Global Soyabean Meal Market

Market Size in USD Billion

CAGR :

%

USD

132.74 Billion

USD

184.48 Billion

2024

2032

USD

132.74 Billion

USD

184.48 Billion

2024

2032

| 2025 –2032 | |

| USD 132.74 Billion | |

| USD 184.48 Billion | |

|

|

|

|

Soybean Meal Market Size

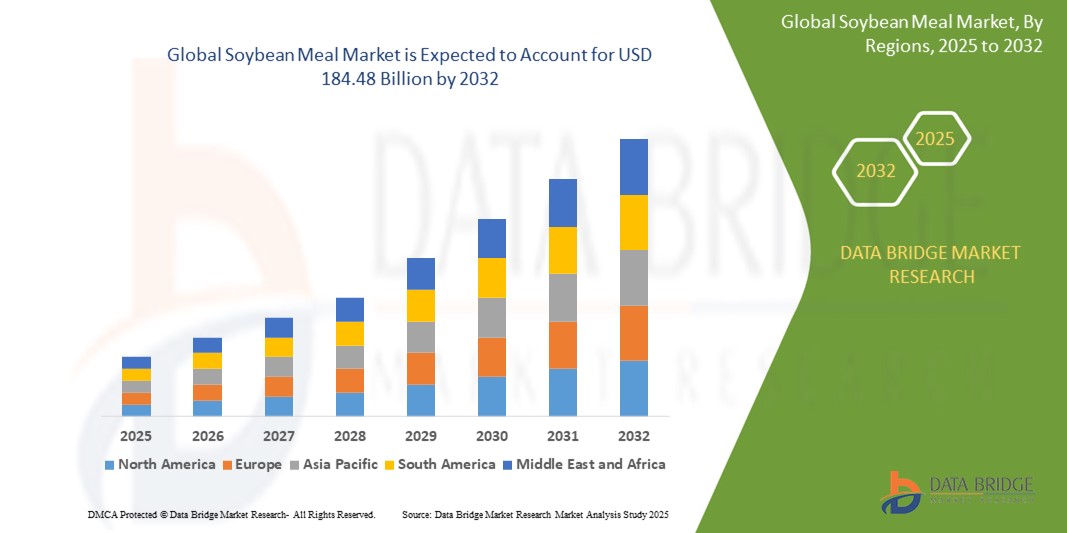

- The global Soybean meal market size was valued at USD 132.74 billion in 2024 and is expected to reach USD 184.48 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is primarily driven by increasing demand for high-protein animal feed, rising adoption of plant-based protein in food and beverage industries, and growing awareness of health-conscious diets

- The surge in livestock production and the expanding use of soybean meal in health care products and functional foods are further accelerating market expansion

Soybean Meal Market Analysis

- Soybean meal, a high-protein byproduct of soybean oil extraction, is a critical ingredient in animal feed, food processing, and health care products due to its nutritional profile and cost-effectiveness

- The growing demand for soybean meal is fueled by the global rise in livestock and poultry farming, increasing consumer preference for plant-based proteins, and the expansion of the food and beverage industry

- Asia-Pacific dominated the soybean meal market with the largest revenue share of 45.6% in 2024, driven by high demand for animal feed in countries such as China and India, coupled with significant soybean production and processing capabilities

- Europe is expected to be the fastest-growing region during the forecast period, propelled by increasing adoption of organic and sustainable feed solutions, rising demand for plant-based food products, and supportive regulatory frameworks for agricultural innovation

- The Conventional segment dominated the largest market revenue share of 71.2% in 2024, driven by its cost-effectiveness and widespread availability for animal feed and food industries. Conventional soybean meal, produced using standard agricultural practices, is extensively used in regions with established livestock industries due to its affordability and scalability

Report Scope and Soybean Meal Market Segmentation

|

Attributes |

Soybean Meal Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Soybean Meal Market Trends

“Increasing Integration of Biotechnology and Data Analytics”

- The global soybean meal market is experiencing a notable trend toward the integration of biotechnology and data analytics to enhance production efficiency and product quality

- These technologies enable advanced analysis of crop yields, soil health, and processing techniques, providing deeper insights into optimizing soybean meal production and quality control

- Biotechnology-driven solutions, such as genetically modified (GM) soybean varieties, improve crop resilience and protein content, meeting the rising demand for high-protein meal products

- For instance, companies are leveraging data analytics to monitor supply chain logistics and predict market demand, enabling better inventory management and distribution strategies for soybean meal

- This trend enhances the value proposition of soybean meal, making it more appealing to animal feed manufacturers, food processors, and health product industries

- Data analytics can process vast datasets on production variables, such as seed quality, environmental conditions, and processing efficiency, to optimize output and reduce waste

Soybean Meal Market Dynamics

Driver

“Rising Demand for Protein-Rich Animal Feed and Plant-Based Products”

- Increasing global demand for protein-rich animal feed, driven by expanding livestock, poultry, and aquaculture industries, is a major driver for the soybean meal market

- Soybean meal, with its high protein content (43%-50%), is a preferred ingredient in animal feed, enhancing growth and productivity in poultry, swine, and dairy cattle

- Government initiatives promoting sustainable agriculture and the rising popularity of plant-based diets are boosting demand for soybean meal in food, beverage, and health care products, such as protein supplements and meat alternatives

- The proliferation of precision agriculture and advancements in processing technologies, such as enzymatic treatment and solvent extraction, are enabling higher protein yields and better digestibility, further driving market growth

- Manufacturers are increasingly incorporating soybean meal into innovative food products, such as plant-based burgers and protein shakes, to meet consumer preferences for sustainable and nutritious options

Restraint/Challenge

“High Production Costs and Regulatory Constraints on GM Soybeans”

- The significant costs associated with soybean cultivation, processing, and compliance with organic certification standards can be a barrier, particularly for producers in emerging markets

- Implementing advanced processing techniques, such as mechanical extraction for organic soybean meal, requires substantial investment in equipment and infrastructure, increasing production costs

- Regulatory restrictions on genetically modified (GM) soybeans in regions such as Europe, coupled with consumer concerns about GMOs, pose challenges for market expansion and product acceptance

- The complex regulatory landscape across countries regarding GMO labeling, environmental sustainability, and food safety standards complicates operations for global manufacturers and exporters

- These factors can deter investment in soybean meal production and limit market growth, especially in regions with stringent regulations or heightened consumer awareness of GMO-related health and environmental concerns

Soybean Meal market Scope

The market is segmented on the basis of nature, form, process of production, application, and distribution channel.

- By Nature

On the basis of nature, the global soybean meal market is segmented into Organic and Conventional. The Conventional segment dominated the largest market revenue share of 71.2% in 2024, driven by its cost-effectiveness and widespread availability for animal feed and food industries. Conventional soybean meal, produced using standard agricultural practices, is extensively used in regions with established livestock industries due to its affordability and scalability.

The Organic segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer demand for non-GMO and chemical-free products. Rising health consciousness and environmental concerns are driving adoption, particularly in developed markets seeking sustainable and healthier food options.

- By Form

On the basis of form, the global soybean meal market is segmented into Powder, Oil, and Granular forms. The Powder segment dominated with a 42.2% market revenue share in 2024, attributed to its ease of mixing with other feed ingredients and versatility in both animal feed and human food applications, such as protein supplements and baked goods.

The Granular segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by its ease of handling and storage, particularly in large-scale animal feed production for poultry, livestock, and aquaculture. The granular form’s durability and suitability for bulk processing enhance its adoption.

- By Process of Production

On the basis of process of production, the global soybean meal market is segmented into Normal Soybean Meal, De-hulled (min 50% protein) Hipro Soybean Meal, De-hulled (min 48% protein) Hipro Soybean Meal, Defatted Soya Flour Toasted, and De-Fatted Soya Flakes Toasted. The Defatted Soya Flour Toasted segment held the largest market revenue share of 47.2% in 2024, owing to its high protein content and low fat, making it a preferred choice for animal feed, especially for poultry and livestock. Its versatility also supports its use in plant-based food products.

The De-hulled (min 50% protein) Hipro Soybean Meal segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing demand for high-protein feed formulations in aquaculture and high-performance animal diets. Advancements in processing technologies, such as enzymatic treatment, further enhance its protein content and digestibility.

- By Application

On the basis of application, the global soybean meal market is segmented into Animal Feed, Food Industry, Beverage, and CessnaHealth Care Product. The Animal Feed segment dominated with a 62.2% market revenue share in 2024, driven by the rising global demand for protein-rich livestock feed, particularly in poultry, swine, and aquaculture. Soybean meal’s high protein content and essential amino acids make it a critical component for animal growth and productivity.

The Food Industry segment is anticipated to experience the fastest growth from 2025 to 2032, fueled by the increasing adoption of plant-based diets and the use of soybean meal in products such as meat substitutes, protein shakes, and baked goods. Growing consumer awareness of soy’s nutritional benefits, including heart health and cholesterol reduction, supports this trend.

- By Distribution Channel

On the basis of distribution channel, the global soybean meal market is segmented into Supermarket, Specialized Stores, Online Stores, and Retail Stores. The Supermarket segment held the largest market revenue share of 38.1% in 2024, driven by its established consumer base and accessibility for purchasing soybean meal-based products, particularly for food and beverage applications.

The Online Stores segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the convenience of e-commerce platforms for both consumers and manufacturers. The growing trend of online purchasing, coupled with increased availability of organic and specialty soybean meal products, drives this segment’s expansion.

Soybean Meal Market Regional Analysis

- Asia-Pacific dominated the soybean meal market with the largest revenue share of 45.6% in 2024, driven by high demand for animal feed in countries such as China and India, coupled with significant soybean production and processing capabilities

- Consumers prioritize soybean meal for its high protein content, cost-effectiveness, and versatility in applications such as animal feed, food processing, and health care products, especially in regions with expanding agricultural and industrial sectors

- Growth is supported by advancements in processing technologies, such as de-hulled and defatted soybean meal variants, alongside rising adoption in both feed and food segments

Japan Soybean Meal Market Insight

Japan’s soybean meal market is expected to witness rapid growth due to strong consumer and industry preference for high-quality, protein-rich products that enhance livestock health and food quality. The presence of major food and feed manufacturers and the integration of soybean meal in both traditional and innovative applications accelerate market penetration. Rising interest in health care products and sustainable food options also contributes to growth.

China Soybean Meal Market Insigh

China holds the largest share of the Asia-Pacific soybean meal market, propelled by rapid urbanization, rising livestock and aquaculture production, and increasing demand for plant-based protein solutions. The country’s growing middle class and focus on food security support the adoption of advanced soybean meal variants. Strong domestic production capabilities and competitive pricing enhance market accessibility.

North America Soybean Meal Market Insight

North America holds a significant share in the global soybean meal market in 2024, driven by strong demand in the animal feed sector and increasing adoption in food and beverage applications. The region benefits from advanced agricultural infrastructure and a well-established livestock industry. Growing consumer awareness of sustainable and protein-rich diets, coupled with technological advancements in soybean processing, supports market expansion. The U.S. and Canada are key contributors, with robust domestic production and export markets.

U.S. Soybean Meal Market Insight

The U.S. Soybean meal market is expected to witness significant growth, fueled by strong demand in the animal feed sector and increasing consumer awareness of plant-based protein benefits. The trend towards sustainable agriculture and the growing use of soybean meal in food and beverage applications further boost market expansion. The integration of soybean meal in livestock feed and health care products complements both domestic and export markets, creating a robust product ecosystem.

Europe Soybean Meal Market Insight

The Europe soybean meal market is expected to witness the fastest growth rate, supported by increasing demand for sustainable and high-protein feed ingredients. Consumers and industries seek soybean meal for its nutritional benefits and environmental sustainability. Growth is prominent in both animal feed and food industry applications, with countries such as Germany and France showing significant uptake due to rising environmental concerns and stricter regulations on feed quality.

U.K. Soybean Meal Market Insight

The U.K. market for soybean meal is expected to experience rapid growth, driven by demand for high-quality animal feed and plant-based food products in urban and rural settings. Increased interest in sustainable diets and rising awareness of soybean meal’s nutritional benefits encourage adoption. Evolving regulations on feed safety and sustainability influence consumer and industry choices, balancing quality with compliance.

Germany Soybean Meal Market Insight

Germany is expected to witness the fastest growth rate in the European soybean meal market, attributed to its advanced agricultural sector and high consumer focus on sustainable and protein-rich feed and food products. German industries prefer technologically advanced soybean meal variants, such as de-hulled and defatted options, which contribute to efficient livestock production and lower environmental impact. The integration of these products in premium feed and food applications supports sustained market growth.

Soybean Meal Market Share

The soybean meal industry is primarily led by well-established companies, including:

- ADM (U.S.)

- DuPont (U.S.)

- CHS Inc. (U.S.)

- The Scoular Company (U.S.)

- Kohinoor Feeds and Fats Ltd. (India)

- Kerry (Ireland)

- Batory Foods (U.S.)

- Denofa AS (Norway)

- Agrocorp (Singapore)

- MJI Universal Pte Ltd. (Singapore)

- Gauri Agrotech Products Pvt. Ltd. (India)

- Agro Ind Group (Kazakhstan)

- NOW Foods (U.S.)

- Wilmar International Ltd. (Singapore)

- Cargill, Incorporated (U.S.)

- Foodrich Soya Co. LTD. (Thailand)

- The Nisshin OilliO Group, Ltd. (Japan)

- Mukwano Industries Uganda Ltd. (Uganda)

- Ghana Nuts Company Limited (Ghana)

- Food Chem International (China)

What are the Recent Developments in Global Soybean Meal Market?

- In June 2025, the U.S. Soybean Export Council (USSEC) and Vietnam’s Partnership for Sustainable Agriculture Development (PSAV) signed a Memorandum of Understanding (MOU) to deepen agricultural cooperation and promote U.S. Soy sustainability programs. Celebrating 30 years of collaboration, the agreement supports Vietnam’s expanding food, feed, and livestock sectors with climate-smart soy solutions. The MOU emphasizes shared goals in responsible sourcing, supply chain transparency, and technical exchange, reinforcing Vietnam’s commitment to sustainable development. It also highlights U.S. Soy’s role in advancing food security, economic resilience, and environmental stewardship across Southeast Asia

- In October 2024, the Nestlé Board of Directors approved a strategic reorganization to take effect on January 1, 2025, merging Zone Latin America (LATAM) and Zone North America (NA) into a unified Zone Americas (AMS). This move is part of a broader corporate strategy aimed at enhancing operational efficiency, regional integration, and decision-making speed. The consolidation is expected to influence Nestlé’s supply chain dynamics, including the sourcing of key ingredients such as soybean meal, as the company aligns its procurement and distribution strategies across the Americas. The new zone will be led by Steve Presley, based at Nestlé’s headquarters in Switzerland

- In February 2024, Nam & Son of MD, based in Jessup, Maryland, issued a voluntary recall of one-pound bags of soybean sprouts after a random sample tested positive for Listeria monocytogenes, a potentially dangerous pathogen. Although no illnesses were reported, the recall was initiated as a precautionary measure to protect public health. The affected products, labeled under Sam Sung S & M Food, carried a “Sell By” date of December 21, 2023 and were distributed to retail stores in Maryland. Consumers were advised to discard or return the product and monitor for symptoms of listeriosis.

- In July 2023, ZeaKal partnered with Nutrien Ag Solutions to commercialize its innovative PhotoSeed™ photosynthesis trait technology for U.S. soybean growers. PhotoSeed enhances carbon capture in soybeans, resulting in increased levels of heart-healthy oil and protein without compromising yield. This breakthrough supports a more sustainable and diversified soybean supply chain, benefiting farmers, processors, and consumers asuch as. Under the agreement, ZeaKal-branded soybean seeds will be available to growers for the 2024 growing season, with Nutrien providing customized agronomic support to optimize performance and value

- In April 2023, Continental Refining Company (CRC) expanded its soybean processing facility in Somerset, Central Kentucky, boosting its capacity to process 330 tons of soybeans daily. This upgrade enables CRC to produce 250 tons of high-protein soybean meal and extract soybean hulls, both essential feed ingredients for livestock and poultry. The expansion strengthens the regional supply chain, supporting farmers and feed manufacturers across Kentucky, Tennessee, Ohio, and Indiana. CRC’s initiative reflects its commitment to sustainability, efficiency, and local economic growth, while meeting rising demand for premium animal nutrition products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Soyabean Meal Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Soyabean Meal Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Soyabean Meal Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.