Global Soy Protein Market

Market Size in USD Billion

CAGR :

%

USD

8.21 Billion

USD

14.90 Billion

2024

2032

USD

8.21 Billion

USD

14.90 Billion

2024

2032

| 2025 –2032 | |

| USD 8.21 Billion | |

| USD 14.90 Billion | |

|

|

|

|

Soy Protein Market Size

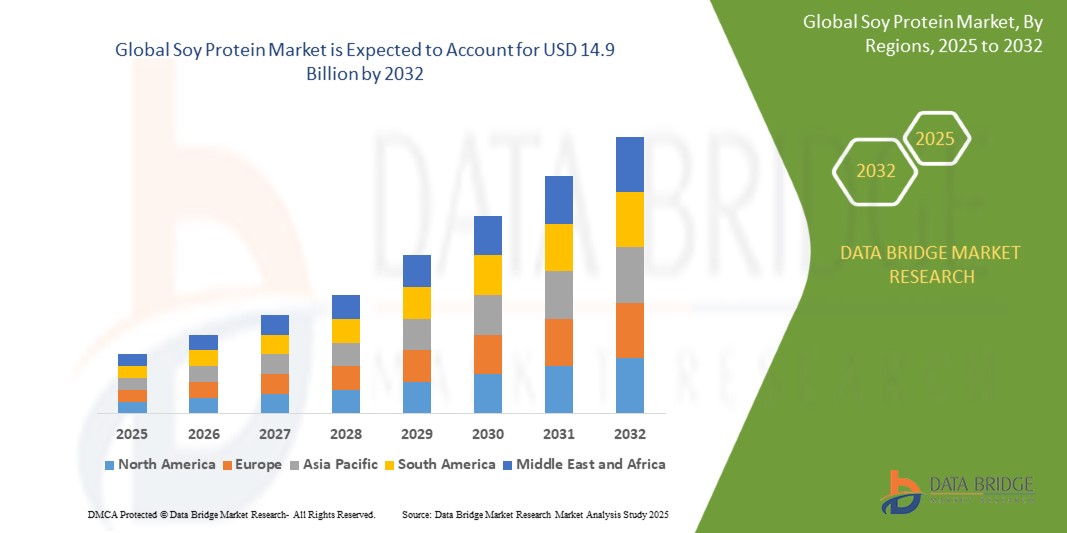

- The global soy protein market size was valued at USD 8.21 billion in 2024 and is expected to reach USD 14.9 billion by 2032, at a CAGR of 6.6% during the forecast period

- The growth of the Soy Protein Market is driven by several key factors, including the rising consumer demand for plant-based protein alternatives, the growing awareness of health and wellness benefits, and the increasing adoption of sustainable and environmentally friendly food products.

Soy Protein Market Analysis

- Soy protein is increasingly being recognized as a versatile and sustainable plant-based protein source, driving its widespread adoption across various industries such as food, beverages, and dietary supplements.

- The demand for soy protein is primarily fueled by rising consumer preference for plant-based products, growing awareness of health benefits, and the increasing trend of vegan and vegetarian diets worldwide

- North America is expected to dominate the soy protein market with a significant market share in 2025, driven by high consumer awareness of the benefits of plant-based proteins, strong investment in research and development, and the growing demand for plant-based alternatives in food products

- Asia-Pacific is projected to be the fastest-growing region in the soy protein market due to increasing urbanization, rising disposable income, and the growing popularity of plant-based proteins in emerging markets like China and India

Report Scope and Soy Protein Market Segmentation

|

Attributes |

Soy Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Soy Protein Market Trends

Increasing Adoption of Plant-Based Proteins in Food and Beverages

- A key trend in the soy protein market is the growing adoption of plant-based proteins in food and beverage products, driven by the rising demand for vegan, vegetarian, and flexitarian diets

- Consumers are increasingly seeking protein-rich plant-based alternatives to meat and dairy products, with soy protein being one of the most popular and versatile options.For example, soy protein is being used in plant-based meat substitutes, dairy alternatives like soy milk and yogurt, and protein bars, catering to a broad spectrum of health-conscious and environmentally aware consumers

- For example, soy protein is being used in plant-based meat substitutes, dairy alternatives like soy milk and yogurt, and protein bars, catering to a broad spectrum of health-conscious and environmentally aware consumers

- This trend is accelerating the development of innovative food products that offer both nutrition and sustainability, as manufacturers look to meet the growing demand for eco-friendly and health-conscious food options

Soy Protein Market Dynamics

Driver

Rising Demand for Plant-Based Proteins and Health-Conscious Diets

- The growing global shift toward plant-based diets and health-conscious food choices is significantly driving the demand for soy protein

- As consumer awareness around the environmental and health benefits of plant-based nutrition increases, more individuals are adopting vegan, vegetarian, and flexitarian lifestyles, fueling the need for plant-based protein alternatives

- Soy protein is widely considered a high-quality protein source due to its amino acid profile and versatility, making it a preferred ingredient in a variety of food and beverage applications

For instance

- The growing popularity of plant-based meat substitutes like soy protein-based burgers and protein shakes has contributed to an increase in demand for soy protein across the food industry

- As consumers become more focused on health, wellness, and sustainability, the demand for plant-based proteins such as soy is expected to continue rising, driving significant market growth

Opportunity

Growing Demand for Plant-Based and Sustainable Protein Alternatives

- The rising global demand for plant-based, vegan, and sustainable protein sources is significantly driving the growth of the soy protein market

- As consumers become more conscious about the environmental impact of animal-based proteins and seek healthier alternatives, plant-based proteins like soy are gaining popularity

- This shift in dietary preferences is creating opportunities for manufacturers to develop new, innovative soy protein-based products that cater to the growing plant-based food trend

For instance,

- Many food manufacturers are creating soy protein-based meat substitutes, dairy-free products, and protein-enriched snacks to meet the demand for plant-based foods

- The growing popularity of sustainable, environmentally friendly foods is expected to fuel further opportunities for soy protein in food and beverage applications globally

Restraint/Challenge

High Cost of Soy Protein Extraction and Processing

- One of the primary restraints in the soy protein market is the high cost of extraction and processing, which can affect the affordability of soy protein products

- The process of isolating and refining soy protein requires specialized equipment, and the energy-intensive nature of extraction increases production costs.

- This can lead to higher prices for soy protein-based products, which may limit their adoption, especially in price-sensitive markets

For instance,

- The high costs associated with advanced processing technologies may make it difficult for smaller producers to compete with larger companies that can benefit from economies of scale.

- This financial barrier may also slow down the expansion of soy protein in certain regions or product categories, restricting its market potential.

Soy Protein Market Scope

The market is segmented on the basis form, nature, function, application.

|

Segmentation |

Sub-Segmentation |

|

By Form |

|

|

By Nature |

|

|

By Function |

|

|

By Application

|

|

In 2025, the active packaging is projected to dominate the market with a largest share in product segment

Dry soy protein is projected to dominate the Global Soy Protein Market with the largest share in the form segment, accounting for 68.4% in 2025. This dominance is attributed to the increasing demand for convenience, longer shelf life, and ease of use in food processing and manufacturing

The food products is expected to account for the largest share during the forecast period in application segment

n 2025, the food products segment is expected to dominate the Global Soy Protein Market with the largest market share of 47.2%. This dominance is driven by the growing consumer preference for plant-based protein alternatives in food products and the increasing demand for healthier, sustainable food options. Soy protein is widely used in meat substitutes, dairy alternatives, and processed foods due to its high nutritional value and versatility.

Soy Protein Market Regional Analysis

North America Holds the Largest Share in the Soy Protein Market

- North America is projected to dominate the global Soy Protein Market, holding the largest share of 40.3% in 2025, driven by increasing consumer demand for plant-based protein products, particularly in the food and beverage industry.

- The U.S. holds a significant market share of 80.7% in North America in 2024, due to a high consumer inclination towards plant-based diets and the rapid adoption of soy protein in various food products such as meat substitutes, dairy alternatives, and processed snacks.

- The growing popularity of plant-based and vegan lifestyles, along with the rising awareness of the health benefits of soy protein, is further propelling the market in this region.

- Additionally, North America benefits from strong research and development (R&D) investments and the presence of leading food manufacturers who are actively incorporating soy protein into their product offerings, contributing to market growth.

- The region’s well-established food processing infrastructure, coupled with supportive regulations for plant-based food innovation and sustainability efforts, further boosts the demand for soy protein products.

Asia-Pacific is Projected to Register the Highest CAGR in the Soy Protein Market

- The Asia-Pacific region is expected to register the highest growth rate in the global Soy Protein Market, driven by rapid urbanization, rising health consciousness, and increasing consumer demand for plant-based protein sources across countries such as China, India, and Japan

- With large populations and increasing disposable incomes, countries like China and India are becoming key markets for soy protein, as more consumers are turning to plant-based alternatives in their diets, particularly in food products like meat substitutes and dairy alternatives

- Japan is at the forefront of the soy protein market in the region, where there is a strong demand for functional foods and healthy eating. The country’s focus on health and wellness, coupled with its strong food innovation sector, is fueling growth in the market for soy protein-based products

- China and India are also experiencing a surge in demand for plant-based proteins, driven by the growing number of health-conscious consumers and the expanding food processing industry. Both countries are increasingly adopting soy protein to meet the rising demand for vegetarian and vegan options in food products

- Government initiatives aimed at promoting sustainable food sources and improving public health are further supporting the growth of soy protein in the region. These efforts, combined with an expanding middle class and increasing focus on clean-label, healthy food products, are accelerating market expansion.

- Moreover, investments in infrastructure and food processing technologies by global companies are further boosting the growth of the soy protein market in Asia-Pacific, making it a highly attractive region for market expansion.

Soy Protein Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Archer Daniels Midland Company (U.S.)

- Cargill, Incorporated (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Soja Austria (Austria)

- Kerry Group plc (Ireland)

- Agri-Mark, Inc. (U.S.)

- CHS Inc. (U.S.)

- The Scoular Company (U.S.)

- Axiom Foods, Inc. (U.S.)

- Best Natural Inc. (U.S.)

- The Green Labs LLC (U.S.)

- Emsland Group (Germany)

- Prolupin GmbH (Germany)

- Soy Protein, Inc. (U.S.)

- Nutrition Resource, Inc. (U.S.)

Latest Developments in Global Soy Protein Market

- In March 2025, Archer Daniels Midland Company (ADM) launched a new line of high-protein soy-based ingredients, designed for the growing plant-based protein sector. The product offers enhanced texture and flavor for plant-based meat alternatives, providing manufacturers with a versatile solution for developing more natural, nutritious products. This new launch aims to meet the rising consumer demand for clean-label, plant-based protein products in various food applications, including ready-to-eat meals, snacks, and beverages

- In February 2025, DuPont Nutrition & Biosciences introduced a next-generation soy protein isolate, providing superior nutritional value with a higher protein content and improved solubility. This product is tailored to meet the increasing demand for healthier, high-protein, and dairy-free options across the food and beverage industry. It is expected to play a significant role in the expansion of plant-based food offerings in both mainstream and specialty markets

- In January 2025, Cargill announced a new partnership with Beyond Meat to co-develop sustainable soy protein-based alternatives that mimic the texture and taste of animal-based meat products. The collaboration focuses on improving the nutritional profile of plant-based meats while enhancing the environmental sustainability of soy protein sourcing and production methods. This move comes in response to the accelerating demand for plant-based meats, particularly in North America and Europe

- In December 2024, the Soy Protein Association (SPA) launched a global initiative to promote the health benefits of soy protein, focusing on educating consumers about its role in heart health, muscle building, and weight management. The campaign includes collaborations with health and wellness influencers and a digital platform aimed at raising awareness of soy protein as a key ingredient in healthy, plant-based diets

- In November 2024, Ingredion Incorporated unveiled its new line of clean-label soy protein concentrates, offering a higher level of customization for food manufacturers seeking to develop plant-based protein products. These concentrates are designed to enhance texture and mouthfeel in products like dairy alternatives, snacks, and nutrition bars, supporting the growing demand for vegan and vegetarian food options with a focus on clean-label ingredients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Soy Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Soy Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Soy Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.