automated medication management solutions are establishing smart pill boxes and bottles as essential tools for enhancing patient safety and adherence. These converging factors are accelerating the adoption of these devices, thereby significantly boosting the industry's growth

Smart Pill Boxes & Bottles Market Analysis

- Smart pill boxes and bottles are connected devices designed to remind users to take medications on time, track adherence, and provide notifications to caregivers through mobile apps or cloud platforms. They integrate with digital health ecosystems, enhancing convenience, safety, and remote monitoring for patients in residential, assisted living, and clinical environments

- The escalating demand for smart pill boxes and bottles is primarily driven by the need to reduce medication errors, support independent living for elderly and chronically ill patients, and improve overall healthcare outcomes through real-time monitoring and adherence tracking

- North America dominated the smart pill boxes & bottles market with a share of 39.2% in 2024, due to increasing awareness of medication adherence solutions and the rising prevalence of chronic diseases among the aging population

- Asia-Pacific is expected to be the fastest growing region in the smart pill boxes & bottles market during the forecast period due to increasing urbanization, rising healthcare awareness, and growing adoption of digital health solutions in countries such as China, Japan, and India

- Smart pill box segment dominated the market with a market share of 58.3% in 2024, due to its user-friendly design, organized compartmentalization for multiple medications, and customizable alarm notifications. These features enhance medication adherence for seniors and patients with chronic conditions, making smart pill boxes highly preferred among caregivers and healthcare providers. In addition, the ability of smart pill boxes to integrate with mobile apps and remote monitoring platforms further strengthens their adoption in both home care and institutional settings. The convenience of scheduled reminders, dosage tracking, and portability contribute to its widespread use across diverse patient populations

Report Scope and Smart Pill Boxes & Bottles Market Segmentation

|

Attributes |

Smart Pill Boxes & Bottles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Pill Boxes & Bottles Market Trends

Integration with Mobile Apps and Digital Health Platforms

- The increasing integration of smart pill boxes and bottles with mobile apps and digital health platforms is transforming medication management. These devices allow users to track dosage schedules and also to synchronize health data with broader healthcare ecosystems for remote monitoring and improved adherence

- For instance, AdhereTech’s smart connected pill bottles feature built-in cellular technology that sends real-time adherence data to caregivers and healthcare providers. Their partnership with disease management programs has resulted in improved patient engagement and reduced hospital readmissions, showcasing the practical impact of integration with digital health platforms

- The expansion of telemedicine is accelerating the adoption of connected medication devices. With virtual consultations becoming more common, smart pill boxes linked to smartphone apps help doctors remotely monitor adherence patterns and adjust treatments based on data insights

- The convergence of artificial intelligence and connected health technologies is enabling predictive analytics in medication management. Emerging solutions use AI to analyze adherence patterns, flag risks of missed doses, and send proactive reminders based on user behavior, driving a more personalized approach to therapy compliance

- In addition, the increasing adoption of Internet of Things (IoT) ecosystems within healthcare settings is creating demand for interoperable smart pill solutions. Pill boxes and bottles that can seamlessly integrate with wearables, hospital management systems, and insurance platforms are becoming more attractive to stakeholders across the healthcare value chain

- The growing consumer emphasis on holistic health management is further shaping product innovation. Smart pill boxes are increasingly marketed as part of a complete wellness system, offering tools for medication adherence and also for lifestyle tracking, nutritional monitoring, and cognitive reminders, enhancing their consumer appeal

Smart Pill Boxes & Bottles Market Dynamics

Driver

Rising Chronic Diseases and Aging Populations

- The rising prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders is driving demand for smart medication management solutions. These conditions often require strict adherence to long-term medications, positioning smart pill boxes and bottles as vital tools for improving compliance

- For instance, MedMinder has launched automated pill dispensers tailored for elderly patients and those managing multiple prescriptions. Their devices provide remote monitoring features that family members and healthcare professionals can access, ensuring consistent adherence among aging populations dealing with long-term therapies

- The aging global population is a key demographic fueling this market, as older adults often face challenges such as forgetfulness, confusion about complex prescriptions, and difficulties managing multiple pill schedules. Smart pill boxes address these challenges with user-friendly interfaces and timely reminders

- In addition, healthcare systems are placing higher emphasis on reducing costs related to non-adherence, which is a leading cause of hospital readmissions. By incorporating smart pill bottles into assisted living and home care, providers are improving outcomes while reducing unnecessary medical expenses

- The increased role of home healthcare, especially after the global expansion of telehealth, is further contributing to adoption. Elderly or chronically ill patients prefer managing treatments at home, making smart pill devices an essential extension of remote care services

Restraint/Challenge

High costs and limited awareness

- One of the strongest barriers to widespread adoption of smart pill boxes and bottles is the relatively high purchasing and subscription costs. Advanced models with connectivity, AI, and data integration features remain outside the budgets of many individual users and smaller healthcare providers

- For instance, advanced solutions offered by innovators such as AdhereTech or MedMinder involve higher upfront costs and recurring fees for connectivity and monitoring services, which can discourage adoption among patients in low- and middle-income regions despite clear health benefits

- Limited awareness among patients and even some healthcare professionals about the existence and benefits of these devices poses another major barrier. Without targeted education campaigns and physician-driven recommendations, demand remains lower than potential in several regions

- In addition, interoperability challenges with electronic health records and other healthcare IT systems slow institutional adoption of smart pill technologies. Hospitals and clinics often remain hesitant unless integration standards are ensured, restraining scalability

- The lack of reimbursement policies for smart medication adherence devices further limits large-scale uptake. In many countries, health insurance plans do not cover connected pill management systems, reducing incentives for elderly or chronically ill patients to adopt such innovations on a sustained basis

Smart Pill Boxes & Bottles Market Scope

The market is segmented on the basis of product type, indication, and end-user.

• By Product Type

On the basis of product type, the smart pill boxes & bottles market is segmented into smart pill boxes and smart pill bottles. The smart pill box segment dominated the largest market revenue share of 58.3% in 2024, driven by its user-friendly design, organized compartmentalization for multiple medications, and customizable alarm notifications. These features enhance medication adherence for seniors and patients with chronic conditions, making smart pill boxes highly preferred among caregivers and healthcare providers. In addition, the ability of smart pill boxes to integrate with mobile apps and remote monitoring platforms further strengthens their adoption in both home care and institutional settings. The convenience of scheduled reminders, dosage tracking, and portability contribute to its widespread use across diverse patient populations.

The smart pill bottles segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing awareness of real-time medication tracking and adherence monitoring. These bottles provide advanced features such as automatic dosage logging, connectivity with healthcare providers, and integration with telehealth services. Their adoption is growing rapidly among tech-savvy patients and caregivers who prioritize remote monitoring and precise medication management. Pharmaceutical companies and healthcare institutions are also driving demand by offering these smart bottles to enhance patient outcomes and reduce medication errors.

• By Indication

On the basis of indication, the smart pill boxes & bottles market is segmented into dementia, Parkinson's disease, cancer management, diabetes care, geriatric care, disability, and others. The dementia segment dominated the market in 2024, as patients with cognitive impairments require strict adherence to complex medication schedules. Caregivers and healthcare facilities rely heavily on smart medication management solutions to minimize missed doses, ensure patient safety, and reduce hospitalization risks. Features such as alarm notifications, mobile alerts, and adherence tracking are particularly valuable for managing dementia patients’ medication routines efficiently.

The diabetes care segment is expected to witness the fastest growth from 2025 to 2032, driven by rising prevalence of diabetes globally and increasing demand for devices that assist in timely insulin or oral medication administration. Integration with mobile apps and cloud platforms allows patients and caregivers to monitor medication adherence, track glucose levels, and share data with healthcare providers. Growing awareness among patients about the consequences of missed doses and the benefits of smart monitoring tools is accelerating adoption in both home care and clinical settings.

• By End User

On the basis of end user, the smart pill boxes & bottles market is segmented into seniors care & assisted living, long-term care centers, and home care settings. The seniors care & assisted living segment held the largest market revenue share in 2024, as these facilities often house elderly patients who require assistance with daily medication routines. Smart pill boxes and bottles improve efficiency for caregivers, reduce human error, and provide timely notifications for scheduled doses. The adoption is further supported by institutional policies prioritizing patient safety, remote monitoring, and improved adherence tracking for residents.

The home care settings segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the rising preference for aging-in-place and remote patient monitoring. Increasing availability of connected devices, user-friendly mobile apps, and integration with telehealth platforms allows family members and healthcare providers to monitor medication intake remotely. Convenience, personalized scheduling, and real-time alerts are driving the uptake among patients managing chronic illnesses at home, enhancing independence while ensuring adherence.

Smart Pill Boxes & Bottles Market Regional Analysis

- North America dominated the smart pill boxes & bottles market with the largest revenue share of 39.2% in 2024, driven by increasing awareness of medication adherence solutions and the rising prevalence of chronic diseases among the aging population

- Consumers in the region value the convenience, real-time monitoring, and remote management features offered by smart pill boxes and bottles, which enable caregivers and family members to track medication intake efficiently

- High disposable incomes, a tech-savvy population, and the growing adoption of connected health devices are further supporting market growth. The market is also boosted by healthcare policies promoting patient safety and initiatives encouraging digital health solutions

U.S. Smart Pill Boxes & Bottles Market Insight

The U.S. market captured the largest revenue share in North America in 2024, driven by rapid adoption of smart health devices and increasing demand for home-based care solutions. Consumers are prioritizing medication adherence and remote monitoring capabilities provided by smart pill boxes and bottles, especially among elderly patients and those with chronic illnesses. Integration with mobile applications, cloud platforms, and telehealth services is further propelling market expansion. Moreover, increasing awareness about medication errors and the benefits of smart adherence solutions is encouraging both individual users and healthcare institutions to adopt these devices.

Europe Smart Pill Boxes & Bottles Market Insight

The Europe market is projected to expand at a significant CAGR during the forecast period, supported by rising healthcare expenditure and stringent regulations for patient safety. Increasing urbanization and a growing aging population are driving the adoption of smart pill management solutions across homes, assisted living facilities, and healthcare institutions. Consumers in Europe are attracted to the convenience, remote monitoring, and integration capabilities of smart pill boxes and bottles. Growth is being observed in both residential and institutional applications, with healthcare providers emphasizing digital health technologies to reduce medication non-adherence.

U.K. Smart Pill Boxes & Bottles Market Insight

The U.K. market is expected to grow at a noteworthy CAGR, driven by the rising trend of home care and increasing awareness of medication adherence benefits. Growing concerns about patient safety, especially among seniors, are encouraging the adoption of smart pill boxes and bottles. Integration with digital health platforms, mobile notifications, and caregiver alerts is further fueling market growth. The robust healthcare infrastructure and expanding e-health solutions in the U.K. are also contributing to the market’s expansion.

Germany Smart Pill Boxes & Bottles Market Insight

Germany’s market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s well-developed healthcare infrastructure and emphasis on technological innovation. Awareness about medication management, chronic disease prevalence, and elderly care needs are key factors driving adoption. Integration of smart pill boxes and bottles with mobile apps and cloud platforms for adherence tracking and remote monitoring is increasingly prevalent. Consumers and healthcare facilities in Germany are showing strong preference for secure, reliable, and user-friendly smart medication management solutions.

Asia-Pacific Smart Pill Boxes & Bottles Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing urbanization, rising healthcare awareness, and growing adoption of digital health solutions in countries such as China, Japan, and India. Expansion of home care services, telemedicine, and government initiatives supporting healthcare digitization are accelerating the adoption of smart pill boxes and bottles. Furthermore, rising disposable incomes and an expanding middle-class population are making these devices more accessible to a broader consumer base.

Japan Smart Pill Boxes & Bottles Market Insight

Japan’s market is gaining momentum due to the country’s aging population and high-tech culture. There is growing demand for easy-to-use medication adherence devices in both residential and assisted living settings. Integration with other digital health tools, such as telehealth platforms and mobile apps, is fueling adoption. Consumers and caregivers are increasingly prioritizing convenience, safety, and remote monitoring capabilities offered by smart pill boxes and bottles.

China Smart Pill Boxes & Bottles Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, an expanding middle class, and growing awareness of chronic disease management. Smart pill boxes and bottles are increasingly being adopted in both home care and institutional settings, supported by affordable options and strong domestic manufacturers. The push towards digital healthcare solutions, smart home integration, and telemedicine platforms is further propelling market growth.

Smart Pill Boxes & Bottles Market Share

The smart pill boxes & bottles industry is primarily led by well-established companies, including:

- e-pill (U.S.)

- Group Medical Supply LLC (U.S.)

- Medipense Inc. (Canada)

- MedMinder Inc. (U.S.)

- MedReady (U.S.)

- PharmRight Corporation (U.S.)

- PillDrill Inc. (U.S.)

- Pillo Inc. (U.S.)

- AdhereTech (U.S.)

- AARDEX Group (Switzerland)

- Tenovi (U.S.)

- EllieGrid (U.S.)

- Hero Health (U.S.)

- Hello Heart (U.S.)

- PillSafe (U.S.)

- Optimize Health (U.S.)

- SecretBox (U.S.)

- Daviky (China)

- Loba (Canada)

Latest Developments in Global Smart Pill Boxes & Bottles Market

- In April 2024, Tenovi introduced the first FDA-listed cellular-connected smart pillbox, designed for remote therapeutic monitoring. This device automatically tracks medication adherence without requiring apps, Wi-Fi, charging, or syncing, making it ideal for patients with limited technological access. Its impact lies in simplifying medication management for individuals in home care settings, thereby reducing caregiver burden and promoting independent living

- In January 2023, Oxfordshire County Council's Innovation Hub launched a smart pill box that reminds individuals to take their medication on time, along with a mobile device featuring a fall sensor. This initiative aimed to facilitate hospital discharge and support at-home recovery, reducing pressure on healthcare services. The program demonstrated the effectiveness of integrating technology into healthcare, enhancing patient autonomy and reducing readmission rates

- In January 2022, Vancouver-based Loba unveiled its first smart pill organizer, combining aesthetics with functionality. The organizer features detachable compartments for a week's worth of pills, split into AM and PM sections, and connects to a mobile app for reminders and tracking. This development caters to individuals seeking a blend of style and practicality in managing their medication, appealing to a broader demographic

- In March 2022, Tricella introduced a Bluetooth-enabled smart pillbox that helps users remember to take their daily medication. The device offers features such as family notifications, making health management a collaborative effort. This innovation supports patients in home care settings by promoting adherence through connectivity and shared responsibility

- In November 2021, DEFI launched an AI-powered smart pill bottle that learns users' medication habits and provides timely reminders. The bottle alerts users if they move beyond a certain distance or open it multiple times within an hour, ensuring adherence. This development leverages artificial intelligence to offer personalized medication management, benefiting individuals in various care settings.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Pill Boxes And Bottles Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Pill Boxes And Bottles Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Pill Boxes And Bottles Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.