Global Solvent Borne Coatings Market

Market Size in USD Billion

CAGR :

%

USD

45.56 Billion

USD

83.70 Billion

2024

2032

USD

45.56 Billion

USD

83.70 Billion

2024

2032

| 2025 –2032 | |

| USD 45.56 Billion | |

| USD 83.70 Billion | |

|

|

|

|

Solvent-Borne Coatings Market Size

- The global solvent-borne coatings market size was valued at USD 45.56 billion in 2024 and is expected to reach USD 83.70 billion by 2032, at a CAGR of 7.9% during the forecast period

- The market growth is largely fueled by the rising demand for high-performance coatings across automotive, industrial, and construction sectors, where solvent-borne solutions are valued for their durability, superior adhesion, and resistance to harsh environments

- Furthermore, the ability of solvent-borne coatings to deliver consistent application, faster drying times, and long-lasting protection is driving their adoption in heavy-duty and large-scale projects. These converging factors are accelerating the uptake of solvent-borne coatings, thereby significantly boosting the industry’s growth

Solvent-Borne Coatings Market Analysis

- Solvent-borne coatings are formulated with organic solvents that act as carriers, enabling smooth application and strong film formation even in challenging environmental conditions. They are widely applied in automotive refinishing, industrial machinery, heavy equipment, and infrastructure projects due to their reliability and performance advantages

- The escalating demand for solvent-borne coatings is primarily fueled by their ability to withstand extreme weather, chemical exposure, and mechanical stress, making them indispensable in critical industries. Despite rising environmental regulations, their unmatched protective qualities continue to sustain their position in the global coatings market

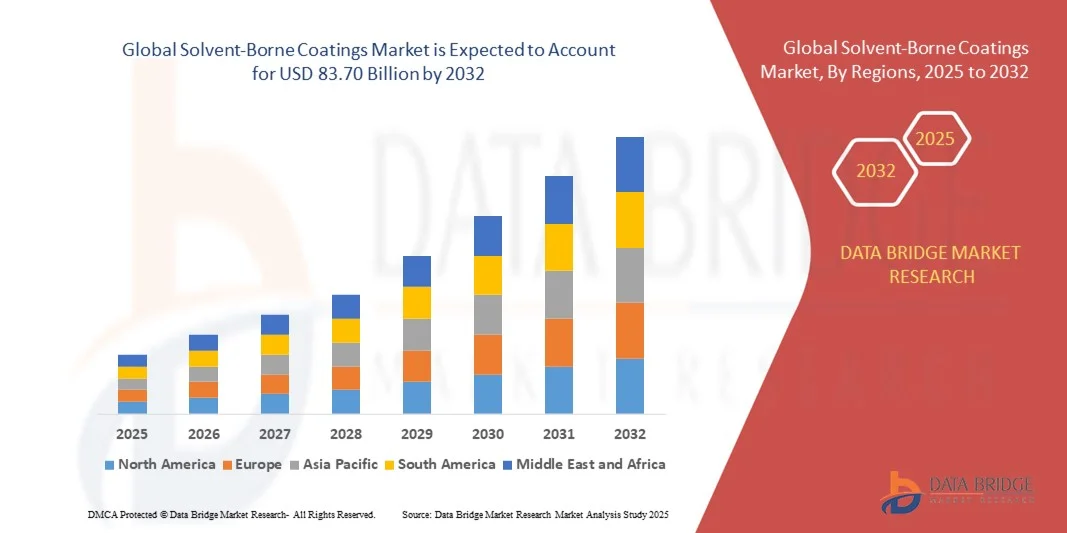

- Asia-Pacific dominated the solvent-borne coatings market with a share of 38.6% in 2024, due to rapid industrialization, growing construction activity, and expanding automotive production across the region

- Europe is expected to be the fastest growing region in the solvent-borne coatings market during the forecast period due to increasing demand for high-performance, durable coatings in industries such as automotive, manufacturing, and oil & gas

- One component system solvent borne coatings segment dominated the market with a market share of 66.9% in 2024, due to their ease of application, cost-effectiveness, and strong adhesion properties across multiple substrates. These coatings are widely used in construction and consumer goods applications due to their durability and minimal surface preparation requirements. Their ability to deliver consistent finishes in demanding environments has strengthened adoption across residential and light industrial uses, ensuring steady demand growth

Report Scope and Solvent-Borne Coatings Market Segmentation

|

Attributes |

Solvent-Borne Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Solvent-Borne Coatings Market Trends

Demand for High-Performance Coatings

- The solvent-borne coatings market is witnessing robust demand due to their superior performance characteristics, including durability, strong adhesion, and resistance to harsh environmental conditions. These coatings continue to be preferred in applications where extreme performance and long-lasting protection are required, such as automotive, marine, industrial machinery, and heavy-duty infrastructure

- For instance, AkzoNobel provides a wide range of solvent-borne coatings engineered for automotive refinishing and industrial uses, emphasizing superior gloss retention and weather resistance. Similarly, PPG Industries offers high-performance solvent-based solutions used in protective and marine coatings where resistance to abrasion and chemicals is essential

- The unique advantage of solvent-borne coatings lies in their ability to provide uniform application and fast curing, even under fluctuating temperature and humidity conditions. This makes them especially useful in large-scale, outdoor, or industrial environments where waterborne alternatives may not perform as efficiently

- Applications in demanding industries such as oil and gas, aerospace, and automotive manufacturing continue to prioritize solvent-borne coatings due to their proven ability to deliver longevity under pressure, corrosion, and exposure to hostile climates. This ensures they remain relevant despite the expansion of eco-friendly alternatives

- Product innovations are also being introduced to improve the environmental profile of solvent-borne coatings by reducing VOC levels while maintaining performance. Hybrid and low-VOC solvent-based formulations are helping manufacturers align with sustainability demands while meeting customer requirements for durability and appearance

- The rising demand for high-performance coatings signifies the continued relevance of solvent-borne technologies in applications requiring uncompromised performance. Despite environmental challenges, their efficiency and protective advantages ensure strong market demand across a wide range of industrial and automotive applications

Solvent-Borne Coatings Market Dynamics

Driver

Rising Demand from Automotive and Industrial Sectors

- The growing demand from automotive and industrial sectors is a major driver fueling the solvent-borne coatings market. Automotive manufacturers continue to rely on solvent-based systems for their superior finish quality, resistance to UV radiation, and durability under extreme environmental conditions

- For instance, BASF Coatings produces solvent-borne refinishing products that are widely used by automotive OEMs to achieve high gloss and scratch resistance in vehicles. Nippon Paint Holdings also provides solvent-based industrial coatings aimed at machinery, equipment, and automotive parts where long-term performance is a priority

- Industrial applications depend heavily on solvent-borne coatings to protect metal structures and machinery from corrosion, abrasion, and chemical exposure. These coatings extend asset lifecycles, reducing maintenance costs and improving reliability across manufacturing plants, pipelines, and heavy equipment

- Their resilience in extreme operational environments such as offshore oil rigs, chemical plants, and power generation facilities further reinforces their importance. Industries continue to prefer solvent-borne coatings due to their robustness and ability to withstand demanding conditions with consistent results

- The growing industrial and automotive demand highlights the enduring role of solvent-borne coatings. Their balance of performance, protection, and ease of application ensures their continued adoption as key solutions in sectors where durability and resistance are critical requirements

Restraint/Challenge

Stringent Environmental and VOC Emission Regulations

- One of the most significant challenges to the solvent-borne coatings market is the stringent environmental regulations surrounding volatile organic compound (VOC) emissions. Regulatory bodies worldwide are placing stricter limits on permissible VOC levels, compelling manufacturers and end-users to shift toward more sustainable alternatives

- For instance, the European Union’s REACH regulations and the U.S. Environmental Protection Agency’s Clean Air Act include strict requirements for reducing VOC emissions from solvent-borne coatings. Manufacturers such as AkzoNobel and PPG Industries must continually invest in reformulating products to meet compliance standards across multiple regions

- Meeting these regulatory requirements often increases costs associated with research, reformulation, and testing, raising challenges for both large players and smaller firms with limited research capabilities. These costs also slow down market expansion in certain regions

- Another ongoing challenge is the perception of solvent-borne coatings as environmentally harmful compared to waterborne alternatives, which further complicates their acceptance in sustainability-driven industries. This narrative is intensifying as customers and regulators push strongly for green and low-VOC solutions

- Overcoming environmental restraints will require adoption of advanced formulations with reduced VOC content, investment in cleaner technologies, and alignment with evolving regulations. Addressing these challenges effectively will be essential for the solvent-borne coatings market to maintain long-term growth while balancing performance and sustainability considerations

Solvent-Borne Coatings Market Scope

The market is segmented on the basis of product type, end use, and industry vertical.

- By Product Type

On the basis of product type, the solvent-borne coatings market is segmented into one component system solvent-borne coatings, two component system solvent-borne coatings, hydrogenated solvent, oxygenated solvent, automotive solvent-borne coating, industrial solvent, and others. The one component system solvent-borne coatings segment dominated the largest market revenue share of 66.9% in 2024, attributed to their ease of application, cost-effectiveness, and strong adhesion properties across multiple substrates. These coatings are widely used in construction and consumer goods applications due to their durability and minimal surface preparation requirements. Their ability to deliver consistent finishes in demanding environments has strengthened adoption across residential and light industrial uses, ensuring steady demand growth.

The two component system solvent-borne coatings segment is projected to witness the fastest growth from 2025 to 2032, driven by their superior chemical resistance, high mechanical strength, and longer durability compared to one component systems. These coatings are increasingly applied in automotive, aerospace, and heavy equipment sectors where long-lasting performance and resilience against harsh conditions are critical. The demand is further supported by rising adoption in industrial manufacturing, where coatings must withstand exposure to solvents, abrasion, and temperature fluctuations. Growing investments in advanced infrastructure projects also provide growth opportunities for this segment.

- By End Use

On the basis of end use, the solvent-borne coatings market is segmented into transportation, consumer products, heavy equipment industry, and machinery industry. The transportation segment accounted for the largest market share in 2024, largely due to the extensive use of solvent-borne coatings in automotive manufacturing, repair, and maintenance. These coatings provide superior gloss, finish quality, and weather resistance, which are essential in the automotive sector. Their ability to deliver faster drying times and robust protective layers makes them the preferred choice among OEMs and aftermarket applications, ensuring dominance of the transportation sector.

The heavy equipment industry segment is anticipated to record the fastest growth over the forecast period, driven by rising demand for durable protective coatings in construction, mining, and agricultural machinery. The need to safeguard heavy equipment against corrosion, wear, and exposure to harsh operating environments has significantly boosted demand for solvent-borne coatings. With global infrastructure expansion and industrialization, heavy-duty coatings offering superior resistance to abrasion and chemicals are increasingly required, making this segment a key growth driver.

- By Industry Vertical

On the basis of industry vertical, the solvent-borne coatings market is segmented into utilities, oil and gas industry, manufacturing industry, hospitals, and others. The oil and gas industry segment held the largest market revenue share in 2024, driven by the high demand for corrosion-resistant coatings to protect pipelines, rigs, storage tanks, and offshore structures. Solvent-borne coatings are critical in this sector as they offer superior adhesion and performance in extreme conditions, including saltwater exposure, high humidity, and fluctuating temperatures. The growing investments in exploration and production projects worldwide have reinforced the dominance of this segment.

The manufacturing industry segment is projected to witness the fastest growth from 2025 to 2032, supported by the increasing need for coatings that protect machinery, production facilities, and equipment from corrosion, wear, and operational stress. Solvent-borne coatings are widely preferred in this sector due to their ability to withstand continuous usage, chemical exposure, and heat. With expanding industrial output and the emphasis on efficient, long-lasting equipment, adoption of advanced solvent-borne coatings is expected to accelerate, driving rapid growth in the manufacturing vertical.

Solvent-Borne Coatings Market Regional Analysis

- Asia-Pacific dominated the solvent-borne coatings market with the largest revenue share of 38.6% in 2024, driven by rapid industrialization, growing construction activity, and expanding automotive production across the region

- The region’s cost-efficient manufacturing base, abundant raw material availability, and strong export orientation are fueling large-scale production of solvent-borne coatings

- Rising infrastructure investments, particularly in China, India, and Southeast Asia, are further accelerating demand. In addition, favorable government policies promoting industrial output and the increasing penetration of global coatings players in the region continue to strengthen market growth

China Solvent-Borne Coatings Market Insight

China held the largest share in the Asia-Pacific solvent-borne coatings market in 2024, driven by its extensive automotive manufacturing base, booming construction sector, and well-developed chemical production ecosystem. The country benefits from economies of scale, advanced manufacturing capabilities, and strong distribution networks that support both domestic demand and exports. Government-backed infrastructure projects and ongoing industrial modernization further sustain the high consumption of solvent-borne coatings across multiple applications.

India Solvent-Borne Coatings Market Insight

India is witnessing the fastest growth in the Asia-Pacific solvent-borne coatings market, attributed to rapid urbanization, expansion of infrastructure projects, and growing automotive demand. The “Make in India” initiative and rising foreign investments in industrial and manufacturing sectors are boosting the adoption of solvent-borne coatings. Increasing demand in consumer products and heavy equipment industries, coupled with strengthening export capabilities, is further driving robust growth in the country’s coatings market.

North America Solvent-Borne Coatings Market Insight

North America accounted for a significant share in 2024, underpinned by robust demand in transportation, industrial, and oil & gas sectors. The region benefits from advanced technological capabilities, strong industrial base, and high consumption of performance coatings in both commercial and residential applications. Investments in infrastructure modernization and the presence of global coatings leaders further support growth. Strict regulatory standards, coupled with a focus on quality and durability, continue to sustain solvent-borne coatings adoption across the U.S. and Canada.

U.S. Solvent-Borne Coatings Market Insight

The U.S. held the largest share in the North America solvent-borne coatings market in 2024, attributed to its strong automotive sector, expansive construction activities, and well-established manufacturing base. The presence of major coatings manufacturers, coupled with rising demand for protective and industrial coatings, drives consistent market growth. In addition, government-backed infrastructure investments and increasing adoption of high-performance coatings in oil & gas and heavy machinery sectors reinforce the U.S.’s leading position in the region.

Europe Solvent-Borne Coatings Market Insight

Europe is projected to grow at the fastest CAGR from 2025 to 2032, supported by increasing demand for high-performance, durable coatings in industries such as automotive, manufacturing, and oil & gas. The region places significant emphasis on sustainability and compliance with stringent environmental standards, leading to continuous innovations in solvent formulations. Investments in advanced R&D, particularly in Germany, France, and the U.K., are enhancing the adoption of solvent-borne coatings in specialized applications. Moreover, rising renovation activities and demand for industrial coatings across the continent are contributing to Europe’s strong growth outlook.

Germany Solvent-Borne Coatings Market Insight

Germany’s solvent-borne coatings market is driven by its leading automotive industry, advanced manufacturing ecosystem, and strong chemical production base. The country is home to several global coatings manufacturers with a focus on innovation, export strength, and high-quality standards. Growing demand for corrosion-resistant and long-lasting coatings in machinery, heavy equipment, and industrial applications further reinforces Germany’s dominant role in the European market.

U.K. Solvent-Borne Coatings Market Insight

The U.K. market is expanding due to increased demand in the construction and consumer products sectors, supported by ongoing urban redevelopment and infrastructure projects. Post-Brexit initiatives to strengthen domestic supply chains and investments in advanced manufacturing are further enhancing the market. The country’s mature coatings industry, combined with emphasis on R&D and specialty product development, continues to make the U.K. a key growth contributor in Europe.

Solvent-Borne Coatings Market Share

The solvent-borne coatings industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Williams-Hayward Protective (U.S.)

- INDUSTRIA CHIMICA ADRIATICA SpA (Italy)

- NEI Corporation. (U.S.)

- Laviosa Mineral Solutions SpA (Italy)

- BYK Additives & Instruments (Germany)

- Croda International Plc (U.K.)

- TOLSA GROUP (Spain)

- DSM (Netherlands)

- Covestro AG (Germany)

- Jamestown Coating Technologies (U.S.)

- Dow (U.S.)

- Glass Paint Technology (Canada)

- Endura Manufacturing Company Ltd. (Canada)

- ALLNEX GMBH (Germany)

- Prestige Coating Limited. (India)

- Excalibur Paint (U.S.)

- Ellis Paint Company (U.S.)

- PRABHAT PAINT INDUSTRIES. (India)

- The Lubrizol Corporation (U.S.)

Latest Developments in Global Solvent-Borne Coatings Market

- In September 2025, PPG introduced the PPG VELOCITY refinish system, a new line of solvent-borne products tailored for the automotive refinish industry in the U.S. This launch enhances PPG’s position in the automotive coatings market by addressing the growing need for high-quality, durable, and easy-to-apply solutions in collision repair shops. By focusing on performance and efficiency in fast-paced repair environments, PPG strengthens its customer value proposition and expands its competitive edge in the solvent-borne coatings space

- In June 2024, PPG unveiled TOMORROW INCLUDED, a sustainability-driven marketing concept for its architectural coatings in the EMEA region. This initiative highlights product benefits such as recyclability, durability, and energy efficiency, reinforcing PPG’s alignment with its 2030 sustainability goals. The launch strengthens PPG’s reputation as an environmentally responsible coatings leader while appealing to the rising consumer and regulatory demand for sustainable coating solutions

- In February 2024, Covestro announced the development of a Waterborne and Waterborne UV resin family designed for industrial coating applications in wood furniture, cabinetry, and building products. This innovation marks a strategic shift towards eco-friendly, high-performance alternatives to solvent-borne coatings, addressing the increasing regulatory pressures and sustainability expectations in industrial markets. By advancing its resin portfolio, Covestro is set to enhance its share in the industrial coatings segment, particularly in applications demanding reduced emissions and long-term durability

- In October 2024, RPM International Inc. acquired France-based TMPC, a producer of outdoor design products, integrating it into its Fibergrate Structure business. This acquisition broadens RPM’s product portfolio with flooring and roofing pedestals and accessories, supporting its strategy of diversification and strengthening its footprint in the European market. By expanding into adjacent markets with synergies in construction and outdoor infrastructure, RPM enhances both its growth opportunities and resilience in competitive industrial coatings and materials sectors

- In October 2023, Sherwin-Williams completed the acquisition of Germany-based SIC Holding, which included Oskar Nolte GmbH and Klumpp Coatings GmbH, both recognized for expertise in industrial wood coatings. This move significantly strengthened Sherwin-Williams’ presence in the European coatings market and expanded its portfolio with radiation-cured, foil, and water-based coatings technologies. The acquisition enhances the company’s innovation capabilities and positions it as a stronger competitor in the high-value industrial wood coatings sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Solvent Borne Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Solvent Borne Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Solvent Borne Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.