Global Sound Quality Testing Market

Market Size in USD Billion

CAGR :

%

USD

2.77 Billion

USD

4.52 Billion

2024

2032

USD

2.77 Billion

USD

4.52 Billion

2024

2032

| 2025 –2032 | |

| USD 2.77 Billion | |

| USD 4.52 Billion | |

|

|

|

|

Sound Quality Testing Market Size

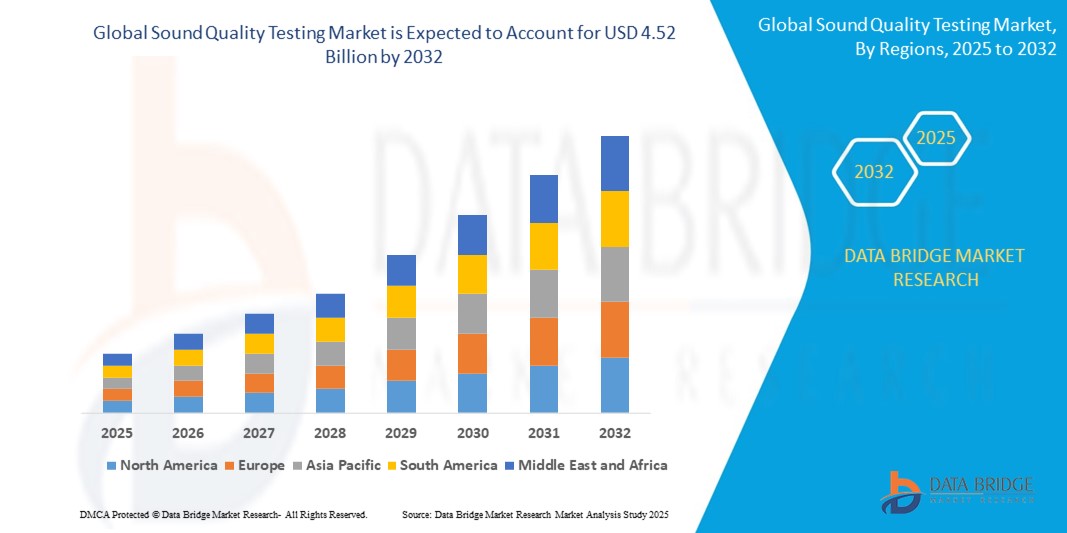

- The global sound quality testing market size was valued at USD 2.77 billion in 2024 and is expected to reach USD 4.52 billion by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is largely fuelled by the increasing adoption of acoustic measurement systems across automotive, consumer electronics, and industrial sectors, driven by the rising demand for enhanced audio performance and noise reduction technologies

- The growing need for compliance with stringent regulatory standards regarding product noise levels and environmental noise emissions is also contributing significantly to the market’s expansion

Sound Quality Testing Market Analysis

- The sound quality testing market is witnessing steady expansion due to growing consumer expectations for premium sound experiences in products such as vehicles, smartphones, speakers, and home entertainment systems

- Manufacturers are increasingly investing in advanced testing tools to ensure optimal product performance, reduce noise, and comply with regulatory standards

- North America dominated the sound quality testing market with the largest revenue share in 2024, driven by the presence of major consumer electronics manufacturers and increased demand for high-performance audio solutions across automotive and smart device segments

- Asia-Pacific region is expected to witness the highest growth rate in the global sound quality testing market, driven by a booming consumer electronics industry, rising urbanization, and increased emphasis on product quality by regional manufacturers in countries such as China, South Korea, and Japan

- The loudspeakers and micro speakers segment dominated the market with the largest revenue share in 2024, driven by the growing demand for immersive sound in home entertainment systems, personal audio devices, and commercial audio installations. The increasing penetration of smart speakers, soundbars, and portable wireless devices is fuelling extensive sound validation processes to ensure clarity, frequency balance, and noise suppression. Manufacturers are investing in high-precision audio testing to meet consumer expectations for distortion-free, high-resolution audio across all price points

Report Scope and Sound Quality Testing Market Segmentation

|

Attributes |

Sound Quality Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Acoustic Testing in Electric Vehicles • Growing Adoption of Smart Consumer Devices Requiring Sound Optimization |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Sound Quality Testing Market Trends

“Integration of Artificial Intelligence in Acoustic Analysis”

- Artificial Intelligence (AI) and machine learning algorithms are increasingly being integrated into acoustic testing tools to automate fault detection, pattern recognition, and real-time performance adjustments, enabling faster diagnostics and reducing manual intervention during product development

- These AI-enabled systems are capable of analyzing complex acoustic signatures across multiple environments, from consumer electronics to automotive interiors, improving the detection of subtle inconsistencies and enhancing product reliability before market release

- Major players in the automotive and electronics sectors are adopting AI-powered sound testing solutions to refine noise levels, such as Tesla’s AI-driven audio calibration systems and Apple’s use of machine learning in tuning speaker outputs for optimal clarity and consistency

- For instance, AI-assisted noise testing has enabled luxury automakers such as BMW to optimize cabin acoustics in electric vehicles, where traditional engine sounds are absent and minor noises are more noticeable to consumers

- This trend is reshaping the acoustic validation process, supporting faster time-to-market, improved user satisfaction, and greater product competitiveness in noise-sensitive industries such as transportation and entertainment

Sound Quality Testing Market Dynamics

Driver

“Increasing Demand for High-Performance Acoustic Systems in Automobiles”

- Rising consumer expectations for high-fidelity audio experiences in automotive, consumer electronics, and smart home devices are driving demand for advanced sound quality testing systems capable of ensuring consistent performance across a range of use conditions

- Automakers are heavily investing in NVH (Noise, Vibration, and Harshness) testing equipment to deliver quieter and more refined in-cabin environments, particularly in electric vehicles where reduced mechanical noise makes other sound anomalies more perceptible

- Companies such as Mercedes-Benz and Hyundai are leveraging acoustic simulation software and real-world audio analysis to fine-tune engine mounts, infotainment systems, and ambient sound features to differentiate their brand experiences in premium vehicle segments

- For instance, Audi’s integration of noise control algorithms and directional microphones in cabin testing has helped reduce road noise by over 30%, contributing to improved customer satisfaction and brand loyalty

- The focus on delivering immersive audio environments is also gaining ground in sectors such as gaming and smart speakers, where sound quality testing ensures competitive differentiation and user engagement through superior acoustic design

Restraint/Challenge

“High Cost of Equipment and Skilled Personnel”

- High capital investment required for setting up sophisticated acoustic laboratories, including anechoic chambers, calibrated microphones, vibration isolators, and high-resolution signal analyzers, is discouraging adoption among small- and mid-scale manufacturers and independent testing facilities

- Ongoing costs related to equipment maintenance, periodic calibration, environmental compliance, and skilled technician training further escalate the operational burden, particularly in emerging markets where demand may not justify long-term investment

- Complex acoustic testing protocols, diverse industry standards, and rapidly evolving technology make it difficult for smaller firms to stay compliant and competitive without incurring additional costs in certifications and system upgrades

- For instance, several acoustic testing projects in Southeast Asia and South America have been delayed or scaled down due to limited infrastructure, technician shortages, and difficulty meeting international testing standards, restricting these regions from capitalizing on rising local demand

- These financial and logistical barriers are restraining market growth in underdeveloped regions, indicating the need for modular, cost-effective testing solutions and targeted support programs to encourage broader market participation and innovation

Sound Quality Testing Market Scope

The market is segmented on the basis of product and end user.

- By Product

On the basis of product, the sound quality testing market is segmented into loudspeakers and micro speakers, automotive audio, wireless devices, telephones, smartphones, hearing aids, and others. The loudspeakers and micro speakers segment dominated the market with the largest revenue share in 2024, driven by the growing demand for immersive sound in home entertainment systems, personal audio devices, and commercial audio installations. The increasing penetration of smart speakers, soundbars, and portable wireless devices is fuelling extensive sound validation processes to ensure clarity, frequency balance, and noise suppression. Manufacturers are investing in high-precision audio testing to meet consumer expectations for distortion-free, high-resolution audio across all price points.

The hearing aids segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising global awareness of hearing health and advances in miniaturized audio technologies. Sound testing is critical in hearing aid production to ensure accurate frequency response, voice clarity, and background noise filtering, especially as digital and AI-powered hearing solutions become more prevalent. Regulatory standards and the shift towards personalized hearing experiences are also contributing to the segment’s rapid expansion.

- By End User

On the basis of end user, the sound quality testing market is segmented into automotive and transportation, aerospace and defence, power generation, consumer electronics, construction, industrial equipment, mining and metallurgy, and others. The automotive and transportation segment held the largest market share in 2024, driven by the rising integration of in-cabin infotainment systems and noise reduction solutions in electric and luxury vehicles. Automakers are focusing on delivering acoustically optimized cabin experiences, using sound quality testing to eliminate unwanted noise and refine speaker performance. With the rise of electric vehicles, subtle sound discrepancies become more prominent, further elevating the importance of acoustic analysis.

The consumer electronics segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for high-fidelity audio in smartphones, tablets, and wearable devices. Manufacturers are emphasizing precision audio testing to enhance product differentiation, particularly in competitive segments such as mobile audio and gaming headsets. The rapid evolution of user expectations for sound quality is pushing consumer electronics brands to adopt more sophisticated sound validation tools and standards.

Sound Quality Testing Market Regional Analysis

• North America dominated the sound quality testing market with the largest revenue share in 2024, driven by the presence of major consumer electronics manufacturers and increased demand for high-performance audio solutions across automotive and smart device segments

• The region benefits from early adoption of advanced testing technologies, stringent quality standards, and strong investments in research and development focused on enhancing user audio experience

• Rising integration of wireless audio systems and connected vehicles is further accelerating the adoption of precision acoustic measurement tools in North America’s automotive and electronics sectors

U.S. Sound Quality Testing Market Insight

The U.S. sound quality testing market accounted for the largest revenue share within North America in 2024, owing to the country’s well-established consumer electronics and automotive industries. The increasing focus on delivering immersive audio experiences in smartphones, wearables, and electric vehicles is driving demand for sophisticated audio testing solutions. In addition, the growing adoption of artificial intelligence and machine learning in audio analysis tools supports enhanced accuracy and customization in quality testing across diverse end-user applications

Europe Sound Quality Testing Market Insight

The Europe sound quality testing market is expected to witness the fastest growth rate from 2025 to 2032, fueled by strict regulatory norms concerning product noise emissions and growing demand for enhanced audio quality in consumer devices. Countries such as Germany, France, and the U.K. are witnessing a rise in the adoption of testing systems in automotive, industrial equipment, and telecommunication sectors. Increasing investment in advanced testing laboratories and the emphasis on sustainability through noise reduction measures are further supporting market growth

Germany Sound Quality Testing Market Insight

The Germany sound quality testing market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s dominant position in the automotive and engineering sectors. The emphasis on superior acoustic performance in electric and autonomous vehicles is driving the adoption of robust sound testing equipment. Germany's strong manufacturing base and innovation-driven ecosystem are enhancing demand for reliable and accurate sound analysis solutions, particularly in high-end industrial and consumer applications

Asia-Pacific Sound Quality Testing Market Insight

The Asia-Pacific sound quality testing market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid expansion of the consumer electronics and automotive sectors in countries such as China, Japan, South Korea, and India. The region’s growing middle-class population and rising demand for premium audio features in mobile devices and vehicles are fueling market growth. In addition, increasing localization of manufacturing and government-led initiatives to improve industrial quality standards are fostering broader adoption of sound testing technologies

China Sound Quality Testing Market Insight

The China sound quality testing market captured the largest revenue share in Asia Pacific in 2024, attributed to the country’s expansive electronics manufacturing industry and its rapid shift toward high-performance audio components. The rise of local brands in smartphones, wearables, and home audio products is boosting the need for efficient and accurate testing solutions. Moreover, government initiatives encouraging domestic innovation and quality control practices are playing a critical role in the continued growth of the market

Japan Sound Quality Testing Market Insight

The Japan sound quality testing market is expected to witness the fastest growth rate from 2025 to 2032, backed by the country’s advanced consumer electronics sector and strong emphasis on product precision. The growing use of high-fidelity audio in smartphones, hearing aids, and smart home devices is driving demand for reliable testing systems. In addition, Japan’s established automotive sector, known for its quality and innovation, is adopting advanced sound testing to refine in-car entertainment and noise control systems, contributing to consistent market expansion

Sound Quality Testing Market Share

The Sound Quality Testing industry is primarily led by well-established companies, including:

- NATIONAL INSTRUMENTS CORP. (U.S.)

- Listen Inc. (U.S.)

- Brüel & Kjær (Denmark)

- Siemens (Germany)

- Prism Media Products Limited (U.K.)

- HEAD acoustics GmbH (Germany)

- imc Test & Measurement GmbH (Germany)

- Sciemetric Instruments ULC (Canada)

- Dewesoft d.o.o. (Slovenia)

- Prosig Ltd. (U.K.)

- GRAS Sound & Vibration (Denmark)

- m+p international measurement and computer technology GmbH(Germany)

- Signal.X Technologies, LLC (U.S.)

- Honeywell International Inc. (U.S.)

- ESI Group (France)

- Thermotron Industries (U.S.)

- Polytec GmbH (Germany)

- Benstone Instruments (Taiwan)

- PCB Piezotronics Inc (U.S.)

Latest Developments in Global Sound Quality Testing Market

- In January 2023, Imc Test & Measurement introduced a new development by launching the Modbus Fieldbus Interface for its imc DAQ Platform. This innovation enables seamless integration of Modbus-enabled external devices, sensors, and data sources into the imc measurement system. Acting as a Modbus client, it supports both Modbus TCP and Modbus RTU protocols, allowing communication with multiple Modbus server devices simultaneously. This advancement is expected to enhance system flexibility and data acquisition efficiency. The development strengthens the company’s portfolio and is likely to boost its presence in industrial automation and test and measurement markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sound Quality Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sound Quality Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sound Quality Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.