Global Specialty Pulp And Paper Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

24.07 Billion

USD

30.96 Billion

2024

2032

USD

24.07 Billion

USD

30.96 Billion

2024

2032

| 2025 –2032 | |

| USD 24.07 Billion | |

| USD 30.96 Billion | |

|

|

|

|

Specialty Pulp and Paper Chemicals Market Size

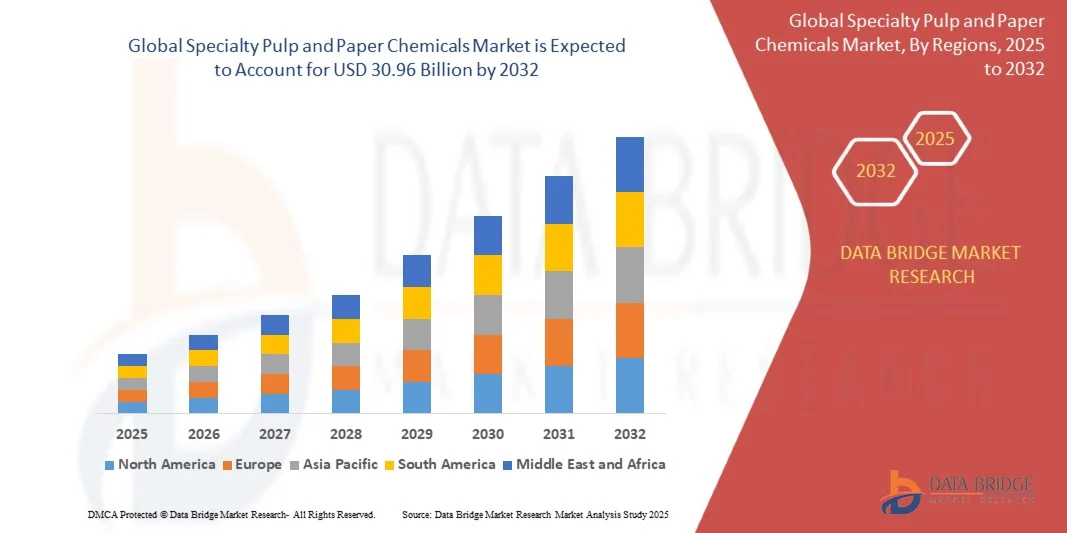

- The global specialty pulp and paper chemicals market size was valued at USD 24.07 billion in 2024 and is expected to reach USD 30.96 billion by 2032, at a CAGR of 3.20% during the forecast period

- The market growth is largely fueled by increasing demand for high-quality paper products across packaging, printing, and labeling applications, coupled with advancements in specialty chemical formulations that enhance paper strength, brightness, and durability

- Furthermore, rising focus on sustainable and energy-efficient paper production is driving manufacturers to adopt functional, bleaching, and process chemicals that optimize pulp processing and minimize environmental impact. These converging factors are accelerating the adoption of specialty pulp and paper chemicals, thereby significantly boosting the industry's growth

Specialty Pulp and Paper Chemicals Market Analysis

- Specialty pulp and paper chemicals, including functional, bleaching, and process chemicals, are critical for enhancing paper performance, ensuring operational efficiency, and meeting the rising quality expectations of packaging, printing, and specialty paper applications

- The escalating demand for these chemicals is primarily fueled by growth in the global paper and packaging industries, increasing environmental regulations, and a shift toward high-performance and sustainable paper manufacturing solutions

- Asia-Pacific dominated the specialty pulp and paper chemicals market with a share of 46.5% in 2024, due to rapid industrialization, growing demand for paper and packaging products, and increasing investments in modern pulp and paper mills

- North America is expected to be the fastest growing region in the specialty pulp and paper chemicals market during the forecast period due to robust demand for specialty chemicals in packaging, printing, and labeling industries

- Packaging segment dominated the market with a market share of 41.5% in 2024, due to the global surge in e-commerce and demand for durable, lightweight, and recyclable paper-based packaging. Specialty chemicals enhance the strength, water resistance, and printability of packaging materials, which is critical for protecting products during transit. Companies increasingly adopt treated paper solutions for food and consumer goods packaging, emphasizing both functional performance and sustainability. The segment’s dominance is also supported by government policies promoting paper-based packaging over plastics and growing investment in automated packaging lines requiring consistent paper quality

Report Scope and Specialty Pulp and Paper Chemicals Market Segmentation

|

Attributes |

Specialty Pulp and Paper Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Specialty Pulp and Paper Chemicals Market Trends

“Rising Use of Eco-Friendly Specialty Pulp and Paper Chemicals”

- The specialty pulp and paper chemicals market is witnessing a notable shift toward the adoption of eco-friendly and bio-based chemical formulations driven by global sustainability mandates and consumer preference for green products. Major manufacturers are prioritizing recycled polymers, enzymes, and environmentally safe additives to support circular economy goals and reduce environmental footprints in paper production

- For instance, SNF and Mitsubishi Chemical Corporation entered a strategic partnership in March 2025 to produce N-vinylformamide, a next-generation monomer essential for sustainable polymer production in the paper industry. This collaboration reflects the sector’s pivot to less hazardous, high-performance chemicals supporting the manufacture of specialty grades and functional paper substrates

- The increasing integration of bio-based coatings and nanotechnology in specialty chemical formulations is enhancing print quality, tensile strength, and water resistance of packaging and labeling papers. Such chemicals are favored due to stringent environmental regulatory frameworks in regions such as the EU, North America, and Japan, where government agencies strictly monitor health and safety compliance in papermaking processes

- Growing demand for biodegradable packaging materials and water-based coatings is fueling innovation in low-VOC (volatile organic compound) and non-toxic chemical solutions. Manufacturers are leveraging advanced fiber treatment agents and deinking aids to upgrade recycled content while improving printability and tissue softness

- The use of functional chemicals including sizing agents, retention aids, and wet strength agents is expanding along with the surge in premium and specialty paper product requirements. These innovations optimize operational reliability for mills but also support the creation of high-value tissue and board products demanded by both retail and industrial segments

- This market trend toward sustainable specialty pulp and paper chemicals is now central to competitive differentiation, regulatory compliance, and long-term sector growth. Companies are expected to continue investing in eco-optimized chemistries, process efficiency, and green certifications to maintain viability in a rapidly transforming industry landscape

Specialty Pulp and Paper Chemicals Market Dynamics

Driver

“Growing Demand for High-Performance Paper Products”

- The growing demand for high-performance paper products across packaging, printing, and hygiene applications is a primary driver for specialty pulp and paper chemicals. These chemicals play an essential role in enhancing product characteristics such as strength, durability, water resistance, and printability, meeting stringent demands of regulatory bodies and end-users globally

- For instance, AkzoNobel N.V. and Kemira Oyj are deploying advanced surface sizing agents and wet strength solutions that enable packaging producers and tissue manufacturers to optimize yield, maintain integrity under adverse conditions, and deliver superior consumer experiences

- The expansion of e-commerce and retail sectors has amplified the need for robust packaging materials with improved barrier properties and operational reliability. High-performance additives, including pigments and drainage aids, also contribute to lower production costs by reducing water usage and energy requirements

- In addition, the proliferation of premium-grade papers in labeling, specialty printing, and food packaging markets is further driving the adoption of functional chemicals. Mills rely on process and coating chemicals to meet the rising standards for brightness, cleanliness, and print clarity across diverse substrate types

- The continuous market shift towards value-added paper products underscores the strategic importance of specialty chemicals. This trend will persist as innovation and regulatory mandates encourage manufacturers to deliver high-performance solutions across packaging, hygiene, and industrial segments

Restraint/Challenge

“High Raw Material Costs and Regulatory Compliance”

- Volatility in raw material prices and complex regulatory compliance requirements present substantial challenges for the specialty pulp and paper chemicals market. Price fluctuations in key feedstocks—such as petroleum-based resins, acids, solvents, and bio-based inputs—impact manufacturer margins and complicate production planning for both global and regional players

- For instance, Berry Global Group and Evonik Industries AG encounter frequent cost adjustments due to shifts in crude oil and commodity chemical markets. These price variances increase procurement risk and pressure companies to reevaluate sourcing and inventory strategies, especially during supply shortages or geopolitical disruptions

- Complying with stringent international regulatory standards, such as those set by the EPA, EU REACH, and national agencies, demands significant investment in certification, periodic audits, safety data documentation, and reformulation to meet changing health and environmental criteria. Operational complexity rises with every product line tailored to diverse regional compliance frameworks

- Transitioning to eco-friendly chemistries—though environmentally beneficial—often increases production costs due to specialized raw material sourcing, advanced process controls, and the need for third-party certification and life cycle analysis. Small- and medium-sized players may find these barriers hinder competitive participation in premium market segments

- Overcoming these challenges through innovation in cost management, supply chain transparency, and harmonized compliance is critical for sustained market growth. As regulatory expectations and raw material pressures intensify, industry players must embrace proactive strategies to maintain profitability and sector leadership

Specialty Pulp and Paper Chemicals Market Scope

The market is segmented on the basis of product and application.

• By Product

On the basis of product, the specialty pulp and paper chemicals market is segmented into basic chemicals, functional chemicals, bleaching chemicals, and process chemicals. The functional chemicals segment dominated the market with the largest market revenue share in 2024, driven by their critical role in enhancing paper strength, durability, and printability. Manufacturers increasingly prefer functional chemicals due to their ability to improve sheet formation, retention, and surface properties, making them essential for producing high-quality specialty paper products. The consistent demand from packaging and printing industries further reinforces the dominance of functional chemicals, supported by innovations that tailor these chemicals for specific performance requirements in different paper grades. Their compatibility with modern, automated paper production lines also boosts adoption across large-scale facilities, ensuring a steady market share.

The bleaching chemicals segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising environmental regulations and demand for high-brightness, eco-friendly paper products. For instance, companies such as Solvay are innovating in chlorine-free and hydrogen peroxide-based bleaching solutions to meet sustainability targets. The growth is further supported by increasing consumption of premium printing and specialty papers where superior whiteness and optical properties are critical. Bleaching chemicals also play a pivotal role in reducing water and energy usage in pulp processing, appealing to manufacturers aiming for operational efficiency and compliance with green manufacturing standards.

• By Application

On the basis of application, the specialty pulp and paper chemicals market is segmented into packaging, labeling, printing, and others. The packaging segment dominated the market with the largest revenue share of 41.5% in 2024, driven by the global surge in e-commerce and demand for durable, lightweight, and recyclable paper-based packaging. Specialty chemicals enhance the strength, water resistance, and printability of packaging materials, which is critical for protecting products during transit. Companies increasingly adopt treated paper solutions for food and consumer goods packaging, emphasizing both functional performance and sustainability. The segment’s dominance is also supported by government policies promoting paper-based packaging over plastics and growing investment in automated packaging lines requiring consistent paper quality.

The printing segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for high-quality printed materials in commercial, advertising, and specialty publications. For instance, manufacturers such as BASF are supplying advanced coating and finishing chemicals that improve ink adhesion, gloss, and color vibrancy. The growth is further supported by the increasing use of specialty papers in labels, greeting cards, and premium print media where visual appeal is critical. Printing applications benefit from chemicals that optimize process efficiency, reduce waste, and ensure consistent print quality across diverse paper grades, driving accelerated adoption in this segment.

Specialty Pulp and Paper Chemicals Market Regional Analysis

- Asia-Pacific dominated the specialty pulp and paper chemicals market with the largest revenue share of 46.5% in 2024, driven by rapid industrialization, growing demand for paper and packaging products, and increasing investments in modern pulp and paper mills

- The region’s cost-effective production landscape, rising adoption of high-performance chemicals, and growing exports of paper products are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rising awareness of sustainable and efficient paper production processes are contributing to increased consumption of specialty chemicals across manufacturing sectors

China Specialty Pulp and Paper Chemicals Market Insight

China held the largest share in the Asia-Pacific specialty pulp and paper chemicals market in 2024, owing to its status as a leading producer of paper and packaging materials. The country’s strong industrial base, favorable government policies supporting chemical and paper sector expansion, and extensive export capabilities are major growth drivers. Demand is further bolstered by investments in advanced functional, bleaching, and process chemicals to enhance paper quality and operational efficiency for both domestic and international markets.

India Specialty Pulp and Paper Chemicals Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid industrialization, rising demand for high-quality packaging, and modernization of paper manufacturing units. Government initiatives promoting Make in India and self-reliance in industrial chemicals are strengthening the demand for specialty pulp and paper chemicals. In addition, expanding packaging, printing, and labeling industries, coupled with increasing investments in eco-friendly and high-performance chemical solutions, are driving robust market expansion.

Europe Specialty Pulp and Paper Chemicals Market Insight

The Europe specialty pulp and paper chemicals market is expanding steadily, supported by stringent environmental regulations, high demand for high-performance paper products, and investments in sustainable chemical solutions. The region emphasizes quality, compliance, and eco-friendly production processes, particularly in packaging and printing applications. Growing adoption of advanced functional and bleaching chemicals to enhance paper durability, whiteness, and printability is further enhancing market growth.

Germany Specialty Pulp and Paper Chemicals Market Insight

Germany’s specialty pulp and paper chemicals market is driven by its leadership in high-quality paper production, strong chemical manufacturing expertise, and export-oriented production model. Well-established R&D networks and collaborations between academic institutions and manufacturers foster continuous innovation in functional and process chemicals. Demand is particularly strong in packaging, printing, and specialty paper applications, where performance, consistency, and sustainability are key requirements.

U.K. Specialty Pulp and Paper Chemicals Market Insight

The U.K. market is supported by a mature industrial base, rising investments in advanced chemical solutions, and growing demand for high-performance paper and packaging products. Focus on eco-friendly and efficient production processes, combined with increasing use of functional and bleaching chemicals in printing and labeling applications, is driving adoption. The U.K. continues to play a significant role in specialty chemicals for premium and sustainable paper production.

North America Specialty Pulp and Paper Chemicals Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by robust demand for specialty chemicals in packaging, printing, and labeling industries. Rising adoption of functional, bleaching, and process chemicals to improve paper quality, durability, and operational efficiency is fueling growth. In addition, modernization of paper mills, focus on sustainable production, and increasing investments in automation and chemical technologies are supporting market expansion.

U.S. Specialty Pulp and Paper Chemicals Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its expansive packaging and printing industries, strong R&D infrastructure, and significant investment in specialty chemical production. The country’s focus on quality, operational efficiency, and sustainable production is encouraging the adoption of high-performance pulp and paper chemicals. Presence of key manufacturers, advanced production facilities, and a well-established distribution network further solidify the U.S.’s leading position in the region.

Specialty Pulp and Paper Chemicals Market Share

The specialty pulp and paper chemicals industry is primarily led by well-established companies, including:

- Ashland (U.S.)

- BASF SE (Germany)

- Buckman (U.S.)

- Dow (U.S.)

- Exxon Mobil Corporation (U.S.)

- Kemira (Finland)

- Ecolab (U.S.)

- SNF (France)

- Evonik Industries AG (Germany)

- Solvay (Belgium)

- ERCO Worldwide (U.S.)

- KEMINDO (Indonesia)

- Nouryon (Netherlands)

- Croda International Plc (U.K.)

- Solenis (U.S.)

- Nalco Water (U.S.)

- Shell Chemicals (Netherlands)

- Akzo Nobel N.V. (Netherlands)

Latest Developments in Global Specialty Pulp and Paper Chemicals Market

- In July 2025, Sappi Limited, a major global producer of specialty pulp and paper products, commissioned a state-of-the-art, energy-efficient chemical recovery boiler at its Ngodwana Mill in South Africa. This development is expected to reduce the mill's greenhouse gas emissions by approximately 100,000 tons annually, significantly enhancing environmental sustainability. The advanced boiler optimizes chemical recovery and energy utilization, reducing operational costs and reinforcing Sappi’s commitment to eco-friendly production processes. By improving efficiency and sustainability, this initiative strengthens the company’s position in the specialty pulp and paper chemicals market and meets the growing regulatory and customer demand for environmentally responsible paper products

- In May 2025, Ahlstrom-Munksjö completed the acquisition of the fine paper business from Smurfit Kappa Group, expanding its operational footprint in Europe and significantly increasing its market share in the specialty pulp and paper chemicals sector. This acquisition enables Ahlstrom-Munksjö to integrate advanced chemical solutions into a wider range of paper products, enhancing performance attributes such as strength, printability, and durability. It also positions the company to better meet increasing demand from packaging, printing, and labeling industries, and strengthens its competitive advantage in a market that values high-quality, specialty paper solutions

- In March 2024, INEOS Styrolution, a leading global styrenics supplier, partnered with ABB, a technology provider, to develop and commercialize a new process technology for producing styrene monomer (SM) from renewable feedstocks. This collaboration is expected to significantly reduce the carbon footprint associated with specialty pulp and paper chemicals production, addressing increasing regulatory pressure and sustainability expectations. The adoption of renewable feedstock technologies enables the industry to move toward greener chemical processes, reduces dependency on fossil-based raw materials, and supports the broader trend of sustainable manufacturing in the pulp and paper sector

- In January 2024, DuPont Nutrition & Biosciences launched Avicel PHD, a new line of specialty pulp and paper chemicals designed to enhance the strength and viscosity of paper pulp. This innovation improves the overall quality of paper, enabling manufacturers to produce more durable, high-performance products suitable for packaging, printing, and specialty paper applications. Avicel PHD also contributes to greater operational efficiency by optimizing pulp processing and reducing material waste, addressing the rising market demand for functional chemicals that enhance paper properties while supporting sustainable production

- In November 2023, Kemira Oyj announced the expansion of its specialty pulp and paper chemicals production facility in Finland to increase the output of functional and bleaching chemicals. This expansion strengthens the company’s supply capabilities and ensures a reliable delivery of high-performance chemicals to meet the growing demand in Europe. By improving production efficiency and broadening its product offerings, Kemira enhances its market competitiveness and supports the industry’s shift toward sustainable and high-quality paper manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Specialty Pulp And Paper Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Specialty Pulp And Paper Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Specialty Pulp And Paper Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.