Global Specialty Fuel Additives Market

Market Size in USD Billion

CAGR :

%

USD

11.68 Billion

USD

17.25 Billion

2024

2032

USD

11.68 Billion

USD

17.25 Billion

2024

2032

| 2025 –2032 | |

| USD 11.68 Billion | |

| USD 17.25 Billion | |

|

|

|

|

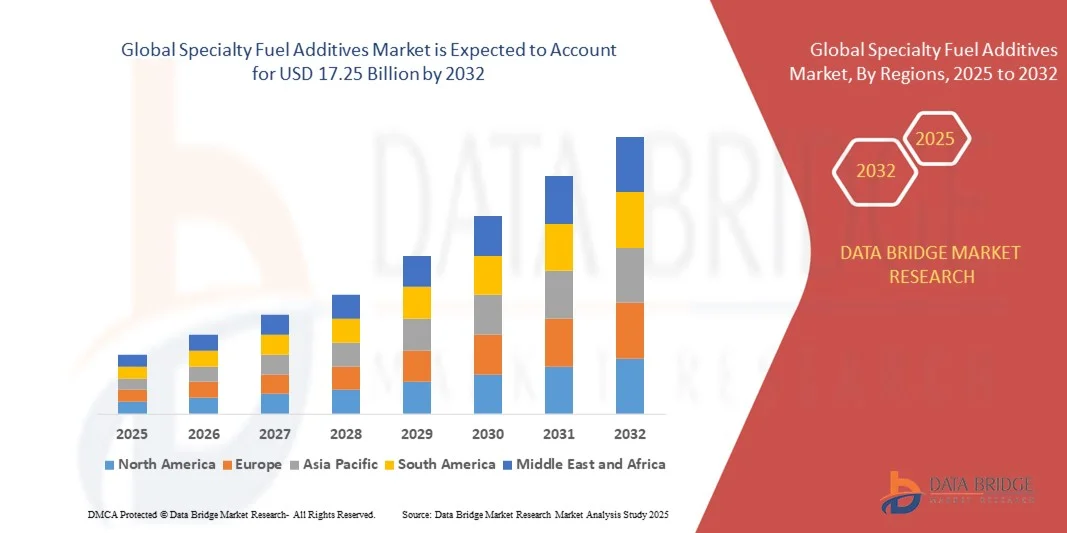

What is the Global Specialty Fuel Additives Market Size and Growth Rate?

- The global specialty fuel additives market size was valued at USD 11.68 billion in 2024 and is expected to reach USD 17.25 billion by 2032, at a CAGR of 4.99% during the forecast period

- Rise in demand by chemicals industry coupled with growing awareness in regards to the benefits of speciality fuel additives such as high-efficiency, lower emissions and prevention of corrosion of equipment is the root cause fuelling up the market growth rate

- Rising industrialization and growth and expansion of various end user verticals especially in the developing economies will also directly and positively impact the growth rate of the market

What are the Major Takeaways of Specialty Fuel Additives Market?

- Growth in the demand for automotive applications, increased focus on consumption of bio-fuel and surge in the demands for ultra-low sulphur diesel will further carve the way for the growth of the market

- However, insufficiency in raw material supply owing to the lockdown and restrictions and growing adoption of compressed natural gas and liquefied petroleum gas will pose a major challenge to the growth of the market

- North America dominated the specialty fuel additives market with the largest revenue share of 41.87% in 2024, driven by high industrial activity, extensive vehicle fleets, and stringent fuel quality regulations

- The Asia-Pacific specialty fuel additives market is poised to grow at the fastest CAGR of 8.25% from 2025 to 2032, driven by rapid industrialization, increasing vehicle fleets, and rising fuel consumption in countries such as China, India, and Japan

- The deposit control additives segment dominated the market with a revenue share of 28.5% in 2024, driven by their critical role in preventing fuel injector deposits, improving engine performance, and ensuring compliance with emission standards

Report Scope and Specialty Fuel Additives Market Segmentation

|

Attributes |

Specialty Fuel Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Specialty Fuel Additives Market?

Shift Toward Environmentally Efficient and High-Performance Additives

- A major trend in the global specialty fuel additives market is the rising focus on eco-friendly, high-performance formulations that enhance fuel efficiency while reducing emissions. Manufacturers are increasingly investing in bio-based and low-sulfur additives to comply with stringent environmental regulations

- For instance, Infineum has launched next-generation diesel additives that optimize combustion efficiency and reduce particulate emissions, while Lubrizol offers specialty gasoline additives designed to improve fuel economy and engine longevity

- Advanced formulations are enabling multifunctional benefits such as improved engine protection, reduced maintenance, and enhanced performance under extreme conditions. Companies are incorporating nanotechnology and precision chemical engineering to improve solubility, thermal stability, and oxidation resistance

- The growing integration of these additives in premium fuels and hybrid engines reflects an industry-wide emphasis on sustainability, operational efficiency, and regulatory compliance. Consequently, manufacturers such as Afton Chemical are expanding R&D pipelines to meet evolving environmental standards and performance expectations

- The demand for high-performance, environmentally conscious additives is rapidly increasing across automotive, industrial, and marine applications, driven by stricter emissions norms and the rising adoption of advanced engines globally

What are the Key Drivers of Specialty Fuel Additives Market?

- The accelerating adoption of stringent environmental regulations and emission standards is a major driver for the growing demand for Specialty Fuel Additives. Governments worldwide are pushing for cleaner fuels, which incentivizes manufacturers to develop advanced additive solutions

- For instance, in 2024, Lubrizol launched a diesel fuel additive range targeting reduced NOx and particulate emissions, helping operators comply with international standards. Such strategic product launches are expected to propel market growth

- Increased demand for fuel-efficient engines across the automotive, marine, and industrial sectors further supports market expansion. Additives improve combustion efficiency, enhance mileage, and reduce engine wear, offering tangible economic benefits to end-users

- The growing adoption of hybrid and high-performance engines drives the requirement for additives that maintain optimal engine functionality under diverse operating conditions. Specialty Fuel Additives also enable compatibility with alternative fuels such as biodiesel and ethanol blends

- Rising industrialization, urbanization, and increased vehicle ownership in emerging economies are contributing to higher fuel consumption, further encouraging the adoption of additives to optimize performance and extend engine life

Which Factor is Challenging the Growth of the Specialty Fuel Additives Market?

- High raw material costs and volatility in crude oil and chemical feedstocks pose a significant challenge for specialty fuel additives manufacturers. Price fluctuations impact the cost of production and may restrict market penetration, especially in price-sensitive regions

- Environmental compliance requirements and complex regulatory frameworks can increase operational costs and delay product launches, limiting growth in certain markets

- Concerns regarding compatibility of additives with older engines or fuel types can hinder adoption. End-users may be hesitant to switch to new additives without thorough testing and certification

- In addition, increasing competition from alternative fuel technologies, such as electric vehicles, could gradually reduce reliance on fuel-based solutions, creating long-term market uncertainty

- Overcoming these challenges requires strategic R&D investment, cost optimization, and awareness campaigns highlighting the performance and environmental benefits of Specialty Fuel Additives, ensuring sustained growth across global markets

How is the Specialty Fuel Additives Market Segmented?

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the specialty fuel additives market is segmented into fuel antioxidants, petroleum dyes and markers, octane enhancers, lubricity improvers, corrosion inhibitors, deposit control additives, cold flow improvers, cetane number improvers, fuel system icing inhibitors, metal deactivators, and others. The deposit control additives segment dominated the market with a revenue share of 28.5% in 2024, driven by their critical role in preventing fuel injector deposits, improving engine performance, and ensuring compliance with emission standards. These additives are widely adopted across automotive, marine, and industrial applications due to their proven efficiency in maintaining engine cleanliness and reducing maintenance costs.

The lubricity improvers segment is expected to witness the fastest CAGR of 10.7% from 2025 to 2032, fueled by the rising use of low-sulfur fuels and the increasing demand for advanced diesel engines. The growing emphasis on fuel efficiency and engine longevity is driving innovations in these additive formulations globally.

- By Application

On the basis of application, the specialty fuel additives market is segmented into gasoline/petrol additives, diesel additives, aviation turbine fuel additives, and others. The diesel additives segment held the largest market revenue share of 35% in 2024, attributed to the widespread use of diesel engines in commercial vehicles, marine transport, and industrial machinery. Diesel additives enhance fuel combustion efficiency, reduce particulate emissions, and provide superior engine protection under high-stress conditions, making them essential for regulatory compliance and operational cost reduction.

The aviation turbine fuel additives segment is projected to witness the fastest CAGR of 11.5% from 2025 to 2032, driven by the aviation industry’s focus on fuel efficiency, emission reduction, and high-performance engine maintenance. Increasing air traffic, stringent environmental regulations, and the push for sustainable aviation fuels are key factors propelling growth in this segment, encouraging additive manufacturers to innovate and expand product portfolios.

Which Region Holds the Largest Share of the Specialty Fuel Additives Market?

- North America dominated the specialty fuel additives market with the largest revenue share of 41.87% in 2024, driven by high industrial activity, extensive vehicle fleets, and stringent fuel quality regulations

- Consumers and industries in the region highly value advanced fuel efficiency, engine protection, and emission compliance offered by Specialty Fuel Additives across diesel, gasoline, and aviation applications

- This widespread adoption is further supported by established chemical manufacturing infrastructure, high technological capability, and significant R&D investments, making North America a preferred region for additive consumption

U.S. Specialty Fuel Additives Market Insight

The U.S. specialty fuel additives market captured the largest revenue share of 81% in North America in 2024, fueled by robust automotive, industrial, and aviation sectors. The growing demand for high-performance fuels, adherence to emission standards, and adoption of cleaner technologies are key growth drivers. In addition, government mandates on low-sulfur fuels and increasing emphasis on engine efficiency are accelerating market expansion. Major companies are leveraging advanced formulations to meet evolving regulatory requirements and enhance fuel performance.

Europe Specialty Fuel Additives Market Insight

The Europe specialty fuel additives market is expected to expand at a substantial CAGR, driven by strict environmental regulations, increasing vehicle electrification, and the need for high-quality fuel in commercial and industrial applications. Growth is also supported by urbanization, technological advancements, and consumer demand for cleaner, more efficient fuels.

U.K. Specialty Fuel Additives Market Insight

The U.K. market is projected to grow at a noteworthy CAGR, fueled by growing transportation and industrial demand, as well as environmental regulations enforcing the use of specialty fuel additives for emissions reduction. The robust chemical manufacturing base and strong R&D focus further promote adoption.

Germany Specialty Fuel Additives Market Insight

Germany’s market is anticipated to expand at a considerable CAGR, driven by the automotive industry’s emphasis on fuel efficiency, engine performance, and emission control. The integration of advanced additives in diesel and gasoline fuels aligns with the country’s eco-conscious and technologically advanced industrial practices.

Which Region is the Fastest Growing Region in the Specialty Fuel Additives Market?

The Asia-Pacific specialty fuel additives market is poised to grow at the fastest CAGR of 8.25% from 2025 to 2032, driven by rapid industrialization, increasing vehicle fleets, and rising fuel consumption in countries such as China, India, and Japan. Government initiatives supporting cleaner fuels, coupled with urbanization and rising disposable incomes, are accelerating adoption. The region is also emerging as a manufacturing hub for fuel additive components, improving accessibility and affordability for local and export markets.

Japan Specialty Fuel Additives Market Insight

Japan is witnessing strong growth due to high automotive and industrial demand, an aging population requiring fuel-efficient transport solutions, and a focus on emissions reduction. Advanced additive formulations integrated with fuel technologies are gaining traction in both commercial and consumer sectors.

China Specialty Fuel Additives Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid urbanization, rising middle-class consumption, and the push for smart, fuel-efficient transport solutions. Expansion of manufacturing capabilities and domestic innovation in fuel additives are key factors driving market growth across gasoline, diesel, and aviation applications.

Which are the Top Companies in Specialty Fuel Additives Market?

The specialty fuel additives industry is primarily led by well-established companies, including:

- Afton Chemical (U.S.)

- The Lubrizol Corporation (U.S.)

- Dorf Ketal Chemicals (I) Pvt. Ltd. (India)

- Innospec (U.K.)

- Chevron Corporation (U.S.)

- Evonik Industries AG (Germany)

- Clariant (Switzerland)

- Infineum International Limited (U.K.)

- Eurenco (France)

- Total (France)

- BASF SE (Germany)

- Buckman (U.S.)

- DOVER CHEMICAL CORPORATION (U.S.)

- Exxon Mobil Corporation (U.S.)

- NewMarket Corporation (U.S.)

- LANXESS (Germany)

- Cummins Inc. (U.S.)

- Baker Hughes Company (U.S.)

- Croda International Plc (U.K.)

- Solvay (Belgium)

What are the Recent Developments in Global Specialty Fuel Additives Market?

- In October 2023, The Lubrizol Corporation announced a new distribution contract with the global distribution partner IMCD Group to supply ingredients and specialty chemicals, aiming to support the expanding fuel additives and lubricant market in Bangladesh, strengthening Lubrizol’s market presence in the region

- In August 2022, BASF commenced production of fuel performance additives at its Pudong facility in Shanghai, China, responding to rising regional demand and ensuring greater supply flexibility and security for clients across Asia, reinforcing BASF’s strategic footprint in the Asian fuel additives market

- In December 2021, BASF launched the multipurpose diesel additive KEROPUR-D in South Korea, designed to remove engine deposits and prevent new buildup, enhancing engine performance and showcasing BASF’s commitment to high-quality diesel fuel solutions in the region

- In November 2021, Evonik established a state-of-the-art oil additive performance testing laboratory in the Asia-Pacific region to provide advanced testing services for additives, demonstrating Evonik’s commitment to supporting customers and innovation in the Asian market

- In January 2021, BASF Enzymes LLC and Innospec Fuel Specialties LLC entered a distribution agreement for DCI-11 Plus ClearTrak, a concentrated corrosion inhibitor, to be supplied to U.S. ethanol producers, reflecting their dedication to increasing value and supporting the ethanol yield business

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Specialty Fuel Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Specialty Fuel Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Specialty Fuel Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.