Global Smoking Cessation And Nicotine De Addiction Market

Market Size in USD Billion

CAGR :

%

USD

29.38 Billion

USD

92.41 Billion

2024

2032

USD

29.38 Billion

USD

92.41 Billion

2024

2032

| 2025 –2032 | |

| USD 29.38 Billion | |

| USD 92.41 Billion | |

|

|

|

|

Smoking Cessation and Nicotine De-Addiction Market Size

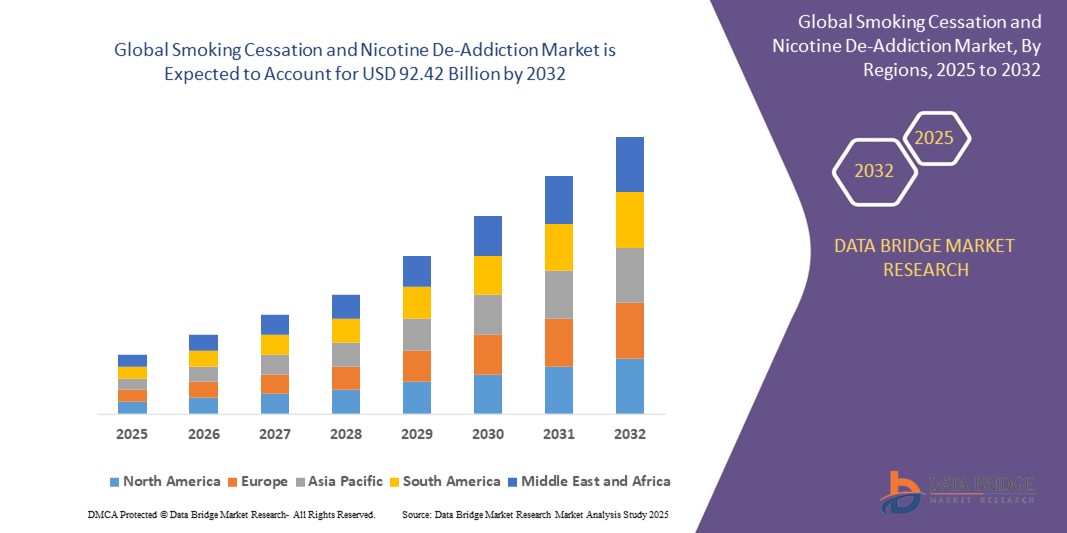

- The global smoking cessation and nicotine de-addiction market size was valued at USD 29.38 billion in 2024 and is expected to reach USD 92.41 billion by 2032, at a CAGR of 15.40% during the forecast period

- The market growth is primarily driven by increasing awareness of the health risks associated with smoking, government initiatives to reduce tobacco consumption, and advancements in cessation therapies and products

- Growing consumer preference for accessible, effective, and non-invasive nicotine de-addiction solutions, coupled with the rise of digital health platforms, is significantly boosting market expansion

Smoking Cessation and Nicotine De-Addiction Market Analysis

- Smoking cessation and nicotine de-addiction products, including nicotine replacement therapies (NRTs), pharmacological treatments, and behavioral therapies, are critical in addressing tobacco dependence and promoting healthier lifestyles globally

- The market is propelled by rising health consciousness, stricter anti-smoking regulations, and increasing adoption of innovative cessation aids such as e-cigarettes and digital therapy platforms

- North America dominated the market with the largest revenue share of 42.5% in 2024, driven by high awareness levels, robust healthcare infrastructure, and significant investments in smoking cessation programs

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, fueled by rising disposable incomes, increasing urbanization, and growing anti-smoking initiatives in countries such as China and India

- The Nicotine Replacement Therapy (NRT) Products segment dominated the largest market revenue share of 68.5% in 2024, driven by its proven effectiveness, wide availability, and over-the-counter accessibility

Report Scope and Smoking Cessation and Nicotine De-Addiction Market Segmentation

|

Attributes |

Smoking Cessation and Nicotine De-Addiction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smoking Cessation and Nicotine De-Addiction Market Trends

“Increasing Integration of Digital Health Solutions and AI-Driven Tools”

- The global smoking cessation and nicotine de-addiction market is experiencing a notable trend toward the integration of digital health solutions and Artificial Intelligence (AI)-driven tools.

- These technologies enable advanced tracking, personalized interventions, and behavioral analysis, providing deeper insights into user habits, cessation progress, and relapse triggers

- AI-powered cessation platforms analyze user behavior, such as smoking frequency and triggers, to offer tailored recommendations, personalized quit plans, and real-time motivational support

- For instance, companies are developing mobile apps and wearable devices that use AI to monitor smoking patterns and provide customized feedback, such as reminders to avoid triggers or gamified incentives for maintaining smoke-free periods

- This trend enhances the effectiveness of smoking cessation programs, making them more engaging and accessible to end-users, including Generation Z, Millennials, Generation X, and the Silent Generation

- AI algorithms can process data from various sources, including user inputs and biometric sensors, to predict high-risk relapse moments and suggest proactive coping strategies

Smoking Cessation and Nicotine De-Addiction Market Dynamics

Driver

“Rising Awareness of Health Risks and Government Initiatives”

- Increasing consumer awareness of the health risks associated with smoking, such as lung cancer and cardiovascular diseases, is a major driver for the global smoking cessation and nicotine de-addiction market

- Products such as Nicotine Replacement Therapy (NRT) products, drug therapies (e.g., Zyban and Chantix), and e-cigarettes are gaining traction as effective cessation aids

- Government initiatives, such as anti-smoking campaigns, higher tobacco taxes, and bans on smoking in public places, particularly in North America, are contributing to the widespread adoption of cessation products

- The proliferation of digital platforms and the expansion of online distribution channels are enabling greater access to cessation products and services, offering convenience and privacy for users seeking to quit

- Manufacturers are increasingly offering innovative products, such as flavored NRT lozenges and advanced e-cigarette devices, to meet consumer preferences and enhance market appeal

Restraint/Challenge

“High Costs of Prescription Therapies and Data Privacy Concerns”

- The high cost of prescription-based smoking cessation therapies, such as varenicline (Chantix) and bupropion (Zyban), which can range from USD 150 to USD 200 per month without insurance, poses a significant barrier to adoption, particularly for lower-income individuals and in emerging market

- Integrating advanced cessation tools, such as AI-driven apps and wearable devices, into existing healthcare systems or consumer routines can be complex and costly

- Data security and privacy concerns are a major challenge, as digital cessation platforms and apps collect sensitive user data, raising risks of breaches, misuse, or non-compliance with regulations such as GDPR in Europe or HIPAA in the U.S.

- The fragmented regulatory landscape across countries regarding data collection, storage, and usage complicates operations for manufacturers and service providers offering online cessation solutions

- These factors can deter potential users, particularly in regions with high awareness of data privacy or cost sensitivity, limiting market expansion despite the dominance of North America and the rapid growth in Asia-Pacific

Smoking Cessation and Nicotine De-Addiction market Scope

The market is segmented on the basis of product type, type, distribution channel, and end-user.

- By Product Type

On the basis of product type, the global smoking cessation and nicotine de-addiction market is segmented into Nicotine Replacement Therapy (NRT) Products (Nicotine Lozenges, Nicotine Gums, Nicotine Sprays, Nicotine Transdermal Patches, Nicotine Sublingual Tablets, Nicotine Inhalers), Drug Therapy (Zyban, Chantix), and E-cigarettes. The Nicotine Replacement Therapy (NRT) Products segment dominated the largest market revenue share of 68.5% in 2024, driven by its proven effectiveness, wide availability, and over-the-counter accessibility. NRT products such as gums, patches, and lozenges provide controlled nicotine doses to manage withdrawal symptoms without the harmful chemicals found in tobacco smoke.

The E-cigarettes segment is expected to witness the fastest growth rate of 8.48% from 2025 to 2032, fueled by the introduction of advanced second- and third-generation e-cigarettes, diverse flavored products, and increasing consumer preference for alternatives to combustible cigarettes. The rise in youth adoption and perceived safety compared to traditional smoking further drives this segment's growth.

- By Type

On the basis of type, the global smoking cessation and nicotine de-addiction market is segmented into Pharmacological, Therapies, and Others. The Pharmacological segment dominated the market with a revenue share of 72.3% in 2024, owing to the widespread use of NRT products and prescription medications such as varenicline (Chantix) and bupropion (Zyban). These solutions are clinically proven to reduce nicotine cravings and withdrawal symptoms, making them a preferred choice among healthcare professionals and consumers.

The Therapies segment, which includes behavioral counseling and digital cessation programs, is anticipated to experience the fastest growth from 2025 to 2032. The rise of AI-driven mobile applications and telemedicine services enhances accessibility and provides personalized support, improving quit success rates and addressing the psychological aspects of nicotine addiction.

- By Distribution Channel

On the basis of distribution channel, the global smoking cessation and nicotine de-addiction market is segmented into Online and Offline. The Offline segment, comprising retail pharmacies and drug stores, held the largest market revenue share of 45.2% in 2024, driven by widespread accessibility and the availability of over-the-counter NRT products such as gums, patches, and lozenges. Retail pharmacies offer immediate access and expert guidance, contributing to their dominance.

The Online segment is expected to witness the fastest growth rate of 10.2% from 2025 to 2032, propelled by increasing digitization, ease of purchase, and discreet packaging. The rise in smartphone penetration and digital buyers globally supports the growth of online platforms, enabling consumers to compare products and order conveniently.

- By End-User

On the basis of end-user, the global smoking cessation and nicotine de-addiction market is segmented into Generation Z, Millennials, Generation X, and Silent Generation. The Millennials segment dominated the market with a revenue share of 38.7% in 2024, driven by high smoking prevalence among this demographic, coupled with growing health consciousness and willingness to adopt cessation products. Millennials are also more likely to use e-cigarettes and digital cessation tools.

The Generation Z segment is anticipated to witness rapid growth of 12.5% from 2025 to 2032, fueled by increasing awareness of smoking-related health risks and the appeal of innovative products such as e-cigarettes and mobile apps. Government initiatives, such as higher tobacco taxes and public smoking bans, further encourage younger consumers to seek cessation solutions.

Smoking Cessation and Nicotine De-Addiction Market Regional Analysis

- North America dominated the market with the largest revenue share of 42.5% in 2024, driven by high awareness levels, robust healthcare infrastructure, and significant investments in smoking cessation programs

- Consumers prioritize products such as nicotine replacement therapies (NRTs) and pharmacological solutions for effective cessation, motivated by rising healthcare costs and government anti-smoking campaigns

- Growth is supported by advancements in product offerings, including nicotine gums, patches, and e-cigarettes, alongside increasing adoption across both online and offline distribution channels

U.S. Smoking Cessation and Nicotine De-Addiction Market Insight

The U.S. smoking cessation and nicotine de-addiction market captured the largest revenue share of 84.4% in 2024 within North America, fueled by strong demand for NRT products such as nicotine gums, lozenges, and transdermal patches, as well as growing awareness of the benefits of quitting smoking. The trend toward personalized healthcare and stricter regulations on tobacco use further boost market expansion. The availability of products such as Chantix and Zyban, combined with robust online distribution, supports a diverse market ecosystem.

Europe Smoking Cessation and Nicotine De-Addiction Market Insight

The European smoking cessation and nicotine de-addiction market is expected to witness significant growth, supported by stringent anti-smoking regulations and a focus on public health. Consumers seek products that provide effective nicotine replacement and improve long-term cessation success rates. Growth is prominent in both pharmacological solutions and therapy-based approaches, with countries such as Germany and France showing notable adoption due to rising health consciousness and government initiatives.

U.K. Smoking Cessation and Nicotine De-Addiction Market Insight

The U.K. market for smoking cessation and nicotine de-addiction products is expected to experience rapid growth, driven by demand for nicotine replacement therapies and e-cigarettes in urban and suburban settings. Increased awareness of the health benefits of quitting smoking and a focus on reducing healthcare burdens encourage adoption. Evolving regulations promoting safer cessation products influence consumer choices, balancing efficacy with accessibility.

Germany Smoking Cessation and Nicotine De-Addiction Market Insight

Germany is expected to witness rapid growth in the smoking cessation and nicotine de-addiction market, attributed to its advanced healthcare sector and high consumer focus on wellness and disease prevention. German consumers prefer technologically advanced products such as nicotine inhalers and sublingual tablets that support effective cessation. The integration of these products in both clinical settings and over-the-counter markets supports sustained market growth.

Asia-Pacific Smoking Cessation and Nicotine De-Addiction Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by increasing smoking prevalence, rising disposable incomes, and growing health awareness in countries such as China, India, and Japan. Demand for nicotine replacement therapies, e-cigarettes, and pharmacological solutions is boosted by government campaigns promoting smoking cessation. The expansion of online distribution channels further encourages market accessibility.

Japan Smoking Cessation and Nicotine De-Addiction Market Insight

Japan’s smoking cessation and nicotine de-addiction market is expected to experience rapid growth due to strong consumer preference for high-quality, innovative products such as nicotine sprays and e-cigarettes that enhance cessation success. The presence of major healthcare and pharmaceutical companies, along with the integration of cessation products in clinical settings, accelerates market penetration. Rising interest in personalized health solutions also contributes to growth.

China Smoking Cessation and Nicotine De-Addiction Market Insight

China holds the largest share of the Asia-Pacific smoking cessation and nicotine de-addiction market, propelled by rapid urbanization, increasing smoking rates, and growing demand for cessation solutions. The country’s expanding middle class and focus on public health support the adoption of products such as nicotine gums, patches, and e-cigarettes. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Smoking Cessation and Nicotine De-Addiction Market Share

The smoking cessation and nicotine de-addiction industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- GlaxoSmithKline plc (U.K.)

- Johnson & Johnson (U.S.)

- Novartis AG (Switzerland)

- Perrigo Company plc (Ireland)

- Cipla Ltd. (India)

- Philip Morris International (U.S.)

- JUUL Labs, Inc. (U.S.)

- British American Tobacco plc (U.K.)

- Fontem Ventures (Netherlands)

- Imperial Brands plc (U.K.)

- Dr. Reddy’s Laboratories (India)

- Alkermes plc (Ireland)

- 22nd Century Group, Inc. (U.S.)

- NJOY (U.S.)

What are the Recent Developments in Global Smoking Cessation and Nicotine De-Addiction Market?

- In January 2025, the U.S. Food and Drug Administration (FDA) granted its first-ever marketing authorization for 20 ZYN nicotine pouch products under the Premarket Tobacco Product Application (PMTA) pathway. These pouches—small, synthetic fiber sachets containing nicotine—are placed between the gum and lip, offering a smokeless, spit-free alternative to traditional tobacco products.

- In June 2024, Dr. Reddy’s Laboratories Ltd. announced a landmark acquisition of Haleon plc’s global Nicotine Replacement Therapy (NRT) portfolio—excluding the U.S. The deal includes leading brands such as Nicotinell, Nicabate, Thrive, and Habitrol, spanning over 30 countries across Europe, Asia, and Latin America. This strategic move significantly strengthens Dr. Reddy’s footprint in the consumer healthcare and OTC wellness space, with the acquired portfolio covering lozenges, patches, gums, and pipeline products. Nicotinell alone ranks as the second-largest NRT brand globally holding top positions in 14 of the 17 largest markets

- In June 2024, the UK Medicines and Healthcare products Regulatory Agency (MHRA) granted approval to Ayrton Saunders Limited for its next-generation, patented nicotine inhaler system—a major milestone in the nicotine replacement therapy (NRT) space. This innovative device is the first clinically approved inhaler to deliver nicotine directly via the lungs, enabling rapid craving relief without combustion, heat, or batteries. Designed like an asthma inhaler, it uses a breath-activated, refillable device with a pressurized nicotine solution, offering a clean taste, no visible exhalate, and discreet use in public spaces. The product is now cleared for over-the-counter sale and online advertising, setting the stage for commercial launches in the UK and beyond

- In April 2024, Kenvue’s nicotine gum and patch products became the first Nicotine Replacement Therapy (NRT) treatments to receive prequalification from the World Health Organization (WHO). This milestone is part of WHO’s initiative to improve global access to effective smoking cessation therapies, especially in low- and middle-income countries. The prequalification confirms the quality, safety, and efficacy of these products, enabling their broader deployment through UN agencies and public health programs. It also aligns with WHO’s new clinical guidelines that emphasize combining pharmacotherapy with behavioral support for better quit rates

- In December 2023, Lupin received U.S. FDA approval for its Varenicline Tablets (0.5 mg and 1 mg), a generic equivalent of Chantix®, developed by PF Prism C.V. This approval allows Lupin to market the product in the U.S. as a smoking cessation aid, expanding access to affordable Nicotine Replacement Therapy (NRT) options. The tablets will be manufactured at Lupin’s Pithampur facility in India, and the reference drug, Chantix®, had estimated annual U.S. sales of October 2023

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.