Global Solid Board Market

Market Size in USD Billion

CAGR :

%

USD

9.43 Billion

USD

13.72 Billion

2025

2033

USD

9.43 Billion

USD

13.72 Billion

2025

2033

| 2026 –2033 | |

| USD 9.43 Billion | |

| USD 13.72 Billion | |

|

|

|

|

What is the Global Solid Board Market Size and Growth Rate?

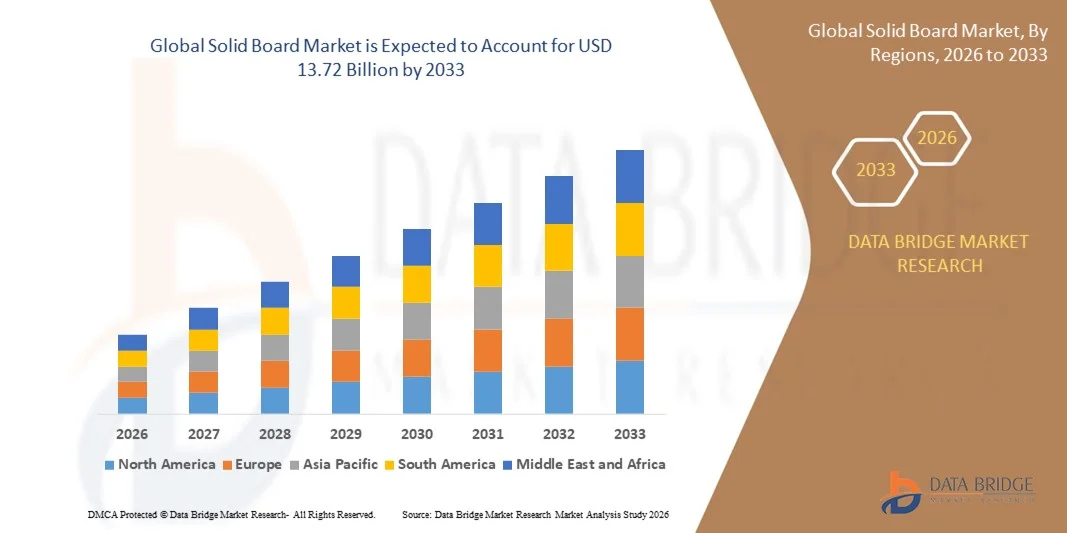

- The global solid board market size was valued at USD 9.43 billion in 2025 and is expected to reach USD 13.72 billion by 2033, at a CAGR of4.80% during the forecast period

- The solid board market is expected to rise in demand due to the light weight of solid boards. The rise in application scope for manufacturing packaging and promotional products such as boxes, layer pads and POP displays is also projected to flourish the growth of the solid board

What are the Major Takeaways of Solid Board Market?

- The point-of-sale appeal and cost-effective packaging solutions, associated with sustainability offered by solid boards when compared to alternatives such as plastic or metal products are also anticipated to boost the demand of the solid board market owing to the above mentioned reasons and is also is projected to grow substantially during the forecast period

- Furthermore, the various benefits of these boards such as high moisture resistance, maximum stiffness and perfect protection for valuable products are also expected to push the growth of solid board market in the above mentioned forecast period

- Europe dominated the solid board market with a 36.25% revenue share in 2025, driven by robust packaging and paperboard manufacturing industries, strong sustainability regulations, and high adoption of recycled and virgin paper-based boards across Germany, France, Italy, and the U.K

- Asia-Pacific is projected to register the fastest CAGR of 9.47% from 2026 to 2033, fueled by rising e-commerce shipments, growing consumer goods markets, and rapid industrialization across China, Japan, India, South Korea, and Southeast Asia

- The Recycled Paper segment dominated the market with a 48.2% share in 2025, driven by increasing environmental awareness, adoption of sustainable packaging, and stringent regulations on reducing carbon footprints

Report Scope and Solid Board Market Segmentation

|

Attributes |

Solid Board Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Solid Board Market?

Increasing Shift Toward High-Speed, Compact, and PC-Based Solid Boards

- The solid board market is experiencing significant adoption of compact, USB-powered, and high-sampling-rate analyzers designed to support embedded systems, IoT devices, FPGA debugging, and complex digital protocols

- Manufacturers are introducing multi-channel, high-bandwidth, and software-defined analyzers that feature advanced triggering, deep memory buffering, and seamless compatibility with modern development environments

- Growing demand for cost-effective, lightweight, and field-deployable testing solutions is driving utilization across electronics design labs, R&D centers, repair workshops, and academic institutions

- For instance, companies such as Saleae, Tektronix, Keysight, and RIGOL have enhanced their portable analyzers with higher channel counts, protocol decoding (SPI, I2C, UART, CAN), and cloud-enabled visualization tools

- Increasing need for rapid debugging, high-speed digital signal validation, and multi-device testing is accelerating adoption of portable, PC-integrated analyzers

- As electronics become more compact and digitally complex, Solid Boards remain indispensable for fast prototyping, real-time testing, and advanced embedded system analysis

What are the Key Drivers of Solid Board Market?

- Rising demand for affordable, accurate, and user-friendly logic analyzers to support rapid debugging and validation in microcontroller, FPGA, and digital circuit development

- For example, in 2025, leading companies such as Saleae, Yokogawa, and Good Will Instrument upgraded analyzer portfolios to support higher sampling rates, advanced protocol decoding, and flexible software interfaces

- Expanding adoption of IoT devices, consumer electronics, robotics, EV systems, and smart automation is fueling demand for digital signal testing tools across the U.S., Europe, and Asia-Pacific

- Advancements in signal acquisition, waveform compression, memory depth, and USB-powered architectures have improved performance, portability, and operational efficiency

- Growing use of AI chips, high-speed serial interfaces, and complex communication buses is driving demand for high-density, multi-channel portable analyzers

- Supported by continuous investment in electronics R&D, semiconductor innovation, and testing infrastructure, the Solid Board market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Solid Board Market?

- High costs associated with premium, high-bandwidth, and multi-channel logic analyzers restrict adoption among small engineering teams and academic institutions

- For instance, during 2024–2025, fluctuations in semiconductor component prices, specialized chip shortages, and extended lead times increased manufacturing costs for several global vendors

- Complexity in analyzing high-speed digital protocols, mixed-signal systems, and advanced timing sequences increases the need for skilled engineers and specialized training

- Limited awareness in emerging markets regarding logic analyzer capabilities, protocol support, and debugging best practices slows adoption

- Competition from digital oscilloscopes with built-in logic analyzer features (MSO), software debuggers, and protocol analyzers creates pricing pressure and reduces product differentiation

- To mitigate these challenges, companies are focusing on cost-optimized designs, training resources, cloud-based analytics, and higher software integration to increase global adoption of solid boards

How is the Solid Board Market Segmented?

The market is segmented on the basis of channel count, application, and vertical.

- By Material Type

On the basis of material type, the solid board market is segmented into Recycled Paper and Virgin Paper. The Recycled Paper segment dominated the market with a 48.2% share in 2025, driven by increasing environmental awareness, adoption of sustainable packaging, and stringent regulations on reducing carbon footprints. Recycled solid boards are widely used in FMCG, food packaging, and e-commerce shipping due to their lower cost and eco-friendly profile. Manufacturers are focusing on improving fiber quality, stiffness, and printability to enhance product performance.

The Virgin Paper segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by demand for high-quality, durable, and premium packaging solutions in luxury goods, electronics, and healthcare industries. Virgin paper solid boards offer superior strength, smooth surfaces, and compatibility with high-end printing technologies, making them preferred for applications requiring aesthetics and structural integrity.

- By Product Type

On the basis of product type, the market is segmented into Bleached Solid Board and Unbleached Solid Board. The Bleached Solid Board segment dominated the market with a 52.4% share in 2025, owing to its superior whiteness, smooth surface, and excellent printability, making it ideal for luxury packaging, food cartons, and retail displays. Bleached boards are preferred by manufacturers requiring high-quality finishes, vibrant graphics, and consistent surface texture.

The Unbleached Solid Board segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for cost-effective, environmentally friendly, and robust packaging materials. Unbleached boards offer higher strength, recyclability, and resistance to moisture, making them suitable for heavy-duty shipping, industrial packaging, and bulk transport applications. Rising e-commerce and industrial logistics requirements are further accelerating adoption of unbleached solid boards globally.

- By Weight

On the basis of weight, the solid board market is segmented into Up to 200 GSM, 201–300 GSM, 301–500 GSM, and Above 500 GSM. The 201–300 GSM segment dominated the market with a 43.7% share in 2025, offering an optimal balance of strength, flexibility, and cost-efficiency, making it widely used for packaging boxes, trays, and POP displays. Boards in this weight range are compatible with high-speed converting machines, making them a preferred choice for FMCG, cosmetics, and food packaging.

The Above 500 GSM segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by demand for high-strength packaging for industrial, electronic, and heavy-duty applications. Heavy-weight boards provide exceptional durability, load-bearing capacity, and resistance to bending, supporting specialized applications in electronics, construction, and premium product packaging.

- By Application

On the basis of application, the solid board market is segmented into Boxes, POP Displays, Edge Protectors, Trays, and Layer Pads. The Boxes segment dominated the market with a 46.8% share in 2025, supported by extensive adoption across e-commerce, food & beverage, and retail industries. Boxes offer easy customization, structural integrity, and protective performance, making them the most common form of solid board packaging.

The POP Displays segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for in-store marketing solutions, retail visibility, and brand engagement. POP displays require aesthetically appealing, strong, and foldable boards, which encourage manufacturers to innovate with printing finishes, surface coatings, and structural designs to attract consumers and enhance retail experiences.

- By End User

On the basis of end user, the market is segmented into Electrical & Electronics, Healthcare & Pharmaceuticals, Cosmetics & Personal Care, Food & Beverages, Industrial Packaging, Building & Construction, and Tobacco Packaging. The Food & Beverages segment dominated the market with a 38.9% share in 2025, driven by rising demand for packaged foods, ready-to-eat meals, and beverage cartons. Solid boards provide protection, hygiene, and aesthetic appeal, supporting brand differentiation.

The Electrical & Electronics segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by the increasing need for durable, protective packaging for electronics, gadgets, and appliances. High-growth electronics sectors in Asia-Pacific and Europe are driving demand for custom solid boards that offer shock absorption, moisture resistance, and premium finish for high-value products.

Which Region Holds the Largest Share of the Solid Board Market?

- Europe dominated the solid board market with a 36.25% revenue share in 2025, driven by robust packaging and paperboard manufacturing industries, strong sustainability regulations, and high adoption of recycled and virgin paper-based boards across Germany, France, Italy, and the U.K. Rising demand for premium packaging, e-commerce shipments, and consumer goods supports growth across the region. Technologically advanced production facilities, efficient logistics networks, and innovation in sustainable packaging solutions further reinforce Europe’s market leadership

- Leading companies in Europe are investing in high-capacity production lines, energy-efficient manufacturing processes, and sustainable fiber sourcing, strengthening regional competitiveness. Continuous investment in recycling technologies, automation, and smart packaging innovation drives long-term market expansion

- High concentration of packaging R&D centers, regulatory support for eco-friendly materials, and established logistics and supply chains further solidify Europe’s dominance in the Solid Board market

Germany Solid Board Market Insight

Germany is the largest contributor in Europe, supported by advanced paperboard production facilities, high export potential, and extensive adoption in e-commerce, food & beverage, and industrial packaging. Increasing demand for recycled and premium solid boards, sustainable packaging initiatives, and advanced printing technologies drives growth. Presence of leading packaging companies, robust R&D, and innovation in lightweight, durable boards further reinforce market expansion.

France Solid Board Market Insight

France contributes significantly to European growth, driven by strong packaging regulations, demand for luxury packaging, and adoption in food, cosmetics, and pharmaceutical sectors. Manufacturers increasingly utilize eco-friendly solid boards and high-quality virgin fiber boards for premium applications. Government initiatives supporting sustainable packaging and recycling enhance market adoption across the country.

Asia-Pacific Solid Board Market

Asia-Pacific is projected to register the fastest CAGR of 9.47% from 2026 to 2033, fueled by rising e-commerce shipments, growing consumer goods markets, and rapid industrialization across China, Japan, India, South Korea, and Southeast Asia. Expanding packaging industries, high-volume production of electronics, FMCG, and processed foods increases demand for durable and lightweight solid boards. Technological adoption in fiber processing, printing, and automated converting solutions continues to accelerate market growth.

China Solid Board Market Insight

China is the largest contributor in Asia-Pacific due to massive manufacturing capacity, government support for sustainable packaging, and rising demand in e-commerce and industrial sectors. High-volume production of premium and recycled boards drives adoption. Local manufacturing capabilities and competitive pricing further expand domestic and export markets.

Japan Solid Board Market Insight

Japan shows steady growth supported by precision manufacturing, advanced printing technologies, and increasing adoption in electronics, luxury goods, and retail packaging. Focus on high-quality, durable boards and sustainability initiatives drives market expansion.

India Solid Board Market Insight

India is emerging as a major growth hub, driven by e-commerce growth, rising demand for food & beverage packaging, and government-backed packaging initiatives. Increasing production capacities, skilled workforce, and adoption of recycled boards accelerate market penetration.

South Korea Solid Board Market Insight

South Korea contributes significantly due to strong industrial growth, increasing demand for electronics and FMCG packaging, and adoption of premium and recycled solid boards. Technological innovation, high-quality production standards, and growing digital ecosystems support sustained market expansion.

Which are the Top Companies in Solid Board Market?

The solid board industry is primarily led by well-established companies, including:

- Smurfit Kappa (Ireland)

- DS Smith (U.K.)

- Mondi (U.K.)

- International Paper (U.S.)

- Tetra Pak (Sweden)

- NIPPON PAPER INDUSTRIES CO., LTD. (Japan)

- Sealed Air (U.S.)

- VPK Group NV (Belgium)

- SOLIDUS SOLUTIONS Holding B.V. (Netherlands)

- Huhtamäki Oyj (Finland)

- Lyburn Supplies Limited (U.K.)

- Sonoco Products Company (U.S.)

- Mayr-Melnhof Karton AG (Austria)

- Georgia-Pacific (U.S.)

- WestRock Company (U.S.)

- Rengo Co. Ltd. (Japan)

- Stora Enso (Sweden)

- Billerudkorsnas AB (Sweden)

- Pactiv LLC (U.S.)

- METSÄ GROUP (Finland)

What are the Recent Developments in Global Solid Board Market?

- In January 2025, Smurfit Kappa, a leading paper-based packaging manufacturer, announced an investment of USD 33 million in Fortaleza, Brazil, aimed at expanding its production capacity to meet rising demand for sustainable and innovative packaging solutions, reinforcing its commitment to eco-friendly packaging

- In April 2024, International Paper and DS Smith Plc declared that they had reached an agreement on the terms of a recommended all-share merger, creating a truly global leader in sustainable packaging solutions, expected to strengthen their competitive position and product portfolio worldwide

- In February 2024, Schubert, a key packaging solutions provider, introduced Dotlock, an innovative technology for manufacturing fully glue-free cardboard packaging, suitable for trays, base-lid applications, and gable top formats, particularly in food, baked goods, and confectionery packaging, highlighting the shift toward sustainable and efficient packaging methods

- In December 2024, Mondi Group, a major packaging and paper provider, announced its acquisition of Olmuksan International Paper, a corrugated packaging manufacturer in Türkiye, enabling Mondi to expand its product offerings and reach both existing and new customers across the region, strengthening its regional presence

- In October 2022, Mayr-Melnhof Group successfully acquired Essentra Packaging Company along with all related entities, complementing its current pharmaceutical packaging operations in the Nordics and France, and enabling entry into cartons, leaflets, and labels, enhancing its footprint in pharmaceutical packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Solid Board Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Solid Board Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Solid Board Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.