Global Smart Shoes Market

Market Size in USD Million

CAGR :

%

USD

352.49 Million

USD

1,025.79 Million

2024

2032

USD

352.49 Million

USD

1,025.79 Million

2024

2032

| 2025 –2032 | |

| USD 352.49 Million | |

| USD 1,025.79 Million | |

|

|

|

|

Smart Shoes Market Size

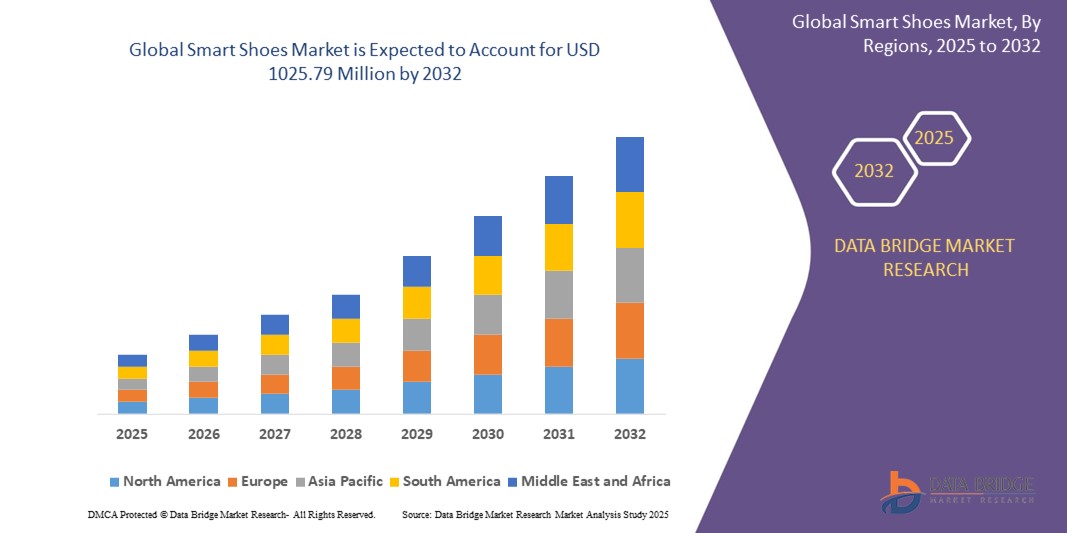

- The global smart shoes market size was valued at USD 352.49 million in 2024 and is expected to reach USD 1025.79 million by 2032, at a CAGR of 15.10% during the forecast period

- The market growth is significantly driven by the increasing adoption and technological advancements in wearable devices, leading to enhanced tracking capabilities and functionalities in footwear

- Furthermore, rising consumer interest in health and fitness tracking, coupled with the convenience and performance insights offered by smart shoes, is establishing them as a preferred choice for individuals seeking to monitor their physical activity and well-being. These converging factors are accelerating the uptake of smart shoe solutions, thereby significantly boosting the industry's growth

Smart Shoes Market Analysis

- Smart shoes, offering technological features integrated into footwear, are increasingly becoming vital components of modern personal technology and well-being tracking in both athletic and everyday use due to their enhanced activity monitoring, performance tracking, and potential for seamless integration with other smart devices

- The escalating interest in smart shoes is primarily fueled by the rising trend of wearable technology adoption, growing consumer focus on health and fitness, and a increasing preference for the convenience and insights offered by connected footwear

- North America dominated the smart shoes market with a share of 44.5% in 2024, due to rising adoption of wearable technology and growing awareness around health and fitness monitoring

- Asia-Pacific is expected to be the fastest growing region in the smart shoes market during the forecast period due to increasing urbanization, rising disposable incomes, and technological advancements, particularly in countries such as China, Japan, and India

- Athletic segment dominated the smart shoes market with a market share of 69% in 2024, due to the rising popularity of fitness and sports activities, as well as increasing consumer demand for performance enhancement tools

Report Scope and Smart Shoes Market Segmentation

|

Attributes |

Smart Shoes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Shoes Market Trends

“Rising Advancements in Technology”

- A significant and accelerating trend in the global smart shoes market is the increasing sophistication and integration of advanced sensors and connectivity features, enhancing the functionality and user experience of modern footwear

- For instance, Nike's Adapt series incorporates motorized laces that automatically adjust to the foot's shape and movement, offering personalized fit and support. Similarly, Adidas' GMR technology integrates a smart insole that tracks on-field performance in soccer, connecting real-world activity with digital gaming experiences

- Advancements in technology in smart shoes enable features such as precise activity tracking, in-depth gait analysis to provide insights on running form, and personalized feedback on performance metrics. For instance, some models from Under Armour integrate seamlessly with the MapMyRun app, offering real-time coaching and post-run analysis. Furthermore, location monitoring capabilities are becoming increasingly common, offering safety and navigation assistance

- The seamless integration of smart shoes with smartphones, fitness trackers, and other digital platforms facilitates centralized data management and analysis of the user's physical activity and well-being. Through dedicated apps and ecosystems, users can track their steps, distance, calories burned, and even receive personalized training recommendations

- This trend towards more technologically advanced, intuitive, and interconnected footwear is fundamentally reshaping user expectations for athletic performance, fitness tracking, and everyday convenience. Consequently, companies such as Puma are developing smart shoes with features such as real-time performance metrics and integration with interactive training platforms

- The demand for smart shoes that offer seamless integration with digital ecosystems and provide valuable insights into the wearer's activity is growing rapidly across both athletic and casual wear sectors, as consumers increasingly prioritize convenience and comprehensive health and performance monitoring functionality

Smart Shoes Market Dynamics

Driver

“Rising Trend of Health and Fitness Tracking”

- The increasing prevalence of health consciousness among individuals and the accelerating adoption of fitness tracking technologies are significant drivers for the heightened demand for smart shoes

- For instance, Nike has integrated its Nike+ platform with its smart shoe offerings, allowing users to track runs, receive personalized coaching, and connect with a community of athletes. Similarly, Adidas' partnership with Strava allows runners using their smart shoes to seamlessly upload and analyze their performance data

- As consumers become more aware of the benefits of an active lifestyle and seek tools to monitor their physical well-being, smart shoes offer advanced features such as step counting, distance tracking, calorie expenditure calculation, and gait analysis, providing a compelling upgrade over traditional footwear

- Furthermore, the growing popularity of fitness wearables and the desire for comprehensive health monitoring are making smart shoes an integral component of these systems, offering seamless integration with other fitness trackers and health applications

- The convenience of effortless activity tracking, personalized insights into workout performance, and the ability to manage fitness data through smartphone applications are key factors propelling the adoption of smart shoes in both athletic training and everyday wellness routines. The trend towards DIY fitness regimes and the increasing availability of user-friendly smart shoe options further contribute to market growth

Restraint/Challenge

“Issue in Durability and Reliability”

- Concerns surrounding the durability and reliability of the electronic components embedded in smart shoes pose a significant challenge to widespread market adoption. As smart shoes integrate sensors, batteries, and connectivity modules, they are susceptible to damage from daily wear and tear, moisture, and impacts, raising anxieties among potential consumers about the longevity of their investment

- For instance, early models of Nike's Adapt BB smart shoes reportedly faced issues with firmware updates causing the shoes to become unusable. Similarly, some users have noted that the battery life of the sensors in Under Armour's connected shoes might not last as long as the shoes themselves, especially for frequent runners

- Addressing these durability and reliability concerns through robust design, water-resistant materials, and stringent quality control measures is crucial for building consumer trust. Companies such as Nike and Adidas are continuously working on improving the durability of their smart shoe components. In addition, the perceived premium for smart shoe technology, coupled with potential uncertainties about their lifespan, can be a barrier to adoption for some consumers who prioritize the long-term value of their footwear

- While advancements in materials and manufacturing processes are gradually improving the durability of smart shoes, the potential for electronic component failure remains a concern for consumers accustomed to the robustness of traditional footwear

- Overcoming these challenges through enhanced durability testing, use of more resilient materials, and transparent communication about product lifespan and warranties will be vital for sustained smart shoe market growth

Smart Shoes Market Scope

The market is segmented on the basis of type, functionality, end user, distribution channel, and technology.

- By Type

On the basis of type, the smart shoes market is segmented into athletic and non-athletic. The athletic segment dominated the largest market revenue share 69% in 2024, driven by the rising popularity of fitness and sports activities, as well as increasing consumer demand for performance enhancement tools. Smart athletic shoes are widely adopted by runners and sports enthusiasts due to their ability to provide real-time data on pace, stride length, and foot pressure, helping users optimize their performance and reduce injury risk. Integration with mobile apps and wearables also supports their growth, especially among tech-savvy fitness users.

The non-athletic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing interest in health monitoring and assistive technologies in everyday footwear. Non-athletic smart shoes are gaining traction among older adults and individuals with mobility challenges, as they offer features such as fall detection, gait analysis, and step tracking. The growing demand for stylish yet functional wearables is also influencing the design and adoption of smart casual and formal footwear.

- By Functionality

On the basis of functionality, the smart shoes market is segmented into activity tracking, in-depth run tracking, gait tracking, location monitoring, step counting, positioning, navigation, and auto-tightening. The activity tracking segment held the largest market revenue share in 2024 due to widespread demand for health and fitness monitoring in daily routines. Consumers increasingly seek shoes that can count steps, monitor calories burned, and analyze movement patterns, with companies such as Nike and Xiaomi offering models that sync with mobile health platforms.

The auto-tightening segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by innovations in adaptive fitting technologies. Brands such as Nike with its Adapt series have set a precedent for smart shoes that automatically adjust their fit based on the wearer's foot shape and activity. This functionality is particularly valued by athletes for comfort during intensive activities and by individuals with mobility issues who face challenges with traditional laces.

- By End-User

On the basis of end-user, the smart shoes market is segmented into children, young, disabled individuals, adults, and old people. The adults segment held the largest market revenue share in 2024, attributed to high purchasing power, active lifestyles, and growing interest in wearable technology for fitness and health optimization. Working professionals and fitness-conscious adults form the core user base, often adopting smart shoes for daily commutes and training sessions.

The disabled individuals segment is projected to register the fastest CAGR from 2025 to 2032, supported by increasing innovations tailored to accessibility and health monitoring. Smart shoes designed for this demographic often include features such as pressure sensors, fall alerts, and GPS-based navigation to enhance independence and safety, particularly for visually impaired or mobility-limited users. Companies are focusing on inclusive designs to cater to this growing demand.

- By Distribution Channel

On the basis of distribution channel, the smart shoes market is segmented into online and offline. The online segment captured the largest market revenue share in 2024 due to the rising popularity of e-commerce platforms and direct-to-consumer strategies by leading brands. Online channels allow broader access to product information, user reviews, and brand comparisons, making them the preferred mode of purchase for tech-savvy consumers.

The offline segment is anticipated to register the fastest CAGR from 2025 to 2032, driven by increasing consumer preference to physically try products before buying. Specialty footwear stores and retail outlets offer fitting sessions, product demonstrations, and after-sales services, which are key factors influencing purchases, especially among older adults and first-time users.

By Technology

On the basis of technology, the smart shoes market is segmented into electronic, mechanical, and electro-mechanical. The electronic segment held the largest market revenue share in 2024, propelled by the integration of advanced sensors, Bluetooth modules, and microchips in smart shoes. These features enable seamless connectivity with mobile apps, supporting real-time monitoring and data sharing.

The electro-mechanical segment is expected to record the fastest CAGR from 2025 to 2032, supported by innovations combining mechanical components with electronic controls. Technologies such as motorized auto-lacing systems and motion-adaptive cushioning fall under this category. The enhanced functionality and user customization offered by electro-mechanical shoes make them increasingly attractive to both performance athletes and healthcare users.

Smart Shoes Market Regional Analysis

- North America dominated the smart shoes market with the largest revenue share of 44.5% in 2024, driven by rising adoption of wearable technology and growing awareness around health and fitness monitoring

- Consumers in the region are increasingly seeking smart footwear equipped with features such as step tracking, posture correction, and gait analysis, often integrated with smartphones or fitness ecosystems such as Apple Health and Fitbit

- The market growth is further propelled by high disposable incomes, strong consumer interest in innovative fitness gear, and widespread adoption of connected devices, making smart shoes a popular choice for both athletic and lifestyle purposes

U.S. Smart Shoes Market Insight

U.S. smart shoes market is a significant contributor to the North American region, driven by a strong demand for connected devices and the increasing emphasis on personal fitness. Consumers are increasingly prioritizing the enhancement of their fitness routines through intelligent footwear with tracking capabilities. The growing preference for DIY fitness tracking solutions, combined with the demand for seamless integration with other smart devices and mobile applications, further propels the smart shoes industry in the U.S.

Europe Smart Shoes Market Insight

The smart shoes market in Europe is experiencing substantial growth, fueled by an increasing interest in fitness and health monitoring. The rising popularity of athleisure wear and the growing acceptance of wearable technology are key drivers in this region. Germany and the U.K. are significant markets in Europe, with a growing emphasis on digital security and technologically advanced solutions extending to footwear. Consumers in Europe are also drawn to the convenience and enhanced performance tracking offered by smart shoes

U.K. Smart Shoes Market Insight

The U.K. smart shoes market is expected to register a healthy CAGR during the forecast period, supported by the growing fitness culture and awareness about digital health solutions. Tech-savvy consumers are showing increased interest in smart footwear that syncs with wearable ecosystems and provides personalized health insights. In addition, the country’s strong retail and e-commerce infrastructure enables faster adoption of innovative wearable products.

Germany Smart Shoes Market Insight

Germany's smart shoes market is anticipated to expand at a considerable CAGR, fueled by innovation in biomechanics and orthopedic applications. As a leader in wearable tech R&D and health innovation, Germany is seeing increased deployment of smart shoes in sports performance optimization and elder care. The demand for data-driven footwear solutions that support injury prevention and rehabilitation is particularly strong across healthcare and fitness sectors.

Asia-Pacific Smart Shoes Market Insight

The Asia-Pacific Smart Shoes market is poised to grow at the fastest CAGR in 2025, driven by increasing urbanization, rising disposable incomes, and technological advancements, particularly in countries such as China, Japan, and India. The region's growing inclination towards smart homes and fitness tracking is boosting the adoption of smart shoes. Furthermore, the increasing affordability and availability of smart shoe components and systems due to APAC being a manufacturing hub are expanding the consumer base. Japan's high-tech culture and focus on convenience and security are contributing to its market growth. China represents a significant portion of the APAC market, attributed to its large population, rapid urbanization, and high rates of technological adoption in the smart home and wearable technology sectors.

Japan Smart Shoes Market Insight

Japan’s smart shoes market is gaining traction due to its advanced tech infrastructure and strong focus on elderly care. High demand for smart solutions in posture correction, foot health, and rehabilitation is driving adoption across healthcare and sports sectors. Integration with IoT devices, including health monitoring systems, is enhancing the functionality and value of smart shoes in the Japanese market.

China Smart Shoes Market Insight

China accounted for the largest revenue share in the Asia-Pacific smart shoes market in 2024, propelled by its growing middle class, fitness-conscious consumers, and strong domestic manufacturing base. Smart shoes are gaining popularity not only in urban fitness circles but also in clinical and eldercare settings. The Chinese government’s push towards smart healthcare and connected ecosystems is further fueling demand for innovative wearable footwear across demographics.

Smart Shoes Market Share

The smart shoes industry is primarily led by well-established companies, including:

- Nike, Inc. (U.S.)

- Puma SE (Germany)

- Adidas AG (Germany)

- Bata Brand (India)

- Honeywell International Inc. (U.S.)

- New Balance (U.K.)

- ELTEN GmbH (Germany)

- Uvex group (Germany)

- Xiaomi (China)

- Oftenrich Holdings Co. Ltd. (U.S.)

- Wolverine World Wide Inc. (U.S.)

- Hewat's Edinburgh (U.K.)

- W. L. Gore & Associates, Inc. (U.S.)

- Sunflower Industrial Group Co., Ltd (China)

- HILLSON FOOTWEAR PVT. LTD (India)

Latest Developments in Global Smart Shoes Market

- In April 2024, Nike, Inc., a leader in athletic footwear, made a significant stride in performance innovation with the launch of its self-lacing basketball shoe, Adapt BB. This technologically advanced shoe features a system that dynamically adjusts to the wearer's foot, providing customized support and fit in real time. This adaptability is anticipated to offer a considerable advantage to athletes by ensuring optimal foot lockdown and responsiveness throughout their performance, potentially leading to enhanced agility and reduced discomfort

- In January 2024, Adidas unveiled the VeloCade, a revolutionary hybrid indoor cycling shoe that showcases the brand's commitment to versatility and performance. This innovative footwear is specifically engineered to excel in diverse environments, featuring a clever, concealed compartment for a two-bolt cleat, allowing for efficient power transfer during cycling. Furthermore, the shoe incorporates a meticulously designed midsole plate that achieves a seamless balance between stiffness, crucial for maximizing pedaling efficiency, and flexibility, enabling comfortable and natural walking when off the bike, catering to athletes and fitness enthusiasts who require adaptability

- In January 2023, Aretto, an emerging footwear technology brand based in India, achieved a notable milestone by receiving a patent from the Government of India for its groundbreaking sole technology. This patented innovation allows Aretto's shoes to expand by up to three sizes, providing an ingenious solution to the common challenge of children outgrowing their footwear quickly. This technology holds significant potential for the children's footwear market, offering a more economical and convenient option for parents while ensuring children always have properly fitting shoes that accommodate their growing feet

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SMART SHOES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SMART SHOES MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL SMART SHOES MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 BRAND OUTLOOK

8 BRAND COMPARATIVE ANALYSIS

9 PRODUCT VS BRAND OVERVIEW

10 PRICING ANALYSIS

11 IMPACT OF ECONOMIC SLOWDOWN

11.1 IMPACT ON PRICES

11.2 IMPACT ON SUPPLY CHAIN

11.3 IMPACT ON SHIPMENT

11.4 IMPACT ON DEMAND

11.5 IMPACT ON STRATEGIC DECISIONS

12 SUPPLY CHAIN ANALYSIS

12.1 OVERVIEW

12.2 LOGISTIC COST SCENARIO

12.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

13 GLOBAL SMART SHOES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) (MILLION UNITS)

13.1 OVERVIEW

13.2 RUNNING SHOES

13.3 GAMING SHOES

13.4 HEALTHCARE SHOES

13.5 SAFETY SHOES

13.6 ASSISTIVE SHOES

13.7 NAVIGATION SHOES

13.8 FOOT MOVEMENT SHOES

13.9 OTHERS

14 GLOBAL SMART SHOES MARKET, BY SOLE MATERIAL, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 ETHYLENE VINYL ACETATE (EVA)

14.3 THERMOPLASTIC RUBBER (TPR)

14.4 POLYURETHANE (PU)

14.5 RUBBER SOLE

14.6 OTHERS

15 GLOBAL SMART SHOES MARKET, BY INNER SOLE, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 AIR INSOLES

15.3 GEL INSOLES

15.4 SMART INSOLES

15.5 CORK INSOLES

15.6 OTHERS

16 GLOBAL SMART SHOES MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 UP TO USD 100

16.3 101 USD TO 500 USD

16.4 MORE THAN 500 USD

17 GLOBAL SMART SHOES MARKET, BY BATTERY TYPE, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 SHAPED POUCH LIPO BATTERY CELL

17.2.1 SHAPED POUCH LIPO BATTERY CELL, BY CAPACITY

17.2.1.1. UP TO 500 MAH

17.2.1.2. 500 MAH TO 1000 MAH

17.2.1.3. 1001 MAH TO 2000 MAH

17.2.1.4. MORE THAN 2000 MAH

17.3 SHAPED METAL CASING LIPO BATTERY CELL

17.3.1 SHAPED METAL CASING LIPO BATTERY CELL, BY CAPACITY

17.3.1.1. UP TO 500 MAH

17.3.1.2. 500 MAH TO 1000 MAH

17.3.1.3. 1001 MAH TO 2000 MAH

17.3.1.4. MORE THAN 2000 MAH

17.4 RECHARGEABLE LITHIUM-ION COIN CELL

17.4.1 RECHARGEABLE LITHIUM-ION COIN CELL, BY CAPACITY

17.4.1.1. UP TO 100 MAH

17.4.1.2. 100 MAH TO 200 MAH

17.4.1.3. MORE THAN 200 MAH

18 GLOBAL SMART SHOES MARKET, BY TECHNOLOGY, 2018-2032 (USD MILLION)

18.1 OVERVIEW

18.2 ELECTRONIC

18.2.1 MICRO-CONTROLLER AND SENSOR BASED

18.2.1.1. PRESSURE

18.2.1.2. ULTRASONIC

18.2.1.3. ACCLEROMETER

18.2.1.4. WATER LEVEL

18.2.1.5. TEMPERATURE

18.2.1.6. ALTITUDE

18.2.1.7. MAGNETOMETER

18.2.1.8. GYROSCOPE

18.2.1.9. PIEZOELECTRIC

18.2.1.10. WIRELESS

18.2.1.10.1. WIFI

18.2.1.10.2. BLUETOOTH

18.2.2 NAVIGATION SYSTEM

18.3 MECHANICAL

18.3.1 PASSIVE PUMP

18.3.2 ACTUATOR

18.3.3 SPRING LEVERED PERDOMETER

18.4 ELECTRO MEHANICAL

18.4.1 GENERATORS

18.4.1.1. ELECTROMAGNETIC

18.4.1.2. PIEZOELECTRIC

18.4.1.3. SOLAR PANEL

18.4.2 MOTORS

19 GLOBAL SMART SHOES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

19.1 OVERVIEW

19.2 STORE BASED RETAILERS

19.2.1 HYPERMARKET AND SUPERMARKET

19.2.2 CONVENIENCE STORES

19.2.3 DISCOUNT STORES

19.2.4 BRAND OUTLETS

19.2.4.1. SINGLE BRAND STORES

19.2.4.2. MULTI-BRAND STORES

19.2.5 TRAVEL RETAIL SHOPS

19.2.6 OTHERS

19.3 NON-STORE RETAILERS

19.3.1 COMPANY OWNED WEBSITES

19.3.2 E-COMMERCE WEBSITES

20 GLOBAL SMART SHOES MARKET, BY END USE , 2018-2032 (USD MILLION)

20.1 OVERVIEW

20.2 ADULT

20.2.1 MEN

20.2.2 WOMEN

20.3 SENIOR CITIZEN

20.3.1 MEN

20.3.2 WOMEN

20.4 PEOPLE WITH DISABILITIES

20.4.1 MEN

20.4.2 WOMEN

20.5 KIDS

21 GLOBAL SMART SHOES MARKET, BY GEOGRAPHY , 2018-2032 (USD MILLION) (MILLION UNITS)

GLOBAL SMART SHOES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

21.1 NORTH AMERICA

21.1.1 U.S.

21.1.2 CANADA

21.1.3 MEXICO

21.2 EUROPE

21.2.1 GERMANY

21.2.2 U.K.

21.2.3 ITALY

21.2.4 FRANCE

21.2.5 SPAIN

21.2.6 SWITZERLAND

21.2.7 RUSSIA

21.2.8 TURKEY

21.2.9 BELGIUM

21.2.10 NETHERLANDS

21.2.11 SWITZERLAND

21.2.12 DENMARK

21.2.13 NORWAY

21.2.14 FINLAND

21.2.15 SWEDEN

21.2.16 REST OF EUROPE

21.3 ASIA-PACIFIC

21.3.1 JAPAN

21.3.2 CHINA

21.3.3 SOUTH KOREA

21.3.4 INDIA

21.3.5 SINGAPORE

21.3.6 THAILAND

21.3.7 INDONESIA

21.3.8 MALAYSIA

21.3.9 PHILIPPINES

21.3.10 AUSTRALIA

21.3.11 NEW ZEALAND

21.3.12 HONG KONG

21.3.13 TAIWAN

21.3.14 REST OF ASIA-PACIFIC

21.4 SOUTH AMERICA

21.4.1 BRAZIL

21.4.2 ARGENTINA

21.4.3 REST OF SOUTH AMERICA

21.5 MIDDLE EAST AND AFRICA

21.5.1 SOUTH AFRICA

21.5.2 EGYPT

21.5.3 SAUDI ARABIA

21.5.4 UNITED ARAB EMIRATES

21.5.5 ISRAEL

21.5.6 BAHRAIN

21.5.7 KUWAIT

21.5.8 OMAN

21.5.9 QATAR

21.5.10 REST OF MIDDLE EAST AND AFRICA

22 GLOBAL SMART SHOES MARKET, COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.5 MERGERS AND ACQUISITIONS

22.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

22.7 EXPANSIONS

22.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL SMART SHOES MARKET- COMPANY PROFILES

23.1 PUMA

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT UPDATES

23.2 NIKE

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT UPDATES

23.3 UNDER ARMOUR, INC.

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT UPDATES

23.4 ADIDAS

23.4.1 COMPANY SNAPSHOT

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT UPDATES

23.5 REEBOK

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT UPDATES

23.6 ASICS

23.6.1 COMPANY SNAPSHOT

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT UPDATES

23.7 XIAOMI

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT UPDATES

23.8 IEE SMART SENSING SOLUTIONS

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT UPDATES

23.9 PRELAUNCH

23.9.1 COMPANY SNAPSHOT

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

24 RELATED REPORTS

25 QUESTIONNAIRE

26 CONCLUSION

27 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.