Global Specialty Oilfield Chemicals Market

Market Size in USD

CAGR :

%

11.23 USD

17.42 USD

2024

2032

11.23 USD

17.42 USD

2024

2032

| 2025 –2032 | |

| USD 11.23 USD | |

| USD 17.42 USD | |

|

|

|

|

Specialty Oilfield Chemicals Market Size

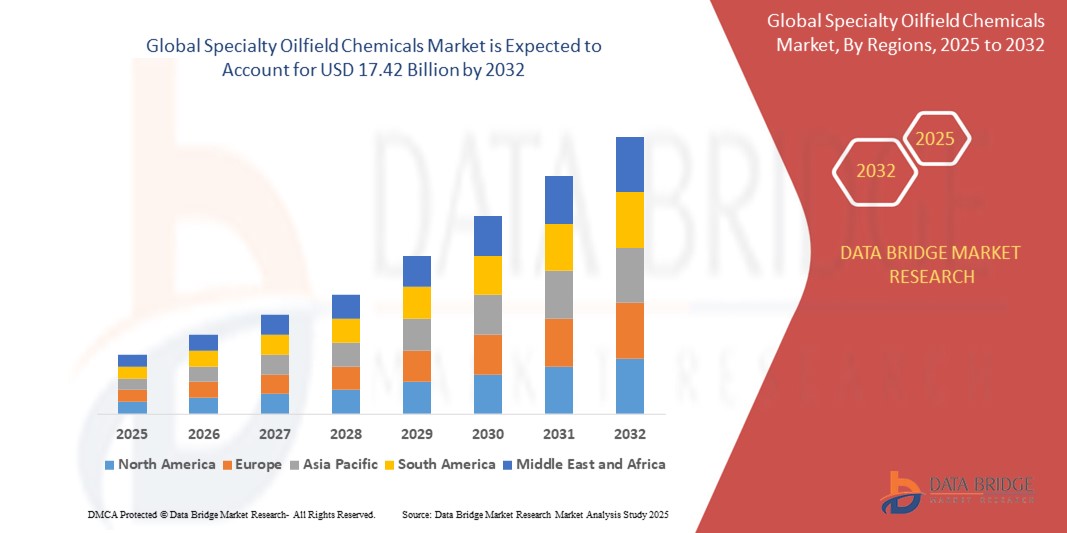

- The global specialty oilfield chemicals market size was valued at USD 11.23 billion in 2024 and is projected to reach USD 17.42 billion by 2032, growing at a CAGR of 5.70% during the forecast period.

- The market growth is fueled by increasing global oil & gas exploration and production activities, rising demand for enhanced oil recovery (EOR), and the growing need for production optimization in mature oilfields.

Specialty Oilfield Chemicals Market Analysis

- pecialty oilfield chemicals are tailored formulations used to improve the efficiency, safety, and economic viability of oil & gas operations. These chemicals play a pivotal role in ensuring smooth operations during drilling, production, cementing, and well stimulation by controlling corrosion, preventing scale buildup, and reducing friction.

- The market is witnessing stable growth supported by growing energy demand, technological advancements in oil recovery methods, and the expansion of deep-water and unconventional oil reserves.

- Asia-Pacific is expected to dominate the global specialty oilfield chemicals market with a market share of 33.89% in 2024, owing to the increasing investments in upstream oil & gas projects in countries like China, India, and Indonesia, along with rising offshore exploration activities.

- North America is anticipated to be the fastest-growing region during the forecast period due to increasing shale gas extraction, EOR activities, and a well-established oilfield services infrastructure in the United States and Canada.

- The Demulsifiers segment is expected to hold the largest market share of 28.65% in 2024, driven by its critical role in separating water and oil emulsions during crude oil production, especially in high water-cut fields. Their effectiveness in enhancing oil quality and minimizing downstream processing issues makes them indispensable in upstream operations.

Report Scope and Specialty Oilfield Chemicals Market Segmentation

|

Attributes |

Specialty Oilfield Chemicals Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Specialty Oilfield Chemicals Market Trends

“Increased Drilling Activities in Unconventional Oil & Gas Reserves”

- One prominent trend in the global specialty oilfield chemicals market is the growing adoption of environmentally friendly and low-toxicity chemical formulations.

- This trend is driven by increasing regulatory pressure, environmental concerns, and growing emphasis on sustainable oil and gas operations. Oilfield operators are under scrutiny to reduce the environmental footprint of exploration and production activities.

- For instance, Schlumberger and Halliburton have launched biodegradable, low-toxicity drilling and completion fluids to align with sustainability goals and meet stringent regional regulations such as those from the EPA (U.S.) and REACH (EU).

- The shift towards greener alternatives is also influencing the development of non-toxic corrosion inhibitors, biodegradable scale inhibitors, and low-emission demulsifiers that can function efficiently under harsh reservoir conditions.

- As the oil & gas sector intensifies its focus on ESG compliance, the demand for sustainable specialty oilfield chemicals is expected to grow, supporting long-term market expansion.

Specialty Oilfield Chemicals Market Dynamics

Driver

“Increased Drilling Activities in Unconventional Oil & Gas Reserves”

- The rising number of exploration and production activities in unconventional reserves such as shale gas, tight oil, and coalbed methane is a key driver of the specialty oilfield chemicals market.

- These reserves often require advanced hydraulic fracturing and horizontal drilling techniques, which in turn demand high-performance chemical solutions for lubrication, scale control, water treatment, and enhanced oil recovery.

- The U.S., China, and Argentina are witnessing increased shale production, pushing the demand for specialty chemicals that ensure operational efficiency and maximize hydrocarbon recovery.

- For instance, Baker Hughes and Clariant have introduced specialty chemical portfolios tailored for tight formations and high-pressure, high-temperature (HPHT) environments, enhancing drilling efficiency and minimizing formation damage.

- As global energy demand persists and operators look to maximize output from complex formations, specialty chemicals will play a pivotal role in supporting extraction performance and cost-efficiency.

Restraint/Challenge

“Volatility in Crude Oil Prices”

- One of the significant challenges facing the specialty oilfield chemicals market is the volatile nature of crude oil prices, which directly affects exploration budgets and chemical procurement strategies.

- Fluctuating oil prices can lead to reduced capital expenditures in upstream activities, causing delays or cancellations of drilling and production projects, particularly in price-sensitive regions like Latin America, Africa, and Southeast Asia.

- This in turn reduces the demand for specialty chemicals such as demulsifiers, corrosion inhibitors, and cementing additives used in well stimulation and production.

- For instance, during periods of low oil prices, companies like Weatherford and Solvay have reported contractions in sales of production-related chemicals due to project slowdowns and cost-cutting measures by oilfield service providers.

- Price volatility adds uncertainty to the market, limiting long-term investment in R&D and adoption of high-cost, high-performance specialty chemicals in emerging markets.

Specialty Oilfield Chemicals Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Specialty Oilfield Chemicals Market is segmented into Demulsifiers, Inhibitors & Scavengers, Rheology Modifiers, Friction Reducers, Specialty Biocides, Specialty Surfactants, Pour Point Depressants, and Others. The Demulsifiers segment accounts for the largest market revenue share of 26.8% in 2025, owing to its critical role in breaking down emulsions during crude oil separation processes. These chemicals are extensively used in upstream operations to improve oil quality and enhance the efficiency of production facilities. The widespread adoption of demulsifiers across onshore and offshore fields is further supported by their ability to minimize operational downtime and reduce processing costs.

However, the Specialty Biocides segment is expected to register the highest CAGR of 6.94% during the forecast period of 2025–2032. The rising focus on microbial control in oilfield systems—particularly in water injection systems and storage tanks—is driving this growth. These biocides play a vital role in controlling sulfate-reducing bacteria (SRB) and preventing biofouling and corrosion, especially in mature fields and enhanced oil recovery (EOR) projects where microbial contamination poses serious operational risks.

- By Application

On the basis of application, the Specialty Oilfield Chemicals Market is segmented into Production, Well Stimulation, Drilling Fluids, Enhanced Oil Recovery, Cementing, and Workover & Completion. The Production segment held the largest market share of 32.4% in 2025, primarily due to the high-volume use of specialty chemicals in ensuring smooth and efficient extraction processes. These include demulsifiers, corrosion inhibitors, scale inhibitors, and biocides, which are essential for maintaining flow assurance, enhancing equipment lifespan, and ensuring regulatory compliance in daily operations.

However, the Enhanced Oil Recovery (EOR) segment is projected to witness the highest CAGR of 7.28% during the forecast period. This growth is fueled by increasing investments in tertiary recovery techniques to maximize output from mature oilfields. Specialty chemicals used in EOR, such as surfactants and polymers, improve oil mobility and recovery efficiency. With the global push toward optimizing existing resources and minimizing the environmental footprint of exploration, the role of high-performance chemicals in EOR is expected to expand significantly.

Global Specialty Oilfield Chemicals Market Regional Analysis

North America Specialty Oilfield Chemicals Market Insight

North America holds a leading position in the global specialty oilfield chemicals market in 2025, attributed to mature oil & gas exploration and production infrastructure across the region. The increasing use of advanced extraction technologies, including enhanced oil recovery (EOR), is driving demand for high-performance chemical solutions to boost production efficiency and asset longevity. The region's focus on shale gas development and offshore drilling activities continues to strengthen consumption of demulsifiers, corrosion inhibitors, and friction reducers. Strict environmental and safety regulations are further pushing the market toward innovative, eco-friendly formulations.

- U.S. Specialty Oilfield Chemicals Market Insight

The U.S. accounts for the largest revenue share in North America’s specialty oilfield chemicals market in 2025, driven by active shale development in the Permian, Bakken, and Eagle Ford basins. Rising horizontal drilling and hydraulic fracturing operations are spurring the need for specialty surfactants, biocides, and rheology modifiers. Additionally, strong investment in R&D and a well-established base of chemical manufacturers are accelerating the development of custom chemical solutions for upstream operations.

- Canada Specialty Oilfield Chemicals Market Insight

The Canadian market is projected to experience steady growth over the forecast period, supported by sustained activity in Alberta’s oil sands and offshore projects in the Atlantic region. Specialty oilfield chemicals are increasingly used in production and workover operations to address harsh environmental conditions and regulatory compliance. Rising emphasis on reducing water usage and improving recovery rates is creating demand for performance-enhancing chemicals such as pour point depressants and inhibitors.

Europe Specialty Oilfield Chemicals Market Insight

The European specialty oilfield chemicals market is poised for moderate growth, driven by rising focus on offshore E&P activities in the North Sea and enhanced recovery from mature fields. The demand for environmentally sustainable chemicals is rising due to stringent EU regulations targeting chemical toxicity and discharge levels.

Innovation in biodegradable and low-toxic solutions is gaining momentum, with increased adoption of high-performance surfactants, biocides, and corrosion inhibitors designed to meet strict environmental standards.

- Norway Specialty Oilfield Chemicals Market Insight

Norway represents a key market in Europe, with its robust offshore oil & gas sector and significant investment in field enhancement technologies. The country’s continued exploration efforts in the Barents Sea and EOR programs are contributing to strong demand for demulsifiers and rheology modifiers. Emphasis on green technologies and sustainable field operations is also fostering growth in environmentally compliant chemical solutions.

- United Kingdom Specialty Oilfield Chemicals Market Insight

The UK market is witnessing stable growth supported by brownfield redevelopment and decommissioning support in the North Sea. Specialty oilfield chemicals are vital for maintaining efficiency in mature wells and reducing production downtime. The UK government’s decarbonization strategy for the oil & gas sector is also promoting innovation in low-VOC, eco-friendly chemical formulations.

Asia-Pacific Specialty Oilfield Chemicals Market Insight

The Asia-Pacific region is anticipated to register the fastest CAGR of over 8.7% during the forecast period, driven by increasing exploration and production activities in Southeast Asia, China, and India. Expanding investment in upstream assets and a growing focus on unconventional resources are supporting demand for performance chemicals across drilling, production, and EOR applications.

Regional governments are encouraging foreign investment and improved domestic production, fueling the need for specialty chemicals that enhance recovery, reduce water handling costs, and improve wellbore integrity.

- China Specialty Oilfield Chemicals Market Insight

China holds the largest share in the Asia-Pacific market due to substantial oilfield development projects and heavy reliance on chemical-enhanced production techniques. Local production of specialty chemicals combined with strong government backing for oilfield modernization is boosting market penetration. Key applications include fracturing fluids, workover chemicals, and production chemicals aimed at maximizing output and maintaining regulatory compliance.

- India Specialty Oilfield Chemicals Market Insight

India is projected to witness rapid growth in the specialty oilfield chemicals market, propelled by increased domestic exploration and a shift toward enhanced oil recovery technologies. ONGC and other domestic players are investing in advanced chemical solutions to reduce declining output from aging fields. Government initiatives aimed at energy security and import reduction are driving market expansion, particularly for drilling fluids, biocides, and scale inhibitors in both onshore and offshore projects.

Specialty Oilfield Chemicals Market Share

The Specialty Oilfield Chemicals industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Clariant AG (Switzerland)

- Halliburton Company (U.S.)

- Schlumberger Limited (U.S.)

- Solvay S.A. (Belgium)

- Croda International Plc (UK)

- Kemira Oyj (Finland)

- Huntsman Corporation (U.S.)

- Baker Hughes Company (U.S.)

- Nouryon (Netherlands)

- Lubrizol Corporation (U.S.)

- Stepan Company (U.S.)

- Albemarle Corporation (U.S.)

- Ashland Inc. (U.S.)

- Innospec Inc. (U.S.)

- SNF Floerger (France)

- Elementis Plc (UK)

- Newpark Resources Inc. (U.S.)

- ChampionX Corporation (U.S.)

- Chevron Phillips Chemical Company (U.S.)

Latest Developments in Global Specialty Oilfield Chemicals Market

- In February 2025, BASF announced the expansion of its oilfield chemicals production facility in Texas (U.S.) to meet the rising demand for demulsifiers and corrosion inhibitors in unconventional oil and gas operations. This investment aims to enhance BASF’s local supply capabilities and reduce lead times, strengthening its competitive position in North America.

- In October 2024, Clariant AG introduced a new range of low-dosage hydrate inhibitors and green corrosion inhibitors under its PHASETREAT® series. Designed to perform efficiently in extreme offshore environments, these formulations are developed to support sustainability goals while improving operational efficiency in oil and gas production.

- In July 2024, Nouryon launched a next-generation friction reducer optimized for high-salinity environments in hydraulic fracturing operations. The product is designed to minimize freshwater usage and boost well productivity, aligning with operators’ goals for cost efficiency and environmental compliance.

- In May 2024, Halliburton Company introduced BioGuard™, a new environmentally friendly biocide formulation targeting microbial-induced corrosion in offshore platforms and pipelines. With its extended protection duration and lower toxicity, the launch reinforces Halliburton’s focus on sustainable oilfield chemistry solutions.

- In March 2024, Kemira Oyj announced a strategic partnership with a major Middle Eastern NOC to co-develop customized scale inhibitors and water clarifiers for enhanced oil recovery projects. This collaboration supports Kemira’s regional expansion and aligns with the growing demand for region-specific formulations in challenging production conditions.

- In January 2024, Croda International Plc launched Synperonic™ OE Series, a line of non-ionic surfactants tailored for oilfield applications such as well stimulation and drilling fluids. With a focus on performance under high pressure and temperature, the launch marks Croda’s entry into more specialized upstream chemical segments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Specialty Oilfield Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Specialty Oilfield Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Specialty Oilfield Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.