Global Sourcing Equipment Ethernet Market

Market Size in USD Billion

CAGR :

%

USD

1.07 Billion

USD

4.76 Billion

2024

2032

USD

1.07 Billion

USD

4.76 Billion

2024

2032

| 2025 –2032 | |

| USD 1.07 Billion | |

| USD 4.76 Billion | |

|

|

|

|

What is the Global Sourcing Equipment Ethernet Market Size and Growth Rate?

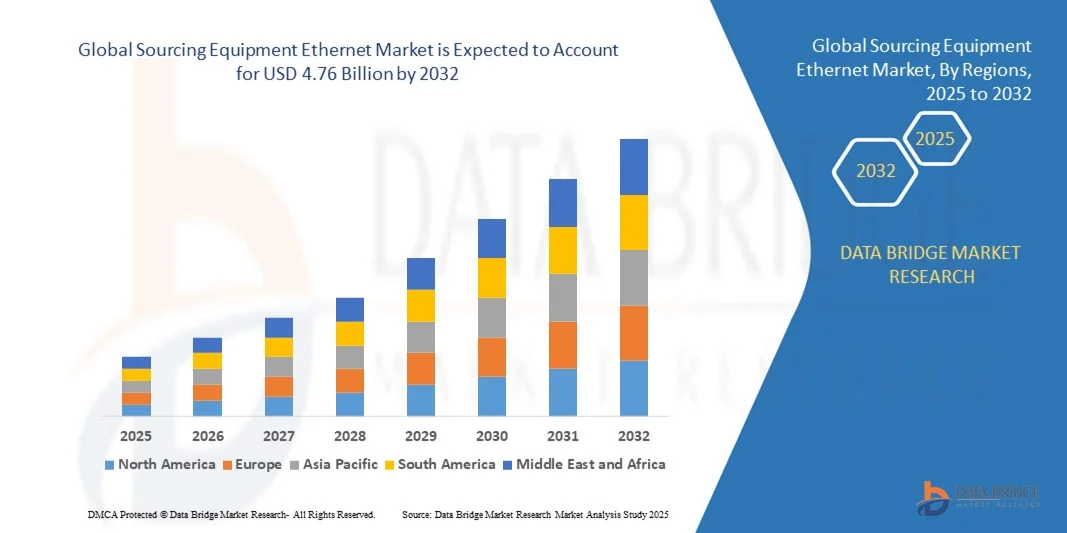

- The global sourcing equipment ethernet market size was valued at USD 1.07 billion in 2024 and is expected to reach USD 4.76 billion by 2032, at a CAGR of 20.53% during the forecast period

- The growing adoption of voice over internet protocol (VoIP) phones and wireless networking, increasing preferences towards simple and cost-effective installation, high level of reliability, rising demand for network security cameras, prevalence of efficient monitoring and flexible network architectures, improved network control along with rising demand of LED lighting system are some of the major as well as important factors which will likely to accelerate the growth of the sourcing equipment ethernet market

What are the Major Takeaways of Sourcing Equipment Ethernet Market?

- Rising demand of new POE standards along with surge in the usage of POE-compatible devices which will further contribute by generating immense opportunities that will led to the growth of the sourcing equipment ethernet market in the above-mentioned projected timeframe

- Increasing number of limitations on the amount of power delivered to end devices along with high cost of product which will likely to act as market restraints factor for the growth of the sourcing equipment ethernet in the above-mentioned projected timeframe. Limited range of POE which will become the biggest and foremost challenge for the growth of the market

- North America dominated the sourcing equipment ethernet market with the largest revenue share of 41.31% in 2024, driven by the high adoption of advanced networking infrastructure, increased awareness of smart building solutions, and strong corporate investments in connected devices

- The Asia-Pacific market is poised to grow at the fastest CAGR of 11.54% during the forecast period from 2025 to 2032, driven by rapid urbanization, rising industrial automation, and increasing adoption of smart building and smart city initiatives

- The IEEE 802.3AT (POE+) segment dominated the market with the largest revenue share of 45% in 2024, driven by its ability to provide higher power levels for advanced devices such as IP cameras, access control systems, and Wi-Fi access points

Report Scope and Sourcing Equipment Ethernet Market Segmentation

|

Attributes |

Sourcing Equipment Ethernet Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Sourcing Equipment Ethernet Market?

Enhanced Connectivity Through Smart Integration and Automation

- A key trend driving the global sourcing equipment ethernet market is the growing integration with smart industrial systems, AI, and automation platforms. Manufacturers and industrial facilities are increasingly adopting Ethernet-enabled sourcing equipment to enable seamless communication, real-time monitoring, and remote control of production processes

- For instance, advanced Ethernet-enabled sourcing systems from companies such as Siemens and ABB allow users to monitor conveyor speeds, inventory levels, and machine status in real time, improving operational efficiency and minimizing downtime

- AI integration enables predictive maintenance, anomaly detection, and automated adjustments based on equipment usage patterns. For instance, smart sensors in sourcing equipment can alert operators of potential failures before they occur, optimizing workflow and reducing operational costs

- Ethernet-enabled systems also support integration with industrial IoT (IIoT) networks, enabling centralized monitoring, analytics, and control over multiple machines and production lines from a single interface

- The trend toward automated, interconnected, and intelligent sourcing solutions is reshaping expectations for operational efficiency and reliability. Companies such as Rockwell Automation and Schneider Electric are actively developing Ethernet-enabled sourcing equipment with advanced analytics, remote monitoring, and automated control capabilities

- Demand for these intelligent, networked sourcing solutions is growing rapidly across manufacturing, logistics, and warehouse operations, as businesses increasingly prioritize efficiency, visibility, and system-wide integration

What are the Key Drivers of Sourcing Equipment Ethernet Market?

- The rising demand for operational efficiency and real-time visibility across production and warehouse processes is a major driver for sourcing equipment ethernet adoption

- For instance, in March 2024, ABB announced Ethernet-enabled sourcing solutions that integrate with industrial control systems to improve inventory tracking and automate material handling. Such innovations are expected to propel market growth

- Companies increasingly prefer sourcing equipment that supports remote monitoring, predictive maintenance, and data analytics, reducing operational risks and enhancing overall productivity

- The growing adoption of industrial automation, smart warehouses, and IoT-driven manufacturing is making Ethernet-enabled sourcing equipment a core component of modern production ecosystems

- Features such as centralized control, automated alerts, remote troubleshooting, and seamless integration with other smart factory devices are key factors driving adoption. Businesses benefit from improved workflow, reduced downtime, and enhanced operational insights

- The trend toward scalable, user-friendly, and interconnected sourcing solutions further contributes to the market expansion, especially in industrial sectors focusing on automation and smart logistics

Which Factor is Challenging the Growth of the Sourcing Equipment Ethernet Market?

- Cybersecurity risks and network vulnerabilities in Ethernet-enabled sourcing equipment pose a key challenge, as connected systems are susceptible to hacking, data breaches, and operational disruptions

- High-profile incidents in industrial IoT networks have caused hesitancy among companies to fully adopt Ethernet-connected sourcing solutions without adequate security protocols

- Addressing these concerns through robust encryption, secure authentication, and regular software updates is critical. Companies such as Siemens and Rockwell Automation emphasize industrial-grade cybersecurity features to build trust

- In addition, the relatively high upfront cost of advanced Ethernet-enabled sourcing systems compared to traditional equipment can limit adoption, particularly in small and medium-sized enterprises or developing region

- While prices are gradually decreasing, the perceived premium for networked and automated equipment can still slow adoption, especially for facilities not immediately requiring advanced capabilities

- Overcoming these challenges through affordable solutions, enhanced cybersecurity, and operator training will be essential for sustained growth in the Sourcing Equipment Ethernet market

How is the Sourcing Equipment Ethernet Market Segmented?

The sourcing equipment ethernet market is segmented on the basis of Ethernet standard, type, device type, application, vertical, and power to port.

- By Ethernet Standard

On the basis of Ethernet standard, the market is segmented into IEEE 802.3AF (POE), IEEE 802.3AT (POE+), and IEEE 802.3BT. The IEEE 802.3AT (POE+) segment dominated the market with the largest revenue share of 45% in 2024, driven by its ability to provide higher power levels for advanced devices such as IP cameras, access control systems, and Wi-Fi access points.

The IEEE 802.3BT segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing adoption of high-power devices requiring over 60W per port, especially in commercial and industrial applications where power-hungry IoT and networking devices are increasingly deployed.

- By Type

On the basis of type, the market is segmented into POE Power Sourcing Equipment (PSE) Controllers and ICS, and POE Powered Device (PD) Controllers and ICS. The POE PSE Controllers and ICS segment held the largest revenue share of 52% in 2024, owing to the critical role of PSE in supplying power to connected devices while maintaining network stability.

The PD Controllers and ICS segment is expected to witness the fastest CAGR, as the demand for intelligent powered devices grows across smart buildings, security, and industrial automation systems.

- By Device Type

On the basis of device type, the market is segmented into Endspan Power Sourcing Equipment (POE Switch) and Midspan Power Sourcing Equipment (POE Injector). The Endspan PSE segment dominated the market with a 60% share in 2024, largely because of its integrated power and data delivery, simplifying deployment in new networks.

The Midspan PSE segment is projected to witness the fastest growth, driven by its adoption in retrofit applications, enabling existing network devices to become POE-enabled without replacing switches.

- By Application

On the basis of application, the market is segmented into Connectivity, Security and Access Control, Infotainment, LED Lighting Control, and Others. The Security and Access Control segment dominated with a revenue share of 47% in 2024, fueled by rising adoption of IP cameras, smart locks, and access management systems.

The Connectivity segment is expected to grow the fastest, driven by expansion of enterprise and campus networks, Wi-Fi access points, and centralized networking solutions requiring reliable power and data delivery.

- By Vertical

On the basis of vertical, the market is segmented into Commercial, Residential, and Industrial. The Commercial vertical accounted for the largest revenue share of 50% in 2024, owing to the wide deployment of Ethernet-powered devices in offices, retail, and corporate campuses.

The Industrial vertical is projected to witness the fastest CAGR, supported by automation, smart manufacturing, and the increasing integration of IoT devices in industrial networks.

- By Power to Port

On the basis of power to port, the market is segmented into Up to 15.4W, Up to 30W, Up to 60W, and Up to 100W. The Up to 30W segment dominated with a market share of 46% in 2024, as most mid-range IP devices and access points operate efficiently within this power range.

The Up to 100W segment is expected to witness the fastest growth, driven by high-power IoT devices, LED lighting systems, and multi-device deployments in commercial and industrial setups requiring high wattage per port.

Which Region Holds the Largest Share of the Sourcing Equipment Ethernet Market?

- North America dominated the sourcing equipment ethernet market with the largest revenue share of 41.31% in 2024, driven by the high adoption of advanced networking infrastructure, increased awareness of smart building solutions, and strong corporate investments in connected devices

- Consumers and enterprises in the region highly value the reliability, scalability, and integration capabilities offered by Sourcing Equipment Ethernets across commercial, industrial, and residential networks

- The widespread adoption is further supported by high technological penetration, robust IT infrastructure, and the preference for centralized network management solutions, establishing Sourcing Equipment Ethernets as a preferred choice for both small-scale and enterprise-level deployments

U.S. Sourcing Equipment Ethernet Market Insight

The U.S. market captured the largest revenue share of 81% in North America in 2024, fueled by the growing deployment of POE-powered devices and network automation solutions. Enterprises are increasingly prioritizing high-efficiency and reliable connectivity solutions, with a focus on smart building integration and IoT adoption. The adoption of next-generation Ethernet standards, combined with cloud-based monitoring and management, is significantly contributing to market expansion.

Europe Sourcing Equipment Ethernet Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, driven by strict regulatory compliance and the increasing need for energy-efficient and intelligent network solutions. The adoption of sourcing equipment ethernets is rising across commercial complexes, industrial facilities, and residential projects, with a focus on improving operational efficiency and security.

U.K. Sourcing Equipment Ethernet Market Insight

The U.K. market is expected to grow at a notable CAGR, fueled by increasing investments in smart offices, data centers, and home automation. The integration of Ethernet-powered devices into corporate and residential networks is supporting market growth, alongside government initiatives promoting digital infrastructure development.

Germany Sourcing Equipment Ethernet Market Insight

Germany’s market is projected to grow steadily, driven by industrial automation, smart city projects, and a strong preference for energy-efficient networking solutions. The country’s advanced manufacturing and IT sectors are increasingly deploying Sourcing Equipment Ethernets to enhance operational control and connectivity.

Which Region is the Fastest Growing Region in the Sourcing Equipment Ethernet Market?

The Asia-Pacific market is poised to grow at the fastest CAGR of 11.54% during the forecast period from 2025 to 2032, driven by rapid urbanization, rising industrial automation, and increasing adoption of smart building and smart city initiatives. Countries such as China, Japan, and India are witnessing significant investment in networking infrastructure and connected devices. The growing manufacturing capabilities in the region are also improving affordability and accessibility of Sourcing Equipment Ethernets for enterprises and residential users.

Japan Sourcing Equipment Ethernet Market Insight

Japan’s market is gaining traction due to the country’s high-tech environment, urban expansion, and growing demand for integrated building solutions. The adoption of Sourcing Equipment Ethernets is increasing in commercial buildings, industrial networks, and residential complexes, supported by IoT integration and advanced network management systems.

China Sourcing Equipment Ethernet Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, the expanding middle-class workforce, and high technology adoption rates. The push towards smart city initiatives, coupled with affordable Ethernet solutions and strong domestic manufacturers, is propelling the market. Sourcing Equipment Ethernets are increasingly being deployed across commercial, residential, and industrial infrastructures, establishing China as a key contributor to APAC market growth.

Which are the Top Companies in Sourcing Equipment Ethernet Market?

The sourcing equipment ethernet industry is primarily led by well-established companies, including:

- Maxim Integrated (U.S.)

- Texas Instruments Incorporated (U.S.)

- Microsemi (U.S.)

- STMicroelectronics (Switzerland)

- Broadcom (U.S.)

- Monolithic Power Systems, Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- Cisco (U.S.)

- Silicon Laboratories (U.S.)

- Avnet, Inc. (U.S.)

- Axis Communications AB (Sweden)

- MSTronic Co., Ltd (China)

- Belden Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Microchip Technology Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Honeywell International Inc (U.S.)

- HP Development Company, L.P. (U.S.)

- Dell (U.S.)

- ALE International, ALE USA Inc. (France / U.S.)

- NETGEAR Inc. (U.S.)

What are the Recent Developments in Global Sourcing Equipment Ethernet Market?

- In May 2025, Rockwell Automation introduced its EtherNet/IP In-cabinet Solution, a major advancement designed to meet the growing demand for smarter, faster, and more connected manufacturing operations, simplifying wiring and integration, accelerating panel production, and enhancing diagnostics, thereby enabling more intelligent manufacturing, which is expected to significantly improve operational efficiency

- In April 2025, OMRON Corporation inaugurated a new Automation Center in Stuttgart dedicated to advancing industrial automation and Ethernet-based technologies, serving as a collaborative hub where customers can explore innovative factory automation approaches, co-develop tailored solutions, and test them in practical, regionally relevant settings, which will strengthen customer engagement and innovation

- In April 2025, Belden Inc. launched the Hirschmann GREYHOUND 2000 Standard Switch, a next-generation device optimized for diverse connectivity requirements, featuring configurable modules, high fiber port density, rugged design, and advanced cybersecurity, making it ideal for power, transit, and industrial applications, which enhances network reliability and future-proofing

- In July 2024, Rockwell Automation collaborated with Cisco Systems, Inc. to develop the Stratix 5200 Ethernet switches, improving OT and IT integration with increased functionality, security, and seamless compatibility with Rockwell’s Studio 5000 software, built on the Cisco IOS XE platform supporting high-speed, redundant architectures and Layer 2 access switching, which ensures robust network performance and compliance with global cybersecurity standards

- In July 2024, Moxa Inc. launched the MRX Series Layer 3 rackmount Ethernet switches supporting up to 64 ports, along with the EDS-4000/G4000 Series Layer 2 switches offering 2.5GbE uplinks to enable high-bandwidth IT/OT convergence for industrial applications, providing industrial-grade reliability, network redundancy, and simplified deployment, which helps future-proof network infrastructures and improve operational resilience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.