Global Solenoid Valves Market

Market Size in USD Billion

CAGR :

%

USD

4.99 Billion

USD

5.98 Billion

2024

2032

USD

4.99 Billion

USD

5.98 Billion

2024

2032

| 2025 –2032 | |

| USD 4.99 Billion | |

| USD 5.98 Billion | |

|

|

|

|

Solenoid Valve Market Size

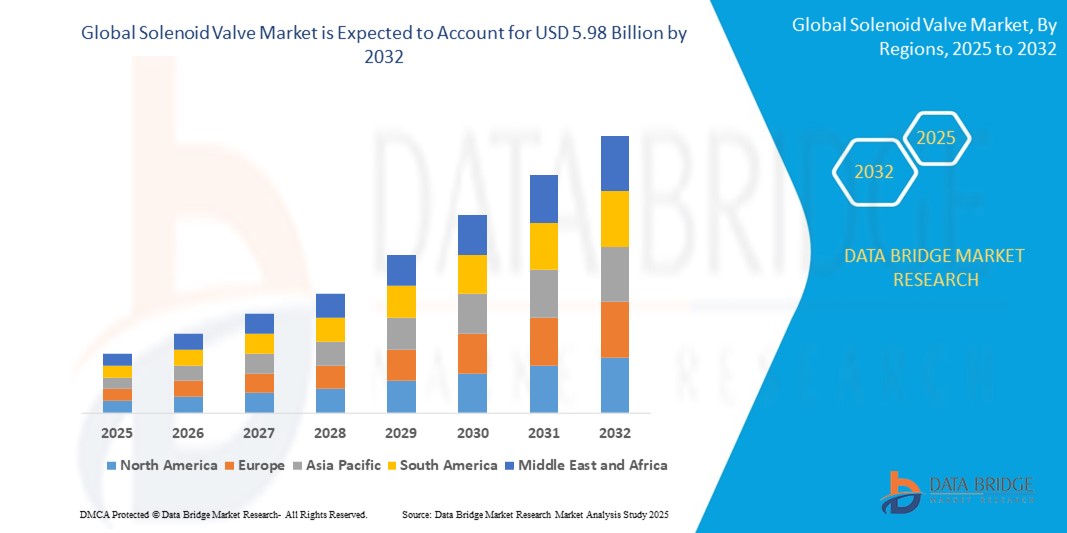

- The global solenoid valve market size was valued at USD 4.99 billion in 2024 and is expected to reach USD 5.98 billion by 2032, at a CAGR of 2.30% during the forecast period

- The market growth is largely fueled by the increasing demand for automation and precise flow control across industries such as oil & gas, chemical, water treatment, and food & beverages, where solenoid valves play a critical role in enhancing operational efficiency

- Furthermore, the integration of advanced technologies, including smart sensors and IoT-enabled systems, is driving the adoption of intelligent solenoid valves, enabling real-time monitoring, remote control, and predictive maintenance, thereby significantly boosting the industry's growth

Solenoid Valve Market Analysis

- A solenoid valve is an electromechanical device that controls the flow of liquids or gases by using an electric current to operate a solenoid coil, enabling precise and automated regulation of fluid movement in various applications

- The increasing adoption of automation technologies, rising demand for energy-efficient systems, and growing emphasis on reducing operational downtime through smart and IoT-enabled valve solutions are key factors driving the expanding use of solenoid valves across multiple industries

- Europe dominated the solenoid valve market with a share of 38.91% in 2024, due to robust industrial infrastructure and growing adoption of automation technologies across key sectors such as manufacturing, automotive, and power generation

- Asia-Pacific is expected to be the fastest growing region in the solenoid valve market during the forecast period due to rapid industrialization, infrastructure development, and manufacturing growth in countries such as China, India, and Japan

- 2 way segment dominated the solenoid valve market with a market share of 43.43% in 2024, due to its fundamental role in controlling flow in on/off applications. These valves are widely adopted across industries for simple flow shut-off or flow direction operations, especially where precision and reliability are critical. Their minimal design complexity, easy maintenance, and broad compatibility with various fluid types enhance their widespread utility in industrial automation and water management

Report Scope and Solenoid Valve Market Segmentation

|

Attributes |

Solenoid Valve Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Solenoid Valve Market Trends

“Increasing Automation in Various Industries”

- A significant and accelerating trend in the global solenoid valve market is the increasing integration of automation technologies across industries such as oil & gas, water treatment, pharmaceuticals, and manufacturing, aimed at enhancing operational efficiency, safety, and precision in fluid control processes

- For instance, Emerson Electric Co. offers smart solenoid valves that support predictive maintenance through real-time monitoring, helping industries reduce unplanned downtime. Similarly, Danfoss provides electrically actuated solenoid valves optimized for automated HVAC and refrigeration systems, ensuring energy efficiency and consistent performance

- Automated solenoid valves are increasingly used in process industries to remotely control the flow of hazardous or high-pressure fluids, ensuring minimal human intervention and maximizing safety. For instance, Bürkert’s solenoid valve systems are designed for seamless integration into industrial automation networks, enabling precise and responsive fluid handling

- The adoption of programmable logic controllers (PLCs) and SCADA systems in factory automation has further propelled demand for solenoid valves capable of integrating with these platforms. This allows real-time data exchange, improved diagnostics, and centralized control of fluid processes across large industrial operations

- This trend toward automation is transforming fluid control systems from manual or semi-automated setups to fully intelligent and responsive networks. As a result, companies such as Parker Hannifin and ASCO (a brand of Emerson) are continuously advancing solenoid valve technology to align with Industry 4.0 requirements, offering valves that are IoT-compatible and support digital communication protocols

- The growing demand for automated, connected, and intelligent valve systems is significantly reshaping industry expectations, pushing manufacturers to develop solenoid valves that are reliable and efficient and also compatible with smart industrial ecosystems

Solenoid Valve Market Dynamics

Driver

“Rising Technological Advancements”

- The rapid pace of technological advancements in fluid control systems is a significant driver for the growing demand in the solenoid valve market, as industries seek more precise, efficient, and intelligent flow control solutions

- For instance, in January 2024, Emerson Electric Co. launched a new line of ASCO Series 256/356 solenoid valves with improved power efficiency and a more compact footprint, designed to support evolving needs in life sciences and analytical instrumentation. Such product developments are expected to accelerate market growth by enhancing operational flexibility and system integration

- As industries increasingly adopt Industry 4.0 practices, solenoid valves with enhanced digital capabilities, such as real-time diagnostics, remote operation, and self-monitoring, offer substantial performance benefits over conventional valve systems

- Furthermore, the integration of advanced materials and sealing technologies has significantly expanded the operating range of solenoid valves, making them more suitable for demanding environments in chemical processing, oil & gas, and pharmaceuticals

- The rising need for energy efficiency, compact design, and compatibility with various automation systems is also driving innovation in valve actuation technologies. These advancements collectively make solenoid valves a key component in next-generation industrial automation systems, contributing to sustained market expansion

Restraint/Challenge

“High Initial Costs”

- The relatively high initial cost associated with advanced solenoid valve systems presents a significant challenge for broader market adoption, particularly among small and mid-sized enterprises seeking cost-effective automation solutions

- For instance, solenoid valves designed for specialized applications—such as those with corrosion-resistant materials, explosion-proof ratings, or digital communication capabilities—often involve higher upfront investments due to complex manufacturing and stringent compliance requirements

- The challenge is especially pronounced in developing economies or cost-sensitive industrial segments such as small-scale manufacturing and water utilities, where budget constraints may delay modernization plans

- Although long-term operational efficiencies, reduced maintenance costs, and process optimization justify the investment over time, the lack of immediate return on investment can deter initial purchases

- To overcome this challenge, manufacturers are increasingly focusing on modular valve designs, offering scalable automation solutions and entry-level models with upgrade options. In addition, financing models or subscription-based pricing for smart valve systems may help lower the entry barrier and drive adoption across a broader customer base

Solenoid Valve Market Scope

The market is segmented on the basis of material, function, and end-use.

- By Material

On the basis of material, the solenoid valve market is segmented into stainless steel, brass, aluminium, and plastic. The stainless steel segment dominated the largest market revenue share of 35.75% in 2024, owing to its superior corrosion resistance, high durability, and suitability for high-pressure and high-temperature environments. Stainless steel solenoid valves are extensively used in industries such as oil & gas, food & beverage, and pharmaceuticals, where hygienic and long-lasting materials are crucial. The material’s robustness and compatibility with aggressive media further solidify its preference in critical applications demanding reliability and safety.

The plastic segment is expected to witness the fastest CAGR of 4.6% from 2025 to 2032, driven by its cost-effectiveness, lightweight properties, and corrosion resistance in non-aggressive and water-based applications. Plastic solenoid valves are particularly gaining traction in water & wastewater treatment systems and low-pressure fluid control in residential or commercial setups. The demand is also boosted by advancements in engineering plastics offering improved mechanical and thermal stability.

- By Function

On the basis of function, the solenoid valve market is segmented into 2 way, 3 way, 4 way, and other functions. The 2 way segment held the largest market revenue share of 43.43% in 2024 due to its fundamental role in controlling flow in on/off applications. These valves are widely adopted across industries for simple flow shut-off or flow direction operations, especially where precision and reliability are critical. Their minimal design complexity, easy maintenance, and broad compatibility with various fluid types enhance their widespread utility in industrial automation and water management.

The 3 way segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by its ability to alternate flow between two outlets or in mixing/diverting applications. These valves are essential in systems that require multiple flow paths or intermediate positions, such as HVAC controls, chemical dosing, and medical equipment. Their versatile control capabilities and increased adoption in process automation contribute significantly to growth in dynamic operational environments.

- By End-Use

On the basis of end-use, the solenoid valve market is segmented into oil & gas, chemical & petrochemical, water & wastewater, food & beverages, power generation, pharmaceuticals, automotive, and other end uses. The oil & gas segment accounted for the largest market revenue share of 23.25% in 2024, fueled by the demand for reliable flow control solutions in hazardous and high-pressure environments. Solenoid valves play a crucial role in controlling fuel, gas, and hydraulic fluids in upstream and downstream operations, offering quick actuation and safety-critical performance that meets industry standards.

The food & beverages segment is expected to witness the fastest CAGR from 2025 to 2032, supported by increasing automation in processing facilities and the need for hygienic flow control systems. Solenoid valves made from food-grade materials and compliant with sanitary regulations are essential for applications involving fluid handling, mixing, and cleaning processes. The rising demand for packaged and processed foods, coupled with investments in smart food factories, propels the rapid adoption of advanced valve technologies in this sector.

Solenoid Valve Market Regional Analysis

- Europe dominated the solenoid valve market with a strong revenue share of 38.91% in 2024, driven by robust industrial infrastructure and growing adoption of automation technologies across key sectors such as manufacturing, automotive, and power generation

- The region exhibits strong demand for solenoid valves due to stringent regulations on energy efficiency and environmental compliance, encouraging the use of precise flow control systems in industries

- The presence of leading valve manufacturers, increasing investment in renewable energy projects, and a strong focus on advanced fluid handling systems contribute to Europe's continued growth in the solenoid valves market

U.K. Solenoid Valve Market Insight

The U.K. solenoid valve market is expected to grow steadily during the forecast period, driven by ongoing advancements in industrial automation and a focus on energy-efficient fluid control systems. The strong presence of the manufacturing, water treatment, and food processing sectors is fostering demand for solenoid valves that deliver precision and reliability. Increasing investment in green technologies and smart infrastructure, supported by regulatory compliance requirements, is further encouraging the adoption of automated valve solutions across the country.

Germany Solenoid Valve Market Insight

The Germany solenoid valve market holds a leading position in Europe due to its advanced industrial base and early adoption of automation technologies. High demand from automotive, chemical, and pharmaceutical sectors is fueling the use of solenoid valves for precise flow and pressure control. Germany’s commitment to sustainability and innovation also drives the integration of smart and energy-efficient valve solutions in both new and retrofitted systems. The presence of globally recognized engineering firms further supports market expansion.

Asia-Pacific Solenoid Valve Market Insight

The Asia-Pacific solenoid valve market is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rapid industrialization, infrastructure development, and manufacturing growth in countries such as China, India, and Japan. Government initiatives supporting water conservation, energy efficiency, and process automation are encouraging the adoption of solenoid valves in sectors including power generation, wastewater management, and food & beverage processing. The presence of cost-effective manufacturing capabilities and expanding industrial output are further driving market growth.

Japan Solenoid Valve Market Insight

The Japan solenoid valve market is growing due to the nation’s strong technological orientation and emphasis on precision engineering. Key sectors such as automotive, electronics, and water treatment are increasingly adopting compact, efficient valve systems to improve operational reliability and control. The country’s focus on automation in both industrial and municipal applications, alongside efforts to modernize infrastructure and address environmental challenges, is creating favorable conditions for solenoid valve adoption.

China Solenoid Valve Market Insight

The China solenoid valve market accounted for the largest revenue share in Asia-Pacific in 2024, driven by extensive infrastructure projects, rapid urbanization, and expansion across key industries such as oil & gas, chemicals, and manufacturing. China’s push toward industrial automation, smart factories, and energy efficiency is accelerating demand for solenoid valves in both process and discrete applications. Local manufacturers offering cost-effective and customizable solutions are also boosting domestic consumption and export growth.

North America Solenoid Valve Market Insight

North America solenoid valve market is projected to grow at significant CAGR from 2025 to 2032, driven by the rising adoption of industrial automation, advanced manufacturing systems, and smart fluid control solutions across sectors such as oil & gas, pharmaceuticals, and water treatment. Growing investments in renewable energy infrastructure and increasing demand for efficient, low-maintenance valve systems are boosting market expansion. Technological advancements, strong regulatory frameworks promoting energy efficiency, and an established industrial base are key contributors to regional growth.

U.S. Solenoid Valve Market Insight

U.S. solenoid valve market is expected to grow steadily during the forecast period within North America, supported by the country’s extensive industrial operations, rapid digital transformation, and modernization of utilities and infrastructure. High demand from automotive, chemical processing, and food & beverage industries is driving adoption of solenoid valves for precise control and safety. Government initiatives supporting environmental compliance and the integration of smart technologies in fluid management systems are further strengthening market growth in the U.S.

Solenoid Valve Market Share

The solenoid valve industry is primarily led by well-established companies, including:

- Emerson Electric Co. (U.S.)

- IMI Process Automation (U.K.)

- Danfoss Industries Ltd. (Denmark)

- Curtiss-Wright Corporation (U.S.)

- Parker Hannifin Corporation (U.S.)

- AirTAC International Group (Taiwan)

- KANEKO SANGYO Co. Ltd. (Japan)

- Anshan Solenoid Valve Co. Ltd. (China)

- CEME Group (Italy)

- SMC Corporation (Japan)

- ASCO Valve, Inc. (U.S.)

- Bosch Rexroth AG (Germany)

- Bürkert Fluid Control Systems (Germany)

- Norgren Ltd (U.K.)

- Christian Bürkert GmbH & Co. KG (Germany)

- CKD Corporation (Japan)

What are the Recent Developments in Global Solenoid Valve Market?

- In March 2024, Emerson introduced a powerful software tool that integrates Fisher control valve expertise with advanced analytics, enabling users to monitor an entire connected fleet of valves while prioritizing maintenance actions based on valve health indices. This innovation enhances operational efficiency, predictive maintenance, and asset management, thereby boosting adoption of smart solenoid valve systems across industries seeking to optimize uptime and reduce unplanned downtime

- In February 2024, Bürkert launched the Type 6440 safety shut-off and Type 6020 proportional control valves, specifically engineered for hydrogen fuel cell systems. Tailored for hydrogen applications in power generation, automotive, and transportation, these valves directly support the global push toward decarbonization. This product introduction positions Bürkert to capture emerging demand in the hydrogen economy, propelling the solenoid valve market’s expansion into sustainable energy sectors

- In August 2023, SMC Corporation released its stainless steel 2-port solenoid valves, designed for use in drinking water systems. This launch strengthens SMC’s presence in the water and wastewater segment by addressing the need for corrosion-resistant, hygienic components. The product’s application in public utilities and residential water systems contributes to market growth driven by rising infrastructure investments and water safety regulations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Solenoid Valves Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Solenoid Valves Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Solenoid Valves Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.