Global Sourdough Market

Market Size in USD Billion

CAGR :

%

USD

2.86 Billion

USD

4.49 Billion

2024

2032

USD

2.86 Billion

USD

4.49 Billion

2024

2032

| 2025 –2032 | |

| USD 2.86 Billion | |

| USD 4.49 Billion | |

|

|

|

|

Sourdough Market Size

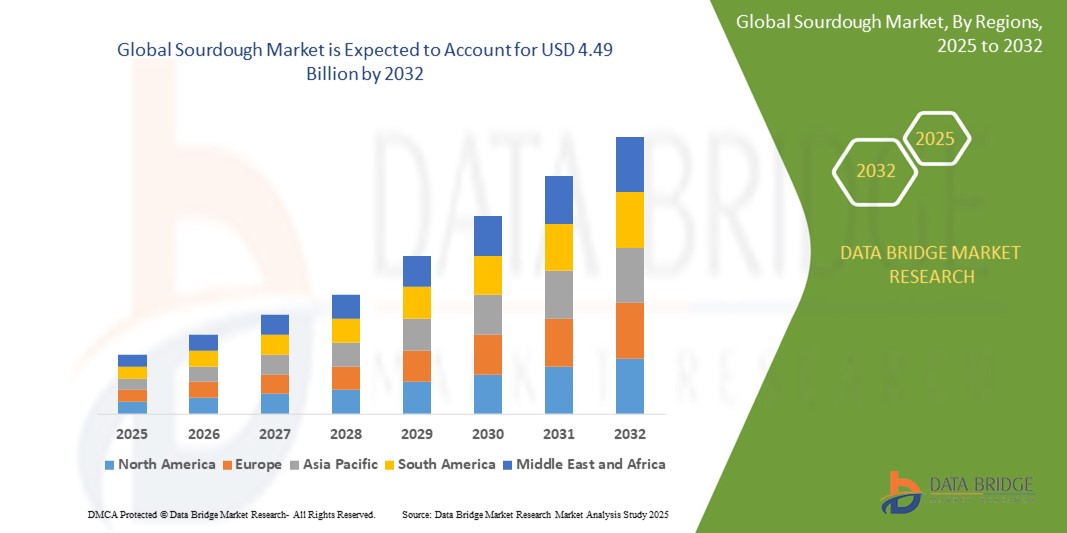

- The global sourdough market size was valued at USD 2.86 billion in 2024 and is expected to reach USD 4.49 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by the increasing consumer shift toward clean-label, fermented, and gut-friendly bakery products, with sourdough gaining popularity for its natural leavening process and perceived health benefits, including improved digestion and lower glycemic impact

- Furthermore, the rising demand for artisanal and premium baked goods across both developed and emerging markets is positioning sourdough as a preferred choice among health-conscious and flavor-seeking consumers. These converging factors are accelerating product innovation and adoption, thereby significantly boosting the sourdough market's growth

Sourdough Market Analysis

- Sourdough, a naturally fermented dough made using wild yeast and lactic acid bacteria, is increasingly recognized as a premium and health-forward alternative to conventional bread and baked goods due to its enhanced digestibility, rich flavor, and clean-label appeal in both artisanal and commercial baking

- The escalating demand for sourdough is primarily fueled by growing consumer awareness of gut health, rising preference for minimally processed foods, and the global resurgence of traditional and craft baking practices across retail, foodservice, and packaged product segments

- Europe dominated the sourdough market with a share of 30.9% in 2024 due to strong consumer demand for artisanal, clean-label, and fermented bakery products across countries such as Germany, France, and Italy

- Asia-Pacific is expected to be the fastest growing region in the sourdough market during the forecast period due to rising urbanization, health awareness, and the growing adoption of Western bakery trends.

- Breads segment dominated the market with a market share of 60.6% in 2024 due to the rising demand for flavorful, gut-friendly bread options and the growing popularity of artisanal bakery products

Report Scope and Sourdough Market Segmentation

|

Attributes |

Sourdough Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sourdough Market Trends

“Increasing Demand for Health-Focused Options”

- A significant and accelerating trend in the global sourdough market is the growing consumer demand for health-focused bakery options that offer digestive benefits, clean-label formulations, and reduced additives. Sourdough, with its natural fermentation process, aligns strongly with these preferences by offering improved nutrient absorption and better glycemic control compared to conventional bread

- For instance, many commercial bakeries and food brands are launching sourdough variants marketed as easier to digest and rich in prebiotics, catering to consumers with food sensitivities or those seeking gut-friendly alternatives. Brands such as Berlin Natural Bakery and Tartine Bakery have gained popularity by emphasizing the health and authenticity of their sourdough processes

- Scientific interest and public awareness around the microbiome and fermented foods are also contributing to the increased visibility of sourdough in mainstream retail. As consumers grow more ingredient-conscious, they are gravitating toward sourdough as a recognizable, wholesome option free from chemical leaveners and preservatives

- The rise of functional foods and wellness-oriented eating patterns is further reinforcing sourdough’s appeal. Product developers are increasingly incorporating whole grains, ancient grains, and seeds into sourdough formulations to enhance nutritional value and target niche segments such as high-fiber or low-gluten diets

- This trend toward health-enhancing bakery products is fundamentally reshaping consumer expectations across global markets. Consequently, bakery chains, packaged food manufacturers, and even fast-casual restaurants are expanding their sourdough offerings to align with demand for nutritious, artisanal, and better-for-you food choices

- The demand for sourdough that supports digestive wellness and fits into clean eating lifestyles is growing rapidly across both developed and emerging markets, positioning it as a central component in the evolution of the health-focused bakery sector

Sourdough Market Dynamics

Driver

“Growing Demand for Artisan and Craft Baking”

- The increasing consumer preference for authentic, handmade, and small-batch bakery products is a significant driver for the growing demand for sourdough in both retail and foodservice sectors

- For instance, in 2024, several artisanal bakeries expanded their sourdough lines, emphasizing traditional fermentation techniques and locally sourced ingredients to appeal to discerning consumers seeking quality and craftsmanship. Such initiatives by key players are expected to accelerate sourdough market growth in the forecast period

- As consumers become more interested in food provenance, natural processes, and unique flavors, sourdough offers a compelling alternative to mass-produced bread due to its rich taste profile and artisanal heritage

- Furthermore, the growing popularity of craft baking and home baking trends, fueled by social media and food culture influencers, is increasing consumer engagement with sourdough products and DIY sourdough starters

- The trend toward healthier, more natural bakery options combined with the desire for artisanal quality is propelling the sourdough market expansion across both developed and emerging markets worldwide

Restraint/Challenge

“Complex Production Process”

- The complexity and time-intensive nature of sourdough production pose a significant challenge to broader market expansion. As sourdough requires careful fermentation, precise temperature control, and longer proofing times, it demands more skill and labor compared to conventional bread-making processes

- For instance, artisanal bakeries and industrial producers face difficulties in scaling sourdough production while maintaining consistent quality and flavor profiles, which can limit supply and increase production costs

- Addressing these production challenges through improved fermentation technology, standardized starter cultures, and enhanced process automation is crucial for meeting growing consumer demand. Companies and bakeries are investing in R&D to optimize sourdough workflows without compromising its traditional characteristics

- In addition, the longer production cycle of sourdough can lead to higher operational costs, making sourdough products relatively more expensive than mass-produced breads, which may deter price-sensitive consumers in some markets

- Overcoming these challenges through technological innovations, training, and efficient scaling methods will be vital for sustained growth and wider availability of sourdough products worldwide

Sourdough Market Scope

The market is segmented on the basis of type, application, form, source, and distribution channel.

- By Type

On the basis of type, the sourdough market is segmented into Type-I, Type-II, and Type-III. The Type-III segment accounted for the largest market revenue share of 43.3% in 2024, driven by its high adaptability to industrial-scale baking processes and consistent quality output. Unlike traditional sourdough, Type-III is typically pasteurized or dried, allowing for extended shelf life, simplified handling, and easy integration into automated food production systems—making it a preferred choice among large commercial bakeries and packaged food manufacturers.

The Type-II segment is projected to witness the fastest growth rate of 7.9% from 2025 to 2032, driven by its suitability for industrial baking processes and consistent performance in controlled production environments. Type-II sourdoughs offer extended shelf life and efficiency in large-scale food manufacturing, encouraging broader commercial adoption.

- By Application

On the basis of application, the sourdough market is segmented into food and beverages, pancakes, waffles, desserts, muffins, piecrust, breads, cookies, cakes, pizza, and others. The breads segment held the largest market revenue share of 60.6% in 2024, fueled by the rising demand for flavorful, gut-friendly bread options and the growing popularity of artisanal bakery products.

The pizza segment is expected to witness the fastest CAGR of 8.6% from 2025 to 2032, driven by the rising consumer demand for artisanal and gourmet-style pizzas featuring healthier, fermented crusts. Sourdough’s unique tangy flavor, natural leavening, and digestive benefits have led to its increasing use in premium and frozen pizza offerings, as brands seek to differentiate through quality and health appeal in a competitive market.

- By Form

On the basis of form, the sourdough market is segmented into dry and liquid. The dry segment dominated the market in 2024, driven by its extended shelf life, ease of storage, and convenience in transportation for large-scale baking operations. Dry sourdoughs are widely used in pre-packaged baking mixes and commercial bakery applications.

The liquid segment is expected to grow at the fastest CAGR from 2025 to 2032, attributed to its enhanced fermentation activity and flavor development, making it ideal for artisanal and premium bakery applications seeking authenticity and superior taste.

- By Source

On the basis of source, the sourdough market is segmented into wheat, rye, oats, and barley. The wheat segment accounted for the largest revenue share in 2024, owing to its widespread use in traditional and modern baking, and its ability to develop robust gluten networks essential for sourdough fermentation.

The rye segment is anticipated to register the fastest growth rate from 2025 to 2032, as consumers increasingly seek denser, fiber-rich alternatives that offer distinct taste profiles and digestive health benefits.

- By Distribution Channel

On the basis of distribution channel, the sourdough market is segmented into store-based and non-store-based. The store-based segment captured the largest market share in 2024, supported by the dominance of supermarkets, bakeries, and specialty stores offering fresh and packaged sourdough products.

The non-store-based segment is poised to grow at the fastest CAGR from 2025 to 2032, driven by the rise of e-commerce platforms, D2C brands, and subscription-based bakery services, which offer consumers convenience and access to niche sourdough products.

Sourdough Market Regional Analysis

- Europe dominated the sourdough market with the largest revenue share of 30.9% in 2024, driven by strong consumer demand for artisanal, clean-label, and fermented bakery products across countries such as Germany, France, and Italy

- European consumers value sourdough for its digestive benefits, natural fermentation process, and richer flavor profile, which aligns with the region’s preference for traditional baking methods and organic ingredients

- The market is further supported by a thriving artisanal bakery culture, rising health consciousness, and growing product innovation across breads, pizza bases, and snacks

U.K. Sourdough Market Insight

U.K. sourdough market is anticipated to grow at a notable CAGR, fueled by the rising popularity of craft baking, increased awareness of gut health, and growing consumer preference for preservative-free bakery products. Demand is being driven by health-focused millennials and premiumization trends in retail and foodservice. Supermarkets and artisanal bakeries are expanding their sourdough offerings, including ready-to-bake and gluten-free variants.

Germany Sourdough Market Insight

Germany’s sourdough market is expected to register significant growth, underpinned by the country’s long-standing tradition of rye-based sourdough breads and consumer preference for nutrient-dense, fiber-rich baked goods. The market is benefiting from innovations in multi-grain and organic sourdough products, as well as increasing penetration in convenience and packaged bread formats. Industrial bakeries are also adopting sourdough starters to meet demand for authentic flavor and improved shelf life.

Asia-Pacific Sourdough Market Insight

Asia-Pacific sourdough market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising urbanization, health awareness, and the growing adoption of Western bakery trends. Countries such as China, Japan, and Australia are witnessing increased demand for fermented bakery products, especially among middle-class consumers seeking digestive benefits and clean-label foods. Product localization, strategic bakery chain expansions, and online bakery platforms are supporting regional market expansion.

Japan Sourdough Market Insight

The Japan sourdough market is gaining momentum, supported by the country’s emphasis on high-quality, health-forward bakery items. Japanese consumers appreciate sourdough’s mild acidity, natural fermentation, and artisanal appeal, particularly in premium breads and convenience store offerings. The integration of sourdough into “shokupan” (Japanese milk bread) and European-style baked goods is boosting product innovation and consumer interest.

China Sourdough Market Insight

The China sourdough market accounted for the largest revenue share in Asia Pacific in 2024, driven by the expanding bakery and café culture, growing health consciousness, and increasing consumer inclination toward naturally leavened bread. E-commerce channels and specialty bakery chains are rapidly introducing sourdough-based products, while domestic manufacturers are investing in scalable sourdough production to meet urban demand for premium, functional foods.

Sourdough Market Share

The sourdough industry is primarily led by well-established companies, including:

- Ernst Böcker GmbH & Co. KG (Germany)

- PURATOS (Belgium)

- Boudin Bakery (U.S.)

- Truckee Sourdough Company (U.S.)

- Morabito Baking Co., Inc. (U.S.)

- Alpha Baking Company, Inc. (U.S.)

- Josey Baker Bread (U.S.)

- The Sourdough Company (U.S.)

- Swiss Bake Ingredients Pvt. Ltd. (India)

- Gluten-Free Sourdough Company (U.S.)

- Sonoma -(U.S.)

- Brian's Artisan Bread Company (U.S.)

- Pasta Fermentata (U.S.)

- Don Rodrigo Sourdough Bakery (U.S.)

- Rotella’s Italian Bakery (U.S.)

- Wild Wheat (U.S.)

- Nantucket Baking Company (U.S.)

- Casa Dolce (U.S.)

- Macphie (U.K.)

- Shepherds Artisan Bakehouse (U.K.)

Latest Developments in Global Sourdough Market

- In October 2024, Lallemand Inc. announced the acquisition of CerealTech Pte Ltd, a prominent bakery ingredient company based in Singapore. The undisclosed deal aims to integrate CerealTech’s operations and workforce into Lallemand’s Baking Solutions (LBS) division, enhancing its offerings. Despite this strategic move, CerealTech will continue to operate under its established brand and commercial teams in Singapore, ensuring continuity for its customers and stakeholders

- In May 2024, Bakels Group introduced Fermdor Active, an innovative concentrated powder designed to enhance bread production. This new ingredient captures the authentic flavor profile of traditional sourdoughs, making it a vital asset for professional bakers. Enriched with specialized active ingredients, Fermdor Active is particularly suited for creating premium artisan bakery products, meeting the increasing consumer demand for authentic and high-quality baked goods in the competitive market

- In May 2024, Puratos Group launched Sapore Lavida, Belgium's first fully traceable active sourdough, made exclusively from whole wheat flour. This pioneering ingredient promotes regenerative agricultural practices, allowing bakers across mainland Europe to respond to the growing consumer preference for locally produced and sustainably sourced sourdough products. By prioritizing transparency and sustainability, Sapore Lavida empowers bakers to create quality offerings while contributing positively to environmental and community well-being

- In December 2023, in a strategic move to bolster its biotechnology capabilities, Lallemand acquired Evolva, a Swiss biotechnology firm known for high-value ingredient production. This acquisition is set to enhance Lallemand's product development across various industries, focusing on innovative solutions through biotechnology and fermentation. By integrating Evolva’s expertise, Lallemand aims to expand its portfolio, strengthen its competitive position in the biotechnology market, and cater to evolving consumer needs

- In August 2022, Puratos and Shiru, an innovative startup specializing in functional ingredients, collaborated to revolutionize chocolate and confectionery production by incorporating sourdough. This partnership focuses on enhancing the nutritional values and flavors of chocolate products while preserving quality. By combining Puratos’ expertise in baking with Shiru’s functional ingredient innovations, the collaboration aims to create healthier and more flavorful confectionery options, appealing to health-conscious consumers

- In January 2021, Puratos expanded its portfolio of local sourdough manufacturers by acquiring Ruskhleb, a leading baking ingredient company in Russia. This strategic acquisition allows Puratos to capitalize on the increasing demand for sourdough products in the region. By integrating Ruskhleb’s operations, Puratos enhances its capabilities in producing authentic sourdough ingredients, supporting local bakers while further establishing its position in the growing sourdough market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sourdough Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sourdough Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sourdough Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.