Global Soft Tissue Allografts Market

Market Size in USD Billion

CAGR :

%

USD

5.09 Billion

USD

8.58 Billion

2024

2032

USD

5.09 Billion

USD

8.58 Billion

2024

2032

| 2025 –2032 | |

| USD 5.09 Billion | |

| USD 8.58 Billion | |

|

|

|

|

Soft Tissue Allografts Market Size

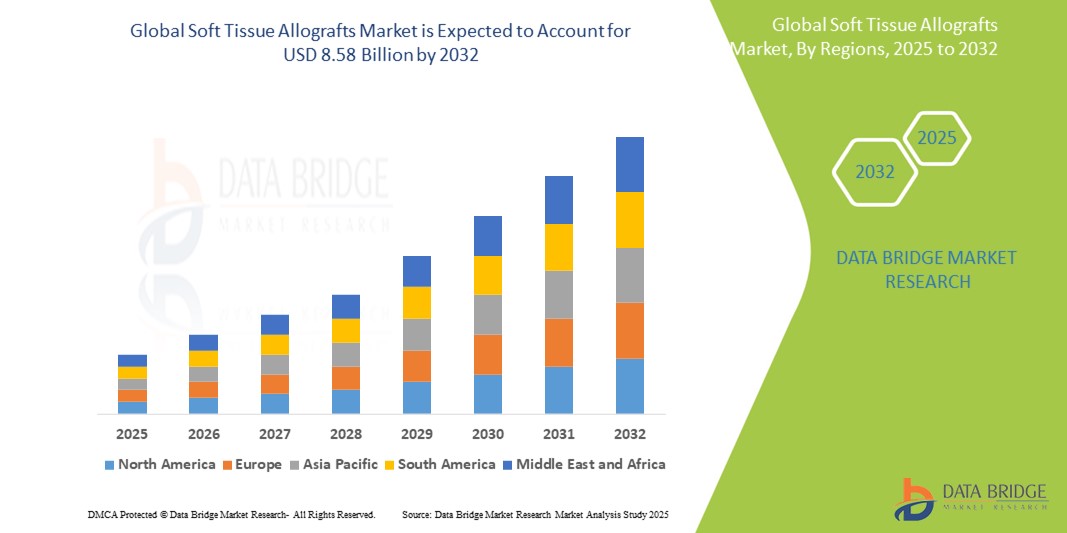

- The global soft tissue allografts market size was valued at USD 5.09 billion in 2024 and is expected to reach USD 8.58 billion by 2032, at a CAGR of 6.75% during the forecast period

- The market growth is largely fueled by the increasing incidence of sports injuries, orthopedic disorders, and trauma cases, which are driving demand for effective biological grafts in surgical reconstruction procedures across hospitals and ambulatory surgical centers. Soft tissue allografts are increasingly favored due to their ability to restore function while minimizing donor site morbidity compared to autografts

- Furthermore, rising demand for minimally invasive surgical procedures and advancements in preservation and sterilization technologies are accelerating the uptake of Soft Tissue Allografts solutions, thereby significantly boosting the industry’s growth. Enhanced graft viability, improved clinical outcomes, and growing surgeon preference are further solidifying soft tissue allografts as a standard in musculoskeletal and reconstructive surgery worldwide

Soft Tissue Allografts Market Analysis

- Soft tissue allografts, used in procedures such as anterior cruciate ligament (ACL) reconstruction, rotator cuff repair, and dental surgeries, are becoming essential biological implants in orthopedic, dental, and reconstructive surgeries due to their biocompatibility, durability, and ability to facilitate faster recovery with reduced donor site morbidity

- The escalating demand for soft tissue allografts is primarily fueled by the rising prevalence of sports injuries, orthopedic disorders, and trauma cases, along with an aging population prone to degenerative joint conditions. In addition, advancements in sterilization techniques and graft preservation are enhancing the safety and efficacy of these allografts, further promoting their adoption across surgical specialties

- North America dominated the soft tissue allografts market with the largest revenue share of 44.7% in 2024, supported by a strong healthcare infrastructure, widespread use of advanced surgical techniques, and the presence of major tissue banks and biotechnology firms

- Asia-Pacific is expected to be the fastest-growing region in the soft tissue allografts market during the forecast period (2025–2032), with a projected CAGR of 9.6%, driven by growing healthcare investments, increasing sports-related injuries, medical tourism, and rising awareness regarding graft alternatives among surgeons

- The tendon allograft segment dominated the soft tissue allografts market with a market share of 38.7% in 2024, primarily due to its extensive application in orthopedic procedures such as anterior cruciate ligament (ACL) reconstruction and other ligament repairs. The segment continues to expand as the number of sports-related injuries rises and surgeons increasingly prefer tendon allografts for their availability, structural integrity, and reduced donor site morbidity

Report Scope and Soft Tissue Allografts Market Segmentation

|

Attributes |

Soft Tissue Allografts Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Soft Tissue Allografts Market Trends

“Rising Adoption Driven by Sports Injuries and Orthopedic Advancements”

- A significant and accelerating trend in the global soft tissue allografts market is the growing utilization of these grafts in orthopedic and sports medicine applications. Increased participation in athletic activities, coupled with a rising number of sports-related injuries such as ligament tears and tendon ruptures, is driving widespread adoption of soft tissue allografts for reconstruction procedures

- For instance, allografts are increasingly used in anterior cruciate ligament (ACL) reconstructions, where they offer benefits such as reduced donor site morbidity, shorter surgical times, and faster recovery compared to autografts. In addition, their use in revision surgeries and complex joint reconstructions further supports their growing clinical relevance

- Technological improvements in tissue processing—such as advanced sterilization techniques and enhanced preservation methods—are ensuring better graft viability and reduced risk of disease transmission. These advancements are expanding surgeon confidence in soft tissue allografts and contributing to their broader acceptance across hospitals, ambulatory surgical centers, and specialty orthopedic clinics

- The versatility of soft tissue allografts across procedures like meniscus repair, rotator cuff repair, and dental surgeries also plays a pivotal role in expanding their demand. Surgeons value their ready availability, standardized sizes, and structural integrity, which simplifies surgical planning and improves patient outcomes

- Furthermore, the growing elderly population—more prone to degenerative joint and soft tissue conditions—is expected to significantly boost the need for allograft-based reconstructive procedures. Emerging economies are witnessing increased healthcare access and procedural volumes, presenting lucrative expansion opportunities for market participants

- The soft tissue allografts market is thus undergoing a transformative phase, marked by higher procedural volumes, improving product safety profiles, and expanding applications in both trauma and elective surgeries. Companies are increasingly investing in research and collaborations with tissue banks to ensure high-quality graft availability, positioning themselves to meet the rising global demand

Soft Tissue Allografts Market Dynamics

Driver

“Growing Demand Due to Increasing Sports Injuries and Orthopedic Procedures”

- The rising incidence of sports injuries, musculoskeletal disorders, and trauma cases is a significant driver fueling the growth of the Soft Tissue Allografts market. As more individuals engage in physically demanding activities, there is a heightened need for surgical interventions involving ligaments, tendons, and cartilage—areas where soft tissue allografts play a crucial role

- For instance, the growing number of anterior cruciate ligament (ACL) reconstruction surgeries worldwide has significantly contributed to the rising demand for tendon allografts. Similarly, the aging population—more susceptible to degenerative joint conditions—requires soft tissue repair and reconstruction, further boosting market growth

- The increasing adoption of allografts over autografts is driven by several clinical advantages, including reduced surgery time, absence of donor-site morbidity, and availability in various sizes and forms. These benefits make soft tissue allografts particularly appealing for revision surgeries and complex reconstructions

- Furthermore, advancements in preservation and sterilization technologies have enhanced the safety and shelf-life of these grafts, instilling greater confidence among healthcare providers and patients. The presence of well-established tissue banks and regulatory support in developed markets also facilitates timely and reliable access to quality grafts, thereby supporting continued market expansion

- As awareness about soft tissue allograft applications increases across surgical disciplines—especially orthopedics, sports medicine, and dental surgeries—more healthcare institutions are integrating these products into standard care protocols, ensuring sustained growth across both developed and emerging markets

Restraint/Challenge

“Regulatory Hurdles and Disease Transmission Risks”

- Despite their clinical benefits, soft tissue allografts face challenges related to stringent regulatory requirements and the risk of disease transmission, which can hinder market growth. Tissue allografts must comply with strict quality control and screening protocols, which vary across regions and may delay product approvals or limit access in some markets

- For instance, regulatory agencies such as the FDA (U.S.) and EMA (Europe) require extensive donor screening, tissue processing documentation, and sterilization validation before these products can be introduced to the market. Compliance with such standards can increase the time and cost involved in bringing new products to healthcare providers

- In addition, although modern sterilization methods have significantly reduced the risk of disease transmission, concerns still exist among some clinicians and patients, particularly regarding the transmission of viruses or prions from donor tissues. These perceptions, though statistically minimal, can impact acceptance and adoption rates in certain settings

- The relatively high cost of some soft tissue allografts, particularly those processed with advanced preservation techniques or designed for niche applications, may also limit uptake in cost-sensitive markets. In resource-constrained settings or among smaller surgical centers, affordability remains a key barrier to widespread usage

Soft Tissue Allografts Market Scope

The market is segmented on the basis of type, application and end user.

• By Type

On the basis of type, the soft tissue allografts market is segmented into cartilage allograft, tendon allograft, meniscus allograft, dental allografts, and others. The tendon allograft segment captured the largest market revenue share of 38.7% in 2024, primarily due to its widespread use in ligament reconstruction surgeries, especially anterior cruciate ligament (ACL) procedures. Tendon allografts offer significant advantages such as shorter surgical time, elimination of donor site morbidity, and ready availability in standardized sizes, making them the preferred choice in orthopedic and sports medicine surgeries.

The cartilage allograft segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing demand for minimally invasive treatments in younger, active populations and athletes suffering from joint cartilage injuries. Advancements in graft preservation and implantation techniques, as well as rising awareness of early cartilage repair, contribute to the growing adoption of this segment.

• By Application

On the basis of application, the soft tissue allografts market is segmented into orthopedic, dentistry, wound care, and others. The orthopedic segment accounted for the largest market revenue share in 2024, driven by the high volume of procedures related to joint reconstruction, sports injuries, and trauma care. Allografts are commonly used in orthopedic procedures for their proven clinical outcomes, reliable integration, and suitability in revision surgeries where autograft options are limited.

The wound care segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the rising burden of chronic wounds such as diabetic foot ulcers, pressure ulcers, and burns. Soft tissue allografts in wound care promote healing by providing a biologically active scaffold and supporting tissue regeneration, making them increasingly valuable in advanced wound management.

• By End-Users

On the basis of end-users, the soft tissue allografts market is segmented into hospitals, aesthetic centers, orthopedic clinics, dental clinics, and others. The hospitals segment held the largest revenue share in 2024, owing to the high volume of surgical procedures, availability of skilled surgeons, and access to a wide variety of tissue allograft products. Hospitals often serve as referral centers for complex surgeries, thereby contributing to higher adoption rates.

The orthopedic clinics segment is expected to grow at the fastest CAGR from 2025 to 2032, supported by the growing number of standalone specialty clinics offering advanced orthopedic and sports injury treatments. These clinics are increasingly adopting soft tissue allografts to provide high-quality, minimally invasive surgical solutions in outpatient settings, particularly in urban regions.

Soft Tissue Allografts Market Regional Analysis

- North America dominated he soft tissue allografts market with the largest revenue share of 44.7% in 2024, driven by a high volume of orthopedic, dental, and reconstructive procedures, as well as increased adoption of advanced allograft processing technologies

- The region’s strong healthcare infrastructure, well-established tissue banks, and favorable reimbursement policies support the widespread use of soft tissue allografts across hospitals, orthopedic clinics, and dental practices. In addition, the presence of key market players and ongoing research collaborations contribute to the development and availability of high-quality allograft products

- Growing awareness among surgeons and patients about the benefits of allografts—such as reduced surgical time, no donor site morbidity, and improved recovery outcomes—is further enhancing demand. This trend, coupled with increasing sports injuries and aging-related degenerative conditions, solidifies North America’s leadership position in the global market

U.S. Soft Tissue Allografts Market Insight

The U.S. soft tissue allografts market captured the largest revenue share of 63.60% within North America in 2024, reflecting its dominance in the global market. This leadership is primarily fueled by the increasing prevalence of musculoskeletal disorders, a high incidence of sports-related injuries (such as ACL tears), and a growing aging population prone to degenerative joint conditions. Robust healthcare infrastructure, favorable reimbursement policies, and the strong presence of key allograft manufacturers and tissue banks further propel market expansion. The continuous advancements in allograft processing techniques and surgical procedures also contribute significantly to the widespread adoption of soft tissue allografts in the U.S.

Europe Soft Tissue Allografts Market Insight

The Europe soft tissue Allografts market is projected to expand at a substantial CAGR throughout the forecast period. This growth is primarily driven by the rising geriatric population, increasing participation in sports leading to a higher incidence of soft tissue injuries, and growing awareness regarding advanced reconstructive and regenerative therapies. The presence of well-established healthcare systems, increasing healthcare expenditure, and the adoption of technologically advanced allograft solutions further foster market growth across various applications like orthopedics and dentistry.

U.K. Soft Tissue Allografts Market Insight

The U.K. soft tissue allografts market is anticipated to grow at a noteworthy CAGR during the forecast period. This growth is driven by the increasing demand for effective solutions for sports injuries and orthopedic conditions, coupled with a rising geriatric population. The country's robust healthcare infrastructure and a strong focus on advanced surgical techniques are encouraging the adoption of allografts. Furthermore, the increasing awareness among both healthcare professionals and patients about the benefits of allografts, such as reduced donor site morbidity and faster recovery times, contributes to sustained market expansion.

Germany Soft Tissue Allografts Market Insight

The Germany soft tissue allografts market is expected to expand at a considerable CAGR during the forecast period, fueled by its advanced healthcare infrastructure, high adoption of innovative medical technologies, and a significant burden of orthopedic conditions. Increasing patient awareness regarding sophisticated treatment options, coupled with a strong emphasis on quality and safety standards for allograft products, promotes market growth. The integration of allografts in a wide range of surgical procedures, from orthopedic reconstruction to dental implants, further supports the market's trajectory in Germany.

Asia-Pacific Soft Tissue Allografts Market Insight

The Asia-Pacific soft tissue allografts market is poised to grow at the fastest CAGR of 9.6% during the forecast period, driven by increasing urbanization, rising disposable incomes, and significant improvements in healthcare infrastructure across countries such as China, Japan, and India. The region's growing medical tourism, increasing prevalence of road accidents and sports injuries, and a large patient pool requiring reconstructive surgeries are key drivers. Furthermore, advancements in tissue banking and processing technologies, along with supportive government initiatives in healthcare, are accelerating the adoption of soft tissue allografts in APAC.

China Soft Tissue Allografts Market Insight

The China soft tissue allografts market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's massive patient population, rapid healthcare infrastructure development, and increasing prevalence of musculoskeletal and dental disorders. High rates of sports participation and road accidents also contribute to the demand for soft tissue repair solutions. The availability of diverse allograft products, coupled with rising healthcare expenditure and supportive government policies promoting domestic manufacturing and utilization of medical technologies, are key factors propelling the market in China.

India Soft Tissue Allografts Market Insight

The India soft tissue allografts market is expected to expand at a noteworthy CAGR of 8.5% during the forecast period. This growth is primarily fueled by the escalating number of sports injuries, a rapidly growing geriatric population, and the increasing prevalence of orthopedic and dental conditions. Improvements in healthcare accessibility, rising patient awareness regarding advanced treatment options, and increasing healthcare spending by both public and private sectors are significant drivers. The expansion of multispecialty hospitals and orthopedic clinics across the country, coupled with the rising adoption of sophisticated surgical procedures, further stimulates the demand for soft tissue allografts in India.

Soft Tissue Allografts Market Share

The soft tissue allografts industry is primarily led by well-established companies, including:

- CONMED Corporation (U.S.)

- XTANT MEDICAL (U.S.)

- ALON SOURCE GROUP (U.S.)

- BD (U.S.)

- Arthrex, Inc (U.S.)

- Bone Bank Allografts (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Stryker (U.S.)

- RTI Surgical (U.S.)

- AlloSource (U.S.)

- MiMed Corporation Ltd. (U.S.)

- Institut Straumann AG (Switzerland)

- Organogenesis Inc. (U.S.)

Latest Developments in Global Soft Tissue Allografts Market

- In May 22, 2025, MTF Biologics and Kolosis BIO jointly launched two novel allografts—ATLAS Sternal Repair Matrix and IKON—aimed at improving sternal fusion and soft tissue repair in cardiac surgery. These products offer advanced matrix proteins and growth-factor support to enhance healing in high-risk patient populations

- In March 27, 2025 AlloSource achieved its 200th implantation of AceConnex Pre‑Sutured Fascia, the only 510(k)-cleared fascia allograft pre‑sutured for hip labral reconstruction. Surgeons report improved consistency and significant time savings in operative procedures

- In March 26, 2025 MTF Biologics completed the first patient implantation for its FlexHD® Pliable device in an IDE clinical trial (SHAPE), aimed at pre-pectoral breast reconstruction. This milestone marks the first IDE-approved human acellular dermal matrix for this surgical application

- In January 2025 MTF Biologics awarded its 2024 Innovation in Allograft Translational Research Grants, totaling USD60 million since 1987. These grants support tissue repair and reconstructive surgery, illustrating long-term commitment to R&D in soft tissue allografting

- In May 2023 AlloSource introduced AlloMend Duo Acellular Dermal Matrix, offering one of the largest footprints in its line for soft tissue reconstruction. Earlier in March 2023, they reported positive clinical outcomes for ProChondrix CR in focal cartilage defect repair

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SOFT TISSUE ALLOGRAFT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SOFT TISSUE ALLOGRAFT MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SOFT TISSUE ALLOGRAFT MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER'S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYSIS AND RECOMMENDATIONS

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNOLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 INSTALLED BASE DATA

15 VALUE CHAIN ANALYSIS

16 HEALTHCARE ECONOMY

16.1 HEALTHCARE EXPENDITURE

16.2 CAPITAL EXPENDITURE

16.3 CAPEX TRENDS

16.4 CAPEX ALLOCATION

16.5 FUNDING SOURCES

16.6 INDUSTRY BENCHMARKS

16.7 GDP RATION IN OVERALL GDP

16.8 HEALTHCARE SYSTEM STRUCTURE

16.9 GOVERNMENT POLICIES

16.1 ECONOMIC DEVELOPMENT

17 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, BY TYPE

17.1 OVERVIEW

17.2 CARTILAGE ALLOGRAFT

17.2.1 BY PRODUCT

17.2.1.1. COSTAL CARTILAGE

17.2.1.2. OSTEOCHONDRAL ALLOGRAFT PLUGS

17.2.1.3. OSTEOCHONDRAL ALLOGRAFT

17.2.1.4. OTHERS

17.2.2 BY CARTILAGE TYPE

17.2.2.1. HYALINE CARTILAGE

17.2.2.2. ELASTIC CARTILAGE

17.2.2.3. FIBRO CARTILAGE

17.2.3 OTHERS

17.3 TENDON ALLOGRAFT

17.3.1 BY PRODUCT

17.3.1.1. NON-BONE TENDON ALLOGRAFT

17.3.1.2. BONE & BTB TENDON ALLOGRAFT

17.3.2 BY TENDON TYPE

17.3.2.1. TIBIALIS

17.3.2.1.1. ANTERIOR TIBIALIS

17.3.2.1.2. POSTERIOR TIBIALIS

17.3.2.2. ARCHILLES TENDON

17.3.2.2.1. ACHILLES TENDON

17.3.2.2.2. ACHILLES TENDON WITH BONE BLOCK

17.3.2.2.3. PRE-SHAPED ACHILLES

17.3.2.2.4. OTHERS

17.3.2.3. PATELLAR TENDON

17.3.2.4. HAMSTRING

17.3.3 OTHERS

17.4 AMNIOTIC ALLOGRAFT

17.4.1 BY LENGTH

17.4.1.1. 14 MM DISC

17.4.1.2. 16 MM DISC

17.4.1.3. OTHERS

17.4.2 BY DIMENSION

17.4.2.1. 2 CM × 4 CM SHEET

17.4.2.2. 3 CM × 3 CM SHEET

17.4.2.3. 4 CM × 4 CM SHEET

17.4.2.4. OTHERS

17.4.3 OTHERS

17.5 MENISCUS ALLOGRAFT

17.5.1 MEDIAL ALLOGRAFT

17.5.2 LATERAL ALLOGRAFT

17.6 DENTAL ALLOGRAFT

17.6.1 FREE GINGIVAL GRAFT

17.6.2 CONNECTIVE TISSUE GRAFT

17.6.3 PEDICLE GRAFT

17.7 COLLAGEN ALLOGRAFT

17.8 OTHERS

18 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, BY SOURCE

18.1 OVERVIEW

18.2 HUMAN ALLOGRAFTS

18.2.1 LIVING DONOR

18.2.2 DECEASED DONOR

18.3 SYNTHETIC ALLOGRAFT

19 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, BY PROCESSING METHOD

19.1 OVERVIEW

19.2 FRESH FROZEN

19.3 DEHYDRATED

19.4 STERILIZED

19.4.1 GAMMA IRRADIATION

19.4.2 ELECTRON-BEAM IRRADIATION

19.4.3 ETHYLENE OXIDE STERILIZATION

19.4.4 PERACETIC ACID–ETHANOL

19.5 OTHERS

20 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, BY POPULATION TYPE

20.1 OVERVIEW

20.2 PEDIATRIC

20.2.1 MALE

20.2.2 FEMALE

20.3 ADULT

20.3.1 MALE

20.3.2 FEMALE

20.4 GERIARTIC

20.4.1 MALE

20.4.2 FEMALE

21 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, BY APPLICATION

21.1 OVERVIEW

21.2 SPINAL

21.3 ORTHOPEDIC

21.3.1 SPORTS MEDICINE

21.3.2 SPINE SURGERIES

21.3.3 GENERAL ORTHOPEDIC

21.3.4 RECONSTRUCTION

21.3.5 OTHERS

21.4 DENTISTRY

21.4.1 DENTAL SENSITIVITY

21.4.2 DENTAL AESTHETICS

21.4.3 OTHERS

21.5 WOUND CARE

21.6 PLASTIC SURGERY

21.7 MUSCULOSKELETAL REPAIR AND RECONSTRUCTION

21.8 OTHER APPLICATIONS

22 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, BY END USER

22.1 OVERVIEW

22.2 HOSPITALS

22.2.1 BY TYPE

22.2.1.1. PUBLIC

22.2.1.2. PRIVATE

22.2.2 BY TIER

22.2.2.1. TIER 1

22.2.2.2. TIER 2

22.2.2.3. TIER 3

22.3 SPECIALTY CLINICS

22.3.1 ORTHOPEDIC CLINICS

22.3.2 DENTAL CLINICS

22.3.3 OTHERS

22.4 TRAUMA CENTERS

22.5 AESTHETICS CENTERS

22.6 AMBULATORY SURGICAL CENTERS

22.7 ACADEMIC AND RESEARCH INSTITUTES

22.8 OTHER

23 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT TENDER

23.3 RETAIL SALES

23.3.1 ONLINE SALES

23.3.2 OFFLINE SALES

23.4 OTHERS

24 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.3 COMPANY SHARE ANALYSIS: EUROPE

24.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

24.5 MERGERS & ACQUISITIONS

24.6 NEW PRODUCT DEVELOPMENT & APPROVALS

24.7 EXPANSIONS

24.8 REGULATORY CHANGES

24.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

25 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, SWOT AND DBMR ANALYSIS

26 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, BY GEOGRAPHY

26.1 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

26.1.1 NORTH AMERICA

26.1.1.1. U.S.

26.1.1.2. CANADA

26.1.1.3. MEXICO

26.1.2 EUROPE

26.1.2.1. GERMANY

26.1.2.2. FRANCE

26.1.2.3. U.K.

26.1.2.4. HUNGARY

26.1.2.5. LITHUANIA

26.1.2.6. AUSTRIA

26.1.2.7. IRELAND

26.1.2.8. NORWAY

26.1.2.9. POLAND

26.1.2.10. ITALY

26.1.2.11. SPAIN

26.1.2.12. RUSSIA

26.1.2.13. TURKEY

26.1.2.14. NETHERLANDS

26.1.2.15. SWITZERLAND

26.1.2.16. REST OF EUROPE

26.1.3 ASIA-PACIFIC

26.1.3.1. JAPAN

26.1.3.2. CHINA

26.1.3.3. SOUTH KOREA

26.1.3.4. INDIA

26.1.3.5. AUSTRALIA

26.1.3.6. SINGAPORE

26.1.3.7. THAILAND

26.1.3.8. MALAYSIA

26.1.3.9. INDONESIA

26.1.3.10. PHILIPPINES

26.1.3.11. VIETNAM

26.1.3.12. REST OF ASIA-PACIFIC

26.1.4 SOUTH AMERICA

26.1.4.1. BRAZIL

26.1.4.2. ARGENTINA

26.1.4.3. PERU

26.1.4.4. COLOMBIA

26.1.4.5. VENEZUELA

26.1.4.6. REST OF SOUTH AMERICA

26.1.5 MIDDLE EAST AND AFRICA

26.1.5.1. SOUTH AFRICA

26.1.5.2. SAUDI ARABIA

26.1.5.3. UAE

26.1.5.4. EGYPT

26.1.5.5. KUWAIT

26.1.5.6. ISRAEL

26.1.5.7. REST OF MIDDLE EAST AND AFRICA

26.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

27 GLOBAL SOFT TISSUE ALLOGRAFT MARKET, COMPANY PROFILE

27.1 ARTHREX, INC.

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 ZIMMER BIOMET

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 OSTEOGENICS BIOMEDICAL

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 CONMED CORPORATION

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 XTANT MEDICAL

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 INTEGRA LIFESCIENCES CORPORATION

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 STRYKER

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 RTI SURGICAL

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 INSTITUT STRAUMANN AG

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 DEPUY SYNTHES

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 ORIGIN BIOLOGICS

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 MTF BIOLOGICS

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 BONE BANK ALLOGRAFTS

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 ALAMO BIOLOGICS

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 AEDICELL

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 VIVEX BIOLOGICS, INC.

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

27.17 VENTERIS MEDICAL LLC

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPMENTS

27.18 ALLIQUA BIOMEDICAL, INC.

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS

27.19 TIDES MEDICAL

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPMENTS

27.2 ELUTIA

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPMENTS

27.21 PROMETHEAN

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPMENTS

27.22 TISSUE REGENIX

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPMENTS

27.23 PARAMETRICS MEDICAL.

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPMENTS

27.24 ORGANOGENESIS INC.

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPMENTS

27.25 AMNIO TECHNOLOGY, LLC

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPMENTS

27.26 STIMLABS LLC

27.26.1 COMPANY OVERVIEW

27.26.2 REVENUE ANALYSIS

27.26.3 GEOGRAPHIC PRESENCE

27.26.4 PRODUCT PORTFOLIO

27.26.5 RECENT DEVELOPMENTS

27.27 SKYE BIOLOGICS HOLDINGS, LLC

27.27.1 COMPANY OVERVIEW

27.27.2 REVENUE ANALYSIS

27.27.3 GEOGRAPHIC PRESENCE

27.27.4 PRODUCT PORTFOLIO

27.27.5 RECENT DEVELOPMENTS

27.28 APPLIED BIOLOGICS

27.28.1 COMPANY OVERVIEW

27.28.2 REVENUE ANALYSIS

27.28.3 GEOGRAPHIC PRESENCE

27.28.4 PRODUCT PORTFOLIO

27.28.5 RECENT DEVELOPMENTS

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.