Global Smoking Accessories Market

Market Size in USD Billion

CAGR :

%

USD

6.82 Billion

USD

10.31 Billion

2024

2032

USD

6.82 Billion

USD

10.31 Billion

2024

2032

| 2025 –2032 | |

| USD 6.82 Billion | |

| USD 10.31 Billion | |

|

|

|

|

Smoking Accessories Market Size

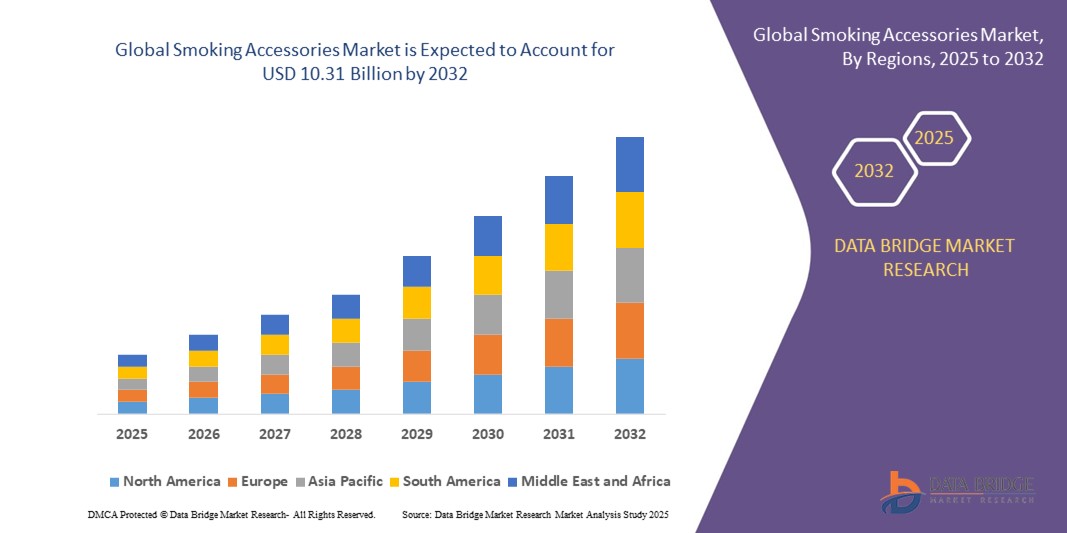

- The global smoking accessories market size was valued at USD 6.82 billion in 2024 and is expected to reach USD 10.31 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is primarily driven by the increasing popularity of vaping, the legalization of recreational and medical cannabis in various regions, and the rising demand for eco-friendly and customizable smoking accessories

- Growing consumer interest in personalized and innovative smoking products, coupled with the expansion of online retail channels, is further propelling the demand for smoking accessories across both traditional and alternative smoking segments

Smoking Accessories Market Analysis

- The smoking accessories market is experiencing consistent growth as consumers increasingly seek products that enhance smoking experiences, provide convenience, and align with health-conscious and eco-friendly trends

- The rise in demand for vaporizers and water pipes, perceived as healthier alternatives to traditional smoking, is encouraging manufacturers to innovate with advanced, sustainable, and aesthetically pleasing products

- North America dominated the smoking accessories market with the largest revenue share of 33.9% in 2024, driven by a mature tobacco and cannabis industry, high consumer spending, and widespread legalization of recreational cannabis

- Asia-Pacific is expected to be the fastest-growing region in the smoking accessories market during the forecast period, fueled by rising disposable incomes, increasing adoption of Western lifestyles, and growing popularity of smoking accessories among younger demographics in countries such as China, India, and Southeast Asian nations

- The vaporizers segment dominated the largest revenue share of 33.0% in 2024, driven by their perceived health benefits and versatility in accommodating various smoking materials such as dry herbs, oils, and concentrates. Vaporizers are favored for their efficiency in extracting active compounds without combustion, reducing harmful byproducts like tar and carbon monoxide

Report Scope and Smoking Accessories Market Segmentation

|

Attributes |

Smoking Accessories Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smoking Accessories Market Trends

Increasing Adoption of Smart and Customizable Accessories

- The global smoking accessories market is experiencing a notable trend toward the integration of smart technologies and customizable products

- Advanced smoking accessories, such as smart vaporizers with digital monitoring tools and adjustable settings, are gaining traction for offering enhanced user experiences

- These technologies allow users to control aspects like vapor intensity, temperature, and battery monitoring, providing a more personalized smoking experience

- For instance, companies like Hubbly Bubbly, Inc. have introduced E-heads for vaporizers that adjust vapor intensity and display battery levels, while Dash Vapes, Inc. offers a range of vaping mods for improved functionality

- Customization is also a key trend, with consumers seeking personalized products such as engraved pipes, custom-designed rolling papers, and designer lighters to reflect individual style and preferences

- This trend is particularly appealing to younger demographics, driving demand for innovative and aesthetically pleasing smoking accessories

Smoking Accessories Market Dynamics

Driver

Rising Popularity of Vaping and Cannabis Legalization

- The global smoking accessories market is experiencing a notable trend toward the integration of smart technologies and customizable products

- Advanced smoking accessories, such as smart vaporizers with digital monitoring tools and adjustable settings, are gaining traction for offering enhanced user experiences

- These technologies allow users to control aspects like vapor intensity, temperature, and battery monitoring, providing a more personalized smoking experience

- For instance, companies like Hubbly Bubbly, Inc. have introduced E-heads for vaporizers that adjust vapor intensity and display battery levels, while Dash Vapes, Inc. offers a range of vaping mods for improved functionality

- Customization is also a key trend, with consumers seeking personalized products such as engraved pipes, custom-designed rolling papers, and designer lighters to reflect individual style and preferences

- This trend is particularly appealing to younger demographics, driving demand for innovative and aesthetically pleasing smoking accessories

Restraint/Challenge

Health Concerns and Regulatory Restrictions

- Health concerns related to smoking and the increasing awareness of nicotine-free alternatives, such as nicotine replacement therapies, are significant restraints for the smoking accessories market

- Stringent government regulations on tobacco and smoking-related products, including advertising and sales restrictions, pose challenges for manufacturers and retailers, particularly in regions with strict anti-smoking initiatives

- Data privacy concerns related to smart smoking accessories, such as vaporizers with digital monitoring, raise issues about the collection and potential misuse of user data, complicating compliance with varying global regulations

- High initial costs for premium and smart smoking accessories, such as advanced vaporizers and eco-friendly rolling papers, can deter cost-sensitive consumers, particularly in emerging markets

- The fragmented regulatory landscape across countries, especially regarding cannabis and tobacco use, creates operational challenges for international manufacturers and limits market expansion in certain regions

Smoking Accessories market Scope

The market is segmented on the basis of type and distribution channel.

- By Type

On the basis of type, the global smoking accessories market is segmented into water pipes, vaporizers, rolling paper and cigarette tubes, lighters, filter, and paper tip. The vaporizers segment dominated the largest revenue share of 33.0% in 2024, driven by their perceived health benefits and versatility in accommodating various smoking materials such as dry herbs, oils, and concentrates. Vaporizers are favored for their efficiency in extracting active compounds without combustion, reducing harmful byproducts like tar and carbon monoxide. Their portability, advanced technology, and availability of flavored nicotine and cannabis products further contribute to their dominance.

The rolling paper and cigarette tubes segment is expected to register the fastest growth rate from 2025 to 2032, fueled by the increasing popularity of roll-your-own (RYO) tobacco and cannabis products. These products offer cost-effectiveness and customization, appealing to consumers seeking personalized smoking experiences. The rise in demand for eco-friendly and biodegradable rolling papers, along with pre-rolled tubes with built-in filters, further supports the segment’s growth.

- By Distribution Channel

On the basis of distribution channel, the global smoking accessories market is segmented into offline and online distribution channels. The offline segment dominated the market in 2024, accounting for over 75.0% of the revenue share, driven by the immediate availability of products and the ability to physically inspect items like glass pipes and bongs. Brick-and-mortar stores, including tobacconists, convenience stores, and specialty shops, provide a tactile and social shopping experience, particularly for items requiring quality assessment. The high reachability and discounts offered by offline retailers further bolster this segment’s dominance.

The online segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the convenience of e-commerce platforms and the increasing use of social media marketing. Online channels offer a wide range of products, competitive pricing, and access to global brands, appealing to younger consumers. The surge in smartphone penetration and the growing trend of direct-to-consumer sales, including customizable and premium accessories, are key drivers of this segment’s rapid expansion.

Smoking Accessories Market Regional Analysis

- North America dominated the smoking accessories market with the largest revenue share of 33.9% in 2024, driven by a mature tobacco and cannabis industry, high consumer spending, and widespread legalization of recreational cannabis

- Consumers prioritize smoking accessories for enhancing user experience, reducing harmful chemical exposure, and achieving aesthetic appeal, particularly in regions with diverse smoking preferences

- Growth is supported by advancements in accessory technology, such as sophisticated vaporizers and eco-friendly rolling papers, alongside rising adoption in both retail and online distribution channels

U.S. Smoking Accessories Market Insight

The U.S. smoking accessories market captured the largest revenue share of 72.8% in 2024 within North America, fueled by strong aftermarket demand and growing consumer awareness of health-conscious smoking alternatives. The trend towards personalized and premium accessories, coupled with increasing legalization of cannabis, further boosts market expansion. Manufacturers’ growing incorporation of advanced accessories, such as vaporizers and water pipes, complements offline and online sales, creating a diverse product ecosystem.

Europe Smoking Accessories Market Insight

The Europe smoking accessories market is expected to witness significant growth, supported by regulatory emphasis on safer smoking alternatives and consumer comfort. Consumers seek accessories that enhance smoking efficiency while reducing health risks. The growth is prominent in both new product purchases and aftermarket customization, with countries such as Germany and the U.K. showing significant uptake due to rising environmental concerns and urban smoking culture.

U.K. Smoking Accessories Market Insight

The U.K. market for smoking accessories is expected to witness rapid growth, driven by demand for enhanced user comfort and aesthetic appeal in urban and suburban settings. Increased interest in personalized accessories and rising awareness of health benefits from vaporizers and filters encourage adoption. Evolving regulations balancing accessory functionality with compliance further influence consumer choices.

Germany Smoking Accessories Market Insight

Germany is expected to witness rapid growth in the smoking accessories market, attributed to its advanced manufacturing sector and high consumer focus on quality and health-conscious smoking solutions. German consumers prefer technologically advanced accessories, such as high-quality vaporizers and eco-friendly rolling papers, that reduce harmful chemical exposure. The integration of these accessories in premium products and aftermarket options supports sustained market growth.

Asia-Pacific Smoking Accessories Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding smoking culture and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of health-conscious smoking alternatives, aesthetic appeal, and accessibility through online channels is boosting demand. Government initiatives promoting regulated cannabis use and innovative accessory designs further encourage the adoption of advanced smoking accessories.

Japan Smoking Accessories Market Insight

Japan’s smoking accessories market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced accessories that enhance smoking comfort and safety. The presence of major manufacturers and the integration of accessories like vaporizers in retail markets accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Smoking Accessories Market Insight

China holds the largest share of the Asia-Pacific smoking accessories market, propelled by rapid urbanization, rising smoking prevalence, and increasing demand for health-conscious and aesthetically appealing smoking solutions. The country’s growing middle class and focus on innovative accessory designs support the adoption of advanced products like vaporizers and water pipes. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Smoking Accessories Market Share

The smoking accessories industry is primarily led by well-established companies, including:

- Bull Brand (U.S.)

- British American Tobacco PLC (U.K.)

- Imperial Brands (U.K.)

- BBK Tobacco & Foods (U.S.)

- Chongz British American Tobacco PLC (U.S.)

- Curved Papers, Inc. (U.S.)

- Univac Furncrafts Pvt. Ltd. (India)

- Republic Technologies International (France)

- Moondust Paper Pvt. Ltd.( New Delhi)

- Jinlin (HK) Smoking Accessories Co., Ltd. (Hong Kong)

- The Rolling Paper Company (U.S.)

What are the Recent Developments in Global Smoking Accessories Market?

- In March 2024, Shell and Lekkerland announced an extension of their long-standing partnership to enhance retail operations across approximately 2,000 Shell stations in Germany. The renewed collaboration focuses on expanding the Shell Café store concept, improving the food service offering, and maintaining Lekkerland’s role as the supply partner for a wide range of products—including beverages, confectionery, tobacco, prepaid items, and car accessories. This initiative reinforces both companies’ commitment to adapting to changing consumer needs and strengthening their presence in the convenience and retail sectors

- In February 2024, Houseplant, the cannabis lifestyle brand co-founded by Seth Rogen, announced a collaboration with OCB, the renowned French rolling paper company, to launch a premium line of rolling papers and cones. Branded as Houseplant by OCB, the collection features sustainable materials such as bamboo, brown rice, and classic wood fibers, designed to elevate the smoking experience while promoting eco-conscious practices. The product line debuted online on February 16, with a broader retail rollout planned for spring 2024, reflecting the growing demand for high-quality, environmentally friendly smoking accessories

- In January 2024, S.T. Dupont partnered with Casablanca Paris to launch a luxury collection of smoking accessories, blending artisanal craftsmanship with high-fashion aesthetics. The collaboration, titled “The Art of Sport,” includes lighters, cigar cutters, ashtrays, and humidors, inspired by Ancient Greek architecture, tennis motifs, and Casablanca’s bold design language. The collection features three distinct lines—Mosaic, Tennis, and Leather Goods—crafted with intricate metalwork, lacquer finishes, and premium materials. This release reflects a growing trend toward premium, collectible smoking accessories that cater to consumers seeking exclusivity and elevated lifestyle products

- In January 2023, Dopeboo, a leading online headshop, unveiled an expanded collection of exclusive smoking accessories, featuring top-tier brands like Grav, Puffco, Marley Naturals, and DaVinci. The updated assortment includes bongs, dab rigs, vaporizers, and grinders, all curated to deliver premium quality and diverse functionality. Dopeboo also introduced its own in-house product line, BooGlass, offering innovative designs such as glow-in-the-dark grinders and classic wooden herb tools. This launch underscores Dopeboo’s commitment to enhancing the online retail experience for modern consumers seeking high-end, stylish smoking gear

- In November 2022, Dr. Dabber, a cannabis technology firm, launched the XS Nano eRig, a compact and portable cannabis vaporizer designed for discreet, on-the-go use. Measuring just 4 inches tall, the XS Nano features TCR heating technology, a Direct Flavor Pathway, and a scientifically inspired water filtration system, delivering smooth vapor at low temperatures. With four precise heat settings and USB-C charging, it offers high performance in a travel-friendly design. This release showcases the industry’s commitment to technological innovation and user-friendly cannabis accessories

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.