Global Sodas Market

Market Size in USD Million

CAGR :

%

USD

131.74 Million

USD

187.35 Million

2025

2033

USD

131.74 Million

USD

187.35 Million

2025

2033

| 2026 –2033 | |

| USD 131.74 Million | |

| USD 187.35 Million | |

|

|

|

|

Sodas Market Size

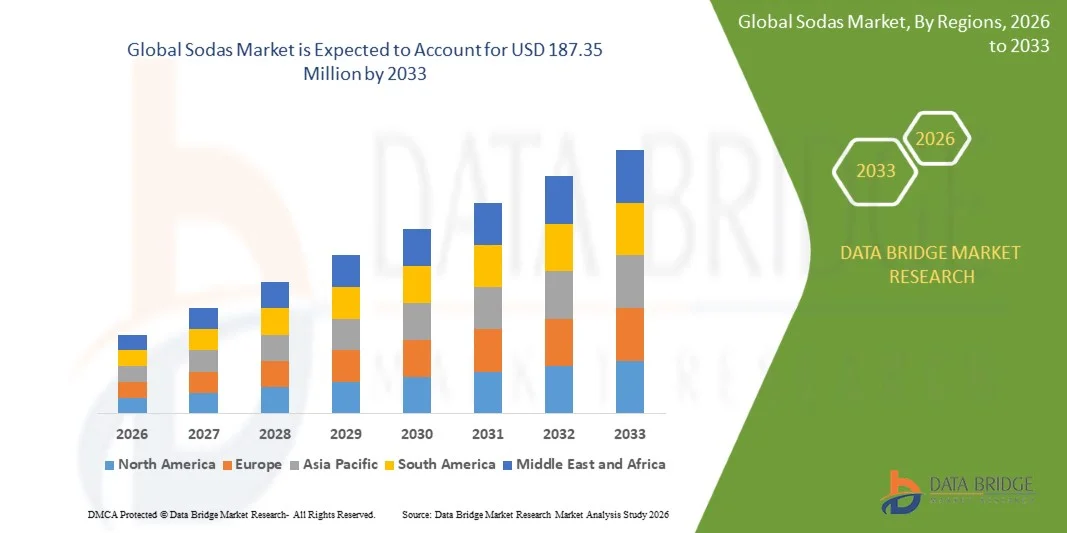

- The global sodas market size was valued at USD 131.74 million in 2025 and is expected to reach USD 187.35 million by 2033, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by increasing consumer preference for refreshing, ready-to-drink beverages and continuous product innovation by leading beverage manufacturers, resulting in a wider range of flavors, reduced-sugar formulations, and functional soda options. The demand is also driven by lifestyle changes, urbanization, and the expanding global presence of key players through aggressive marketing and diversified product portfolios

- Furthermore, rising health awareness among consumers has prompted beverage companies to reformulate sodas with natural ingredients, prebiotics, and low-calorie sweeteners, making them more appealing to a broader demographic. These evolving consumer preferences and technological advancements in beverage processing and packaging are significantly accelerating the growth of the sodas market

Sodas Market Analysis

- Sodas, encompassing carbonated soft drinks infused with various flavoring and sweetening agents, remain a widely consumed beverage category worldwide due to their refreshing appeal, convenience, and extensive product variety. The market is witnessing a gradual transformation toward healthier and functional variants, driven by increasing health consciousness and demand for natural ingredients

- The escalating demand for sodas is primarily fueled by the entry of new product lines such as prebiotic and low-sugar sodas, robust distribution networks, and the influence of premium packaging and digital marketing. This shift toward balanced indulgence and innovation is reinforcing the global market’s expansion trajectory

- North America dominated the sodas market with a share of 32.6% in 2025, due to strong brand presence, high per-capita consumption, and continuous product innovation by leading beverage manufacturers

- Asia-Pacific is expected to be the fastest growing region in the sodas market during the forecast period due to rapid urbanization, rising disposable incomes, and expanding youth populations in countries such as China, Japan, and India

- Bottles segment dominated the market with a market share of 58.8% in 2025, due to its high convenience, resealability, and suitability for both individual and family consumption. PET and glass bottles remain the preferred choices for manufacturers due to their durability and adaptability for various packaging sizes. Consumers favor bottles for on-the-go consumption and multi-serve purposes, and sustainability initiatives, such as recyclable PET materials, are further strengthening the segment’s dominance

Report Scope and Sodas Market Segmentation

|

Attributes |

Sodas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sodas Market Trends

Growing Demand for Functional and Low-Sugar Sodas

- The global sodas market is undergoing a transformation with rising consumer preference for functional and low-sugar formulation beverages that align with modern wellness trends. Consumers are increasingly opting for sodas enriched with natural ingredients, added vitamins, probiotics, and botanical extracts that provide refreshment along with specific health benefits such as improved digestion and immunity support

- For instance, The Coca-Cola Company and PepsiCo have introduced low- and zero-calorie soda variants supplemented with functional ingredients such as antioxidants and electrolytes. Coca-Cola’s Smartwater+ and PepsiCo’s Driftwell exemplify this shift, offering enhanced hydration and stress relief properties that resonate with health-focused consumers seeking alternatives to traditional sugary soft drinks

- The growing awareness of sugar-related health risks including obesity and diabetes is encouraging soda producers to reduce calorie content through natural sweeteners such as stevia, monk fruit, and allulose. These ingredients maintain the desired flavor profile while helping brands meet consumer demand for cleaner, guilt-free beverage options

- In addition, the integration of plant-based and organic ingredients in functional sodas has gained momentum, supported by rising consumer interest in transparency and natural product sourcing. Formulations featuring adaptogens, herbs, and fruit-derived flavor blends have become increasingly popular among younger demographics who associate soda consumption with holistic wellness

- Manufacturers are investing in product innovations that combine taste satisfaction with nutritional appeal, such as sparkling prebiotic and vitamin-infused beverages. These offerings are helping reposition the soda category within the broader functional beverage landscape, catering to consumers who prioritize both convenience and health benefits

- The increasing move toward low-sugar, naturally flavored, and functional sodas is redefining category growth by merging indulgence with health-conscious innovation. This trend is expected to continue as brands adapt to regulatory shifts and evolving global consumer lifestyles centered around balanced nutrition and wellness-oriented refreshment

Sodas Market Dynamics

Driver

Increasing Consumer Preference for Ready-To-Drink and Flavored Beverages

- The growing consumer inclination toward ready-to-drink and flavored beverages is a major factor driving the global sodas market. The increasing pace of urban life, coupled with demand for accessible and refreshing beverages, is encouraging consumers to choose sodas that offer convenient, on-the-go consumption across various occasions

- For instance, PepsiCo and Keurig Dr Pepper have expanded their product portfolios with innovative flavor variations such as fruit-infused and lightly carbonated beverages targeting diverse consumer palates. PepsiCo’s bubly sparkling water and Keurig Dr Pepper’s Canada Dry Bold exemplify this trend, offering refreshing formats tailored to modern lifestyle demands

- The expansion of quick-service restaurants, cafés, and food delivery platforms has further bolstered soda consumption, as these channels consistently promote single-serve packaging and personalized flavor options. Such accessibility is stimulating stronger consumer engagement and increasing repeat purchases across multiple demographics

- In addition, the younger population’s preference for new and exotic taste experiences has encouraged global brands to introduce seasonal, local, and limited-edition flavors. These innovations promote brand differentiation and align well with the consumer desire for novelty and experiential consumption

- As consumers remain drawn to flavorful, pre-packaged, and refreshing beverage experiences, the demand for sodas continues to evolve beyond traditional formats. This preference for convenience and flavor diversity is projected to remain a primary growth driver in the global carbonated beverage segment

Restraint/Challenge

Rising Health Concerns and Regulatory Restrictions on Sugar Content

- Rising global health awareness regarding the negative effects of excessive sugar intake is presenting significant challenges for the soda market. Growing incidences of obesity, diabetes, and heart diseases have led consumers to reassess their beverage choices and reduce the consumption of high-sugar soft drinks

- For instance, government regulations such as sugar taxes introduced in countries including the United Kingdom, Mexico, and South Africa have directly impacted soda sales and prompted reformulation of product recipes. Leading companies such as The Coca-Cola Company and PepsiCo have responded by launching reduced-sugar and zero-calorie alternatives to comply with evolving dietary guidelines

- The increased scrutiny of nutritional labeling, advertising restrictions, and pressure from public health organizations have intensified the challenges for soda producers. These regulations aim to discourage excessive consumption of sugary drinks, further compelling companies to invest in healthier product lines and transparent ingredient communication

- In addition, consumers are increasingly substituting traditional sodas with healthier alternatives such as flavored water, kombucha, and sparkling teas. This competitive shift is narrowing the growth potential of high-calorie soft drinks and elevating the need for aggressive innovation and reformulation in the soda segment

- Overcoming these challenges will depend on the industry’s ability to balance taste expectations with health and regulatory compliance. Innovations in natural sweeteners, functional ingredients, and sustainable production practices are key strategies to sustain competitiveness and consumer trust in an increasingly health-aware beverage market

Sodas Market Scope

The market is segmented on the basis of flavor, packaging type, and distribution channel.

- By Flavor

On the basis of flavor, the sodas market is segmented into cola, lemon, lime, orange, and others. The cola segment dominated the market with the largest market revenue share in 2025, attributed to its strong global brand recognition, wide availability, and consistent consumer preference across all age groups. Major players such as Coca-Cola and PepsiCo have established deep-rooted brand loyalty and extensive distribution networks, allowing cola variants to maintain steady demand. The classic taste profile, paired with continuous innovation through low-sugar and flavored cola options, sustains its leadership position in both mature and emerging markets.

The lemon segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer preference for lighter, citrus-based, and refreshing beverages that align with health-conscious lifestyles. Lemon sodas are gaining traction as an alternative to high-sugar colas due to their perceived natural and revitalizing flavor profile. The growing popularity of lemon-infused sparkling drinks and zero-calorie variants among millennials and urban populations further boosts segment expansion, supported by product launches from brands emphasizing natural ingredients and functional benefits.

- By Packaging Type

On the basis of packaging type, the sodas market is segmented into bottles and cans. The bottles segment dominated the market with the largest market revenue share of 58.8% in 2025, driven by its high convenience, resealability, and suitability for both individual and family consumption. PET and glass bottles remain the preferred choices for manufacturers due to their durability and adaptability for various packaging sizes. Consumers favor bottles for on-the-go consumption and multi-serve purposes, and sustainability initiatives, such as recyclable PET materials, are further strengthening the segment’s dominance.

The cans segment is projected to witness the fastest CAGR from 2026 to 2033, propelled by the rising demand for portable, single-serve beverages and the growing popularity of canned sodas in e-commerce and vending machine channels. Aluminum cans are increasingly favored due to their lightweight, quick-chilling properties, and high recyclability, aligning with sustainability trends. The expanding presence of premium and craft soda brands in canned formats, coupled with improved printing and design aesthetics, also contributes to the segment’s accelerated growth.

- By Distribution Channel

On the basis of distribution channel, the sodas market is segmented into store-based and non-store-based. The store-based segment held the largest market share in 2025, attributed to the strong presence of supermarkets, hypermarkets, convenience stores, and specialty beverage retailers. Consumers continue to prefer store-based purchases for instant availability, variety selection, and promotional offers. Retailers also enhance visibility through product placement and brand partnerships, maintaining the dominance of this channel in both developed and developing economies.

The non-store-based segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rapid expansion of online retail platforms and changing consumer shopping behavior toward digital convenience. E-commerce offers a wider product range, subscription-based deliveries, and personalized promotions, attracting a growing base of tech-savvy consumers. The rise of direct-to-consumer models and partnerships with food delivery services further accelerates online soda sales, making this channel a key growth driver in the forecast period.

Sodas Market Regional Analysis

- North America dominated the sodas market with the largest revenue share of 32.6% in 2025, driven by strong brand presence, high per-capita consumption, and continuous product innovation by leading beverage manufacturers

- The region’s demand is reinforced by consumer preference for both classic carbonated drinks and new low-calorie or zero-sugar alternatives

- Well-established distribution networks, robust marketing strategies, and the influence of major players such as The Coca-Cola Company and PepsiCo contribute significantly to market dominance. The region’s growing trend toward healthier soda variants and sustainable packaging solutions continues to reshape market dynamics

U.S. Sodas Market Insight

The U.S. sodas market captured the largest revenue share in 2025 within North America, supported by deep-rooted consumption habits and a strong affinity for iconic cola and flavored carbonated beverages. Major beverage companies are expanding their low-calorie and functional soda lines to appeal to health-conscious consumers. The rise of craft and specialty sodas featuring natural ingredients is also reshaping consumer preferences. In addition, extensive retail availability, coupled with aggressive promotional activities and product diversification, ensures the U.S. maintains its dominant position in the regional market.

Europe Sodas Market Insight

The Europe sodas market is projected to grow at a significant CAGR throughout the forecast period, driven by evolving consumer preferences toward low-sugar, organic, and natural soda variants. The region’s stringent regulations on sugar content have encouraged manufacturers to innovate healthier formulations. High adoption of premium and flavored sodas across Western Europe, along with sustainability-focused packaging initiatives, is supporting steady growth. Rising demand from younger demographics seeking diverse flavors further contributes to the market expansion across the region.

U.K. Sodas Market Insight

The U.K. sodas market is anticipated to grow at a noteworthy CAGR during the forecast period, influenced by the government’s sugar tax initiatives and the rising popularity of low-calorie and plant-based beverages. Manufacturers are focusing on reformulating traditional sodas and introducing new variants with natural sweeteners to align with consumer health goals. The country’s strong retail network and the rise of ready-to-drink carbonated options across supermarkets and convenience stores bolster overall market development.

Germany Sodas Market Insight

The Germany sodas market is expected to expand at a considerable CAGR, fueled by increasing demand for premium, fruit-flavored, and functional soda beverages. German consumers are showing strong interest in natural and sustainably produced drinks, driving innovation within the carbonated beverage sector. The country’s well-developed beverage industry, coupled with advanced bottling and packaging infrastructure, supports product diversification and efficient distribution. The growth of local and organic soda brands also strengthens Germany’s market performance.

Asia-Pacific Sodas Market Insight

The Asia-Pacific sodas market is poised to grow at the fastest CAGR during 2026–2033, driven by rapid urbanization, rising disposable incomes, and expanding youth populations in countries such as China, Japan, and India. The increasing influence of Western consumption patterns, coupled with the surge in organized retail and e-commerce platforms, is propelling demand. Manufacturers are focusing on localized flavors and smaller pack sizes to cater to diverse consumer preferences, further fueling regional growth.

China Sodas Market Insight

The China sodas market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by the country’s massive population, growing middle class, and strong beverage manufacturing base. The introduction of innovative soda flavors tailored to local tastes and the expansion of online sales channels contribute to rapid growth. Domestic and international players are investing in low-sugar and functional carbonated beverages to meet evolving consumer preferences, solidifying China’s position as the key growth engine in the region.

Japan Sodas Market Insight

The Japan sodas market is experiencing steady growth driven by the nation’s high demand for quality beverages and continuous innovation in carbonation technology. Japanese consumers favor unique, premium soda flavors with reduced sugar content and functional benefits. The integration of traditional ingredients with modern beverage concepts enhances appeal among younger demographics. Furthermore, Japan’s strong convenience store culture and increasing focus on eco-friendly packaging solutions are contributing to sustained market expansion.

Sodas Market Share

The sodas industry is primarily led by well-established companies, including:

- Nestlé S.A. (Switzerland)

- PepsiCo, Inc. (U.S.)

- The Coca-Cola Company (U.S.)

- Anheuser-Busch Companies LLC (U.S.)

- Danone S.A. (France)

- Suntory Holdings Limited (Japan)

- Keurig Dr Pepper Inc. (U.S.)

- Red Bull GmbH (Austria)

- Asahi Soft Drinks Co., Ltd. (Japan)

- Unilever PLC (U.K.)

- POM Wonderful LLC (U.S.)

- Highland Spring Ltd. (U.K.)

- ITO EN (North America) Inc. (U.S.)

- Britvic PLC (U.K.)

- innocent Drinks (U.K.)

- A.G. Barr PLC (U.K.)

- Rasna Pvt. Ltd. (India)

- Parle Agro Pvt. Ltd. (India)

- Bisleri International Pvt. Ltd. (India)

- JONES SODA CO. (U.S.)

Latest Developments in Global Sodas Market

- In May 2025, PepsiCo completed the acquisition of functional soda brand Poppi for approximately US $1.95 billion, marking one of the most significant deals in the beverage sector. This strategic move strengthens PepsiCo’s foothold in the rapidly expanding functional beverage market, particularly in the prebiotic and low-sugar soda segment. The acquisition enables PepsiCo to diversify its product portfolio beyond traditional carbonated drinks and appeal to health-conscious consumers seeking digestive and wellness benefits. By leveraging its global distribution network, PepsiCo aims to accelerate Poppi’s international expansion, reinforcing its leadership in the evolving soda landscape

- In April 2025, PepsiCo announced the launch of its new prebiotic beverage line, Pepsi Prebiotic Cola, featuring added dietary fiber and reduced sugar content. The product blends classic cola taste with functional health attributes, addressing the rising demand for gut-friendly and lower-calorie beverages. This development signifies PepsiCo’s strategic shift toward innovation within its flagship brand portfolio, allowing it to retain market relevance amid changing consumer health preferences. By integrating prebiotic ingredients into a mainstream cola product, the company is bridging the gap between indulgence and functionality in the global soda market

- In February 2025, The Coca-Cola Company unveiled Simply Pop, its first prebiotic soda line containing real fruit juice, six grams of prebiotic fiber, and no added sugar. This product introduction marks Coca-Cola’s entry into the functional soda category, expanding its reach beyond traditional carbonated soft drinks. The launch positions Coca-Cola competitively in the wellness-oriented beverage segment, responding to consumer demand for natural ingredients and digestive health benefits. The move underscores the company’s ongoing transformation strategy focused on health-forward innovation and sustainable product differentiation

- In January 2025, Bloom Nutrition introduced Bloom Pop, a functional soda line featuring prebiotic ingredients, low sugar, and only 20 calories per can, which subsequently launched across over 3,000 Walmart locations. This rollout highlights the increasing presence of wellness-driven, digitally native beverage brands in mainstream retail. Bloom Nutrition’s entry into the soda category reinforces the growing consumer appetite for clean-label, functional beverages and the shift of soda consumption toward healthier alternatives. The expansion also signals a competitive challenge to established players as emerging brands leverage retail partnerships for rapid market penetration

- In early 2025, Dr Pepper launched a new permanent flavor, Dr Pepper Blackberry, available in both regular and zero-sugar versions across the U.S. This flavor addition reflects the brand’s commitment to innovation and flavor diversity within the traditional soda category. By introducing a fruit-infused variant, Dr Pepper aims to attract younger consumers seeking novelty while maintaining loyalty among long-term fans. The launch also underscores how established soda brands are responding to shifting preferences by enhancing product variety and offering healthier, low-sugar choices, thereby sustaining relevance in a highly competitive market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sodas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sodas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sodas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.