Global Specialty Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

66.33 Billion

USD

85.93 Billion

2024

2032

USD

66.33 Billion

USD

85.93 Billion

2024

2032

| 2025 –2032 | |

| USD 66.33 Billion | |

| USD 85.93 Billion | |

|

|

|

|

Specialty Vehicle Market Size

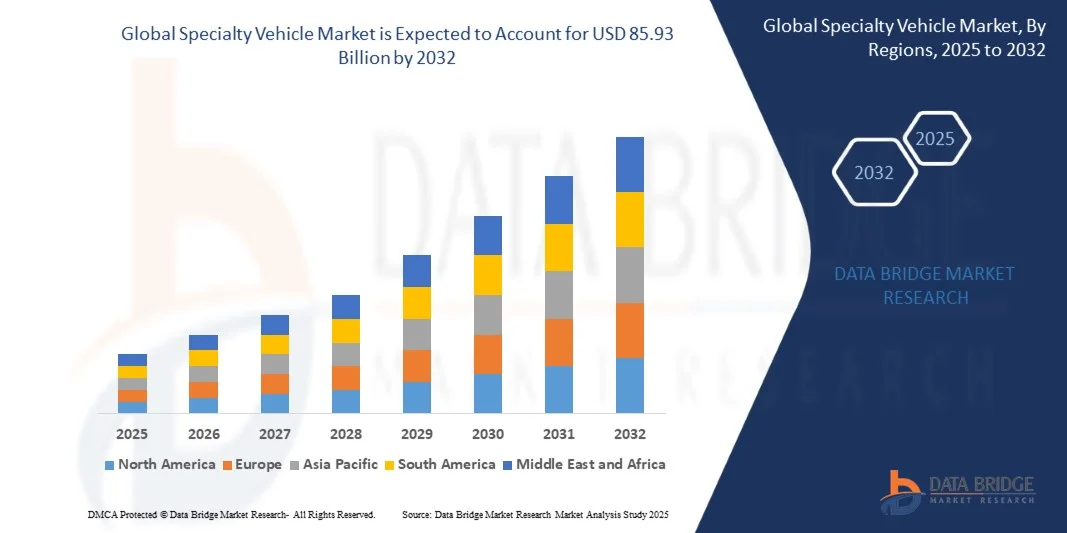

- The global specialty vehicle market size was valued at USD 66.33 billion in 2024 and is expected to reach USD 85.93 billion by 2032, at a CAGR of 3.29% during the forecast period

- The market growth is largely fuelled by rising demand for vehicles customized for industrial, defense, emergency, and commercial applications

- Increasing urbanization, infrastructure development, and technological advancements in vehicle design and safety features are further driving market expansion

Specialty Vehicle Market Analysis

- The global specialty vehicle market is witnessing steady growth due to increasing demand for customized vehicles across industries such as defense, emergency services, agriculture, and construction. The need for vehicles designed for specific operational requirements is driving innovation and product development

- Rising urbanization, infrastructure expansion, and industrialization are creating opportunities for specialty vehicles in logistics, municipal services, and off-road applications. Manufacturers are focusing on advanced technologies, safety features, and fuel efficiency to meet diverse customer needs

- Europe dominated the specialty vehicle market with the largest revenue share of 37.80% in 2024, driven by stringent safety regulations, growing infrastructure development, and rising demand for eco-friendly mobility solutions.

- Asia-Pacific region is expected to witness the highest growth rate in the global specialty vehicle market, driven by rapid urbanization, rising disposable incomes, and industrial expansion in countries such as China, Japan, and Australia. The increasing focus on electric and hybrid specialty vehicles, along with favorable policies for sustainable mobility, is accelerating market growth across the region

- The construction vehicles segment held the largest market revenue share in 2024, driven by growing infrastructure development, urbanization, and industrial expansion. These vehicles are designed to meet rigorous operational requirements, improve efficiency, and enhance safety across construction and civil projects

Report Scope and Specialty Vehicle Market Segmentation

|

Attributes |

Specialty Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Specialty Vehicle Market Trends

“Rising Adoption of Electric and Autonomous Specialty Vehicles”

- The growing shift toward electric and autonomous specialty vehicles is transforming the market by offering enhanced efficiency, reduced emissions, and improved safety. These vehicles allow fleet operators and commercial users to optimize operations while complying with stricter environmental regulations. This trend is driving innovation in vehicle design and functionality

- Increasing demand for specialized vehicles in construction, defense, and logistics sectors is accelerating adoption of modular and purpose-built platforms. These vehicles provide operational flexibility, reduce downtime, and support mission-critical applications in challenging environments. The trend is further supported by government incentives and funding programs

- Affordability and technological advancements in autonomous and electric systems are making specialty vehicles more accessible for mid-sized operators. Integration of telematics, fleet management, and remote monitoring tools improves operational efficiency and predictive maintenance. Users benefit from reduced operational costs and enhanced safety features

- For instance, in 2023, several logistics companies in North America implemented electric cargo vehicles and autonomous yard trucks, which resulted in lower fuel costs, reduced carbon footprint, and improved delivery reliability. These implementations highlight the operational and environmental advantages of next-generation specialty vehicles

- While adoption of advanced specialty vehicles is accelerating, the impact depends on continued technology development, infrastructure availability, and workforce training. Manufacturers must focus on localized solutions and scalable deployment strategies to fully capitalize on market opportunities

Specialty Vehicle Market Dynamics

Driver

“Increasing Demand For Custom And Environmentally Friendly Vehicles”

- The rising need for specialized, custom-built vehicles across industries such as defense, construction, logistics, and agriculture is pushing manufacturers to invest heavily in innovation, modular platforms, and advanced vehicle technologies. These vehicles are designed to meet sector-specific operational requirements, enhance safety standards, and increase productivity. The trend is further driven by growing government and corporate fleet modernization initiatives

- Growing focus on reducing carbon emissions, achieving sustainability goals, and complying with stricter environmental regulations is fueling the adoption of electric, hybrid, and low-emission specialty vehicles. Companies are increasingly prioritizing eco-friendly solutions to align with corporate ESG commitments and regulatory mandates. The adoption of renewable energy-powered fleets also enhances brand reputation and operational efficiency

- Public and private sector initiatives promoting green mobility, smart logistics, and advanced transportation infrastructure are strengthening market growth. From tax incentives, subsidies, and grants for electric vehicle adoption to investments in charging networks and fleet modernization programs, supportive frameworks are enabling wider industry uptake. These measures also encourage investment in research and development for next-generation specialty vehicles

- For instance, in 2022, several European municipalities and government agencies introduced incentives and funding programs for electric utility and service vehicles, resulting in increased fleet electrification, improved operational efficiency, and reduced urban emissions. Adoption of autonomous and connected specialty vehicles also improved route optimization and safety metrics

- While demand for specialized and environmentally conscious vehicles is high, continuous innovation, technological integration, workforce training, and regulatory alignment are essential to sustain long-term growth. Collaboration among manufacturers, policymakers, and logistics operators will be critical to unlocking new market segments and overcoming adoption barriers

Restraint/Challenge

“High Acquisition Costs And Infrastructure Limitations”

- The high purchase price of advanced specialty vehicles, including electric, autonomous, and hybrid platforms, makes them less accessible for small and mid-sized operators, limiting market penetration in price-sensitive regions. High upfront investment costs, coupled with long payback periods, pose challenges for fleet operators looking to modernize

- Many regions still lack adequate charging and fueling infrastructure, maintenance facilities, and trained personnel to support electric and autonomous vehicle fleets. This reduces operational efficiency, increases downtime, and slows adoption, particularly in rural and developing regions

- Supply chain constraints, including inconsistent availability of batteries, semiconductors, specialized components, and raw materials, affect production timelines and vehicle delivery schedules. This can result in project delays, higher prices, and market volatility, especially in emerging economies

- For instance, in 2023, several fleet operators in Sub-Saharan Africa and Southeast Asia delayed electrification and automation initiatives due to limited charging stations, lack of certified maintenance personnel, and component shortages, highlighting regional adoption challenges

- While technological advancements continue to improve vehicle performance, safety, and reliability, addressing high costs, infrastructure gaps, and workforce limitations remains crucial. Stakeholders must focus on scalable, cost-effective, and localized solutions, including partnerships with governments and technology providers, to unlock long-term market potential and enable widespread adoption

Specialty Vehicle Market Scope

The market is segmented on the basis of vehicle type, fuel type, end use, and load capacity.

• By Vehicle Type

On the basis of vehicle type, the specialty vehicle market is segmented into firefighting vehicles, ambulances, construction vehicles, recreational vehicles, and waste collection vehicles. The construction vehicles segment held the largest market revenue share in 2024, driven by growing infrastructure development, urbanization, and industrial expansion. These vehicles are designed to meet rigorous operational requirements, improve efficiency, and enhance safety across construction and civil projects.

The recreational vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising disposable incomes, changing lifestyles, and increasing demand for leisure and tourism mobility solutions. Recreational vehicles offer enhanced comfort, customization options, and advanced technological features, making them highly attractive for personal and commercial rental purposes.

• By Fuel Type

On the basis of fuel type, the specialty vehicle market is segmented into internal combustion engine, electric, hybrid, and alternative fuels. The internal combustion engine segment held the largest market revenue share in 2024, driven by its widespread availability, reliability, and established refueling infrastructure. These vehicles remain the preferred choice across construction, emergency, and municipal applications due to operational familiarity and cost efficiency.

The electric segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by government incentives, environmental regulations, and rising demand for sustainable mobility solutions. Electric specialty vehicles offer lower emissions, reduced operational costs, and quiet operation, making them increasingly suitable for urban areas, emergency services, and eco-conscious commercial applications.

• By End Use

On the basis of end use, the specialty vehicle market is segmented into public sector, private sector, and commercial use. The public sector segment held the largest market revenue share in 2024, driven by investment in emergency services, municipal operations, and government fleet modernization programs. These vehicles support critical services and are designed to meet strict safety and operational standards.

The private sector segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising disposable incomes, growing small business activities, and increased demand for recreational and customized vehicles. Vehicles in this segment offer enhanced comfort, flexibility, and advanced features tailored to individual or organizational requirements.

• By Load Capacity

On the basis of load capacity, the specialty vehicle market is segmented into light duty, medium duty, and heavy duty. The heavy-duty segment held the largest market revenue share in 2024, driven by extensive use in construction, waste management, and emergency services. These vehicles are engineered for durability, high payload, and intensive operational requirements.

The light-duty segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by urbanization, increasing recreational activities, and the rising popularity of small-scale commercial applications. Light-duty vehicles provide versatility, ease of maneuvering, and cost-effective solutions for various end users.

Specialty Vehicle Market Regional Analysis

- Europe dominated the specialty vehicle market with the largest revenue share of 37.80% in 2024, driven by stringent safety regulations, growing infrastructure development, and rising demand for eco-friendly mobility solutions.

- Consumers and organizations across the region highly value specialized vehicles that enhance operational efficiency, safety, and compliance with regulatory standards.

- The widespread adoption is further supported by strong industrialization, technological advancements, and government incentives promoting electric and hybrid vehicle integration, establishing specialty vehicles as a preferred solution for public and private sector operations.

Germany Specialty Vehicle Market Insight

The Germany specialty vehicle market captured the largest revenue share in 2024 within Europe, fueled by rising industrial automation, stringent safety and emission regulations, and adoption of eco-friendly vehicle technologies. Companies are increasingly investing in electric and hybrid platforms to meet sustainability goals while maintaining high performance and durability. Strong R&D capabilities and a focus on smart mobility solutions are further propelling market growth. Moreover, integration with telematics and advanced fleet management systems is significantly enhancing operational efficiency.

U.K. Specialty Vehicle Market Insight

The U.K. specialty vehicle market is expected to witness the fastest growth rate from 2025 to 2032, driven by infrastructure modernization, increasing demand for electric construction and utility vehicles, and advancements in fleet management technologies. Public and private sector initiatives promoting sustainability and emission reduction are encouraging adoption. In addition, the U.K.’s robust automotive R&D ecosystem and strong industrial infrastructure are expected to continue supporting market expansion across commercial, public, and emergency sectors.

Asia-Pacific Specialty Vehicle Market Insight

The Asia-Pacific specialty vehicle market is expected to witness the fastest growth rate from 2025 to 20322, driven by rapid urbanization, industrialization, and rising infrastructure development in countries such as China, Japan, and India. Increasing demand for electric and hybrid specialty vehicles, supported by government incentives for green mobility, is fueling adoption. In addition, APAC’s emergence as a hub for specialty vehicle manufacturing is enhancing affordability and accessibility across public, private, and commercial sectors.

Japan Specialty Vehicle Market Insight

The Japan specialty vehicle market is expected to witness the fastest growth rate from 2025 to 2032 due to advanced automotive technology, strong industrial base, and growing demand for customized, eco-friendly vehicles. Adoption is driven by fleet electrification in emergency services, recreational vehicles, and industrial applications. Integration with telematics and smart fleet management platforms is enhancing efficiency, while Japan’s focus on safety and sustainability is expected to boost demand across public and commercial sectors.

China Specialty Vehicle Market Insight

The China specialty vehicle market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, infrastructure expansion, and increasing industrial investments. China is a leading hub for electric and hybrid specialty vehicles, driven by government incentives, local manufacturing capabilities, and rising adoption in municipal, industrial, and emergency applications. Competitive pricing, technological innovations, and a focus on sustainable mobility are propelling the market forward across the region.

North America Specialty Vehicle Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, driven by growing demand across public safety, construction, and recreational sectors. Consumers and organizations in the region highly value vehicles that offer customization, advanced safety features, and operational efficiency for industry-specific applications. Supportive government initiatives, incentives for electric and hybrid vehicle adoption, and a strong industrial and automotive infrastructure are further strengthening market growth.

U.S. Specialty Vehicle Market Insight

The U.S. specialty vehicle market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising infrastructure projects, defense requirements, and demand for electric and hybrid platforms. Adoption of advanced telematics, fleet management systems, and eco-friendly vehicle technologies is accelerating. Manufacturers are focusing on innovation, durability, and regulatory compliance to cater to public sector, private sector, and commercial applications. In addition, government incentives for green mobility and robust industrial infrastructure continue to drive market expansion across all specialty vehicle segments.

Specialty Vehicle Market Share

The Specialty Vehicle industry is primarily led by well-established companies, including:

- Oshkosh Corporation (U.S.)

- Paccar Inc (U.S.)

- Magna International (Canada)

- Mack Trucks (U.S.)

- Bennett International Group (U.S.)

- Freightliner (U.S.)

- CXT International (U.S.)

- Terex Corporation (U.S.)

- EOne (Canada)

- IVECO (Italy)

- Thunder Motorcycles (U.S.)

- Altec Industries (U.S.)

- Workhorse Group (U.S.)

Latest Developments in Specialty Vehicle Market

- In May 2024, Oshkosh Air Products launched five Oshkosh Striker 6x6 Aircraft Rescue and Firefighting (ARFF) vehicles for ADM Aeroports de Montreal, enhancing emergency response capabilities at Montréal-Trudeau International and YMX International airports. These advanced firefighting trucks improve operational safety, reduce response times, and set a benchmark for airport emergency readiness, strengthening Oshkosh’s presence in the global firefighting vehicle market

- In March 2024, Mercedes-Benz Special Trucks, alongside Esterer, delivered an all-electric refueling truck based on the Mercedes-Benz eEconic to Stuttgart Airport. Equipped with a 40,000-liter battery-powered system, this vehicle serves as a test model for Skytanking’s finalize! project, reducing carbon emissions, showcasing sustainable technology, and positioning Mercedes-Benz as a leader in electric specialty vehicles

- In November 2023, Oshkosh Corporation entered a five-year supply agreement with Mississauga Fire and Emergency Services, including initial orders for nine apparatus featuring Pierce Volterra electric pumpers and Enforcer heavy-duty rescue units. This development introduces net-zero, energy-efficient vehicles into the fleet, promoting sustainability and innovation, while expanding market adoption of electric specialty vehicles

- In July 2023, Stadtwerke Torgau added a Unimog U 427 to its municipal fleet for daily street cleaning operations. The vehicle’s advanced performance and reliability improve urban maintenance efficiency, reduce operational downtime, and highlight growing demand for versatile, eco-friendly utility vehicles in municipal applications

- In April 2023, Braun Industries Inc., in collaboration with Demers Ambulance and Crestline Coach, unveiled premium Chief XL Type 1 ambulances at FIDC International 2023. Mounted on Ford F-550 gas chassis with solid-body construction and advanced sliding doors, these vehicles enhance patient safety, operational efficiency, and fleet modernization, bolstering demand for high-quality ambulance solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.