Global Speaker Driver Market

Market Size in USD Billion

CAGR :

%

USD

28.69 Billion

USD

33.87 Billion

2024

2032

USD

28.69 Billion

USD

33.87 Billion

2024

2032

| 2025 –2032 | |

| USD 28.69 Billion | |

| USD 33.87 Billion | |

|

|

|

|

Speaker Driver Market Size

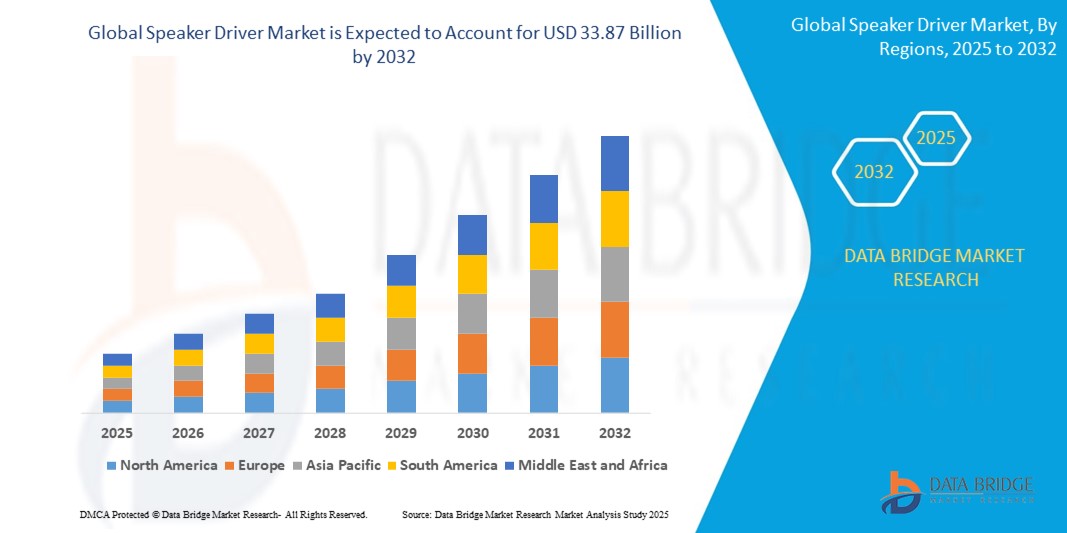

- The global speaker driver market size was valued at USD 28.69 billion in 2024 and is expected to reach USD 33.87 billion by 2032, at a CAGR of 2.10% during the forecast period

- The market growth is largely fuelled by the increasing adoption of smart speakers, wireless audio devices, and in-car infotainment systems across residential, commercial, and automotive sectors

- The rising trend of immersive audio experiences in home entertainment systems and gaming consoles is further contributing to the rising demand for advanced speaker drivers

Speaker Driver Market Analysis

- The speaker driver market is witnessing steady growth driven by rising demand for smart audio devices, home entertainment systems, and portable wireless speakers across residential and commercial spaces

- Increasing integration of speaker drivers in automotive infotainment systems, especially in electric and luxury vehicles, is contributing significantly to market expansion

- Asia-Pacific dominated the speaker driver market with the largest revenue share of 38.4% in 2024, driven by rapid industrialization, expansion of consumer electronics manufacturing, and growing demand for audio devices across emerging economies

- North America region is expected to witness the highest growth rate in the global speaker driver market, driven by increasing adoption of advanced audio technologies across consumer electronics, growing demand for immersive home entertainment systems, and the rising popularity of wireless headphones, smart speakers, and gaming peripherals

- The headphone/earphone segment dominated the market with the largest revenue share in 2024, driven by the widespread consumer adoption of wireless earbuds, gaming headsets, and over-ear headphones. This growth is supported by the rise in music streaming, mobile gaming, and video conferencing, all of which demand high-quality, compact drivers for immersive audio experiences. Manufacturers are focusing on integrating features such as active noise cancellation, voice assistant compatibility, and spatial audio, further boosting demand for speaker drivers in this segment

Report Scope and Speaker Driver Market Segmentation

|

Attributes |

Speaker Driver Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Adoption of Voice-Controlled Smart Devices • Expansion of Automotive Infotainment and In-Car Audio Systems |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Speaker Driver Market Trends

“Rising Popularity Of Compact Wireless Audio Devices”

- Rising demand for true wireless stereo (TWS) earbuds is driving innovation in ultra-small speaker drivers that balance sound quality and battery efficiency, appealing to fitness and lifestyle users. These compact audio solutions cater to on-the-go consumers seeking wireless convenience without compromising on immersive audio. The growing popularity of workout-friendly wearables is accelerating the need for reliable, high-output miniature drivers

- Growth of wearable smart devices such as glasses and rings is encouraging manufacturers to embed speaker components without increasing bulk, enabling discreet audio and voice assistant access. With the rise in multifunctional wearables, sound output must be optimized to work effectively in close proximity to the ear without causing discomfort. Developers are prioritizing size, weight, and directional sound performance in new product lines

- Miniaturized balanced armature drivers and hybrid dual-driver configurations are being adopted to enhance clarity and bass response in limited space, making them ideal for in-ear monitors and hearing aids. These technologies allow high-frequency precision and deep lows even in compact enclosures, offering premium sound for audiophiles and professionals alike. The dual-driver setup is also gaining momentum in high-end consumer devices

- Consumers now expect premium audio and hands-free convenience in devices used for remote work, travel, and fitness, pushing brands to integrate responsive and efficient speaker technologies. As everyday tech becomes more personal and portable, audio quality is no longer seen as a trade-off for form factor. The demand for seamless integration is reshaping product design and user interface priorities

- For instance, Apple’s AirPods Pro and Sony’s LinkBuds exemplify this trend by offering spatial audio, ANC (active noise cancellation), and compact speaker driver architecture within ultra-light, wearable formats. These products have demonstrated that advanced audio technologies can be delivered in devices that are stylish, lightweight, and practical for everyday use, setting new standards in the wearable sound category

- The speaker driver market is undergoing a transformation fueled by user expectations for portability, precision, and performance across all devices. As form factors shrink and device functionality expands, speaker driver technology is playing a pivotal role in enhancing the overall user experience. This shift is expected to drive continual innovation in miniaturization, sound clarity, and smart integration.

Speaker Driver Market Dynamics

Driver

“Growing Demand For Immersive Audio Experiences In Home Entertainment And Gaming”

- Increasing demand for immersive home audio and cinema experiences is pushing the adoption of high-performance speaker drivers with enhanced frequency response and sound clarity, particularly in home theatres, soundbars, and multi-room systems. Consumers now seek high-definition audio setups for watching movies, streaming content, and music playback, elevating expectations for audio precision. This trend is encouraging brands to innovate in diaphragm materials, voice coil structures, and magnetic systems

- Growth in the gaming industry and rise in VR/AR headsets is fuelling the need for advanced speaker drivers that support surround and spatial sound, offering gamers realistic and engaging audio environments. As gaming becomes more immersive and competitive, users are investing in headphones and audio gear that provide directional accuracy and depth. The increasing integration of 3D sound in gaming accessories is expanding the market potential for compact, high-performance drivers

- Expansion of smart homes and connected devices is driving the integration of speaker drivers in voice-assisted products such as smart speakers, security systems, and digital hubs for seamless user experiences. Voice-activated smart audio devices now serve as central controls in many households, blending entertainment and functionality. Speaker drivers in these devices must ensure voice clarity and response accuracy, leading to demand for more refined driver components

- Rising consumption of music and video content on mobile platforms is supporting the demand for portable Bluetooth speakers and earbuds powered by compact and efficient drivers that do not compromise on audio quality. As mobility becomes a lifestyle necessity, users expect lightweight yet powerful audio solutions. This has prompted manufacturers to focus on miniaturized driver designs that balance performance, battery life, and comfort

- For instance, Sony's HT-A7000 Dolby Atmos soundbar and Bose’s QuietComfort Ultra Earbuds have gained popularity for offering premium audio powered by cutting-edge speaker driver technologies. These products have set new benchmarks in delivering cinematic sound at home and clear, immersive audio on the go, underscoring how innovation in driver architecture drives consumer adoption

- The speaker driver market is evolving rapidly to meet rising expectations for sound quality, device integration, and user-centric design. Innovations in material science and acoustic engineering are now at the forefront of competitive differentiation. This momentum is expected to sustain demand across diverse industries from consumer electronics to immersive tech applications

Restraint/Challenge

“Volatility In Raw Material Costs and Supply Chain Disruptions”

- Fluctuating costs of raw materials such as neodymium and copper used in speaker drivers are challenging manufacturers to maintain competitive pricing and stable supply in the global market. With sourcing often concentrated in politically unstable or trade-sensitive regions, procurement costs are highly volatile. This directly impacts manufacturing budgets, long-term contracts, and overall product pricing strategies

- Ongoing global supply chain disruptions are affecting the timely procurement of key components, resulting in delayed production cycles and inventory shortages for several audio device makers. Disruptions from geopolitical tensions, shipping container shortages, and port congestions are slowing down the flow of goods. This lag affects not only the delivery of final products but also research and development timelines for new driver innovations

- High competition among established players and emerging brands in the speaker driver space is exerting pricing pressure, limiting the profit margins for manufacturers in price-sensitive regions. While demand is strong, companies are forced to differentiate through pricing or add-on features, making it harder to sustain profitability. This intensifies the focus on cost efficiency and faster production without compromising quality

- Environmental concerns and regulatory policies around rare earth mining and electronics waste disposal are prompting manufacturers to seek alternatives, which may increase R&D costs and complexity. Governments are tightening control over ecological impacts of resource extraction and disposal methods, leading to compliance burdens. Manufacturers must balance sustainability goals with maintaining product performance and cost-effectiveness

- For instance, during the COVID-19 pandemic, companies such as Harman and Bowers & Wilkins experienced production slowdowns and shipment delays due to raw material shortages and transportation constraints. These disruptions not only impacted quarterly revenues but also delayed the launch of new audio products, revealing the vulnerabilities in global supply logistics for audio component manufacturers

- The speaker driver market faces several challenges ranging from cost volatility and supply chain fragility to competitive pricing and regulatory pressures. These hurdles are reshaping how manufacturers source, produce, and innovate speaker components. Navigating these constraints will be essential for companies aiming to sustain profitability and growth in an increasingly complex global market

Speaker Driver Market Scope

The market is segmented on the basis of device type, driver type, driver size, and application.

- By Device Type

On the basis of device type, the speaker driver market is segmented into headphone/earphone, hearing aid, mobile phones/tablets, smart speakers, and loudspeakers. The headphone/earphone segment dominated the market with the largest revenue share in 2024, driven by the widespread consumer adoption of wireless earbuds, gaming headsets, and over-ear headphones. This growth is supported by the rise in music streaming, mobile gaming, and video conferencing, all of which demand high-quality, compact drivers for immersive audio experiences. Manufacturers are focusing on integrating features such as active noise cancellation, voice assistant compatibility, and spatial audio, further boosting demand for speaker drivers in this segment.

The smart speaker segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing adoption of voice-controlled devices in connected homes. Smart speakers are being integrated into household ecosystems for entertainment, control, and productivity, prompting the need for advanced drivers that deliver clear vocals and consistent performance across varied room acoustics. The popularity of smart assistants such as Alexa, Siri, and Google Assistant is also fuelling segment growth.

- By Driver Type

On the basis of driver type, the market is segmented into dynamic drivers, planar magnetic drivers, electrostatic drivers, balanced armatures, and others. The dynamic drivers segment held the largest revenue share in 2024, attributed to their versatility, cost-effectiveness, and widespread use across consumer devices such as headphones, earbuds, and mobile accessories. These drivers are favored for their ability to produce deep bass and handle a wide range of frequencies with ease, making them suitable for both casual and high-performance audio products.

The balanced armatures segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its compact size and high efficiency, especially in in-ear monitors and hearing aids. Balanced armatures deliver detailed and accurate sound reproduction, making them ideal for audiophiles and professional applications. Their growing adoption in high-end earbuds and medical-grade hearing devices is expected to further propel segment growth.

- By Driver Size

On the basis of driver size, the market is segmented into below 20 mm, 20–110 mm, and others. The below 20 mm segment dominated the market in 2024, supported by the booming sales of compact audio devices such as TWS earbuds, hearing aids, and wearable audio products. These miniature drivers are critical for delivering powerful and precise sound in space-constrained applications without compromising audio quality. Advances in materials and diaphragm designs are enabling better output from smaller drivers, making them a preferred choice for modern portable devices.

The 20–110 mm segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand in smart speakers, soundbars, and high-fidelity home audio systems. These larger drivers offer broader frequency response and louder sound, making them ideal for delivering immersive audio in larger environments. The growth in home entertainment and professional studio equipment is likely to boost demand in this size category.

- By Application

On the basis of application, the market is segmented into consumer, professional/enterprise, medical, and others. The consumer segment accounted for the largest share of the market in 2024, driven by the widespread use of speaker drivers in smartphones, laptops, gaming consoles, televisions, smart speakers, and personal audio devices. Increasing disposable income, digital media consumption, and the popularity of wireless audio products are supporting this segment’s dominance.

The medical segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising use of high-precision speaker drivers in hearing aids and therapeutic audio devices. Aging populations, advancements in digital hearing solutions, and growing awareness of hearing health are pushing demand for compact, low-power, high-clarity drivers specifically tailored for medical-grade devices.

Speaker Driver Market Regional Analysis

- Asia-Pacific dominated the speaker driver market with the largest revenue share of 38.4% in 2024, driven by rapid industrialization, expansion of consumer electronics manufacturing, and growing demand for audio devices across emerging economies

- The region benefits from the presence of major electronics producers in China, South Korea, and Japan, along with rising disposable incomes and increasing penetration of smartphones and wireless audio products

- Technological advancements, low production costs, and government initiatives supporting electronics and wearable manufacturing are also contributing to the widespread use of speaker drivers across consumer and medical applications

China Speaker Driver Market Insight

The China speaker driver market captured the largest revenue share within Asia-Pacific in 2024, attributed to the country’s massive production capabilities and its leading role in global consumer electronics manufacturing. China is home to several key speaker driver and audio component manufacturers, enabling fast innovation and scalable supply chains. With increasing consumer demand for TWS earbuds, smartphones, and Bluetooth speakers, the market is witnessing strong volume growth, supported by domestic brands and a rapidly expanding middle class.

Japan Speaker Driver Market Insight

The Japan speaker driver market is expected to witness the fastest growth rate from 2025 to 2032, fueled by high-tech product demand, aging population needs, and preference for high-fidelity audio systems. Japanese consumers place strong emphasis on quality and innovation, supporting the adoption of balanced armature and planar magnetic drivers in premium headphones and hearing aids. The country’s established electronics industry and consistent investment in R&D further reinforce market growth.

North America Speaker Driver Market Insight

The North America speaker driver market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of smart speakers, premium audio systems, and wearable tech. Consumers in the region are early adopters of advanced technologies and continue to prioritize audio performance across home, automotive, and personal electronics segments. The region's strong demand for voice-assisted devices, coupled with innovation in high-end driver designs, contributes to its competitive market position.

U.S. Speaker Driver Market Insight

The U.S. speaker driver market is expected to witness the fastest growth rate from 2025 to 2032, supported by robust consumption of wireless headphones, gaming headsets, and smart home audio systems. Rising interest in immersive home entertainment and productivity-focused audio tools has boosted the need for high-efficiency, compact drivers. In addition, the proliferation of music streaming and growing demand for studio-quality sound has increased the presence of premium driver technologies across consumer and professional applications.

Europe Speaker Driver Market Insight

The Europe speaker driver market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by increased interest in smart home audio, high-quality infotainment systems, and energy-efficient hearing devices. Growing consumer focus on audio clarity and sustainability is influencing manufacturers to adopt advanced, eco-conscious materials and compact driver designs. The region's strong automotive sector also plays a key role in boosting demand for high-performance in-car speaker systems.

Germany Speaker Driver Market Insight

The Germany speaker driver market is expected to witness the fastest growth rate from 2025 to 2032, backed by strong demand for premium audio products in both consumer and professional sectors. Known for its emphasis on precision engineering and quality, Germany is witnessing increased use of speaker drivers in smart homes, offices, and cars. The integration of sustainable manufacturing practices and energy-efficient components aligns well with market trends and regulatory standards in the country.

U.K. Speaker Driver Market Insight

The U.K. speaker driver market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing demand for portable speakers, earbuds, and smart audio accessories. Rising digital media consumption, coupled with strong music and podcasting culture, is supporting the uptake of compact, high-fidelity audio devices. As consumers seek immersive sound in both personal and professional settings, manufacturers are responding with tailored solutions featuring innovative driver technologies.

Speaker Driver Market Share

The Speaker Driver industry is primarily led by well-established companies, including:

- Sennheiser Electronic GmbH & Co. KG (Germany)

- SAMSUNG (South Korea)

- Sony Group Corporation (Japan)

- Knowles Electronics, LLC (U.S.)

- Goertek (China)

- Beyerdynamic GmbH & Co. KG (Germany)

- Fostex Company (Japan)

- Concraft Holding Co., Ltd. (China)

- Eastech Holding Limited (Taiwan)

- VOZ Communications (China)

- Fortune Grand Technology Inc. (Taiwan)

- Tymphany HK Limited (Hong Kong)

- Premium Sound Solutions (Belgium)

- Ole Wolff Elektronik A/S (Denmark)

- Koninklijke Philips N.V. (Netherlands)

- AAC Technologies (China)

- Sonion (Denmark)

- Klipsch Group, Inc. (U.S.)

- Molex (U.S.)

- Audeze (U.S.)

Latest Developments in Global Speaker Driver Market

- In September 2020, Sennheiser launched the CX 400BT True Wireless earbuds featuring 7mm dynamic drivers, aimed at delivering high-fidelity stereo sound with deep bass, clear treble, and detailed mids. This product development enhances the user experience through immersive audio quality, comfort, and sleek design. The introduction of such advanced earbuds strengthens Sennheiser’s position in the premium audio segment and caters to growing consumer demand for high-performance wireless audio solutions, positively influencing market competitiveness

- In April 2020, Mayht introduced a breakthrough in speaker driver technology, backed by investment from FORWARD.one. This innovation is designed to significantly boost audio performance through compact yet powerful drivers, offering enhanced sound quality across applications. The development reflects increasing confidence in next-generation audio solutions and is expected to reshape future product designs by enabling more efficient, space-saving, and superior-sounding devices in both consumer and professional audio markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Speaker Driver Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Speaker Driver Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Speaker Driver Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.