Global Soft Gels Market

Market Size in USD Billion

CAGR :

%

USD

4.83 Billion

USD

7.38 Billion

2024

2032

USD

4.83 Billion

USD

7.38 Billion

2024

2032

| 2025 –2032 | |

| USD 4.83 Billion | |

| USD 7.38 Billion | |

|

|

|

|

What is the Global Soft Gels Market Size and Growth Rate?

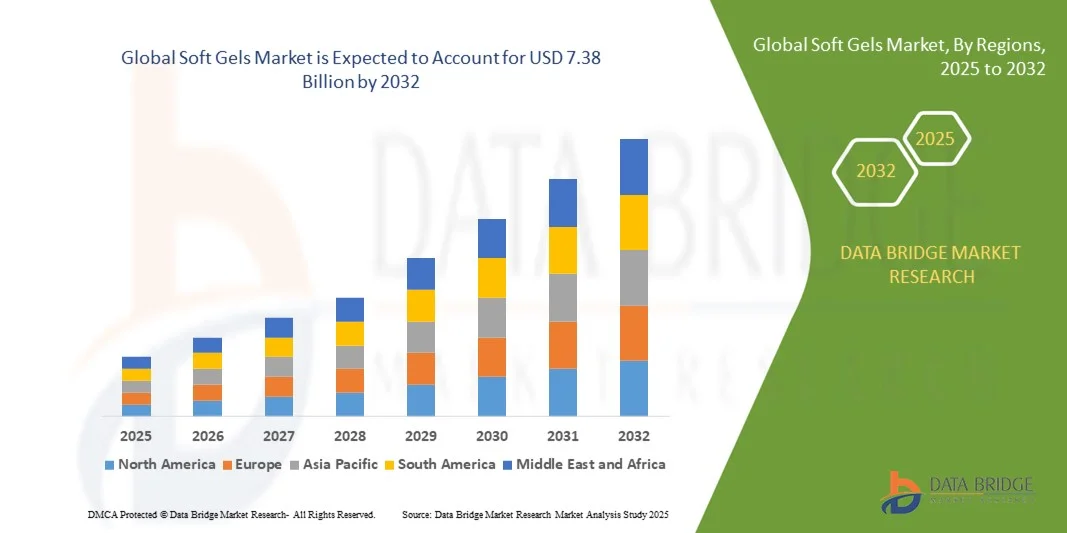

- The global soft gels market size was valued at USD 4.83 billion in 2024 and is expected to reach USD 7.38 billion by 2032, at a CAGR of 5.45% during the forecast period

- Rising personal disposable income and growing awareness about maintaining a healthy lifestyle are the major factors fostering the growth of the market. Changing lifestyle, rising demand for natural and organic foods and ever-rising global population are other important factors acting as market growth determinants

- Improving distribution channel, growing focus of the manufacturers on the development of advanced manufacturing technologies and surge in the demand for products with high nutritional content will further induce growth in the market value. Also, growth and expansion of various end user verticals will further carve the way for the growth of the market

What are the Major Takeaways of Soft Gels Market?

- Concerns regarding the degrading quality of soft gels will pose a major challenge to the growth of the market. Fluctuations in the prices of raw materials will further restrict the scope of growth for the market. Also, large financial costs associated with the non-animal based soft gels will also derail the market growth rate

- North America dominated the soft gels market with the largest revenue share of 41.25% in 2024, driven by the growing demand for dietary supplements, functional foods, and nutraceuticals

- The Asia-Pacific soft gels market is poised to grow at the fastest CAGR of 8.34% during 2025–2032, driven by rising disposable incomes, rapid urbanization, and increased awareness of health and wellness in countries such as China, Japan, and India

- The Gelatine Soft Gel Capsules segment dominated the market with the largest revenue share of 62% in 2024, driven by its established use in pharmaceuticals and nutraceuticals due to superior solubility, bioavailability, and long-standing acceptance in global supply chains

Report Scope and Soft Gels Market Segmentation

|

Attributes |

Soft Gels Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Soft Gels Market?

Rising Preference for Plant-Based and Customized Formulations

- A significant trend in the global soft gels market is the growing shift towards plant-based, vegan-friendly, and tailored soft gel formulations. This trend is driven by increasing consumer awareness of health, wellness, and environmental sustainability

- For instance, companies are launching algae-based omega-3 soft gels as alternatives to traditional fish oil, offering allergen-free and sustainable options for health-conscious consumers. Similarly, personalized nutraceutical soft gels with customized dosages are gaining traction for targeted health benefits

- Integration of advanced encapsulation technologies enables enhanced bioavailability, controlled release, and improved stability of active ingredients. Companies are leveraging these innovations to provide premium, differentiated soft gel products

- This trend reflects the rising demand for functional nutrition solutions that cater to dietary restrictions, lifestyle choices, and specific health goals. Consequently, brands are investing in R&D and marketing strategies to meet the evolving consumer expectations

- The growing focus on clean-label ingredients, natural oils, and plant-based capsules is reshaping product offerings and driving premiumization in the soft gels market

What are the Key Drivers of Soft Gels Market?

- The increasing health-consciousness among consumers, coupled with rising demand for dietary supplements and nutraceuticals, is a primary driver for soft gels adoption

- For instance, in May 2023, Nuseed Global launched Nuseed Nutriterra plant-based omega-3 oil, addressing the demand for sustainable and plant-derived soft gels. Such product innovations are expanding the consumer base

- Consumers increasingly prefer soft gels due to ease of swallowing, precise dosage, and improved absorption of nutrients compared to tablets or powders

- Furthermore, the surge in lifestyle-related health issues, aging population, and rising disposable incomes are fueling demand across regions, particularly in North America and Europe

- Convenience-driven consumption, combined with enhanced bioavailability and the expansion of online retail channels, is driving rapid adoption of soft gels in both dietary supplements and functional food applications

Which Factor is Challenging the Growth of the Soft Gels Market?

- The high production cost associated with advanced encapsulation technologies and high-quality ingredients poses a challenge to market growth. Premium soft gels often come with elevated prices, limiting adoption in price-sensitive markets

- In addition, regulatory complexities across regions, such as approvals for novel ingredients or labeling requirements, can slow down product launches and commercialization

- Consumer skepticism regarding efficacy, coupled with a preference for traditional tablets or capsules in certain demographics, can also limit widespread acceptance

- Supply chain constraints for raw materials, such as fish oil, algae oil, or plant-based alternatives, further add to cost and production challenges

- Overcoming these hurdles through cost optimization, regulatory compliance, and effective consumer education on the health benefits of soft gels will be critical for sustained market growth

How is the Soft Gels Market Segmented?

The soft gels market is segmented on the basis of product type, raw material, end user and application.

- By Product Type

On the basis of product type, the soft gels market is segmented into Gelatine Soft Gel Capsules and Vegetarian Soft Gel Capsules. The Gelatine Soft Gel Capsules segment dominated the market with the largest revenue share of 62% in 2024, driven by its established use in pharmaceuticals and nutraceuticals due to superior solubility, bioavailability, and long-standing acceptance in global supply chains. Gelatine capsules are widely used for delivering oils, fat-soluble vitamins, and liquid formulations, making them a preferred choice across healthcare and wellness applications.

The Vegetarian Soft Gel Capsules segment is anticipated to witness the fastest CAGR of 18.5% from 2025 to 2032, fueled by the rising demand for vegan, plant-based, and allergen-free alternatives. Increasing consumer awareness of dietary restrictions and sustainable sourcing is driving adoption, especially in nutraceutical and functional supplement markets. Overall, the product type segment reflects both traditional dominance and rapid growth in alternative formulations.

- By Raw Material

On the basis of raw material, the soft gels market is segmented into Type-A Gelatine, Type-B Gelatine, Fish Bone Gelatine, HPMC, Starch Material, and Pullulan. The Type-A Gelatine segment dominated with a 45% market revenue share in 2024, owing to its superior clarity, consistency, and wide applicability in encapsulating oils, vitamins, and nutraceutical ingredients. Type-A Gelatine’s compatibility with pharmaceutical standards and global regulatory approvals reinforces its leading position.

The HPMC (Hydroxypropyl Methylcellulose) segment is projected to witness the fastest CAGR of 19% from 2025 to 2032, driven by the surge in vegetarian and vegan soft gel demand, along with clean-label initiatives. Manufacturers are increasingly adopting HPMC as a plant-based, allergen-free alternative for encapsulation, aligning with consumer preference for natural, sustainable, and environmentally friendly materials. The raw material segment highlights the balance between established gelatin dominance and emerging plant-based trends.

- By End User

On the basis of end user, the soft gels market is segmented into Pharmaceutical Companies, Nutraceutical Companies, Cosmeceutical Companies, and Contract Research Organizations (CROs). The Pharmaceutical Companies segment held the largest market revenue share of 53% in 2024, owing to the extensive use of soft gels for delivering prescription medications, vitamins, and active ingredients in precise dosages. Soft gels are favored for their ease of swallowing, stability, and bioavailability, making them a primary choice in healthcare.

The Nutraceutical Companies segment is anticipated to witness the fastest CAGR of 20% from 2025 to 2032, driven by the growing demand for dietary supplements, functional nutrition, and wellness products. The expanding health-conscious population, combined with personalized supplementation trends, is accelerating adoption in nutraceutical applications. This segment illustrates the dominance of pharma while highlighting nutraceuticals as a key growth driver.

- By Application

On the basis of application, the soft gels market is segmented into Antacid and Anti-flatulent Preparations, Anti-anaemic Preparations, Anti-Inflammatory Drugs, Antibiotic and Antibacterial Drugs, Cough and Cold Preparations, Cardiovascular Therapy Drugs, Health Supplements, Vitamin and Dietary Supplements, and Others. The Vitamin and Dietary Supplements segment dominated the market with a 49% revenue share in 2024, fueled by increasing health awareness, preventive care trends, and the rising intake of omega-3, multivitamins, and mineral supplements in soft gel form.

The Health Supplements segment is expected to witness the fastest CAGR of 21% from 2025 to 2032, driven by the surge in functional nutrition, personalized wellness products, and global aging population seeking convenient supplementation options. The application segment demonstrates that while vitamins lead the market, health-focused innovations are driving the most rapid expansion.

Which Region Holds the Largest Share of the Soft Gels Market?

- North America dominated the soft gels market with the largest revenue share of 41.25% in 2024, driven by the growing demand for dietary supplements, functional foods, and nutraceuticals

- Consumers in the region highly value high-quality, convenient, and bioavailable soft gel formulations, supporting the widespread adoption of both pharmaceutical and nutraceutical Soft Gels

- This dominance is further reinforced by well-established manufacturing infrastructure, high disposable incomes, and robust regulatory frameworks, establishing North America as a leading market for Soft Gels across healthcare and wellness sectors

U.S. Soft Gels Market Insight

The U.S. soft gels market captured the largest revenue share of 71% in 2024 within North America, fueled by rising health consciousness, preventive care trends, and the increasing adoption of vitamins and dietary supplements. Consumers are increasingly prioritizing bioavailability, ease of consumption, and plant-based alternatives, which propels the market growth. In addition, innovation in formulation technologies and expanded distribution through pharmacies, retail chains, and e-commerce platforms is significantly contributing to market expansion.

Europe Soft Gels Market Insight

The Europe soft gels market is projected to expand at a substantial CAGR during the forecast period, primarily driven by regulatory compliance, increasing health awareness, and the rising demand for functional foods and nutraceuticals. Consumers are attracted to convenience, product safety, and advanced bioavailability offered by soft gels. Europe is witnessing growing adoption across dietary supplements, pharmaceuticals, and cosmeceuticals, with both new product launches and reformulations boosting regional growth.

U.K. Soft Gels Market Insight

The U.K. soft gels market is anticipated to grow at a noteworthy CAGR, driven by rising health-consciousness, preference for plant-based and vegan supplements, and increasing preventive healthcare adoption. The country’s strong retail and e-commerce networks support widespread availability of soft gel products. In addition, the focus on personalized nutrition and innovative formulations is expected to stimulate further market growth in the forecast period.

Germany Soft Gels Market Insight

The Germany soft gels market is expected to expand at a considerable CAGR, fueled by the demand for technologically advanced, high-quality, and sustainable soft gel products. Germany’s mature pharmaceutical and nutraceutical sector, combined with a focus on innovation and consumer health awareness, promotes the adoption of soft gels. Increasing use of plant-based and eco-conscious formulations is also contributing to growth in both residential and commercial health applications.

Which Region is the Fastest Growing Region in the Soft Gels Market?

The Asia-Pacific soft gels market is poised to grow at the fastest CAGR of 8.34% during 2025–2032, driven by rising disposable incomes, rapid urbanization, and increased awareness of health and wellness in countries such as China, Japan, and India. Government initiatives supporting nutritional supplementation and preventive healthcare are boosting adoption. Moreover, APAC’s growing manufacturing capabilities and cost-effective production are expanding accessibility, making soft gels increasingly popular across residential, pharmaceutical, and nutraceutical sectors.

Japan Soft Gels Market Insight

The Japan soft gels market is gaining momentum due to high health consciousness, aging population, and demand for convenient and bioavailable supplements. Adoption is driven by functional foods, nutraceuticals, and cosmeceutical applications. Integration of innovative delivery formats, plant-based capsules, and high-quality soft gel formulations is further accelerating growth across both individual and institutional consumers.

China Soft Gels Market Insight

The China soft gels market accounted for the largest revenue share in Asia-Pacific in 2024, driven by an expanding middle class, rapid urbanization, and growing awareness of preventive healthcare. Soft gels are increasingly preferred for vitamins, dietary supplements, and functional nutrition products. The push towards affordable, high-quality, and innovative formulations, supported by strong domestic manufacturers, is a key factor propelling market growth.

Which are the Top Companies in Soft Gels Market?

The soft gels industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Aenova Holding GmbH (Germany)

- Nature’s Bounty (U.S.)

- Lonza (Switzerland)

- Fuji Capsule (Japan)

- Sirio Pharma Co., Ltd. (China)

- Catalent, Inc (U.S.)

- EuroCaps Ltd (U.K.)

- GuangDong Yichao Biological Co., Ltd. (China)

- Elnova Pharma (Germany)

- Softgel International Inc. (U.S.)

- Weihai Baihe Biology Technological Co., Ltd. (China)

- Strides Pharma Science Limited (India)

- CAPTEK Softgel International Inc. (U.S.)

- INTERNATIONAL VITAMIN CORPORATION (U.S.)

- Yuwang Group (China)

- Amway (U.S.)

- ACG (India)

- QUALICAPS (Japan)

- SUHEUNG (South Korea)

What are the Recent Developments in Global Soft Gels Market?

- In December 2023, Amneal Pharmaceuticals, Inc. and Strides Pharma Science Limited launched Icosapent ethyl acid soft gel capsules, a product referencing VASCEPA. The capsules were in-licensed from Strides and commercialized by Amneal in Q4 2023, strengthening their portfolio in cardiovascular health and soft gel innovation

- In October 2022, The Aenova Group formed a strategic partnership with Microcaps to accelerate and enhance the development and production of pharmaceuticals, food supplements, and various other soft gel products, reinforcing their R&D and manufacturing capabilities

- In November 2021, Roquette introduced LYCAGEL PREMIX, a ready-to-use, pharmaceutical-grade vegetarian soft gel capsule formulation, providing manufacturers with a convenient and high-quality solution for soft gel production

- In May 2021, Hofseth BioCare ASA (HBC) partnered with Catalent to develop a delayed-release formulation of HBC’s OmeGo fish oil. Catalent utilized its proprietary OptiGel DR technology to encapsulate OmeGo, a sustainable, traceable, and fresh Norwegian Atlantic salmon oil, enhancing soft gel efficacy and consumer appeal

- In November 2020, Aenova Holding GmbH announced the launch of VegaGels, a new generation of vegetarian soft capsules, providing manufacturers and consumers with innovative, plant-based alternatives in the soft gel segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SOFT GELS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SOFT GELS MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SOFT GELS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL SOFT GELS MARKET, BY PRODUCT, 2022-2031, (USD MILLION)

11.1 OVERVIEW

11.2 GELATIN-BASED/ANIMAL-BASED

11.3 NON-ANIMAL-BASED

12 GLOBAL SOFT GELS MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 ANTACID AND ANTI-FLATULENT PREPARATION

12.3 ANTI-ANEMIC PREPARATIONS

12.4 ANTI-INFLAMMATORY DRUGS

12.5 ANTIBIOTIC AND ANTIBACTERIAL DRUGS

12.6 COUGH AND COLD PREPARATIONS

12.7 HEALTH SUPPLEMENT

12.8 VITAMIN AND DIETARY SUPPLEMENT

12.9 PREGNANCY

12.1 OTHERS

13 GLOBAL SOFT GELS MARKET, BY END-USE, 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 PHARMACEUTICAL COMPANIES

13.3 NUTRACEUTICAL COMPANIES

13.4 COSMECEUTICAL COMPANIES

13.5 CONTRACT MANUFACTURING ORGANIZATION

14 GLOBAL SOFT GELS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS & PARTNERSHIP

14.8 REGULATORY CHANGES

15 GLOBAL SOFT GELS MARKET, BY GEOGRAPHY, 2022-2031, (USD MILLION)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 U.K.

15.2.3 ITALY

15.2.4 FRANCE

15.2.5 SPAIN

15.2.6 SWITZERLAND

15.2.7 NETHERLANDS

15.2.8 BELGIUM

15.2.9 RUSSIA

15.2.10 TURKEY

15.2.11 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 AUSTRALIA

15.3.6 SINGAPORE

15.3.7 THAILAND

15.3.8 INDONESIA

15.3.9 MALAYSIA

15.3.10 PHILIPPINES

15.3.11 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 UAE

15.5.3 SAUDI ARABIA

15.5.4 KUWAIT

15.5.5 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL SOFT GELS MARKET, SWOT & DBMR ANALYSIS

17 GLOBAL SOFT GELS MARKET, COMPANY PROFILES

17.1 SIRIO EUROPE GMBH CO KG

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 CAPTEK SOFTGEL INTERNATIONAL INC.

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 FUJI CAPSULE

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 PROCAPS LABORATORIES, INC.

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 LONZA

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 AENOVA GROUP

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 EUROCAP

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 CATALENT, INC.

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 GUANGDONG YICHAO BIOLOGICAL CO., LTD.

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 ELNOVA PHARMA

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 GELTEC

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 SOFT GEL TECHNOLOGIES, INC

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 SOFTCAPS (TITANIUM TECHNOLOGIES INDIA PVT LTD).

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 CONCLUSION

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Soft Gels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Soft Gels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Soft Gels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.