Global Smart Pill Dispenser Market

Market Size in USD Billion

CAGR :

%

USD

2.72 Billion

USD

5.04 Billion

2024

2032

USD

2.72 Billion

USD

5.04 Billion

2024

2032

| 2025 –2032 | |

| USD 2.72 Billion | |

| USD 5.04 Billion | |

|

|

|

|

Smart Pill Dispenser Market Size

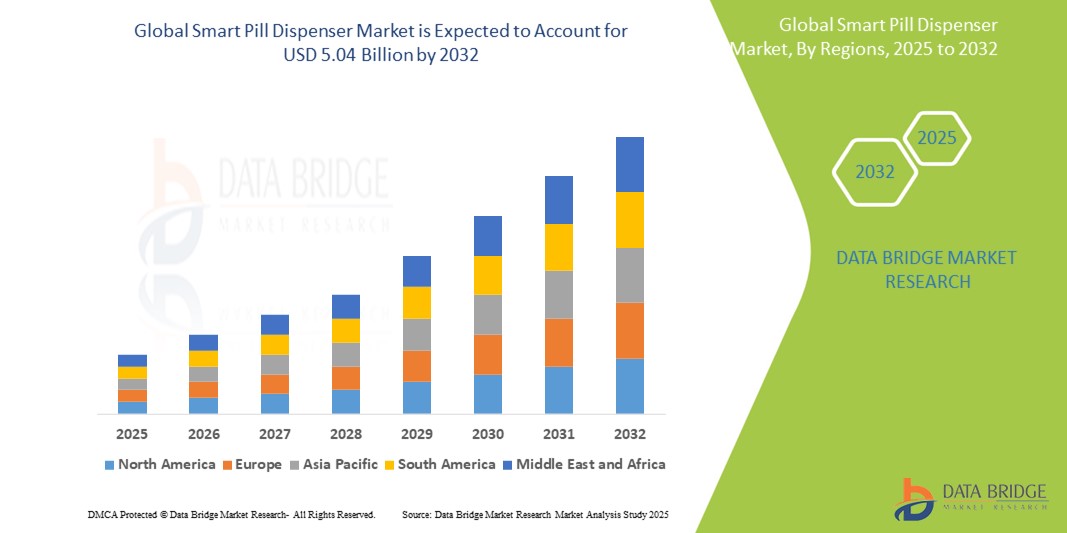

- The global smart pill dispenser market was valued at USD 2.72 billion in 2024 and is expected to reach USD 5.04 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.00%, primarily driven by the rising prevalence of chronic diseases and the growing demand for medication adherence solutions among aging populations

- This growth is driven by factors such as the increasing healthcare digitization, rising demand for remote patient monitoring, and advancements in smart medication management technologies

Smart Pill Dispenser Market Analysis

- Smart pill dispensers are automated devices designed to manage, schedule, and monitor medication intake, ensuring accurate dosages and adherence, especially for elderly patients and those with chronic conditions. They play a vital role in reducing medication errors and improving treatment outcomes

- The demand for smart pill dispensers is significantly driven by the growing elderly population, rising prevalence of chronic diseases, and the increasing need for remote healthcare solutions. The integration of IoT and mobile connectivity features has further accelerated market growth

- North America stands out as one of the dominant regions for smart pill dispensers, supported by a strong healthcare ecosystem, high healthcare expenditure, and early adoption of digital health technologies

- For instance, the U.S. has seen a sharp rise in home healthcare adoption and telemedicine services, where smart pill dispensers are frequently employed to support independent living and reduce hospital readmissions

- Globally, smart pill dispensers are becoming a critical component in the medication management ecosystem, especially in homecare and eldercare settings, ranking just behind telehealth platforms in importance for remote patient care

Report Scope and Smart Pill Dispenser Market Segmentation

|

Attributes |

Smart Pill Dispenser Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Pill Dispenser Market Trends

“Integration of IoT and AI for Enhanced Medication Management”

- One prominent trend in the global smart pill dispenser market is the increasing integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies to enhance medication management and patient compliance

- These advanced capabilities enable real-time monitoring, automated alerts, and data sharing with caregivers and healthcare providers, reducing the risk of missed or incorrect dosages

- For instance, AI-powered smart dispensers can analyze patient adherence patterns and send reminders or alerts via connected apps, while IoT connectivity allows for remote access and intervention by healthcare professionals

- These systems also support integration with electronic health records (EHRs), enabling a more holistic and data-driven approach to patient care

- This trend is transforming traditional medication routines into intelligent, personalized regimens, improving adherence, minimizing errors, and driving increased adoption in both homecare and institutional healthcare settings

Smart Pill Dispenser Market Dynamics

Driver

“Rising Demand for Medication Adherence Among Aging and Chronically Ill Populations”

- The growing need to improve medication adherence among elderly individuals and patients with chronic diseases is a major driver for the global smart pill dispenser market

- As the global population aging rapidly, age-related cognitive decline and complex medication schedules are making it increasingly difficult for individuals to manage their prescriptions without assistance

- Chronic conditions such as diabetes, hypertension, and cardiovascular diseases often require strict medication regimens, and non-adherence can lead to complications, hospital readmissions, and higher healthcare costs

- The Smart pill dispensers offer automated dosing, reminders, and real-time monitoring features, which help ensure timely medication intake, reduce human error, and enhance patient safety

- Healthcare providers and caregivers are increasingly relying on these devices to remotely monitor medication adherence, especially in homecare settings

For instance,

- In August 2022, according to the Centers for Disease Control and Prevention (CDC), nearly 50% of Americans aged 65 and older are on five or more medications daily, highlighting the critical need for automated solutions that support adherence and reduce the risk of medication errors

- In a 2023 survey published by the National Institutes of Health (NIH), it was found that medication non-adherence leads to nearly 125,000 deaths and USD 100 billion in avoidable healthcare costs annually in the U.S. alone, underlining the urgency for smart pill dispenser adoption

- As the burden of chronic illness and elderly care continues to rise, the demand for smart pill dispensers is expected to grow substantially, driven by the need for reliable, tech-enabled medication management solutions

Opportunity

“Enhancing Medication Management with AI and Predictive Analytics”

- The integration of Artificial Intelligence (AI) and predictive analytics in smart pill dispensers presents a significant opportunity to revolutionize medication management, especially for elderly and chronically ill patients

- AI-enabled dispensers can learn user behavior, analyze medication adherence patterns, and send personalized reminders or alerts to patients and caregivers, improving compliance and reducing health risks

- In addition, these systems can also anticipate missed doses or detect irregularities in usage, allowing healthcare providers to intervene early and adjust treatment plans accordingly

For instance,

- In February 2024, according to a report published by the World Health Organization, AI-powered medication management systems are capable of reducing medication non-adherence by up to 30% by delivering real-time insights and predictive alerts to healthcare professionals

- In October 2023, an article published in the Journal of Medical Internet Research highlighted that the smart dispensers integrated with AI not only improve adherence but also help in tracking the efficacy of medications, thus enabling personalized treatment strategies and minimizing adverse drug events

- By leveraging AI and predictive analytics, smart pill dispensers can shift from reactive tools to proactive health management systems—enhancing patient outcomes, supporting remote care models, and opening new opportunities for innovation in the digital health space

Restraint/Challenge

“High Product Costs and Limited Reimbursement Slowing Market Adoption”

- The high cost of smart pill dispensers, particularly those integrated with advanced features such as IoT connectivity, AI analytics, and remote monitoring capabilities, presents a key challenge for widespread market penetration—especially in low- and middle-income regions

- The Prices for advanced models can range from a few hundred to several thousand dollars, making them less accessible to individual users, small clinics, and underfunded healthcare systems

- This financial burden is further compounded by limited reimbursement options in many countries, where smart pill dispensers are not yet covered under standard health insurance or public health schemes

For instance,

- In June 2024, a report by the Digital Health Alliance highlighted that less than 20% of smart medication management devices are eligible for insurance reimbursement in developing nations, limiting their adoption in homecare settings

- In March 2023, according to a study published in the Journal of Healthcare Finance, cost-related concerns remain a significant deterrent for small-scale healthcare providers, particularly in rural or underserved regions, where budget constraints restrict investment in digital medication technologies

- Consequently, despite their clinical benefits, the high cost and lack of financial incentives can delay adoption, widen the digital health gap, and restrict the smart pill dispenser market’s potential in cost-sensitive regions

Smart Pill Dispenser Market Scope

The market is segmented on the basis of product, type, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By End Use |

|

Smart Pill Dispenser Market Regional Analysis

“North America is the Dominant Region in the Smart Pill Dispenser Market”

- North America leads the smart pill dispenser market, primarily due to its robust healthcare infrastructure, high adoption of digital health technologies, and a growing aging population with complex medication needs

- U.S. holds a major share, supported by increasing healthcare digitization, rising demand for remote patient monitoring, and a strong presence of innovative medical device manufacturers

- The favorable government initiatives promoting telehealth and home-based care, along with well-structured reimbursement systems, contribute significantly to the market's growth in the region

- In addition, the increasing prevalence of chronic conditions and a growing emphasis on personalized medicine are accelerating the adoption of smart pill dispensers in both homecare and institutional setting

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the fastest growth in the smart pill dispenser market, driven by a rising elderly population, increasing chronic disease burden, and growing demand for smart healthcare solutions

- Countries such as China, Japan, South Korea, and India are becoming key markets, with rapid urbanization, improving healthcare infrastructure, and increasing awareness of medication adherence solutions

- Japan known for its technological innovation and aging demographic, is advancing in the deployment of AI-integrated healthcare devices, including smart pill dispensers

- China and India are experiencing strong growth due to government-led digital health initiatives, expanding telemedicine networks, and increasing investments by both domestic and international medical technology companies

Smart Pill Dispenser Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Hero Health, Inc. (U.S.)

- Medminder Systems, Inc. (U.S.)

- Lepu Medical Technology (Beijing) Co., Ltd. (China)

- TabTimer Pty Ltd (Australia)

- Axplora (Germany)

- Koninklijke Philips N.V., (The Netherlands)

- AceAge (Canada)

- PharmRx Pty Ltd (Australia)

- Omnicell Inc. (U.S.)

- Oracle (U.S.)

- Capsa Healthcare (U.S.)

- Parata Systems, LLC (U.S.)

- e-pill (U.S.)

- Dose Health LLC (U.S.)

- Pivotell Ltd (U.K.)

- Karie Health (Canada)

- DeepSea Developments (U.S.)

- MedReady (U.S.)

- AdhereTech (U.S.)

Latest Developments in Global Smart Pill Dispenser Market

- In June 2024, PharmAdva enhanced its MedaCube smart pill dispenser by integrating cloud functionality and an advanced caregiver portal. The update provides real-time medication adherence tracking, customized reminders, and secure data sharing, improving support for elderly and chronically ill patients

- In April 2024, Medtronic launched its next-generation AI-powered smart pill for gastrointestinal diagnostics. This advanced capsule incorporates AI-enhanced imaging and improved battery life, offering real-time insights for better clinical decision-making. The device is designed for seamless integration with digital health systems to improve diagnostic efficiency and reduce patient discomfort

- In January 2024, Hero partnered with AARP to expand the reach of its smart pill dispensers to the senior population. The partnership includes special pricing and access to Hero's technology, which automates dispensing, sends alerts for missed doses, and provides adherence reports to caregivers and family members

- In July 2023, Equasens Group acquired Caremeds, adding the AUTOMEDS semi-automatic dispensing system to its portfolio. This move strengthens Equasens’ presence in the medication management space and expands its capabilities in delivering flexible, pharmacist-driven dispensing solutions

- In July 2023, Dignio AS integrated AceAge’s Karie smart pill dispenser into its Connected Care platform. The collaboration enables remote monitoring of medication adherence, enhances care continuity, and supports elderly patients in homecare environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.