Global Space Propulsion Market

Market Size in USD Billion

CAGR :

%

USD

10.94 Billion

USD

31.24 Billion

2024

2032

USD

10.94 Billion

USD

31.24 Billion

2024

2032

| 2025 –2032 | |

| USD 10.94 Billion | |

| USD 31.24 Billion | |

|

|

|

|

Space Propulsion Market Size

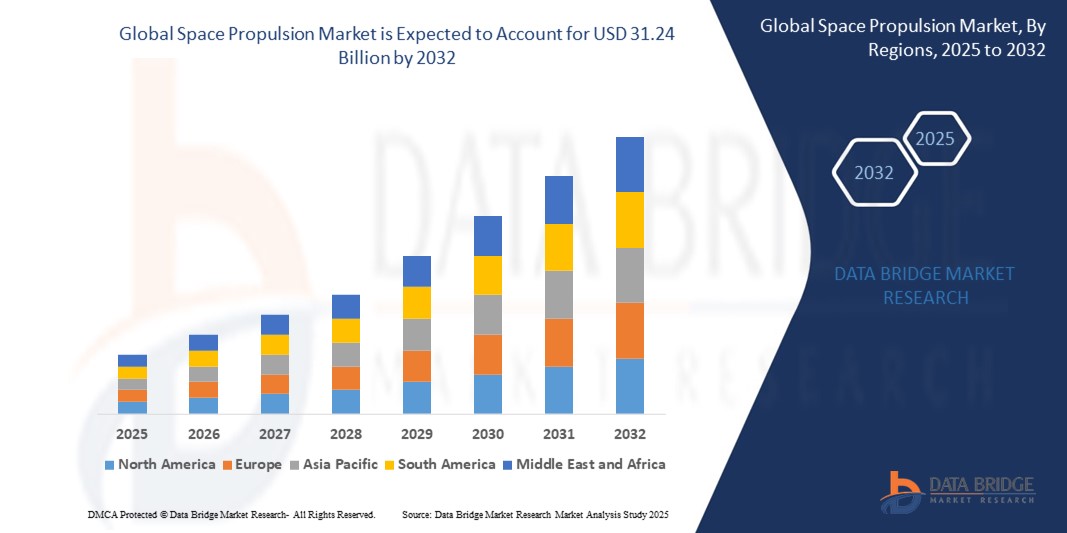

- The global space propulsion market size was valued at USD 10.94 billion in 2024 and is expected to reach USD 31.24 billion by 2032, at a CAGR of 14.01% during the forecast period

- The market growth is largely fuelled by the surge in satellite launches for communication, Earth observation, and navigation purposes, along with rising investments in space exploration programs by government and private players

- In addition, technological advancements in electric and green propulsion systems are contributing to increased mission efficiency, reduced fuel consumption, and extended satellite lifespan, further boosting market demand

Space Propulsion Market Analysis

- The market is witnessing a shift toward advanced propulsion systems, such as ion and Hall-effect thrusters, to support deep-space missions and long-duration orbital operations

- Increasing collaboration between government space agencies and commercial space startups is enhancing innovation and expanding the scope of propulsion applications across civil, commercial, and defense sectors

- North America dominated the global space propulsion market with the largest revenue share of 42.7% in 2024, driven by significant investments in satellite deployment, deep-space exploration programs, and a robust presence of leading aerospace companies

- Asia-Pacific region is expected to witness the highest growth rate in the global space propulsion market, driven by national space initiatives, increasing launch frequency, and a rapidly expanding commercial satellite sector. Countries such as China, India, and Japan are investing heavily in next-generation propulsion systems and building domestic launch capabilities, making the region a central hub for future space activities

- The chemical propulsion segment dominated the market with the largest market revenue share of 51.6% in 2024, driven by its well-established technology, high thrust efficiency, and proven reliability across launch vehicles and orbital maneuvers. Chemical propulsion systems remain widely used in both commercial and defense missions due to their rapid acceleration capabilities and compatibility with a wide range of space platforms

Report Scope and Space Propulsion Market Segmentation

|

Attributes |

Space Propulsion Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Increasing Adoption of Electric Propulsion Technologies • Expanding Private Investments in Commercial Space Missions |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Space Propulsion Market Trends

“Rise of Electric Propulsion Systems in Commercial Satellite Programs”

- Electric propulsion systems are gaining significant traction due to their high fuel efficiency and lower launch mass, which helps reduce operational costs for satellite operators. These systems enable prolonged thrust over time, making them ideal for deep-space and long-duration missions. Their lightweight structure also allows more payload capacity, making them increasingly favored in commercial satellite launches

- Electric propulsion is particularly suited for orbit raising and station-keeping, especially in low-Earth and geostationary orbits where long-duration efficiency is vital. The technology also aligns with growing demands for sustainable space operations, with minimal propellant usage and precise trajectory control. Major companies are focusing on integrating such systems to enhance satellite lifetime and reduce in-orbit failure risks

- The rising popularity of mega-constellation programs has created a strong market pull for compact, scalable, and power-efficient electric propulsion solutions. Companies are seeking systems that offer maneuverability and longevity with minimal maintenance needs. This is especially relevant in the era of reusable launch platforms and scalable satellite infrastructure

- For instance, SpaceX has equipped its Starlink satellites with Hall-effect thrusters to perform orbital adjustments and debris avoidance, enabling long-term functionality while ensuring global internet coverage. Similarly, Airbus has developed all-electric telecom satellites to lower satellite mass and cost. These real-world applications are solidifying electric propulsion’s viability in large-scale missions.

- In conclusion, electric propulsion is shaping the future of satellite mobility, offering unmatched performance benefits and cost savings. Its continued adoption highlights the industry's shift toward advanced, sustainable, and economically scalable propulsion technologie

Space Propulsion Market Dynamics

Driver

“Increasing Satellite Launches and Demand for Cost-Effective Propulsion Systems”

- The number of satellite launches has surged in recent years, largely driven by the expansion of global broadband coverage, Earth observation programs, and commercial ventures. This uptrend is increasing demand for reliable, scalable propulsion systems that can support various mission profiles. The rising satellite volume is prompting manufacturers to develop more efficient and lightweight propulsion designs

- Small satellite developers and CubeSat operators are demanding cost-effective propulsion systems that offer precision in orbital positioning and extended operational lifespans. Their smaller form factors require propulsion solutions that are compact, low-power, and easy to integrate. As launch costs drop, propulsion systems play a crucial role in maximizing onboard capabilities within tight space and weight limits

- The reusable launch vehicle trend is reinforcing the need for propulsion systems that are compatible with repeated flight cycles and modular spacecraft designs. Advanced propulsion is now seen not just as a tool for movement but as a critical enabler of reusability, sustainability, and agility in satellite design. The focus is shifting toward systems that can deliver high thrust-to-weight ratios at optimized cost

- For instance, Rocket Lab's Photon satellite platform integrates propulsion capabilities tailored to small satellite missions, enabling flexible deployment across various orbits and applications. Photon’s success showcases how compact propulsion can enhance satellite autonomy and operational efficiency. Such examples are reshaping the business model for space startups and service providers

- In conclusion, propulsion systems are becoming central to space mission economics, allowing broader participation in space through lower entry barriers. The expanding launch frequency and miniaturization trend will continue to fuel innovation in efficient, low-cost propulsion technologies

Restraint/Challenge

“Complex Design and High Development Costs of Advanced Propulsion Systems”

- Advanced propulsion systems require specialized materials, extensive engineering, and rigorous testing to ensure durability and performance in space. These requirements result in high research and development costs, posing a major hurdle for new entrants and smaller players. Long development timelines and high failure risks further add to the financial strain

- Integrating propulsion systems into diverse spacecraft configurations is a highly technical task that demands precise calibration and customized engineering. Safety regulations, especially when dealing with nuclear or chemical propulsion, introduce compliance challenges and slow the pace of innovation. The need for regulatory approvals and testing protocols adds both time and cost

- Startups and mid-sized aerospace firms often lack the capital and infrastructure to invest in developing or scaling such systems, limiting market competition. High costs deter experimentation and lead to concentration of innovation among a few major players. This slows the democratization of space access and hinders dynamic technological progress

- For instance, NASA's development of solar electric propulsion systems for long-range exploration has experienced delays due to challenges in integrating high-voltage power systems and maintaining long-term thrust stability. These setbacks underline how even the most advanced agencies face barriers in scaling next-generation propulsion

- In conclusion, despite strong demand, the high cost and complexity of propulsion systems remain critical roadblocks for the market. Addressing these challenges will require strategic collaborations, funding mechanisms, and continued investment in modular, cost-efficient propulsion platforms

Space Propulsion Market Scope

The market is segmented on the basis of propulsion type, system component, support services, orbit, platform, and end-user.

- By Propulsion Type

On the basis of propulsion type, the space propulsion market is segmented into chemical propulsion, non-chemical propulsion, tether propulsion, nuclear propulsion, and laser propulsion. The chemical propulsion segment dominated the market with the largest market revenue share of 51.6% in 2024, driven by its well-established technology, high thrust efficiency, and proven reliability across launch vehicles and orbital maneuvers. Chemical propulsion systems remain widely used in both commercial and defense missions due to their rapid acceleration capabilities and compatibility with a wide range of space platforms.

The non-chemical propulsion segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for long-duration missions, efficient fuel usage, and sustainable deep-space exploration. Technologies such as electric and ion propulsion are gaining traction for their precision in maneuvering satellites and interplanetary probes, especially in commercial and scientific applications that prioritize energy efficiency and operational longevity.

- By System Component

On the basis of system component, the space propulsion market is segmented into nozzle, power processing unit, propellant feed system, rocket motors, thermal control system, and thrusters. The thrusters segment held the largest market revenue share in 2024, attributed to its widespread deployment across satellite and spacecraft platforms for attitude control, orbital adjustments, and station-keeping. Thrusters play a critical role in mission stability and success, especially in low Earth and geostationary orbits where precise movements are essential.

The power processing unit segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing integration of electric propulsion systems that rely heavily on efficient power distribution. As spacecraft become more energy-dependent, particularly in deep-space and commercial satellite constellations, the demand for advanced power processing solutions is accelerating.

- By Support Services

On the basis of support services, the space propulsion market is segmented into design, engineering and operation, fueling and launch support, and hot firing and environmental test execution. The design, engineering and operation segment led the market with the largest revenue share in 2024, due to the growing complexity of propulsion systems and the need for customized configurations tailored to mission-specific requirements. Increasing investments in space research and satellite development have further emphasized the importance of detailed propulsion engineering and real-time mission support.

The fueling and launch support segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the surge in satellite launches and reusable rocket missions. Efficient and safe fueling processes are essential to mission success, and advancements in cryogenic handling and automation are enhancing launch reliability and turnaround times.

- By Orbit

On the basis of orbit, the space propulsion market is segmented into beyond geosynchronous orbit, geosynchronous orbit, low Earth orbit, and medium Earth orbit. The low Earth orbit segment accounted for the largest revenue share in 2024, owing to the increasing deployment of satellite constellations for communications, Earth observation, and broadband internet. The shorter revisit times and lower latency associated with LEO make it an attractive orbit for commercial operators.

The beyond geosynchronous orbit segment is expected to witness the fastest growth rate from 2025 to 2032, supported by deep-space missions, interplanetary exploration, and rising investments in lunar and Mars programs. These missions require advanced propulsion technologies capable of operating efficiently in extreme and prolonged environments.

- By Platform

On the basis of platform, the space propulsion market is segmented into capsule/cargo, interplanetary spacecraft and probes, launch vehicles, and satellite. The satellite segment held the largest market revenue share in 2024, driven by the boom in satellite-based services, such as navigation, imaging, and communication. Growing public and private satellite programs are significantly boosting propulsion demand for both small and large-scale platforms.

The interplanetary spacecraft and probes segment is expected to witness the fastest growth rate from 2025 to 2032, as governments and private companies focus on missions to Mars, asteroids, and outer planets. These exploratory efforts depend heavily on advanced propulsion for long-duration travel, maneuverability, and safe return or extended deployment.

- By End-User

On the basis of end-user, the space propulsion market is segmented into commercial, satellite operators and owners, space launch service providers, government and defense, Department of Defense, national space agencies, and others. The government and defense segment dominated the market with the highest revenue share in 2024, due to continued investments in national security, surveillance, and strategic space missions. National space programs across the U.S., Russia, China, and India are actively funding propulsion innovations for exploration and defense preparedness.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid commercialization of space, growing interest from private firms, and increasing use of satellites for data services, logistics, and Earth analytics. The entrance of new players and broader funding support for private space ventures is reshaping end-user dynamics in the propulsion sector.

Space Propulsion Market Regional Analysis

• North America dominated the global space propulsion market with the largest revenue share of 42.7% in 2024, driven by significant investments in satellite deployment, deep-space exploration programs, and a robust presence of leading aerospace companies

• The region benefits from increasing governmental space budgets, particularly in the U.S., which is pushing the development of advanced propulsion systems for both commercial and defense missions

• Ongoing collaborations between space agencies and private firms, along with a well-established launch infrastructure, continue to boost the adoption of innovative propulsion technologies across North America

U.S. Space Propulsion Market Insight

The U.S. space propulsion market accounted for the highest share in North America in 2024, supported by rising demand for reusable launch vehicles and interplanetary missions. Initiatives by NASA and the Department of Defense, along with a thriving commercial space sector led by companies such as SpaceX, Blue Origin, and Northrop Grumman, are fueling advancements in propulsion technologies. Growing interest in cislunar exploration and Mars-bound missions has also intensified efforts to develop nuclear and electric propulsion systems, ensuring the U.S. remains at the forefront of global space propulsion innovation.

Europe Space Propulsion Market Insight

The Europe space propulsion market is expected to witness the fastest growth rate from 2025 to 2032, driven by increased investments in satellite constellations, intergovernmental space projects, and the transition to sustainable propulsion systems. Agencies such as the European Space Agency (ESA) are prioritizing electric propulsion for future missions, and several EU-led initiatives are supporting low-emission propulsion research. The region also benefits from a highly coordinated aerospace industry and growing public-private partnerships focused on long-term space sustainability.

U.K. Space Propulsion Market Insight

The U.K. space propulsion market is expected to witness the fastest growth rate from 2025 to 2032, underpinned by national programs aimed at advancing satellite capabilities and building domestic launch facilities. The government’s support for low-Earth orbit missions and small satellite launches is increasing the demand for compact, efficient propulsion systems. Furthermore, the rise of U.K.-based space startups and the strategic development of Spaceport Cornwall and Sutherland are expected to enhance the country’s footprint in the space propulsion ecosystem.

Germany Space Propulsion Market Insight

The Germany space propulsion market is expected to witness the fastest growth rate from 2025 to 2032, owing to its leadership in space component manufacturing and commitment to green propulsion development. Germany's contributions to ESA missions and its focus on hydrogen and electric propulsion technologies are fostering innovation in the segment. With strong R&D infrastructure and government-industry alignment, Germany is emerging as a critical contributor to the design and supply of next-generation propulsion components across Europe.

Asia-Pacific Space Propulsion Market Insight

The Asia-Pacific space propulsion market is expected to witness the fastest growth rate from 2025 to 2032, driven by escalating satellite deployment, growing defense space budgets, and expanding private aerospace startups in countries such as China, India, and Japan. National space programs are emphasizing indigenous launch capabilities and interplanetary exploration, leading to increased demand for chemical, electric, and nuclear propulsion systems. The region’s investment in spaceports, research facilities, and public-private ventures is transforming it into a global hotspot for propulsion development.

Japan Space Propulsion Market Insight

The Japan space propulsion market is expected to witness the fastest growth rate from 2025 to 2032 fueled by ongoing innovations from JAXA and leading aerospace manufacturers. Japan's strategic initiatives focus on lunar exploration, asteroid missions, and enhancing small satellite capabilities, driving the need for efficient propulsion systems. The country’s emphasis on miniaturized electric propulsion and international collaborations, such as the Artemis program, is accelerating its influence in both commercial and scientific space endeavors.

China Space Propulsion Market Insight

The China space propulsion market secured the largest revenue share in the Asia-Pacific region in 2024, attributed to an aggressive expansion of its national space program and strong investments in both crewed and uncrewed missions. China’s development of reusable rockets, electric propulsion for satellites, and nuclear propulsion concepts highlights its intent to dominate space technology leadership. The presence of state-owned entities and a rapidly growing network of private aerospace firms further strengthens China’s capacity to deliver and scale propulsion technologies across various orbital domains.

Space Propulsion Market Share

The Space Propulsion industry is primarily led by well-established companies, including:

- Accion Systems (U.S.)

- IHI Corporation (Japan)

- Ball Corporation (U.S.)

- Dawn Aerospace (New Zealand)

- SAFRAN (France)

- SPACEX (U.S.)

- Northrop Grumman (U.S.)

- BLUE ORIGIN LLC (U.S.)

- Moog Inc. (U.S.)

- Lockheed Martin Corporation (U.S.)

- OHB SE (Germany)

- Sierra Nevada Corporation (U.S.)

- Thales (France)

- Honeywell International Inc. (U.S.)

- Airbus (France)

- Cobham Limited (U.K.)

- L3Harris Technologies, Inc. (U.S.)

- Boeing (U.S.)

Latest Developments in Global Space Propulsion Market

- In December 2023, Blue Origin secured a NASA Launch Services II Indefinite Delivery Indefinite Quantity (IDIQ) contract, marking a key development in space launch services. The agreement enables the company’s reusable New Glenn orbital vehicle to launch a range of NASA missions including planetary, Earth observation, exploration, and scientific satellites. This initiative is expected to significantly strengthen NASA's launch capabilities while promoting cost-effective, sustainable space missions

- In February 2023, Blue Origin was selected by NASA’s Launch Services Program (LSP) to support the ESCAPADE mission, aimed at studying Mars’ magnetosphere. The mission will utilize the New Glenn reusable launch vehicle, highlighting a major milestone in the integration of innovative, reusable spaceflight technologies. This advancement supports NASA’s long-term goals for deep space exploration and sustainability in orbital transportation

- In February 2023, Thales Alenia Space signed a contract with the Korea Aerospace Research Institute (KARI) to provide integrated electric propulsion systems for the GEO-KOMPSAT-3 (GK3) satellite. This partnership is set to improve the satellite’s operational efficiency and extend its lifespan. The development reinforces Thales Alenia Space’s leading position in satellite propulsion technologies and supports Korea’s ambitions in advanced satellite capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.