Global Smart Shelves Market

Market Size in USD Billion

CAGR :

%

USD

4.29 Billion

USD

22.54 Billion

2024

2032

USD

4.29 Billion

USD

22.54 Billion

2024

2032

| 2025 –2032 | |

| USD 4.29 Billion | |

| USD 22.54 Billion | |

|

|

|

|

Smart Shelves Market Size

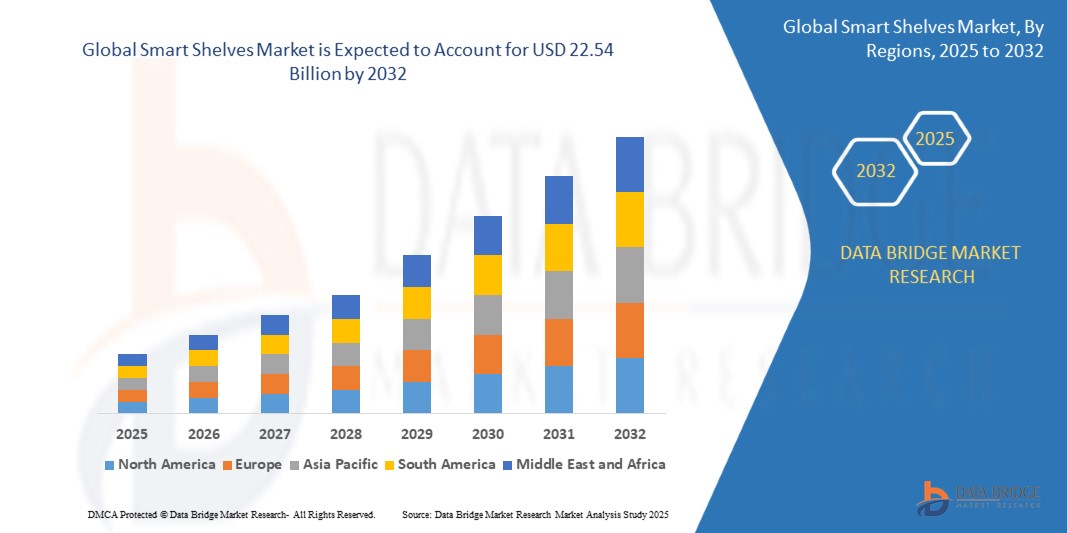

- The global smart shelves market size was valued at USD 4.29 billion in 2024 and is expected to reach USD 22.54 billion by 2032, at a CAGR of 23.05% during the forecast period

- The market growth is largely driven by increasing demand for retail automation and real-time inventory management across hypermarkets, supermarkets, and convenience stores, as retailers seek to improve operational efficiency and enhance customer experience

- Furthermore, rising adoption of IoT and RFID technologies in retail environments is enabling automated shelf monitoring, dynamic pricing, and data-driven decision-making, which is accelerating the deployment of smart shelving systems across various retail formats

Smart Shelves Market Analysis

- Smart shelves are intelligent retail solutions equipped with sensors, RFID tags, and wireless connectivity to detect product information, monitor stock levels, and communicate data to backend systems in real time. These systems help automate inventory management, optimize shelf space, and enhance planogram compliance

- The market is gaining momentum due to the growing need for cost-efficient retail operations, the integration of analytics and AI with shelf monitoring systems, and the rising focus on sustainability through reduced waste and energy-efficient display solutions

- Europe dominated the smart shelves market with a share of 35.5% in 2024, due to high adoption of retail automation technologies and increasing demand for efficient shelf management in large-format retail stores

- Asia-Pacific is expected to be the fastest growing region in the smart shelves market during the forecast period due to the rapid modernization of retail infrastructure and growing emphasis on automation in countries such as China, Japan, and India

- Hardware segment dominated the market with a market share of 47.5% in 2024, due to the extensive deployment of RFID tags, weight sensors, and infrared sensors that form the core infrastructure for real-time shelf monitoring. These components are integral to automating inventory tracking and improving shelf replenishment accuracy, making them critical in large-scale retail operations. The growing adoption of IoT-enabled shelves that require robust and scalable hardware platforms has further contributed to this dominance

Report Scope and Smart Shelves Market Segmentation

|

Attributes |

Smart Shelves Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Smart Shelves Market Trends

Integration of AI and Analytics for Predictive Inventory Management

- Smart shelves are increasingly leveraging artificial intelligence (AI) and advanced analytics to enable predictive inventory management, allowing retailers to optimize stock levels, prevent out-of-stock situations, and reduce excess inventory

- For instance, companies such as Trax Retail and SES-imagotag deploy AI-powered smart shelf solutions that use real-time data and machine learning algorithms to forecast demand trends, automate replenishment, and enhance merchandising strategies

- The integration of IoT sensors, RFID technology, and electronic shelf labels (ESLs) provides continuous monitoring of products on shelves, improving inventory accuracy and operational efficiency

- Retailers are adopting smart shelves with interactive digital displays that personalize customer engagement through targeted promotions and product information, enhancing the in-store shopping experience

- Data collected from smart shelves is increasingly utilized to support sustainability efforts by minimizing food waste and overstocking, aligning with regulatory and consumer demands for greener retail operations

- The rising adoption of 5G connectivity and cloud computing enables faster data transmission and centralized control, facilitating scalable deployment of smart shelf networks across multiple retail outlets

Smart Shelves Market Dynamics

Driver

Rising Demand for Real-Time Inventory Visibility

- The growing need for real-time visibility into inventory levels to improve supply chain responsiveness, reduce stockouts, and enhance customer satisfaction is a major driver for smart shelves adoption

- For instance, Honeywell International and Lenovo PCCW Solutions have implemented smart shelf technologies in major retail chains, enabling instantaneous inventory tracking and automated alerts for replenishment

- Increasing consumer expectations for product availability and seamless shopping experiences push retailers to invest in technologies that ensure shelves are consistently stocked with desired products

- Expansion of omnichannel retailing demands synchronized inventory management across physical and online stores, which smart shelves support by providing accurate, real-time data

- The surge in e-commerce and click-and-collect services drives retailers to leverage smart shelves for precise inventory monitoring, thereby optimizing order fulfillment and reducing operational costs

Restraint/Challenge

High Initial Implementation Cost

- The substantial upfront investment required for hardware procurement, installation, integration with existing retail systems, and staff training is a significant barrier for small to medium-sized retailers

- For instance, several regional retail chains have delayed smart shelf deployments due to budget constraints and complexities in retrofitting legacy infrastructure with new sensor and IoT technologies

- Ongoing maintenance, software licensing fees, and the need for reliable network connectivity add to the total cost of ownership, affecting adoption rates especially in cost-sensitive markets

- Data security and privacy concerns related to the collection and handling of customer and inventory data necessitate additional investments in cybersecurity, further increasing overall expenses

- The complexity involved in integrating smart shelves with diverse retail IT ecosystems, including point-of-sale and supply chain management systems, slows down large-scale implementation

Smart Shelves Market Scope

The market is segmented on the basis of component, application, and end use.

• By Component

On the basis of component, the smart shelves market is segmented into hardware, software, and services. The hardware segment accounted for the largest market revenue share of 47.5% in 2024, driven by the extensive deployment of RFID tags, weight sensors, and infrared sensors that form the core infrastructure for real-time shelf monitoring. These components are integral to automating inventory tracking and improving shelf replenishment accuracy, making them critical in large-scale retail operations. The growing adoption of IoT-enabled shelves that require robust and scalable hardware platforms has further contributed to this dominance.

The software segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the rising need for intelligent analytics platforms that interpret shelf data into actionable insights. Retailers are increasingly investing in software that enables predictive inventory management, planogram compliance verification, and personalized content delivery. Integration with AI and cloud platforms is also enhancing the value of software solutions by supporting remote configuration, real-time alerts, and trend forecasting, making software central to strategic retail operations.

• By Application

On the basis of application, the smart shelves market is segmented into planogram management, inventory management, pricing management, content management, and others. The inventory management segment dominated the largest revenue share in 2024, owing to its critical role in enabling real-time stock visibility, minimizing out-of-stock incidents, and optimizing restocking processes. Retailers rely heavily on smart shelves for automated tracking, which reduces manual labor and increases operational efficiency. Integration with backend inventory systems ensures consistency across store networks, supporting omnichannel retail strategies.

The planogram management segment is expected to register the fastest growth rate from 2025 to 2032, as retailers focus on ensuring accurate product placement to enhance visual merchandising and compliance. Smart shelves provide real-time feedback on product positioning and shelf layout adherence, reducing execution gaps between headquarters and store locations. The ability to detect and report planogram deviations automatically helps in maintaining brand standards, maximizing sales potential through optimal product visibility.

• By End Use

On the basis of end use, the smart shelves market is segmented into hypermarkets, supermarkets, department stores, warehouses, and others. The hypermarkets segment held the largest market share in 2024, primarily due to their scale of operations, complex inventory requirements, and high customer traffic. Smart shelf systems in hypermarkets help manage a vast product assortment efficiently, reduce shrinkage, and improve on-shelf availability. These retailers benefit significantly from automated stock alerts, dynamic pricing, and shelf-level data analytics to improve decision-making and customer satisfaction.

The warehouse segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the accelerating trend of automation in supply chain logistics and fulfillment centers. Smart shelves in warehouses enhance inventory accuracy, streamline picking processes, and support just-in-time operations. Integration with warehouse management systems allows for continuous monitoring, predictive restocking, and efficient space utilization. As e-commerce grows, warehouses are increasingly turning to smart shelf technologies to handle rising order volumes with precision and speed.

Smart Shelves Market Regional Analysis

- Europe dominated the smart shelves market with the largest revenue share of 35.5% in 2024, driven by high adoption of retail automation technologies and increasing demand for efficient shelf management in large-format retail stores

- Retailers across Europe are investing heavily in smart shelves to enhance inventory visibility, reduce shrinkage, and improve customer experience through dynamic pricing and real-time stock updates

- The region benefits from stringent retail compliance regulations and a strong focus on digital transformation, especially among hypermarkets, supermarkets, and department stores

Germany Smart Shelves Market Insight

The Germany smart shelves market captured the largest share, supported by the country’s advanced retail infrastructure and emphasis on operational precision. German retailers are early adopters of technologies that reduce human error and optimize logistics. The increasing use of RFID-based smart shelving for inventory accuracy, along with growing interest in sustainable and automated store formats, is boosting demand. As smart retail solutions become more mainstream, Germany is likely to remain a strong contributor to Europe's leadership in the smart shelves market.

U.K. Smart Shelves Market Insight

The U.K. smart shelves market is anticipated to grow steadily, driven by the country’s established retail ecosystem and rising investments in in-store digital transformation. Large supermarket chains and department stores are integrating smart shelves to optimize space, enable dynamic promotions, and reduce restocking time. With growing consumer expectations for tech-enhanced shopping, U.K. retailers are prioritizing real-time shelf monitoring and data-driven merchandising strategies.

North America Smart Shelves Market Insight

The North America smart shelves market is projected to maintain a strong presence, driven by rising demand for inventory automation and advanced shelf management in retail and warehouse settings. U.S. retailers are actively deploying smart shelves to reduce out-of-stock occurrences and improve supply chain transparency. The market benefits from high retail technology spending and strong partnerships between retailers and IoT solution providers.

U.S. Smart Shelves Market Insight

The U.S. smart shelves market accounted for the largest revenue share in North America in 2024, propelled by a widespread focus on omnichannel retail and customer-centric innovations. Retail chains are leveraging smart shelves to improve shelf availability, support BOPIS (Buy Online, Pick Up In-Store) models, and integrate with back-end inventory systems. The growth of smart warehouses and fulfillment centers is also contributing to increased adoption of these technologies.

Asia-Pacific Smart Shelves Market Insight

The Asia-Pacific smart shelves market is expected to expand at the fastest CAGR from 2025 to 2032, fueled by the rapid modernization of retail infrastructure and growing emphasis on automation in countries such as China, Japan, and India. The expanding middle class, rising disposable income, and increasing penetration of IoT technologies are driving adoption in both organized retail and warehousing sectors. Government initiatives promoting smart cities and digital transformation are also playing a pivotal role.

China Smart Shelves Market Insight

China led the Asia-Pacific smart shelves market in terms of revenue in 2024, supported by strong manufacturing capabilities, rapid tech adoption, and aggressive retail digitization strategies. Large domestic retailers and logistics providers are integrating smart shelves to enhance efficiency and responsiveness. The country’s push toward smart retail formats and smart warehousing continues to fuel market expansion.

Japan Smart Shelves Market Insight

Japan’s smart shelves market is witnessing notable growth, driven by its advanced retail ecosystem and emphasis on consumer convenience. Retailers are adopting smart shelves for automated restocking, planogram compliance, and real-time analytics. Japan’s integration of robotics and IoT in stores supports seamless retail experiences, positioning smart shelves as a key enabler of operational agility and innovation.

Smart Shelves Market Share

The smart shelves industry is primarily led by well-established companies, including:

- SES-Imagotag (France)

- Pricer (Sweden)

- Trax (Singapore)

- Avery Dennison (U.S.)

- Samsung (South Korea)

- E Ink (Taiwan)

- Intel (U.S.)

- Huawei (China)

- Honeywell (U.S.)

- Solum (South Korea)

- NEXCOM (Taiwan)

- DreamzTech Solutions (U.S.)

- Sennco (U.S.)

- TroniTag (Germany)

- Mago S.A. (Poland)

- Happiest Minds (India)

- PCCW Solutions (Hong Kong)

- NXP Semiconductor (Netherlands)

- Diebold Nixdorf (U.S.)

- Software AG (Germany)

- Minew (China)

- AWM Smart Shelves (U.S.)

- WiseShelf (Israel)

- Trigo (Israel)

- Caper (U.S.)

- Zippin (U.S.)

- Focal Systems (U.K.)

Latest Developments in Global Smart Shelves Market

- In April 2024, Inc. entered a strategic partnership with Taiwan-based AUO Corporation to co-develop ePaper display technologies tailored for smart retail environments. This collaboration is expected to significantly advance the smart shelves market by introducing energy-efficient, low-power display solutions that enhance sustainability and reduce operational costs for retailers. The move positions Inc. to meet growing demand for digital shelf labeling and eco-friendly display systems in retail stores globally

- In March 2024, Huawei Technologies Co. Ltd. unveiled its Smart Retail Solution designed for retail campuses, stores, and multi-branch networks. This solution integrates intelligent warehousing, smart stores, digital marketing, and energy optimization, aiming to improve overall operational efficiency. Huawei’s entry strengthens its presence in the retail technology market and is likely to accelerate the adoption of smart shelving and connected store infrastructures across regions seeking cost-effective digital transformation

- In March 2022, SES-imagotag launched its VUSION Operating System alongside an IoT sustainability initiative aimed at modernizing physical retail locations. By enabling real-time data insights and automation, this launch supports retailers in enhancing store connectivity and operational transparency. The platform is expected to boost adoption of smart shelves globally by aligning with sustainability goals and digital retail strategies

- In July 2021, Trax partnered with Storecheck to improve SKU performance tracking in traditional mom-and-pop stores. This partnership expands the reach of smart shelf technology into smaller, independent retail formats, enhancing visibility and stock optimization for under-digitized retail environments. It reflects the industry's shift toward inclusive digital transformation across retail scales

- In January 2021, E Ink collaborated with Atmosic to launch a power-optimized eBadge reference design featuring 2.9” or 3.7” black-and-white E Ink displays. This innovation aimed to reduce power consumption in display-based applications, reinforcing E Ink’s relevance in the smart shelves and digital signage market. The development supports sustainable shelf-labeling solutions and addresses growing demands for long-lasting, battery-efficient retail technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.