Global Soil Monitoring System Market

Market Size in USD Million

CAGR :

%

USD

906.97 Million

USD

1,535.19 Million

2024

2032

USD

906.97 Million

USD

1,535.19 Million

2024

2032

| 2025 –2032 | |

| USD 906.97 Million | |

| USD 1,535.19 Million | |

|

|

|

|

Soil Monitoring System Market Size

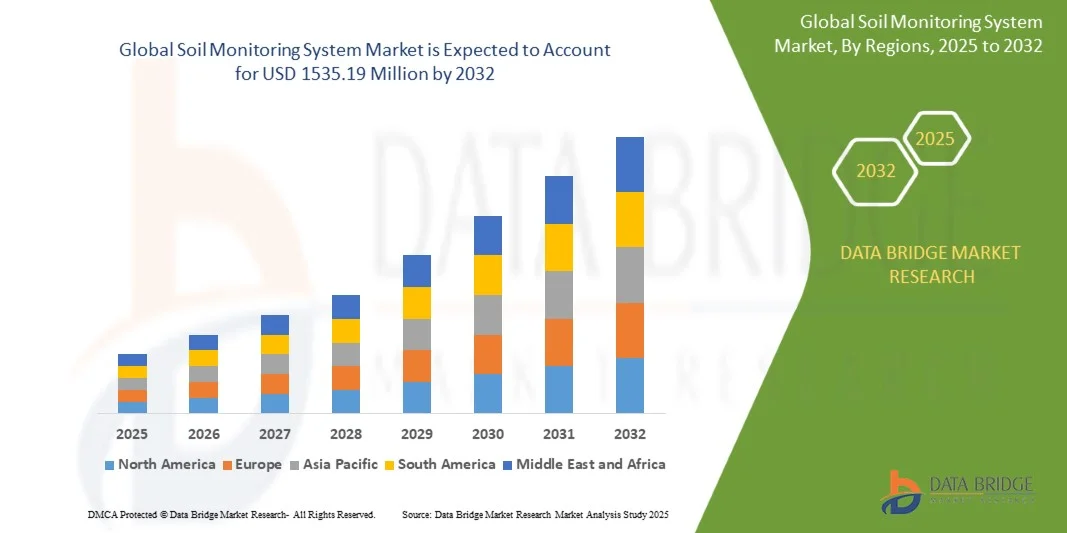

- The global soil monitoring system market size was valued at USD 906.97 million in 2024 and is expected to reach USD 1535.19 million by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of precision agriculture and technological advancements in soil monitoring solutions, leading to better resource management, crop yield optimization, and sustainable farming practices

- Furthermore, rising demand for real-time soil data, automated irrigation management, and data-driven decision-making is driving the adoption of soil monitoring systems across commercial farms, research institutions, and non-farming applications. These factors are accelerating the uptake of connected soil monitoring technologies, thereby significantly boosting the industry's growth

Soil Monitoring System Market Analysis

- Soil monitoring systems consist of hardware sensors, software platforms, and services that collect and analyze soil data, including moisture, nutrient content, and pH levels. These systems provide actionable insights to optimize irrigation, fertilization, and crop management, enhancing both productivity and sustainability in agriculture

- The escalating demand for soil monitoring solutions is primarily fueled by the adoption of IoT-enabled and cloud-based technologies, increasing focus on precision agriculture, government initiatives supporting smart farming, and the need for efficient water and soil resource management

- North America dominated the soil monitoring system market with a share of 36.5% in 2024, due to the increasing adoption of precision agriculture practices and advanced farming technologies

- Asia-Pacific is expected to be the fastest growing region in the soil monitoring system market during the forecast period due to rapid urbanization, rising agricultural modernization, and increasing government support for smart farming technologies

- Hardware segment dominated the market with a market share of 46.5% in 2024, due to the increasing adoption of advanced soil sensors, probes, and IoT-enabled devices that provide real-time monitoring of soil moisture, nutrient content, and pH levels. Hardware solutions are essential for collecting accurate and timely soil data, which is critical for optimizing crop yield and resource management. The segment benefits from continuous technological advancements in sensor durability, precision, and integration with automated irrigation systems. Farmers and agribusinesses increasingly prefer hardware-rich solutions due to their reliability and ability to function under varying environmental conditions

Report Scope and Soil Monitoring System Market Segmentation

|

Attributes |

Soil Monitoring System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Soil Monitoring System Market Trends

“Growing Use of IoT and Cloud Analytics for Real-Time Soil Monitoring”

- The soil monitoring system market is gaining momentum with the increasing integration of IoT sensors and cloud-based analytics for real-time soil health tracking. These innovations are enabling farmers to collect continuous soil data on parameters such as moisture, temperature, and nutrient content, supporting informed decision-making and resource optimization

- For instance, CropX Technologies has deployed IoT-enabled soil sensing platforms combined with cloud analytics that provide actionable insights to farmers on irrigation and fertilization. Such solutions demonstrate how leading companies are leveraging digital technologies to improve farm productivity and sustainability

- The use of IoT devices allows automatic data logging and wireless transmission to cloud platforms, reducing dependence on manual labor while ensuring more precise soil health assessments. This integration saves time and also ensures higher accuracy in farm management strategies

- Cloud-based analytics platforms offer predictive insights for irrigation scheduling, nutrient application, and crop management by analyzing real-time soil data along with weather information. This feature allows farmers to optimize input usage, reduce waste, and enhance overall crop yields while conserving natural resources

- Advancements in soil monitoring systems are also supporting large-scale farms and agri-businesses in adopting data-driven farming practices. Access to real-time soil health metrics helps ensure high productivity while promoting sustainable land use and minimizing ecological impacts

- The growing adoption of IoT and cloud-enabled soil monitoring solutions is transforming farm practices toward digital precision farming. This trend is shaping a connected agricultural ecosystem that prioritizes efficiency, sustainability, and long-term soil health management globally

Soil Monitoring System Market Dynamics

Driver

“Rising Adoption of Precision and Sustainable Farming Practices”

- The growing emphasis on precision farming techniques and sustainable agriculture is a significant driver for the soil monitoring system market. Farmers are increasingly adopting advanced tools to optimize resource use, improve yields, and maintain soil fertility while addressing environmental concerns

- For instance, AgriWebb and other digital agriculture players have integrated soil monitoring solutions into broader farm management platforms. Such tools provide data-driven insights that enable farmers to fine-tune irrigation patterns and nutrient management, driving efficiency in crop production

- The rise of sustainable farming practices has placed soil health at the center of agricultural strategies. Soil monitoring systems are helping farmers track usage of inputs such as fertilizers and water while reducing environmental impacts such as nutrient runoff and soil degradation

- Precision farming relies heavily on accurate data to minimize resource use and maximize productivity. By using soil monitoring technologies, farmers can efficiently allocate water, plan crop cycles, and manage soil conditions in a more scientific way, aligning with global sustainability targets

- The combination of rising demand for sustainable practices and the need for productivity enhancement ensures soil monitoring systems play a vital role in the modernization of agriculture worldwide. This trend points to sustained long-term demand as governments and farmers align toward greener practices

Restraint/Challenge

“High Cost and Complexity Limiting Smallholder Adoption”

- A major challenge for the soil monitoring system market is the high cost of IoT-enabled sensors, software platforms, and cloud subscription services, which makes adoption difficult for smallholder farmers. These costs often outweigh perceived benefits in regions with tight farming budgets

- For instance, smallholder farms in countries such as India and Kenya have shown hesitation in adopting digital soil monitoring due to high upfront investment and ongoing service fees. Companies such as Bosch and Stevens Water Monitoring Systems have had to customize low-cost solutions to address affordability concerns in emerging markets

- The technical complexity of setting up, maintaining, and interpreting soil monitoring systems adds another adoption barrier. Farmers with limited digital literacy face challenges in extracting actionable insights from sensor-driven data, reducing system effectiveness

- Limited infrastructure in remote agricultural regions, including weak internet connectivity and power supply constraints, further complicates the consistent operation of IoT-enabled soil monitoring platforms. This hinders widespread market penetration among small and mid-sized farms

- To address these adoption hurdles, vendors are focusing on cost-effective sensor designs, bundled financing models, and training programs to reduce complexity for farmers. Resolving these issues will be essential to encourage wider adoption and unlock the full potential of soil monitoring systems across global agriculture

Soil Monitoring System Market Scope

The market is segmented on the basis of component, connectivity, and end use.

• By Component

On the basis of component, the soil monitoring system market is segmented into hardware, software, and service. The hardware segment dominated the largest market revenue share of 46.5% in 2024, driven by the increasing adoption of advanced soil sensors, probes, and IoT-enabled devices that provide real-time monitoring of soil moisture, nutrient content, and pH levels. Hardware solutions are essential for collecting accurate and timely soil data, which is critical for optimizing crop yield and resource management. The segment benefits from continuous technological advancements in sensor durability, precision, and integration with automated irrigation systems. Farmers and agribusinesses increasingly prefer hardware-rich solutions due to their reliability and ability to function under varying environmental conditions.

The software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising need for data analytics, predictive insights, and cloud-based soil management platforms. Software solutions enable seamless visualization of soil parameters, trend analysis, and decision-making support, helping farmers optimize irrigation schedules, fertilizer application, and crop planning. Integration with AI and machine learning further enhances the predictive accuracy of soil monitoring systems, making software a crucial component for precision agriculture and sustainable farming practices.

• By Connectivity

On the basis of connectivity, the soil monitoring system market is segmented into wired and wireless. The wired segment held the largest market revenue share in 2024, driven by its reliability and consistent data transmission over long distances in commercial farming setups. Wired systems are preferred for large-scale agricultural fields where uninterrupted soil monitoring is critical for maintaining crop health and ensuring optimal irrigation and fertilization. The segment also benefits from established infrastructure and minimal susceptibility to signal interference, which is important for continuous soil data collection in high-value crops.

The wireless segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing adoption of IoT-enabled and remote monitoring systems. Wireless soil monitoring solutions offer flexibility in installation, scalability, and real-time access to data from mobile devices and cloud platforms. This segment is increasingly preferred in both small and medium-sized farms, where ease of deployment, low maintenance, and integration with smart farming applications provide efficient soil management and cost savings.

• By End Use

On the basis of end use, the soil monitoring system market is segmented into farming use and non-farming use. The farming use segment dominated the largest market revenue share in 2024, driven by the widespread adoption of precision agriculture practices and the need to optimize crop yield, resource utilization, and soil health. Farmers rely on soil monitoring systems to make informed decisions about irrigation, fertilization, and crop rotation, which directly impact productivity and profitability. The segment also benefits from government initiatives promoting smart agriculture and sustainable farming practices across major agricultural regions.

The non-farming use segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by applications in landscaping, sports fields, research institutions, and environmental monitoring. Non-farming users increasingly deploy soil monitoring systems to manage soil quality for turf management, botanical research, and urban green spaces. The segment growth is supported by technological advancements, such as mobile soil testing kits and wireless monitoring solutions, which provide convenience, accurate data, and actionable insights for non-agricultural applications.

Soil Monitoring System Market Regional Analysis

- North America dominated the soil monitoring system market with the largest revenue share of 36.5% in 2024, driven by the increasing adoption of precision agriculture practices and advanced farming technologies

- Farmers in the region highly value real-time soil data to optimize irrigation, fertilization, and crop yield, enhancing operational efficiency and sustainability. This widespread adoption is supported by high investment in agri-tech startups, government initiatives promoting smart farming, and a technologically savvy farming population

- The integration of soil monitoring systems with IoT, AI, and cloud-based analytics is further accelerating market growth, making these systems a preferred choice across large-scale commercial farms

U.S. Soil Monitoring System Market Insight

The U.S. soil monitoring system market captured the largest revenue share in North America in 2024, fueled by the rapid uptake of connected agricultural devices and precision farming solutions. Farmers are increasingly focusing on optimizing resource utilization and crop productivity through data-driven soil management. The growing adoption of automated irrigation systems, soil sensors, and mobile-based monitoring platforms is driving demand. Moreover, supportive government policies and funding programs for sustainable agriculture and digital farming technologies are significantly contributing to market expansion.

Europe Soil Monitoring System Market Insight

The Europe soil monitoring system market is projected to grow at a significant CAGR during the forecast period, driven by stringent environmental regulations and the increasing emphasis on sustainable farming practices. Rising urbanization, combined with the growing need for efficient land use and crop management, is fostering the adoption of soil monitoring systems. European farmers and agribusinesses are increasingly leveraging technology to optimize water usage, reduce fertilizer wastage, and maintain soil health. The market is witnessing steady growth across countries such as Germany, France, and the Netherlands, with adoption in both new agricultural projects and modernization of existing farms.

U.K. Soil Monitoring System Market Insight

The U.K. soil monitoring system market is expected to grow at a notable CAGR during the forecast period, driven by the adoption of precision agriculture and smart farming practices. Concerns regarding soil degradation, water management, and crop yield optimization are prompting farmers to invest in soil monitoring technologies. The growing penetration of connected devices, mobile applications for farm management, and government incentives for digital agriculture are supporting market growth. In addition, the U.K.’s strong research and development ecosystem in agri-tech further stimulates the adoption of advanced soil monitoring solutions.

Germany Soil Monitoring System Market Insight

The Germany soil monitoring system market is poised to expand at a considerable CAGR, fueled by increasing awareness of sustainable agriculture, soil conservation, and precision farming solutions. Germany’s advanced agricultural infrastructure, combined with government initiatives supporting environmental sustainability and digital farming, promotes the adoption of soil monitoring systems. Farmers and agri-businesses are integrating sensors, software analytics, and automated irrigation systems to improve productivity, reduce input costs, and ensure soil health, particularly in high-value crop segments.

Asia-Pacific Soil Monitoring System Market Insight

The Asia-Pacific soil monitoring system market is anticipated to grow at the fastest CAGR during 2025–2032, driven by rapid urbanization, rising agricultural modernization, and increasing government support for smart farming technologies. Countries such as China, Japan, and India are witnessing a growing emphasis on efficient water use, precision irrigation, and soil fertility management. The region is emerging as a hub for cost-effective sensor manufacturing, which is making soil monitoring solutions more accessible to small and medium-sized farms. Furthermore, awareness campaigns and subsidies promoting digital agriculture are accelerating adoption across both commercial and smallholder farms.

Japan Soil Monitoring System Market Insight

The Japan soil monitoring system market is expanding due to high-tech adoption in agriculture, limited arable land, and the need for optimized crop management. Japanese farmers are leveraging connected soil sensors and IoT-based platforms to enhance productivity and manage soil health efficiently. Integration with automated irrigation and climate monitoring systems is fueling market growth. In addition, the aging farming population is increasing demand for easy-to-use, automated soil monitoring solutions that reduce labor dependency while ensuring precision agriculture practices.

China Soil Monitoring System Market Insight

The China soil monitoring system market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expansion of the middle class, and increased technological adoption in agriculture. Soil monitoring systems are gaining traction in commercial farms, agribusiness projects, and government-supported smart agriculture initiatives. The push towards smart cities, sustainable farming practices, and the availability of affordable, locally manufactured soil sensors are key factors propelling market growth. The integration of AI, big data analytics, and mobile platforms further strengthens the adoption across diverse agricultural landscapes.

Soil Monitoring System Market Share

The soil monitoring system industry is primarily led by well-established companies, including:

- Stevens Water Monitoring Systems Inc. (U.S.)

- SGS SA (Switzerland)

- METER Group, Inc. USA (U.S.)

- Element Materials Technology (U.K.)

- The Toro Company (U.S.)

- Campbell Scientific, Inc. (U.S.)

- Sentek (Australia)

- Spectrum Technologies, Inc. (U.S.)

- Irrometer Company, Inc. (U.S.)

- CropX inc. (Israel)

- Acclima, Inc. (U.S.)

- AquaCheck (South Africa)

- Caipos GmbH (Austria)

- Manx Technology Group (Scotland)

- Delta-T Devices Ltd. (U.K.)

- IMKO Micromodultechnik GmbH (Germany)

- Vegetronix (U.S.)

- AquaSpy (U.S.)

- Soil Scout Oy (Finland)

- E.S.I. Environmental Sensors, Inc. (U.S.)

Latest Developments in Soil Monitoring System Market

- In February 2025, Toro Company partnered with TerraRad to launch the Spatial Adjust software, designed to integrate seamlessly with the Toro Lynx Central Control platform. This innovative solution leverages TerraRad’s turfRad smart sensors to monitor soil moisture levels in real time during mowing operations. The integration enhances precision irrigation management, enabling landscapers and golf course managers to optimize water usage, reduce waste, and improve turf health, thereby strengthening the adoption of smart soil monitoring solutions in managed landscapes

- In January 2025, John Deere introduced next-generation autonomous machines and perception autonomy kits, aimed at transforming precision agriculture. These advanced systems integrate real-time soil and crop health assessments with autonomous equipment, providing farmers with automated insights for better decision-making. The innovation is expected to accelerate the adoption of data-driven soil monitoring technologies, enhancing efficiency, crop yield, and sustainable resource management in large-scale agricultural operations

- In May 2024, Stevens Water Monitoring Systems, Inc. acquired Dyacon's weather instrument products, expanding its capabilities in meteorological and soil monitoring applications. This strategic acquisition strengthens Stevens’ portfolio across agriculture, climatology, fire weather monitoring, and small airport operations. The move enhances the company’s ability to deliver early warning and real-time soil and environmental data, supporting precision agriculture and improving soil management practices

- In February 2024, CropX Technologies partnered with Syngenta to optimize seed suppliers' sustainability and yield performance in the American Midwest. CropX’s agronomic platform collects real-time soil and machinery data, transmitting it to the cloud for advanced analytics and visualization. This collaboration empowers growers with actionable insights into soil health, irrigation, and crop management, driving the adoption of smart soil monitoring solutions in large-scale commercial farming

- In December 2024, Trimble and GroundProbe collaborated to offer a unified soil and geotechnical monitoring platform for mining and environmental applications. By integrating Trimble’s monitoring solutions with GroundProbe’s sensors and software, the partnership provides streamlined access to soil and environmental data. This development enhances soil stability monitoring and risk management, promoting the broader adoption of integrated soil monitoring technologies beyond traditional agriculture, including industrial and environmental sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.