Global Solar Photovoltaic Pv Backsheet Market

Market Size in USD Billion

CAGR :

%

USD

2.44 Billion

USD

3.64 Billion

2024

2032

USD

2.44 Billion

USD

3.64 Billion

2024

2032

| 2025 –2032 | |

| USD 2.44 Billion | |

| USD 3.64 Billion | |

|

|

|

|

Solar Photovoltaic (PV) Backsheet Market Size

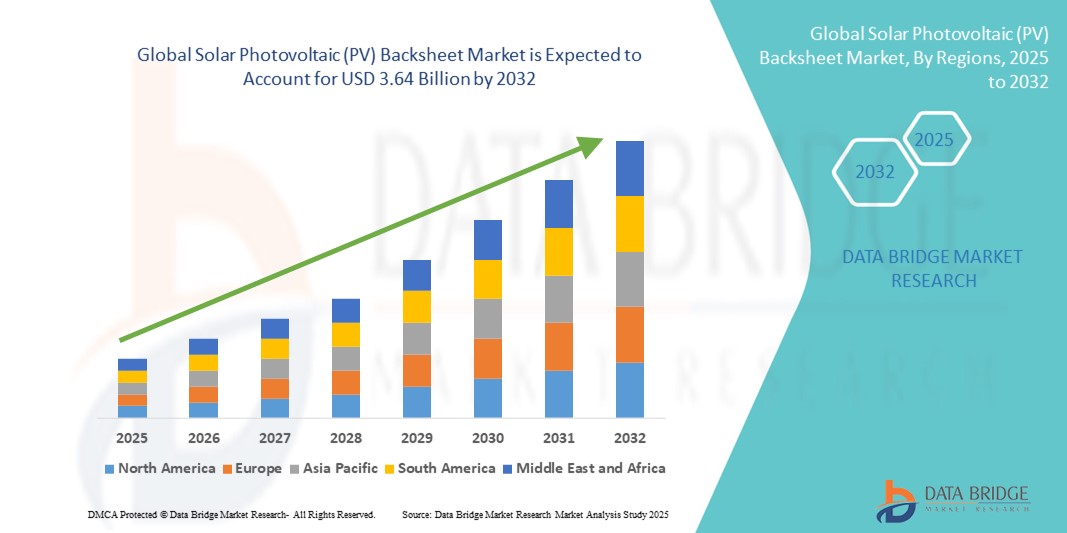

- The global solar photovoltaic (PV) backsheet market size was valued at USD 2.44 billion in 2024 and is expected to reach USD 3.64 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely driven by the increasing global deployment of solar energy systems, particularly in utility-scale and residential rooftop installations, where durable and efficient backsheet materials are essential for long-term module protection

- Furthermore, growing government incentives, declining solar PV costs, and the push for sustainable energy are propelling demand for advanced backsheet technologies that enhance energy yield and resist environmental degradation. These key drivers are strengthening the adoption of high-performance PV backsheets, thereby significantly contributing to market expansion

Solar Photovoltaic (PV) Backsheet Market Analysis

- PV backsheets, functioning as the outer protective layer of solar modules, are essential for preventing moisture ingress, providing electrical insulation, and shielding against UV degradation, thereby ensuring long-term durability and optimal performance of solar systems in various environmental conditions

- The growing demand for PV backsheets is primarily fueled by the global shift toward renewable energy, rising investments in solar infrastructure, and the need for high-efficiency and cost-effective photovoltaic solutions across utility, industrial, and residential sectors

- North America dominated the solar photovoltaic (PV) backsheet market with the largest revenue share of 41.7% in 2024, supported by federal incentives, strong utility-scale solar project development, and a growing preference for durable, high-performance backsheet materials in the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the solar photovoltaic (PV) backsheet market during the forecast period due to rapid urbanization, large-scale solar manufacturing capacity, and favorable government policies in countries such as China and India

- Fluoride segment dominated the solar photovoltaic (PV) backsheet market with a market share of 64% in 2024, owing to its superior resistance to UV rays and harsh weather conditions, making it ideal for long-term module reliability and performance

Report Scope and Solar Photovoltaic (PV) Backsheet Market Segmentation

|

Attributes |

Solar Photovoltaic (PV) Backsheet Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Solar Photovoltaic (PV) Backsheet Market Trends

Material Innovation for Enhanced Durability and Efficiency

- A significant and growing trend in the global solar PV backsheet market is the advancement of material technologies aimed at improving durability, energy yield, and environmental resistance. Innovations in both fluoropolymer and non-fluoropolymer backsheets are enabling higher module efficiency and longer operational lifespans, which are critical as the demand for cost-effective solar energy increases

- For instance, companies such as DuPont and Cybrid Technologies are developing enhanced backsheet formulations with multilayer barrier properties that provide greater resistance to UV exposure, moisture ingress, and thermal degradation extending module longevity in harsh conditions

- In addition, the push for environmentally friendly materials has led to the growing development of recyclable, non-fluoride backsheets that meet stringent sustainability and disposal standards. These alternatives are particularly gaining traction in European markets due to increasing regulatory pressure on solar component end-of-life management

- Manufacturers are also investing in advanced coatings and nanotechnology to improve reflectivity, which helps maximize power output while maintaining electrical insulation. Such innovations are vital for high-efficiency modules used in utility-scale and high-temperature installations

- The demand for high-performance backsheets is rapidly increasing as solar deployment expands in extreme climates such as deserts and coastal regions, where standard materials face accelerated wear. As a result, global players such as Krempel GmbH and Isovoltaic are focusing on premium backsheet solutions that balance performance with cost efficiency

- This trend toward technologically advanced and sustainable backsheet materials is reshaping manufacturer priorities and investment strategies, driving the global market toward higher quality standards and innovation-led growth

Solar Photovoltaic (PV) Backsheet Market Dynamics

Driver

Rising Global Demand for Solar Energy and High-Efficiency Modules

- The rapid increase in global solar energy adoption, driven by government initiatives, declining PV module costs, and international climate goals, is a primary driver for the solar PV backsheet market. As solar installations expand in scale and complexity, the need for high-performance backsheets that enhance durability and energy yield is growing accordingly

- For instance, the U.S. Inflation Reduction Act and the EU Green Deal have significantly boosted solar investments, particularly in utility-scale projects, increasing demand for advanced backsheet materials that can endure harsh operational environments over long lifespans

- With high-efficiency modules such as bifacial and PERC gaining popularity, the backsheet's role in thermal regulation and electrical insulation becomes more critical, further driving innovation and material demand

- In addition, the global shift toward decarbonization and energy independence has intensified solar adoption across residential, commercial, and industrial sectors, positioning backsheets as essential to module reliability and overall system performance

Restraint/Challenge

Price Sensitivity and Regulatory Compliance for Material Composition

- One of the key challenges in the PV backsheet market is the balancing act between performance, environmental compliance, and cost. Fluoride-based backsheets, while offering superior durability, are typically more expensive and pose challenges in recycling, raising regulatory and cost concerns

- For instance, evolving regulations in Europe and parts of Asia are tightening restrictions on fluorinated compounds due to environmental and disposal issues, pressuring manufacturers to develop compliant alternatives without compromising product performance

- Meanwhile, price-sensitive markets, particularly in developing countries, often opt for cheaper non-fluoride backsheets, which may not offer the same long-term reliability, posing performance risks in demanding climates

- The competitive pricing of PV modules also limits the margin available for high-end backsheet materials, making it harder for advanced products to penetrate the cost-sensitive segments

- To overcome these challenges, key players are investing in R&D to develop recyclable, cost-effective, and high-performance alternatives while maintaining compliance with evolving environmental regulations and market expectations for sustainability

Solar Photovoltaic (PV) Backsheet Market Scope

The market is segmented on the basis of product, thickness, material, technology, installation, and end user.

- By Product

On the basis of product, the solar photovoltaic (PV) backsheet market is segmented into TPT-Primed, TPE, PET, PVDF, and PEN. The TPT-Primed segment dominated the market with the largest market revenue share of 34.7% in 2024, owing to its excellent mechanical strength, thermal resistance, and long-standing use in standard PV module configurations. Its compatibility with various module technologies and proven durability make it the preferred choice for both utility-scale and rooftop installations.

The PVDF segment is anticipated to witness the fastest growth rate of 20.9% from 2025 to 2032, fueled by increasing demand for high-performance backsheets that offer superior resistance to UV radiation and harsh environmental conditions. Its application in bifacial and high-efficiency PV modules is driving rapid adoption, especially in regions with extreme climates.

- By Thickness

On the basis of thickness, the solar photovoltaic (PV) backsheet market is segmented into <100 micrometer, 100 to 500 micrometer, and >500 micrometer. The 100 to 500 micrometer segment dominated the market with the largest market revenue share of 58.3% in 2024, driven by its ideal balance of flexibility, insulation, and durability, making it the most widely used thickness range across all major installation types.

The <100 micrometer segment is expected to witness the fastest growth rate from 2025 to 2032, due to the increasing production of lightweight, compact, and flexible solar panels, particularly for residential, portable, and specialized commercial applications where space and weight are key considerations.

- By Material

On the basis of material, the solar photovoltaic (PV) backsheet market is segmented into Fluoride and Non-Fluoride. The Fluoride segment dominated the market with the largest market revenue share of 64% in 2024, attributed to its superior resistance to UV degradation, weathering, and moisture ensuring long module life in demanding outdoor environments. This makes it highly suitable for large-scale, long-term solar projects.

The Non-Fluoride segment is expected to experience significant growth through 2032, driven by increasing environmental awareness, recyclability requirements, and regulatory pressure particularly in Europe and parts of Asia to minimize fluorinated chemical usage in solar panel components.

- By Technology

On the basis of technology, the solar photovoltaic (PV) backsheet market is segmented into crystalline, thin film, and ultra-thin film solar pv modules. The Crystalline segment dominated the market with the largest market revenue share of 79.2% in 2024, due to its widespread deployment across all regions, higher energy efficiency, and compatibility with a wide range of backsheet types.

The Ultra-Thin Film segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by rising demand for flexible, lightweight, and building-integrated PV solutions. While still a niche, technological advances are expanding its adoption, especially in portable and off-grid solar applications.

- By Installation

On the basis of installation, the solar photovoltaic (PV) backsheet market is segmented into Roof Mounted, Ground, and Floating. The Ground segment dominated the market with the largest revenue share of 52.8% in 2024, driven by the rapid expansion of utility-scale solar projects globally, which require high-durability backsheets capable of withstanding prolonged exposure to sunlight and heat.

The Floating segment is projected to be the fastest growing from 2025 to 2032, owing to the increasing deployment of floating solar farms on reservoirs, lakes, and other water bodies. These applications demand backsheets with enhanced waterproofing and anti-corrosion features to ensure operational stability in high-humidity environments.

- By End User

On the basis of end user, the solar photovoltaic (PV) backsheet market is segmented into residential, industrial, utility, and others. The Utility segment dominated the market with the largest revenue share of 48.6% in 2024, reflecting the growing number of large-scale solar projects worldwide, where long-lasting, high-performance backsheets are critical to ensure module reliability and return on investment.

The Residential segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by increasing rooftop solar adoption, supportive government incentives, and consumer interest in sustainable energy solutions. Lightweight and aesthetically compatible backsheets are particularly favored in this segment for ease of installation and visual integration with rooftops.

Solar Photovoltaic (PV) Backsheet Market Regional Analysis

- North America dominated the solar photovoltaic (PV) backsheet market with the largest revenue share of 41.7% in 2024, supported by federal incentives, strong utility-scale solar project development, and a growing preference for durable, high-performance backsheet materials in the U.S. and Canada

- The region’s focus on long-term energy sustainability and grid decarbonization has increased demand for durable, high-performance backsheets capable of withstanding diverse climatic conditions, from deserts to snowy regions

- This market leadership is further reinforced by robust R&D activity, a mature solar industry supply chain, and the increasing adoption of advanced PV technologies in both residential and commercial installations, positioning backsheets as a key enabler of reliable solar module performance across North America

U.S. Solar Photovoltaic (PV) Backsheet Market Insight

The U.S. solar photovoltaic (PV) backsheet market captured the largest revenue share of 77% in 2024 within North America, driven by rising utility-scale solar deployments, federal tax incentives, and an accelerating shift toward clean energy. The increasing use of advanced PV modules in residential and commercial applications is generating robust demand for high-performance backsheets. In addition, the focus on long-term module durability and the need to withstand diverse climate conditions across regions are pushing adoption of weather-resistant, fluoropolymer-based backsheets, particularly in large-scale installations.

Europe Solar Photovoltaic (PV) Backsheet Market Insight

The Europe solar photovoltaic (PV) backsheet market is projected to grow at a substantial CAGR throughout the forecast period, bolstered by ambitious renewable energy targets, recycling regulations, and widespread adoption of solar technology across both established and emerging solar markets. Demand for environmentally compliant, durable backsheets is increasing as European countries focus on sustainability and module life cycle management. The market is witnessing notable traction in rooftop and ground-mounted systems, particularly in Germany, France, and Spain, driven by pro-solar government policies and consumer environmental consciousness.

U.K. Solar Photovoltaic (PV) Backsheet Market Insight

The U.K. solar photovoltaic (PV) backsheet market is expected to expand at a noteworthy CAGR during the forecast period, supported by rising solar installations in both residential and community energy sectors. With the growing emphasis on decentralized energy generation and net-zero targets, the demand for high-quality, efficient backsheets is intensifying. In addition, regulatory frameworks emphasizing product traceability and circular economy practices are fostering the adoption of recyclable backsheet materials in the country.

Germany Solar Photovoltaic (PV) Backsheet Market Insight

The Germany solar photovoltaic (PV) backsheet market is anticipated to grow at a considerable CAGR during the forecast period, driven by the country's leadership in solar innovation and strong investments in green energy infrastructure. The preference for durable, high-efficiency modules with low environmental impact is promoting demand for advanced backsheet materials. Germany’s focus on solar panel recycling and sustainable material sourcing is encouraging manufacturers to invest in eco-friendly backsheet alternatives aligned with national energy and environmental goals.

Asia-Pacific Solar Photovoltaic (PV) Backsheet Market Insight

The Asia-Pacific solar photovoltaic (PV) backsheet market is poised to grow at the fastest CAGR of 25.3% during the forecast period of 2025 to 2032, driven by rapid urbanization, expanding energy access, and government-led clean energy initiatives. Countries such as China, India, and Japan are leading large-scale solar deployments, fueling demand for cost-effective, high-performance backsheets. APAC’s role as a global manufacturing hub for PV components is also enabling technological advancement and lower costs, further supporting widespread market growth across residential and utility sectors.

Japan Solar Photovoltaic (PV) Backsheet Market Insight

The Japan solar photovoltaic (PV) backsheet market is gaining momentum owing to its high population density, limited land availability, and strong focus on high-efficiency, space-optimized solar solutions. The integration of backsheets with advanced thin-film and bifacial modules is accelerating in residential and commercial spaces. Moreover, Japan’s leadership in technological innovation and its focus on long-term module reliability are increasing the use of high-grade, durable backsheet materials to support its growing solar footprint.

India Solar Photovoltaic (PV) Backsheet Market Insight

The India solar photovoltaic (PV) backsheet market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s ambitious solar energy targets, including the National Solar Mission, and a strong pipeline of utility-scale and rooftop solar projects. With growing domestic manufacturing capabilities and favorable government incentives for solar production and deployment, demand for cost-effective, reliable backsheets is soaring. India’s tropical climate and high irradiance also necessitate the use of weather-resistant materials, pushing manufacturers to deliver robust, climate-adapted backsheet solutions.

Solar Photovoltaic (PV) Backsheet Market Share

The solar photovoltaic (PV) backsheet industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Jolywood (China)

- Hangzhou First Applied Material Co., Ltd. (China)

- Coveme S.p.A. (Italy)

- Toray Industries, Inc. (Japan)

- Arkema S.A. (France)

- Taiflex Scientific Co., Ltd. (Taiwan)

- Toppan Inc. (Japan)

- Krempel GmbH (Germany)

- 3M (U.S.)

- Flexcon Company, Inc. (U.S.)

- Targray Technology International Inc. (Canada)

- Cybrid Technologies Inc. (China)

- Vishakha Renewables Pvt. Ltd. (India)

- SFC Co., Ltd. (South Korea)

- Madico, Inc. (U.S.)

- Lucky Film Co., Ltd. (China)

- Isovoltaic GmbH (Austria)

- Toyal America, Inc. (U.S.)

- ZTT Group (Jiangsu Zhongtian Technology Co., Ltd.) (China)

What are the Recent Developments in Global Solar Photovoltaic (PV) Backsheet Market?

- In May 2023, DuPont, a global leader in materials innovation, introduced a new generation of Tedlar PVF film specifically designed for high-performance solar PV backsheets. The product offers superior weatherability, UV resistance, and extended durability, meeting the evolving needs of solar module manufacturers. This advancement reinforces DuPont’s commitment to sustainability and innovation while supporting the long-term reliability of solar installations worldwide

- In April 2023, Jolywood (Suzhou) Sunwatt Co., Ltd., a major Chinese backsheet manufacturer, announced the expansion of its fluoride-free backsheet production line to address the rising demand for environmentally friendly solar module components. The company’s new products aim to reduce environmental impact while maintaining high performance, aligning with the global push for greener energy solutions

- In March 2023, Arkema, a French specialty materials company, unveiled advancements in its Kynar PVDF-based backsheet materials, enhancing resistance to harsh environmental conditions. These enhancements cater to next-generation high-efficiency solar panels, especially in extreme climates. The innovation strengthens Arkema’s position in delivering robust and sustainable material solutions for the solar energy sector

- In February 2023, Coveme, a leading Italian backsheet producer, launched a new line of backsheets using recycled PET as part of its commitment to circular economy practices. These backsheets maintain excellent electrical insulation and weather protection, offering a greener alternative for solar module manufacturers. Coveme’s innovation responds to increasing regulatory and consumer demands for eco-friendly photovoltaic solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.