Global Smokeless Tobacco Products Market

Market Size in USD Billion

CAGR :

%

USD

17.55 Billion

USD

24.87 Billion

2024

2032

USD

17.55 Billion

USD

24.87 Billion

2024

2032

| 2025 –2032 | |

| USD 17.55 Billion | |

| USD 24.87 Billion | |

|

|

|

|

Smokeless Tobacco Products Market Size

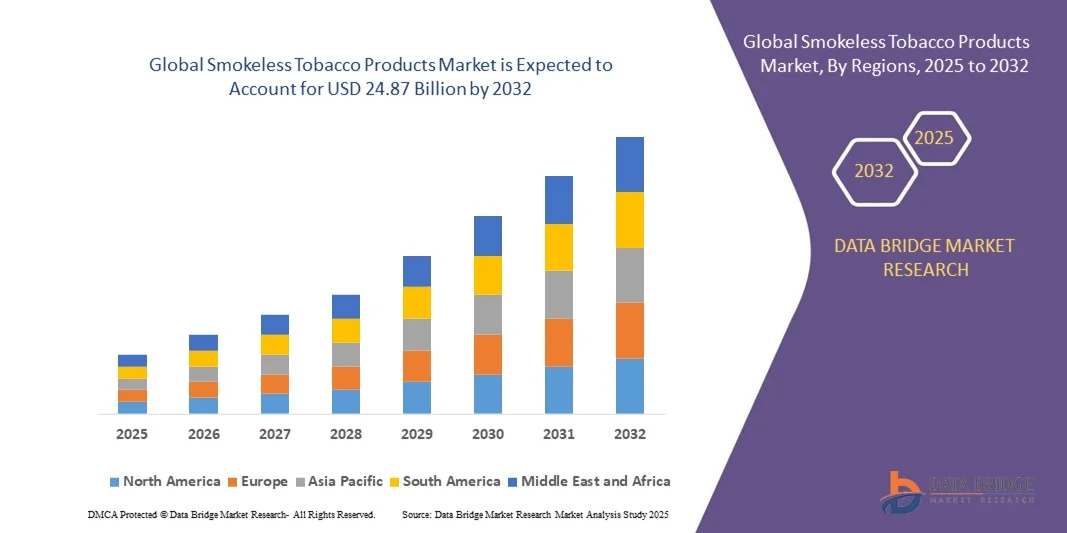

- The global smokeless tobacco products market size was valued at USD 17.55 billion in 2024 and is expected to reach USD 24.87 billion by 2032, at a CAGR of 4.45% during the forecast period

- The market growth is largely fueled by increasing consumer preference for smokeless alternatives to traditional cigarettes, driven by rising health awareness, regulatory restrictions on smoking, and the growing popularity of convenient, discreet nicotine products such as pouches, snuff, and chewing tobacco

- Furthermore, innovations in product formats, flavors, and portion-controlled packaging are attracting a wider consumer base, particularly among younger adults and urban populations. These converging factors are accelerating the adoption of smokeless tobacco products, thereby significantly boosting the industry’s growth

Smokeless Tobacco Products Market Analysis

- Smokeless tobacco products, including chewing tobacco, snuff, dissolvable tobacco, and nicotine pouches, are increasingly sought after as alternatives to smoking due to their convenience, discreet consumption, and perceived reduced harm in certain regulated markets

- The escalating demand for smokeless tobacco is primarily fueled by product innovations, expanding retail and online distribution networks, rising disposable incomes, and cultural acceptance in key regions, which together are driving growth across residential, commercial, and urban consumer segments

- Asia-Pacific dominated smokeless tobacco products market with a share of 38% in 2024, due to high cultural acceptance, increasing disposable incomes, and a strong presence of traditional consumption practices such as chewing tobacco and snuff

- North America is expected to be the fastest growing region in the smokeless tobacco products market during the forecast period due to increasing health awareness, rising demand for smokeless alternatives, and strong online and offline retail networks

- Snuff segment dominated the market with a market share of 55.4% in 2024, due to its traditional popularity, high nicotine content, and long-standing consumer preference in key regions. Its strong market position is further supported by established manufacturing practices, availability in multiple flavors and formats, and ease of use compared to other smokeless tobacco products. The segment also benefits from widespread cultural acceptance and brand loyalty, which reinforce consistent demand and sustained revenue growth

Report Scope and Smokeless Tobacco Products Market Segmentation

|

Attributes |

Smokeless Tobacco Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smokeless Tobacco Products Market Trends

Growing demand for Flavored and Portion-Controlled Smokeless Tobacco

- The smokeless tobacco products market is experiencing notable growth driven by increasing consumer demand for flavored, portion-controlled, and discreet alternatives to traditional tobacco products. As smoking restrictions tighten and health awareness increases, users are gravitating toward convenient, odor-free tobacco options that fit modern lifestyles

- For instance, Altria Group, Inc. has diversified its moist snuff and nicotine pouch portfolio under brands such as Copenhagen and On! to include multiple flavor variants and pre-portioned sachets. This reflects a broader industry shift focusing on customization, convenience, and flavor innovation to attract adult consumers seeking smoke-free experiences

- Flavored smokeless tobacco—such as mint, citrus, coffee, and berry—has gained popularity among young adult demographics and transitioning smokers due to its sensory appeal and ease of use. Portion-controlled products, particularly modern nicotine pouches and snus, provide precise dosing and reduced mess, boosting their acceptance in markets emphasizing hygiene and discretion

- In addition, advancements in formulation technology are enhancing product flavor consistency and nicotine release profiles, ensuring a balance between satisfaction and health risk reduction. Manufacturers are incorporating moisture-regulation techniques and biodegradable pouch materials to improve product performance and sustainability

- The emergence of premium and innovative oral tobacco categories, including white pouches and low-nicotine variants, is further expanding market diversity. This product differentiation supports customer retention among smokers shifting toward safer, regulated alternatives aligned with modern consumption habits

- As public environments increasingly restrict smoking and consumers become more health-conscious, the demand for flavored and portioned smokeless tobacco products continues to rise. Industry players are focusing on regulatory compliance, product safety, and design innovation to position smokeless alternatives as socially acceptable, modern nicotine solutions

Smokeless Tobacco Products Market Dynamics

Driver

Rising Preference for Smoke-Free Alternatives

- The increasing global shift toward smoke-free nicotine consumption is a key driver of the smokeless tobacco products market. As awareness of the health risks associated with cigarette smoking grows, consumers are showing greater interest in non-combustible options that deliver nicotine without smoke or odor exposure

- For instance, Swedish Match AB, now part of Philip Morris International, has achieved significant growth through its ZYN nicotine pouch line, catering to consumers seeking convenient, discreet, and spit-free tobacco alternatives. The brand’s success underscores how changing lifestyle preferences and public restrictions on smoking are accelerating smokeless segment penetration

- Smokeless tobacco products allow users to experience nicotine satisfaction with minimal disruption in public or workplace settings where smoking bans are enforced. Their perceived harm-reduction potential, combined with convenience and subtle consumption formats, is driving adoption across both developed and emerging economies

- In addition, the rise of low-risk tobacco regulatory frameworks, such as those promoted by the U.S. Food and Drug Administration’s modified-risk tobacco product (MRTP) approvals, has enhanced consumer trust in certified smokeless alternatives. This endorsement strengthens market positioning for established brands promoting scientifically substantiated reduced-risk claims

- The expansion of premium and modern oral categories such as snus, nicotine lozenges, and pouches is reshaping tobacco consumption patterns. As consumers move toward cleaner and more controlled nicotine delivery systems, the transition to smokeless formats is expected to sustain long-term industry growth driven by evolving preferences and harm-reduction awareness

Restraint/Challenge

Strict Regulations Limiting Promotion and Sales

- Stringent regulations on tobacco promotion, labeling, and cross-border trade represent a significant challenge for the smokeless tobacco products market. Government agencies across several regions are enforcing restrictions on advertising, flavor use, and public display, which constrain market visibility and consumer outreach

- For instance, regulatory frameworks in the European Union and India have imposed flavor bans and plain packaging requirements for smokeless tobacco products, directly impacting brand differentiation and marketing flexibility. Similarly, in the United States, the FDA’s premarket tobacco product application (PMTA) process adds time and cost burdens for product approvals

- The growing emphasis on youth protection policies and anti-tobacco advocacy initiatives is also limiting market expansion. Restrictions on digital advertising, sponsorships, and retail availability hinder the ability of manufacturers to engage with adult consumers while ensuring compliance with strict monitoring and distribution controls

- In addition, taxation policies on tobacco alternatives and enforcement of import/export restrictions create variability in market access. Companies face logistical and regulatory challenges in adapting product formulations and packaging to meet diverse compliance requirements across countries

- To mitigate these challenges, leading manufacturers are prioritizing product standardization, scientific substantiation of reduced-risk profiles, and transparent engagement with regulators. The long-term market outlook depends on achieving a regulatory balance that supports harm-reduction innovation while maintaining controls to prevent youth exposure and misuse

Smokeless Tobacco Products Market Scope

The market is segmented on the basis of product, form, route, and distribution channel.

- By Product

On the basis of product, the smokeless tobacco products market is segmented into chewing tobacco, dipping tobacco, dissolvable tobacco, snuff, and others. The snuff segment dominated the market with the largest revenue share of 55.4% in 2024, driven by its traditional popularity, high nicotine content, and long-standing consumer preference in key regions. Its strong market position is further supported by established manufacturing practices, availability in multiple flavors and formats, and ease of use compared to other smokeless tobacco products. The segment also benefits from widespread cultural acceptance and brand loyalty, which reinforce consistent demand and sustained revenue growth.

The dissolvable tobacco segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer demand for discreet, convenient, and smoke-free alternatives. Its appeal lies in ease of use, minimal odor, and compatibility with modern lifestyles, particularly among younger adult consumers seeking less conspicuous forms of tobacco consumption. Innovations in flavors, formats, and portability further contribute to the rapid adoption of dissolvable tobacco products globally.

- By Form

On the basis of form, the smokeless tobacco products market is segmented into dry and moist. The moist segment held the largest market revenue share in 2024, driven by its widespread traditional use and enhanced flavor release, which provides a more satisfying experience for users. Moist smokeless tobacco is often preferred for its stronger nicotine delivery and cultural familiarity in key markets, making it a staple product among existing consumers. Manufacturers continue to innovate in packaging and portion-controlled formats, ensuring consistent quality and ease of use, which sustains the segment’s dominance.

The dry form segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising urbanization and increasing adoption among younger consumers seeking cleaner, more convenient tobacco products. Dry forms are often easier to store, transport, and consume without creating residue, making them attractive in markets with strict smoking regulations. Innovations in flavor, size, and ready-to-use formats further support its expanding market presence.

- By Route

On the basis of route, the smokeless tobacco products market is segmented into oral and nasal. The oral segment dominated the market in 2024 with the largest revenue share, owing to its higher consumer acceptance, variety of product types, and ease of use. Oral smokeless tobacco offers a more controlled and convenient nicotine intake, and its availability in multiple flavors, strengths, and packaging enhances user preference. The segment also benefits from ongoing product innovations and targeted marketing strategies that appeal to both traditional users and new consumers.

The nasal segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing popularity of less conventional consumption methods and the rise of niche markets seeking discreet nicotine delivery. Nasal products are valued for their rapid absorption, minimal residue, and ability to offer alternative experiences for users looking to diversify from oral forms. Awareness campaigns and product innovations tailored to consumer convenience are likely to accelerate adoption.

- By Distribution Channel

On the basis of distribution channel, the smokeless tobacco products market is segmented into online and offline. The offline segment held the largest revenue share in 2024, driven by the established retail infrastructure, wide availability in convenience stores, tobacco shops, and supermarkets, and traditional consumer buying habits. The physical retail environment allows consumers to examine products, compare flavors, and access trusted brands, which reinforces the dominance of offline channels in key markets.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing e-commerce penetration, convenience of home delivery, and increasing acceptance of digital payment methods. Online channels also allow consumers to access a wider variety of brands, flavors, and formats that may not be available locally, enhancing market reach. Targeted online marketing and discreet packaging further drive adoption among tech-savvy and younger demographics.

Smokeless Tobacco Products Market Regional Analysis

- Asia-Pacific dominated the smokeless tobacco products market with the largest revenue share of 38% in 2024, driven by high cultural acceptance, increasing disposable incomes, and a strong presence of traditional consumption practices such as chewing tobacco and snuff

- The region’s large consumer base, growing urbanization, and rising e-commerce penetration are accelerating market expansion

- Increasing product innovations, favorable distribution networks, and government initiatives promoting regulated smokeless alternatives are contributing to higher consumption across both urban and rural areas

China Smokeless Tobacco Products Market Insight

China held the largest share in the Asia-Pacific smokeless tobacco products market in 2024, owing to its large population, cultural acceptance of smokeless forms such as snuff and chewing tobacco, and increasing disposable incomes. Widespread retail and online distribution, coupled with the availability of flavored and portion-controlled products, is driving demand. In addition, government regulations on smoking and rising health awareness are encouraging a shift toward smokeless alternatives.

India Smokeless Tobacco Products Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by traditional usage patterns, increasing awareness of smoke-free alternatives, and rising disposable incomes. Government campaigns promoting regulated tobacco products and innovations in flavors and convenient formats are supporting market expansion. A large youth population and growing online retail penetration further contribute to robust growth in the smokeless tobacco segment.

Europe Smokeless Tobacco Products Market Insight

The Europe smokeless tobacco products market is expanding steadily, supported by rising awareness of tobacco alternatives, stringent regulations on smoking, and growing adoption of discreet consumption formats. Countries such as Germany and the U.K. are witnessing higher demand for portion-controlled and flavored smokeless products. The presence of well-established retail and e-commerce infrastructure enhances product accessibility, further supporting market growth.

Germany Smokeless Tobacco Products Market Insight

Germany’s smokeless tobacco products market is driven by increasing consumer awareness, high-quality product offerings, and strong retail and e-commerce networks. The country emphasizes safe and convenient alternatives to smoking, with growing interest in snuff, dry, and portion-controlled products. Strong regulations and focus on product quality and innovation further reinforce the market’s expansion.

U.K. Smokeless Tobacco Products Market Insight

The U.K. market is supported by growing awareness of health risks from smoking, the demand for convenient alternatives, and increasing online retail penetration. Product innovation in flavored and dissolvable tobacco formats, along with strong brand presence, encourages adoption. The U.K.’s mature distribution channels and consumer preference for ready-to-use smokeless tobacco contribute to sustained market growth.

North America Smokeless Tobacco Products Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing health awareness, rising demand for smokeless alternatives, and strong online and offline retail networks. Technologically enabled marketing, flavored and portion-controlled products, and established brand loyalty are key growth drivers. Regulatory support for safer alternatives further boosts market expansion.

U.S. Smokeless Tobacco Products Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by strong cultural acceptance of traditional products such as snuff and chewing tobacco. High disposable incomes, innovative product offerings, and widespread e-commerce and retail availability encourage higher adoption. In addition, government regulations promoting regulated smokeless tobacco consumption, combined with robust brand presence, consolidate the U.S.’s leading position in the region.

Smokeless Tobacco Products Market Share

The smokeless tobacco products industry is primarily led by well-established companies, including:

- Altria Group, Inc. (U.S.)

- British American Tobacco (U.K.)

- Imperial Brands (U.K.)

- DS Group (India)

- Philip Morris International (U.S.)

- Swedish Match (Sweden)

- Japan Tobacco (Japan)

- Swisher International, Inc. (U.S.)

- Mac Baren Tobacco Company (Denmark)

- U.S. Smokeless Tobacco Company (U.S.)

- Turning Point Brands (U.S.)

- Black Buffalo Inc. (U.S.)

- Smoky Mountain Chew, Inc. (U.S.)

- Chattahoochee Herbal Snuff (U.S.)

- Outlaw Dip (U.S.)

- Turmeaus (U.K.)

- ITC Limited (India)

Latest Developments in Global Smokeless Tobacco Products Market

- In October 2024, Japan Tobacco International (JTI) completed the acquisition of Logic Technology Development, a U.S.-based e-cigarette company. This acquisition enhances JTI’s presence in the U.S. market and broadens its smokeless tobacco product offerings. By integrating Logic Technology Development’s expertise and distribution networks, JTI aims to capitalize on growing demand for alternative nicotine products and diversify its portfolio to align with evolving consumer trends

- In June 2024, Scandinavian Tobacco Group (STG) announced its acquisition of Mac Baren Tobacco Company for approximately USD 76.9 million (DKK 535 million), financed by cash and debt. This strategic move is aimed at strengthening STG’s portfolio in smokeless tobacco, particularly in the U.S., Denmark, and Germany. The integration, expected to take up to 120 days, will leverage Mac Baren’s established presence in pipe tobacco and nicotine pouches, enhancing STG’s market reach and enabling collaborative innovations across product lines

- In February 2024, British American Tobacco (BAT) raised a total of USD 1.7 billion in the U.S. dollar market under its SEC Shelf Programme. This financial strategy supports BAT’s expansion in the U.S. smokeless tobacco market, enabling the company to enhance production capabilities and marketing efforts for its nicotine pouch and other smokeless products. The capital infusion strengthens BAT’s competitive position as consumer demand for smokeless alternatives continues to rise

- In June 2023, Imperial Brands acquired various nicotine pouch products from TJP Labs to enter the U.S. market. This acquisition allows ITG Brands to offer 14 product variants to American consumers, with a planned relaunch in 2024. The move expands Imperial Brands’ product portfolio and presence in the growing U.S. smokeless tobacco segment, positioning the company to capture shifting consumer preferences toward smokeless alternatives

- In March 2023, Altria Group expanded its smokeless tobacco portfolio through strategic investments in product innovation and flavor diversification. The initiative targeted increasing consumer adoption of smokeless alternatives such as pouches and snuff, responding to rising health awareness and declining traditional cigarette consumption. These efforts strengthened Altria’s market presence and reinforced its positioning as a key player in the evolving smokeless tobacco landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.