Global Solar Window Film Market

Market Size in USD Billion

CAGR :

%

USD

3.69 Billion

USD

5.66 Billion

2024

2032

USD

3.69 Billion

USD

5.66 Billion

2024

2032

| 2025 –2032 | |

| USD 3.69 Billion | |

| USD 5.66 Billion | |

|

|

|

|

Solar Window Film Market Size

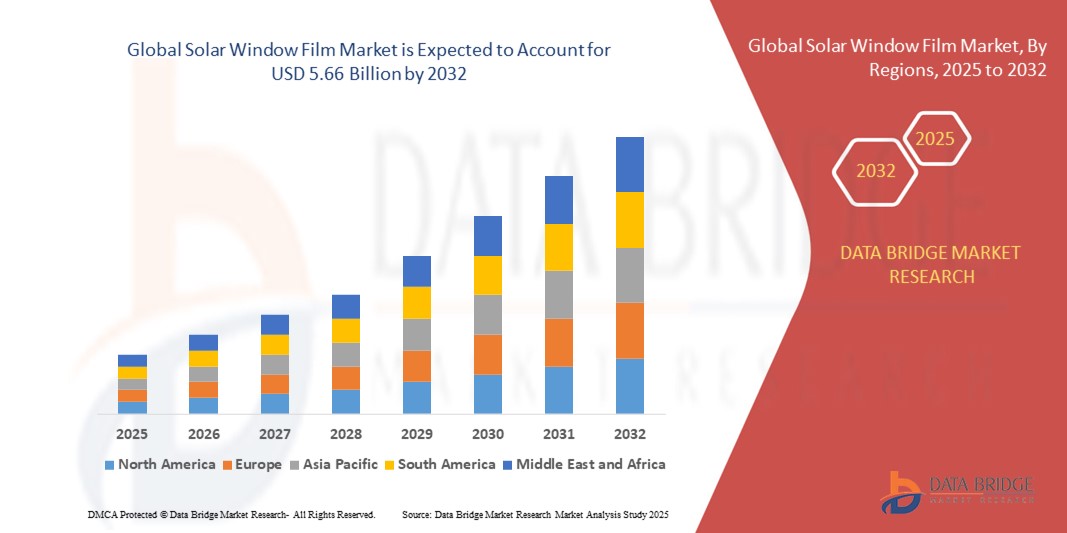

- The global solar window film market size was valued at USD 3.69 billion in 2024 and is expected to reach USD 5.66 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for energy-efficient buildings, rising awareness about UV protection and skin health, and growing adoption of sustainable construction materials

- Advancements in nanotechnology and material science are leading to the development of high-performance solar films offering better heat rejection, durability, and optical clarity

Solar Window Film Market Analysis

- The market is witnessing steady growth due to the rising need for reducing energy consumption in buildings, along with growing urbanization and modernization of infrastructure worldwide

- Increasing focus on smart cities, sustainable architecture, and eco-friendly construction solutions is expected to drive further demand for solar window films in the coming years

- North America dominated the solar window film market with the largest revenue share of 38.5% in 2024, driven by the rising demand for energy-efficient building solutions and increasing awareness of sustainable construction practices

- Asia-Pacific region is expected to witness the highest growth rate in the global solar window film market, driven by increasing smart city projects, rising disposable incomes, and growing emphasis on eco-friendly construction materials

- The Ceramic segment held the largest market revenue share in 2024, driven by its superior heat rejection, durability, and ability to maintain optical clarity without interfering with electronic signals. Ceramic films are widely adopted in both residential and commercial buildings for energy efficiency and UV protection

Report Scope and Solar Window Film Market Segmentation

|

Attributes |

Solar Window Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Solar Window Film Market Trends

Growing Adoption Of Energy-Efficient And Sustainable Window Solutions

• The global shift toward energy-efficient infrastructure is accelerating the demand for solar window films as they help reduce heat gain, improve indoor comfort, and lower cooling costs. Building owners and facility managers are increasingly viewing them as a cost-effective alternative to replacing entire windows, which can be significantly more expensive and time-consuming

• The rising focus on sustainability and green building certifications is boosting adoption, as solar films help buildings comply with energy performance standards while reducing carbon footprints. This aligns with global environmental goals and supports corporate ESG commitments, driving rapid adoption across both commercial and residential sectors

• Rapid urbanization and the increasing number of commercial and residential high-rise projects are driving demand for glare control and UV protection solutions. Solar window films not only enhance energy efficiency but also improve occupant comfort and protect interior furnishings from sun damage, increasing overall property value

• For instance, in 2023, multiple commercial complexes across Singapore installed advanced low-emissivity solar window films, reporting a reduction in HVAC energy consumption by up to 20%. This initiative was part of a larger government-led sustainability program aiming to reduce urban carbon emissions and operational costs for businesses

• While solar window films are gaining popularity, continued innovation in nanotechnology coatings, improved aesthetics, and enhanced durability are essential to meet evolving consumer expectations. Companies investing in smart tinting features and self-cleaning capabilities are expected to gain a competitive edge in the coming years

Solar Window Film Market Dynamics

Driver

Rising Energy Costs And Stringent Building Energy Regulations

• The steady rise in global energy costs is compelling property owners to seek energy-saving solutions, with solar window films emerging as a practical and affordable retrofit option. They provide immediate benefits by reducing cooling loads in summer while retaining indoor heat in winter, lowering utility bills significantly over time

• Governments worldwide are introducing stringent energy efficiency regulations, incentivizing commercial and residential buildings to adopt energy-saving technologies, including advanced window films. Many countries are offering tax credits, rebates, or subsidies for retrofitting buildings with energy-efficient materials to meet climate targets

• Growing consumer awareness about indoor heat management, UV protection, and energy-efficient lifestyles is further accelerating the shift toward solar window films. Educational campaigns and endorsements from green building councils are helping homeowners and businesses recognize the long-term financial and environmental benefits

• For instance, in 2022, the European Union introduced revised energy efficiency directives, pushing for reduced energy consumption in buildings and accelerating demand for retrofitting solutions such as solar window films. This regulation also encouraged public sector buildings to set an example by implementing sustainable solutions first

• While regulatory pressure and cost savings are driving adoption, the market will benefit further from expanded awareness campaigns and financial incentives for building owners. Wider availability of innovative products with faster payback periods will also play a key role in boosting mass adoption globally

Restraint/Challenge

High Initial Installation Costs And Limited Awareness In Developing Regions

• The upfront cost of installing premium solar window films, especially those with advanced coatings or smart-tinting features, remains a barrier for cost-sensitive consumers and small businesses. In price-conscious regions, buyers often delay upgrades despite long-term energy savings due to immediate capital constraints

• In many developing regions, low awareness about the long-term benefits of solar window films leads to slow adoption, as building owners often prioritize short-term expenses over energy savings. A lack of marketing efforts and demonstration projects in rural and semi-urban areas further restricts consumer understanding of potential benefits

• Limited availability of professional installation services and the absence of standardized quality benchmarks in emerging markets restrict product penetration and consumer confidence. Poor installation practices and the risk of counterfeit products also discourage large-scale investments in these regions

• For instance, in 2023, surveys across rural and semi-urban areas in Southeast Asia revealed that over 60% of homeowners were unaware of solar window films as a solution for energy savings and UV protection. Many respondents associated window upgrades solely with aesthetic improvements rather than functional energy efficiency benefits

• Addressing cost barriers through subsidies, financing schemes, and awareness programs is critical to unlocking the untapped potential in developing markets. Partnerships between governments, NGOs, and private companies will be essential to build trust and ensure technology reaches underserved regions effectively

Solar Window Film Market Scope

The market is segmented on the basis of type, film type, technology, applications, and end user.

- By Type

On the basis of type, the solar window film market is segmented into Organic, Metallic, and Ceramic. The Ceramic segment held the largest market revenue share in 2024, driven by its superior heat rejection, durability, and ability to maintain optical clarity without interfering with electronic signals. Ceramic films are widely adopted in both residential and commercial buildings for energy efficiency and UV protection.

The Organic segment is expected to witness the fastest growth rate from 2025 to 2032 due to its cost-effectiveness and flexibility in design, making it suitable for decorative purposes and low-cost energy efficiency solutions in emerging markets.

- By Film Type

On the basis of film type, the market is segmented into Clear Film, Tinted Film, Reflective Film, Decorative Film, and Vacuum Coated Film. The Reflective Film segment dominated the market in 2024 owing to its excellent glare control, privacy benefits, and ability to significantly reduce solar heat gain in high-rise commercial buildings.

The Decorative Film segment is expected to witness the fastest growth rate from 2025 to 2032 as aesthetic customization, branding needs, and interior design trends continue to drive demand across residential and commercial spaces.

- By Technology

On the basis of technology, the market is segmented into Tinted, Polymer Dispersed Liquid Crystal, Suspended Particle Device, and Others. The Tinted technology segment accounted for the largest share in 2024, supported by its affordability, ease of application, and widespread usage in energy-saving retrofits for existing buildings.

The Suspended Particle Device segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing demand for smart films with adjustable transparency and advanced energy management features in modern architecture.

- By Applications

On the basis of applications, the solar window film market is segmented into Residential, Commercial, and Others. The Commercial segment held the dominant revenue share in 2024 owing to stringent energy efficiency regulations, rising operating costs, and the increasing adoption of green building certifications across office spaces and retail complexes.

The Residential segment is expected to witness the fastest growth rate from 2025 to 2032 as urban homeowners increasingly adopt solar films for energy savings, glare reduction, and enhanced indoor comfort.

- By End User

On the basis of end user, the market is segmented into Construction, Automotive, Marine, and Others. The Construction segment accounted for the largest share in 2024 due to rapid urbanization, government energy efficiency mandates, and the growing focus on sustainable building materials.

The Automotive segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for passenger comfort, UV protection, and enhanced fuel efficiency through reduced air-conditioning loads in vehicles.

Solar Window Film Market Regional Analysis

• North America dominated the solar window film market with the largest revenue share of 38.5% in 2024, driven by the rising demand for energy-efficient building solutions and increasing awareness of sustainable construction practices.

• Consumers in the region prefer solar window films for their ability to reduce cooling costs, enhance indoor comfort, and provide UV protection without compromising natural light.

• The growing adoption of green building certifications, stringent energy regulations, and retrofitting initiatives for residential and commercial properties further accelerate the regional market growth.

U.S. Solar Window Film Market Insight

The U.S. solar window film market captured the largest revenue share in 2024 within North America, fueled by a rapid shift toward energy-efficient infrastructure and the need to reduce carbon emissions. Commercial complexes and residential high-rises are increasingly installing solar window films to meet regulatory standards while reducing HVAC energy consumption. In addition, government incentives for sustainable building solutions and the growing popularity of low-emissivity and smart-tinting films are propelling market adoption.

Europe Solar Window Film Market Insight

The Europe solar window film market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising energy costs and strict EU energy efficiency directives. The growing adoption of energy-saving solutions in commercial buildings, along with increased awareness of UV protection and occupant comfort, is fostering demand. The region also benefits from strong sustainability initiatives and a growing focus on modernizing aging building infrastructure with advanced solar window film technologies.

U.K. Solar Window Film Market Insight

The U.K. solar window film market is expected to witness the fastest growth rate from 2025 to 2032, fueled by stringent building energy performance standards and the push for sustainable urban infrastructure. Rising concerns over high energy bills and increasing adoption of green building certifications such as BREEAM are driving demand for solar window films in both residential and commercial segments.

Germany Solar Window Film Market Insight

The Germany solar window film market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s strong commitment to renewable energy and eco-friendly construction practices. The demand for solar films in modern office complexes and retrofitting projects is growing, driven by the need to meet stringent energy efficiency regulations while improving building aesthetics and comfort levels.

Asia-Pacific Solar Window Film Market Insight

The Asia-Pacific solar window film market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing energy consumption in countries such as China, India, and Japan. The region’s booming construction sector, combined with government initiatives promoting energy efficiency, is accelerating the adoption of solar window films across residential, commercial, and industrial applications.

Japan Solar Window Film Market Insight

The Japan solar window film market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s high focus on energy conservation, modern infrastructure development, and the need for thermal comfort in densely populated cities. The adoption of advanced technologies, including smart-tinting and low-emissivity films, is rising as consumers prioritize energy efficiency and environmental sustainability.

China Solar Window Film Market Insight

The China solar window film market accounted for the largest market share in Asia-Pacific in 2024, fueled by massive urbanization, government-led green building initiatives, and the country’s focus on reducing carbon emissions. Affordable solar film solutions from domestic manufacturers and rising consumer awareness of energy-efficient building technologies are accelerating market adoption in both residential and commercial sectors.

Solar Window Film Market Share

The Solar Window Film industry is primarily led by well-established companies, including:

- 3M Company (U.S.)

- Eastman Chemical Company (U.S.)

- Saint Gobain SA (France)

- Madico Inc (U.S.)

- Hanita Coating (Israel)

- Johnson window films (U.S.)

- Avery Dennison corporation (U.S.)

- Sekisui S-Lec America, LLC (U.S.)

- Dexerials Corporation (Japan)

- Garware Hi-Tech Films (India)

- Lintec Corporation (Japan)

- E&B Co., Ltd. (South Korea)

- Haverkamp GmbH (Germany)

Latest Developments in Global Solar Window Film Market

- In April 2024, the Window Film Company announced the launch of its advanced solar control window film solutions, offering a wide range of finishes and performance levels tailored to meet diverse customer requirements. This development aims to enhance energy efficiency, reduce heat gain, and improve indoor comfort for residential and commercial buildings. By providing customizable solutions, the company seeks to cater to growing sustainability demands and strengthen its position in the global solar window film market

- In 2023, Global Window Films completed a major facility expansion in Aurangabad, establishing what is claimed to be the world’s largest film factory. This strategic move significantly boosts production capacity, enabling the company to meet the rising global demand for solar window films. The expansion is expected to enhance supply chain efficiency, reduce lead times, and support the development of innovative, high-performance film solutions for various applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Solar Window Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Solar Window Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Solar Window Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.