Global Space Camera Market

Market Size in USD Billion

CAGR :

%

USD

2.53 Billion

USD

8.90 Billion

2024

2032

USD

2.53 Billion

USD

8.90 Billion

2024

2032

| 2025 –2032 | |

| USD 2.53 Billion | |

| USD 8.90 Billion | |

|

|

|

|

Space Camera Market Size

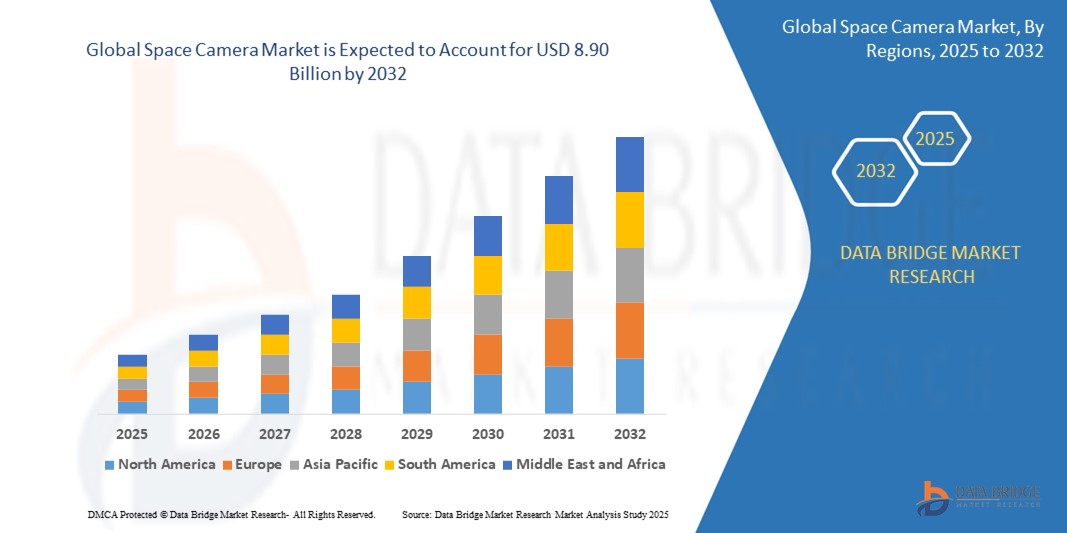

- The global space camera market was valued at USD 2.53 billion in 2024 and is expected to reach USD 8.90 billion by 2032.

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 17.10%, primarily driven by the high research optimization and growth in emerging sectors

- This growth is driven by factors such as operate and maintain advanced technological advancements, also developing in emerging markets

Space Camera Market Analysis

- Space cameras refer to specialized imaging systems designed to operate in the harsh environment of space. These cameras are engineered to withstand extreme temperatures, radiation, and vacuum conditions, and are used for various applications such as Earth observation, planetary exploration, and space surveillance. They encompass a range of technologies, including optical, infrared, and hyperspectral imaging

- The demand for space camera solutions is significantly driven by its crucial role in areas like Earth observation for environmental monitoring and disaster management, planetary exploration for scientific research, and space situational awareness for national security. These sectors require advanced imaging capabilities to capture high-resolution images and spectral data of celestial bodies and Earth's surface

- As governments and private organizations focus on expanding space exploration, improving Earth observation capabilities, and enhancing space situational awareness, the market is expected to grow, providing solutions for more detailed and accurate imaging from space. This supports advancements in various fields, including climate science, resource management, and space exploration.

- North America stand out as dominant regions for the Space camera market, driven by their established space agencies, advanced technological infrastructure, and substantial investments in space research and development. Asia-Pacific is also a growing market due to increasing space programs in countries like China and India.

Report Scope and Space Camera Market Segmentation

|

Attributes |

Space Camera Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, Rest of Europe, China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East & Africa |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, PORTER analysis, and PESTLE analysis.. |

Space Camera Market Trends

“Expansion of Commercial Earth Observation Services”

- One prominent trend in the growing demand for high-resolution Earth observation data from private industries like agriculture, urban planning, and environmental monitoring

- By offering cost-effective and timely satellite imagery and data analytics, companies can cater to the increasing need for geospatial information

- As commercial space ventures expand, there's a significant potential to provide specialized imaging services for various sectors

- For instance, In February 2024, Maxar Technologies announced a significant expansion of its WorldView satellite constellation, specifically designed to enhance its precision agriculture offerings. The upgraded satellites, equipped with advanced multispectral and thermal imaging sensors, now provide farmers with near-real-time data on crop health, soil moisture, and irrigation efficiency. By integrating this high-resolution imagery with AI-driven analytics, Maxar enables farmers to optimize fertilizer application, predict crop yields, and implement sustainable farming practices, leading to reduced resource consumption and increased productivity

- These satellites are tailored for rapid disaster response and infrastructure monitoring. By providing frequent and detailed imagery, Planet Labs enables emergency responders to assess damage, plan relief efforts, and monitor recovery progress in near real-time. This capability is crucial for mitigating the impact of natural disasters and ensuring efficient infrastructure management, demonstrating the increasing role of commercial Earth observation in critical applications

Space Camera Market Dynamics

Driver

“Increasing Investment in Space Exploration and Earth Observation”

- Government agencies and private companies worldwide are increasing their investments in space exploration and Earth observation programs

- This increased funding drives the development of advanced space camera technologies and expands the market for related products and services

For instance,

- In March 2024, the U.S. government allocated a substantial increase in NASA’s budget, with a significant portion dedicated to Earth science missions. This funding boost will support the development and launch of advanced Earth observation satellites equipped with state-of-the-art imaging systems. These missions will provide crucial data for climate monitoring, environmental research, and disaster management, reflecting the growing recognition of the importance of space-based observations for addressing global challenges. Furthermore, the rise of private space companies like SpaceX and Blue Origin has led to a surge in private investment in space infrastructure

- In February 2024, SpaceX announced a new initiative to deploy a large constellation of imaging satellites for commercial and government applications, leveraging its Starlink infrastructure to provide cost-effective and high-bandwidth data transmission. This initiative demonstrates the increasing role of private companies in driving innovation and expanding the capabilities of space-based imaging systems

- The Climate change awareness and the push for sustainable resources are driving major investments in Earth observation. Accurate space data is vital for understanding and mitigating environmental impacts, as well as optimizing resource use. This growing need fuels market growth and innovation, making Earth observation crucial for policy, regulation, and sustainable development

Opportunity

“Advancements in Planetary Exploration Missions”

- This opportunity focuses on the growing demand for high-resolution Earth observation data from private industries like agriculture, urban planning, and environmental monitoring

- By offering cost-effective and timely satellite imagery and data analytics, companies can cater to the increasing need for geospatial information

- As commercial space ventures expand, there's a significant potential to provide specialized imaging services for various sectors.

For instance,

- In January 2024, NASA announced the final design and testing phase for the advanced high-resolution camera system to be deployed on the Europa Clipper mission, scheduled for launch in late 2024. This camera system, featuring cutting-edge optical and infrared sensors, is designed to capture detailed images of Europa’s icy surface and potentially subsurface oceans. The high-resolution imagery will allow scientists to identify potential landing sites, analyze surface features, and assess the habitability of Europa, providing crucial data for future exploration.

- in April 2024, the European Space Agency (ESA) successfully tested the advanced imaging systems on the ExoMars rover, which is set to explore the Martian surface for signs of past or present life. These imaging systems, including high-resolution stereo cameras and hyperspectral imagers, will enable the rover to analyze the Martian terrain, identify potential biosignatures, and capture detailed images of geological formations. The data collected will contribute to our understanding of Mars’s geological history and the potential for life on other planets

- With commercial space ventures growing, specialized imaging services offer significant potential. Tailored solutions for agriculture, infrastructure, and urban planning enable data-driven decisions. Real-time data for disaster response and environmental monitoring enhances efficiency. This commercialization democratizes access and fosters innovation, driving growth across sectors

Restraint/Challenge

“High Cost of Space Camera”

- The development and launch of space camera systems are associated with high costs, which can limit market growth and innovation

- The stringent requirements for space-qualified hardware and the complexity of space missions contribute to these high costs

- The need for specialized expertise and infrastructure further increases the financial burden

For instance,

- In May 2024, a report by the European Space Agency (ESA) highlighted the significant financial challenges associated with developing advanced hyperspectral imaging systems for space missions. The report emphasized the need for substantial investments in research and development, as well as specialized manufacturing facilities, to ensure the performance and reliability of these systems in the harsh space environment. The high costs associated with developing such advanced technologies can limit the number of missions and the scope of scientific research. Additionally, the launch costs for placing large and complex imaging satellites into orbit remain a significant barrier, particularly for smaller companies and research institutions

- The need for specialized expertise and infrastructure significantly escalates the financial burden, hindering market entry and widespread adoption. This requirement for highly trained personnel, coupled with the substantial investment in cutting-edge equipment and facilities, creates a barrier for smaller players and developing regions

Space Camera Market Scope

The market is segmented into four notable segments based on type, technology, sensor type, application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Technology |

|

|

By Sensor Type |

|

|

By Application |

|

Space Camera Market Country Analysis

“"North America is a Dominant Region in the Global Space Camera Market”

- North America dominates the global space camera market, driven by the presence of leading space agencies such as NASA and a robust private aerospace sector with companies like SpaceX, Blue Origin, and Northrop Grumman

- The U.S. holds a significant share due to its high frequency of satellite launches, space exploration missions, and growing deployment of Earth observation and scientific satellites requiring advanced imaging systems

- Substantial government funding, strong collaboration between space agencies and private firms, and continuous innovation in high-resolution and multispectral camera systems further support market growth

- In addition, advancements in satellite technology, increased demand for real-time data from space, and growing investments in space-based surveillance and communication systems are fueling the regional market expansion

Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to register the highest growth rate in the global space camera market, driven by increasing government investments in space programs, rising participation in satellite launches, and advancements in space research capabilities

- Countries such as China, India, and Japan are emerging as key contributors, supported by active space agencies such as CNSA, ISRO, and JAXA, which are expanding satellite constellations and deep-space missions

- Japan remains a vital market, leveraging its advanced imaging technologies and precision engineering capabilities to support high-quality space camera development for both domestic and international missions

- China and India, with their ambitious space agendas, are boosting local manufacturing and research initiatives in space optics and imaging systems. The growing role of private aerospace startups and increasing international collaborations are further accelerating regional market growth

Space Camera Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Teledyne Technologies Incorporated (U.S.)

- Leonardo S.p.A. (Italy)

- Airbus Defence and Space (Europe)

- Thales Alenia Space (Europe)

- Ball Aerospace & Technologies Corp. (U.S.)

- L3Harris Technologies (U.S.)

- Maxar Technologies (U.S.)

- OHB SE (Germany)

- Raptor Photonics (U.K.)

- Jenoptik AG (Germany)

- Raytheon Intelligence & Space (U.S.)

- SSC (Swedish Space Corporation) (Sweden)Salesforce, Inc. (U.S.)

- Hewlett Packard Enterprise (HPE) (U.S.)

Latest Developments in Global Space Camera Market

- In February 2024, Teledyne announced the development of a new line of advanced CMOS image sensors specifically designed for next-generation Earth observation satellites. These sensors offer improved sensitivity, higher resolution, and enhanced spectral response compared to previous models. This development aims to enable more detailed and accurate Earth observation data for applications like climate monitoring, environmental research, and disaster management. Teledyne's advancements in sensor technology are crucial for enhancing the capabilities of future space camera systems, allowing for more precise and reliable data collection

- In February 2024, NVIDIA Corporation released a new generation of GPUs optimized for Space camera workloads, featuring improved ray tracing capabilities and AI-accelerated rendering. These advancements enable developers to create more realistic and interactive virtual environments, facilitating applications like virtual training simulations and architectural design. This hardware upgrade is expected to accelerate the adoption of Space camera in sectors that rely on high-fidelity visual representations

- In April 2024, Maxar Technologies announced the integration of advanced AI algorithms into its satellite imagery services, enabling automated analysis and interpretation of Earth observation data. This development allows for faster and more efficient extraction of valuable insights from satellite imagery, supporting applications like urban planning, infrastructure monitoring, and environmental impact assessment. By combining high-resolution imagery with AI-driven analytics, Maxar is enhancing the utility of space-based data for various commercial and governmental applications, providing more actionable intelligence.

- In May 2024, The European Space Agency (ESA), in collaboration with leading European technology firms, announced the successful deployment of a revolutionary quantum-enhanced space camera system. "This milestone marks a new era in hyperspectral imaging," stated an ESA spokesperson. "The unprecedented sensitivity and resolution achieved through quantum entanglement will allow us to monitor Earth's atmosphere and environment with unparalleled precision, significantly improving our understanding of climate change and pollution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.