Global Smart Water Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

18.62 Billion

USD

47.44 Billion

2024

2032

USD

18.62 Billion

USD

47.44 Billion

2024

2032

| 2025 –2032 | |

| USD 18.62 Billion | |

| USD 47.44 Billion | |

|

|

|

|

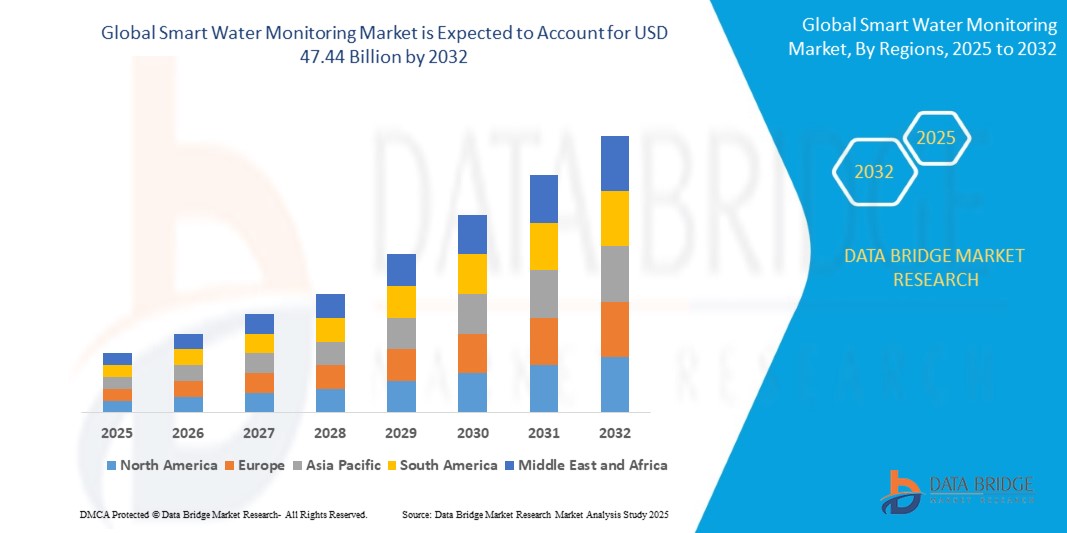

What is the Global Smart Water Monitoring Market Size and Growth Rate?

- The global smart water monitoring market size was valued at USD 18.62 billion in 2024 and is expected to reach USD 47.44 billion by 2032, at a CAGR of 12.40% during the forecast period

- The smart water monitoring market is experiencing significant growth, driven by increasing demands for efficient water management and the advancement of technology. As urbanization accelerates and water scarcity issues become more pressing, smart water monitoring systems offer crucial solutions for real-time data collection and analysis, helping to optimize water use and ensure sustainability

- These systems leverage cutting-edge technologies such as Internet of Things (IoT) sensors, cloud computing, and machine learning to provide detailed insights into water quality, usage, and infrastructure performance

What are the Major Takeaways of Smart Water Monitoring Market?

- The market is expanding due to several factors, including the rise of smart city initiatives, which integrate intelligent water management solutions into broader urban infrastructure. Governments and utilities are investing heavily in modernizing water infrastructure to address challenges such as leaks, contamination, and resource wastage

- In addition, increasing awareness about environmental sustainability and the need for efficient water resource management are contributing to the growing adoption of smart water monitoring systems

- North America dominated the smart water monitoring market with the largest revenue share of 33.25% in 2024, driven by growing adoption of smart infrastructure, increasing investments in water conservation technologies, and robust government initiatives for efficient water resource management

- Asia-Pacific is expected to grow at the fastest CAGR of 12.56% from 2025 to 2032, driven by rapid urban development, infrastructure expansion, and increasing demand for efficient water resource management in countries such as China, India, and Japan

- The Ultrasonic Sensor segment dominated the smart water monitoring market with the largest market revenue share of 28.9% in 2024, due to its high accuracy in level detection and non-contact measurement, which reduces wear and maintenance costs

Report Scope and Smart Water Monitoring Market Segmentation

|

Attributes |

Smart Water Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Smart Water Monitoring Market?

“AI-Driven Predictive Analytics and Leak Detection”

- A leading trend reshaping the smart water monitoring market is the integration of Artificial Intelligence (AI) and machine learning (ML) to enable real-time leak detection, predictive maintenance, and water usage optimization. These smart systems leverage data patterns to forecast potential failures and water wastage, enabling timely intervention

- For instance, TaKaDu offers an AI-based Central Event Management (CEM) system that analyzes data from multiple sources, including flow meters and pressure sensors, to detect anomalies such as pipe bursts and leaks before they escalate. Similarly, i2O Water uses AI-powered demand forecasting and network monitoring to reduce water loss and improve efficiency

- AI-based smart water monitoring systems can learn consumption patterns, identify abnormal usage, and send proactive alerts to utilities or end-users. This significantly reduces non-revenue water (NRW), improves operational efficiency, and supports water conservation goals

- These solutions are increasingly being adopted by municipalities and water utilities to meet regulatory mandates and sustainability objectives. Integration with IoT devices and cloud platforms enhances scalability and remote monitoring capabilities

- Key companies such as ABB and SUEZ are deploying advanced AI-based monitoring systems that allow for automated data collection, real-time analytics, and remote diagnostics, ensuring smarter and more efficient water infrastructure management

- As global water stress rises, AI-powered smart water monitoring solutions are becoming critical in achieving sustainable water management, transforming traditional utility operations into intelligent, data-driven systems

What are the Key Drivers of Smart Water Monitoring Market?

- The growing demand for efficient water management, especially in water-scarce regions, is a primary driver propelling the smart water monitoring market. Aging infrastructure and increasing water loss rates have compelled utilities to adopt smart systems for leak detection, usage tracking, and pressure management

- For instance, in February 2024, SUEZ expanded its digital water platform, incorporating new AI modules for predictive analytics and customer consumption forecasting—enhancing both operational efficiency and customer engagement

- Rising urbanization and the growth of smart cities are encouraging governments and private sectors to invest in smart water technologies. These solutions support non-revenue water reduction, energy savings, and regulatory compliance, aligning with global sustainability goals

- In addition, real-time water quality monitoring—enabled by smart sensors—helps detect contamination, ensuring public health and safety

- The increasing affordability and availability of IoT-enabled meters, cloud-based software, and mobile monitoring applications further boost market adoption among both residential and commercial users

Which Factor is challenging the Growth of the Smart Water Monitoring Market?

- A significant challenge hindering the growth of the smart water monitoring market is the high initial cost of deployment, especially for developing economies and small-scale utilities. Installation of smart meters, data transmission infrastructure, and integration with existing systems requires substantial capital investment

- For instance, some utilities report upfront costs exceeding USD 250 per household for full AMI (Advanced Metering Infrastructure) integration, which may not be feasible without government subsidies or public-private partnerships

- In addition, data security and privacy concerns persist due to the use of wireless networks and cloud-based data storage. Breaches or unauthorized access to consumption data could undermine consumer trust

- Limited technical expertise in system implementation and maintenance—particularly in rural and underdeveloped regions—also poses adoption challenges. Moreover, interoperability issues among hardware and software vendors can result in integration inefficiencies

- Addressing these challenges requires standardized protocols, training programs, and scalable, cost-effective solutions. Companies like Trimble Water and Oracle are working on cloud-based, modular platforms that lower setup costs while enabling secure data analytics

- Overcoming these barriers is essential for expanding the reach of smart water solutions and ensuring long-term resilience in water infrastructure

How is the Smart Water Monitoring Market Segmented?

The market is segmented on the basis of component, application, and end user.

• By Component

On the basis of component, the smart water monitoring market is segmented into Ultrasonic Sensor, Temperature Sensor, PH Sensor, Flow Sensor, Communication Network, and Others. The Ultrasonic Sensor segment dominated the smart water monitoring market with the largest market revenue share of 28.9% in 2024, due to its high accuracy in level detection and non-contact measurement, which reduces wear and maintenance costs. These sensors are widely used for water tank level monitoring and industrial fluid management due to their reliability and versatility in various environmental conditions.

The Communication Network segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing need for real-time data transmission, remote monitoring, and integration with cloud-based platforms. The rise of IoT-based solutions and smart city initiatives is accelerating demand for robust, scalable, and secure communication infrastructure to support water monitoring applications.

• By Application

On the basis of application, the smart water monitoring market is segmented into Water Tank Level Monitoring, Water Quality Monitoring, and Water Pipe Leakage Detection. The Water Quality Monitoring segment held the largest market revenue share in 2024, driven by rising awareness of water pollution, increasing government regulations, and the need for safe drinking water. These systems help detect changes in parameters such as pH, turbidity, and chemical composition in real-time, supporting both residential and municipal water safety initiatives.

The Water Pipe Leakage Detection segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by aging infrastructure and increasing concerns over non-revenue water losses. Smart sensors embedded in pipelines provide early warnings of leaks or bursts, significantly reducing water wastage and maintenance costs, especially in urban utilities and industrial facilities.

• By End User

On the basis of end user, the smart water monitoring market is segmented into Water Utilities, Industry, Commercial, and Residential. The Water Utilities segment accounted for the largest market revenue share of 36.4% in 2024, supported by large-scale deployment of smart meters, government funding for infrastructure upgrades, and stringent compliance mandates for water conservation. Utilities benefit from advanced metering infrastructure (AMI) that enables accurate billing, real-time data access, and remote system diagnostics.

The Residential segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing consumer demand for smart home water management solutions, leak alerts, and usage tracking via mobile apps. Rising water costs and growing environmental awareness are encouraging homeowners to invest in smart systems that reduce waste and optimize consumption.

Which Region Holds the Largest Share of the Smart Water Monitoring Market?

- North America dominated the smart water monitoring market with the largest revenue share of 33.25% in 2024, driven by growing adoption of smart infrastructure, increasing investments in water conservation technologies, and robust government initiatives for efficient water resource management

- Utilities and municipalities across the region are rapidly upgrading legacy systems with smart metering, leak detection sensors, and real-time analytics platforms to reduce non-revenue water and improve service efficiency

- The region’s leadership is further supported by advanced IoT infrastructure, widespread internet penetration, and strong presence of leading solution providers, making North America a technological hub for smart water monitoring deployment

U.S. Smart Water Monitoring Market Insight

The U.S. smart water monitoring market captured the largest share in 2024 within North America, driven by rising water scarcity concerns, stringent environmental regulations, and increasing adoption of smart city frameworks. Federal and state initiatives promoting sustainable water management, such as the WaterSMART program, are encouraging utilities to implement real-time monitoring solutions. Furthermore, the demand for predictive maintenance and remote water usage tracking is spurring investment in AI-enabled and cloud-integrated monitoring platforms.

Europe Smart Water Monitoring Market Insight

Europe smart water monitoring market is projected to grow at a robust CAGR through the forecast period, driven by sustainability regulations such as the EU Water Framework Directive and the need to reduce water loss in aging infrastructure. Urbanization and the digital transformation of utilities are supporting the adoption of smart metering and network monitoring tools. The integration of data analytics for leak detection and consumption forecasting is also gaining momentum in countries like France, Italy, and the Netherlands.

U.K. Smart Water Monitoring Market Insight

The U.K. smart water monitoring market is expected to grow at a significant CAGR, backed by increasing investments in smart grid and water management technologies. Initiatives such as Ofwat’s innovation funding for water utilities and the AMP7 water efficiency programs are driving the deployment of real-time monitoring systems. In addition, consumer awareness of water conservation and rising concerns over climate-induced water stress are fueling adoption across residential and commercial sectors.

Germany Smart Water Monitoring Market Insight

The Germany smart water monitoring market is experiencing strong growth, supported by the country’s emphasis on efficient resource management, industrial automation, and environmental compliance. Germany’s utilities are investing in IoT-based systems for pipe network diagnostics, flow monitoring, and smart billing. In addition, research collaborations and public-private partnerships are promoting innovation in water-saving technologies, positioning Germany as a leader in smart utility modernization.

Which Region is the Fastest Growing Region in the Smart Water Monitoring Market?

Asia-Pacific is expected to grow at the fastest CAGR of 12.56% from 2025 to 2032, driven by rapid urban development, infrastructure expansion, and increasing demand for efficient water resource management in countries such as China, India, and Japan. Government-led initiatives for smart cities, water conservation, and rural water digitization are accelerating market growth. Affordable sensor technologies and growing public-private collaborations are expanding access across both urban and rural landscapes. The region’s position as a manufacturing hub for IoT hardware and software solutions further enhances scalability, driving strong adoption of smart water monitoring systems across utility, industrial, and residential applications.

Japan Smart Water Monitoring Market Insight

The Japan smart water monitoring market is growing steadily, driven by its aging infrastructure, high technology adoption rate, and focus on disaster-resilient water management systems. Japan’s emphasis on automation and predictive analytics in utilities aligns well with smart water solutions that offer leak detection, pressure management, and early fault alerts. Smart meters and AI-based data systems are being adopted widely in both urban and remote areas to optimize water distribution.

China Smart Water Monitoring Market Insight

The China smart water monitoring market held the largest share in the Asia-Pacific region in 2024, supported by aggressive infrastructure digitization, smart city rollouts, and government mandates to reduce water loss. Chinese tech firms are rapidly innovating in cost-effective sensor and analytics solutions, expanding accessibility across municipalities. In addition, rising industrial water demand and pollution concerns are pushing adoption of real-time quality and flow monitoring systems in both public and private sectors.

Which are the Top Companies in Smart Water Monitoring Market?

The smart water monitoring industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- ABB (Switzerland)

- Itron (U.S.)

- Schneider Electric (France)

- IBM Corporation (U.S.)

- SENSUS USA INC (U.S.)

- Elster Group SE (Germany)

- Siemens (Germany)

- Global Water Management, LLC (U.S.)

- Neptune Technology Group (U.S.)

- Trimble Water (U.S.)

- TaKaDu (Israel)

- SenzIoT (Israel)

- SUEZ (France)

- Oracle Corporation (U.S.)

- i2O Water Ltd (U.K.)

What are the Recent Developments in Global Smart Water Monitoring Market?

- In April 2025, SUEZ announced a five-year strategic partnership with the French National Centre for Scientific Research (CNRS) aimed at driving innovation in sustainable water and waste management. The collaboration is focused on developing advanced technologies and research-backed solutions to address environmental challenges through smarter water management. This partnership strengthens SUEZ’s leadership in intelligent water systems and supports global progress toward resilient, eco-efficient infrastructure

- In March 2025, Honeywell International Inc. revealed its integration of Verizon 5G connectivity into smart utility meters, aiming to boost remote monitoring and autonomous management of water and energy systems. This collaboration enhances operational efficiency and grid resiliency while empowering utilities with real-time data insights. The initiative positions Honeywell at the forefront of next-generation smart water infrastructure innovation

- In January 2025, Siemens entered a strategic partnership with KETOS to advance global water resource management through the deployment of real-time water analytics. By combining Siemens’ automation expertise with KETOS’ monitoring technologies, the partnership aims to deliver integrated, data-driven solutions that promote sustainability and improved water quality control. This collaboration underscores Siemens’ growing role in digital water transformation

- In January 2024, ABB announced the acquisition of Real Tech, a Canadian company specializing in optical sensor technology for real-time water testing and monitoring. The acquisition broadens ABB’s water segment capabilities and enhances its portfolio with essential optical tools for smart water management. This move reinforces ABB’s commitment to delivering precise, intelligent water solutions

- In August 2023, Kohler launched two new water monitoring systems, KOHLER H2Wise and H2Wise+ Powered by Phyn, combining its deep plumbing expertise with Phyn’s innovative water-sensing technologies. These solutions enable homeowners to monitor usage and detect leaks, enhancing control over home water consumption. This launch expands Kohler’s footprint in smart home water management and reinforces its innovation leadership in the sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Water Monitoring Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Water Monitoring Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Water Monitoring Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.