Global Speed Sensor Market

Market Size in USD Billion

CAGR :

%

USD

10.09 Billion

USD

14.68 Billion

2024

2032

USD

10.09 Billion

USD

14.68 Billion

2024

2032

| 2025 –2032 | |

| USD 10.09 Billion | |

| USD 14.68 Billion | |

|

|

|

|

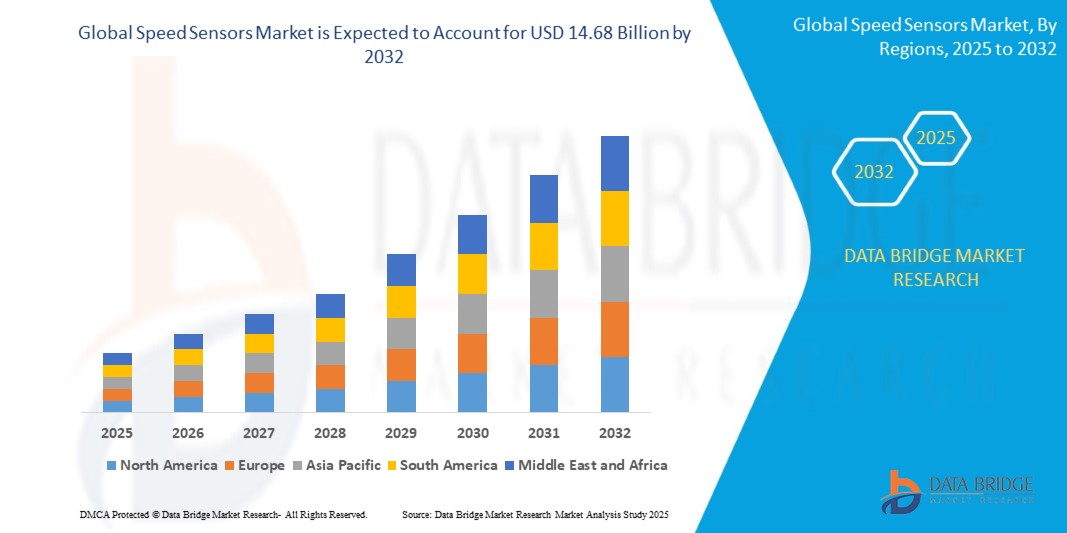

What is the Global Speed Sensors Market Size and Growth Rate?

- The global speed sensors market size was valued at USD 10.09 billion in 2024 and is expected to reach USD 14.68 billion by 2032, at a CAGR of 4.80% during the forecast period

- The global speed sensors market refers to the industry involved in the manufacturing, distribution, and sale of sensors designed to detect the speed of objects or systems. Speed sensors are utilized across various sectors, including automotive, aerospace, industrial manufacturing, consumer electronics, and healthcare, to monitor and control the speed of processes, machinery, vehicles, and devices. These sensors provide critical data for optimizing performance, ensuring safety, and enhancing efficiency in diverse applications

What are the Major Takeaways of Speed Sensors Market?

- The increasing focus on automotive safety features, such as anti-lock braking systems (ABS), electronic stability control (ESC), and adaptive cruise control (ACC), is driving the demand for speed sensors in the automotive sector. Speed sensors play a crucial role in enabling these safety systems by providing accurate speed data for real-time monitoring and control

- North America dominated the speed sensors market with the largest revenue share of 33.25% in 2024, propelled by robust demand across the automotive and industrial sectors

- Asia-Pacific is projected to be the fastest-growing region in the speed sensors market, with a CAGR of 11.54% from 2025 to 2032, driven by rising automotive production, industrial digitization, and expanding electronics manufacturing in China, India, and Japan

- The Hall Effect segment dominated the market with the largest revenue share of 31.5% in 2024, due to its wide usage in automotive systems and industrial applications for detecting rotational and linear speed

Report Scope and Speed Sensors Market Segmentation

|

Attributes |

Speed Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Speed Sensors Market?

“Integration with IoT and Predictive Maintenance Solutions”

- A prominent trend shaping the speed sensors market is the increasing integration of speed sensors with Internet of Things (IoT) platforms and predictive maintenance systems in industrial and automotive applications. This trend is enhancing real-time performance monitoring, fault detection, and operational efficiency

- Manufacturers are embedding speed sensors into broader condition monitoring frameworks that use data analytics and machine learning to predict potential equipment failures before they occur, thereby minimizing downtime and maintenance costs. For instance, ABB has developed sensor-integrated systems that help industrial users anticipate failures in electric motors and rotating machinery

- In the automotive sector, the shift toward electrification and autonomous driving is driving demand for advanced speed sensors capable of interfacing with Electronic Stability Control (ESC), Advanced Driver-Assistance Systems (ADAS), and traction control systems. These sensors ensure accurate real-time feedback for functions such as cruise control, braking, and acceleration

- Integration with wireless communication and cloud-based dashboards is further improving visibility into machinery health, empowering operators with actionable insights for efficient resource allocation

- This shift is encouraging manufacturers to innovate smart, compact, and high-precision sensors that offer both analog and digital outputs compatible with Industry 4.0 standards

- As predictive analytics and real-time diagnostics become standard, the demand for multi-functional speed sensors is expected to rise across manufacturing, logistics, and mobility sectors globally

What are the Key Drivers of Speed Sensors Market?

- The rising demand for automated and connected vehicles and the rapid adoption of industrial automation are key drivers boosting the speed sensors market. These sensors are critical for performance monitoring and enhancing system safety in automotive, aerospace, robotics, and manufacturing equipment

- For instance, in January 2024, Denso Corporation announced the development of a next-generation rotational speed sensor designed specifically for EV platforms, enhancing control precision for motors and inverters

- In the industrial sector, the need for precise speed measurement in pumps, motors, turbines, and conveyors is increasing with the push for operational efficiency and real-time analytics. This is creating sustained demand for both magnetic and optical speed sensors

- In addition, regulatory mandates for improved vehicle safety and fuel efficiency in the U.S., Europe, and China are accelerating the incorporation of speed sensors into powertrain control units, anti-lock braking systems (ABS), and automatic transmissions

- Growth in renewable energy installations such as wind turbines, where rotational speed plays a critical role in power optimization, also contributes to demand. Speed sensors help maximize energy capture and protect against over-speed failures

Which Factor is challenging the Growth of the Speed Sensors Market?

- One of the primary challenges in the speed sensors market is the sensitivity of sensors to harsh environmental conditions, such as extreme temperatures, moisture, dust, and vibration, which can lead to reduced accuracy or sensor failure

- For instance, applications in off-road vehicles, aerospace, and marine systems require ruggedized sensors with high durability, yet the added complexity and cost of such sensors may hinder adoption, especially in cost-sensitive markets

- In addition, price competition from low-cost unbranded or regional manufacturers, especially in Asia-Pacific, can erode profit margins for premium brands and reduce overall investment in R&D and innovation

- Another constraint is the lack of skilled personnel to implement, calibrate, and maintain smart sensor systems, particularly in small- and medium-sized enterprises transitioning to automation

- While companies such as Honeywell and Bosch are addressing these issues through durable packaging materials and adaptive signal processing technologies, the high initial setup cost for smart industrial sensor networks remains a barrier

- To overcome these obstacles, the industry must focus on enhancing sensor reliability, offering cost-effective ruggedized solutions, and promoting training programs to equip the workforce with the skills needed to manage sensor-integrated systems effectively

How is the Speed Sensors Market Segmented?

The market is segmented on the basis of technology, application, and type.

• By Technology

On the basis of technology, the speed sensors market is segmented into Hall Effect, Variable Reluctance (VR), Inductive, Magnetoresistive (MR), Optical, Doppler, and Others. The Hall Effect segment dominated the market with the largest revenue share of 31.5% in 2024, due to its wide usage in automotive systems and industrial applications for detecting rotational and linear speed. Hall Effect sensors offer high reliability, compact size, and cost-effectiveness, making them a preferred choice across industries.

The Magnetoresistive (MR) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand for high-resolution sensing and enhanced sensitivity in electric vehicle (EV) applications and precision automation equipment.

• By Application

On the basis of application, the market is segmented into Automotive, Aerospace and Defense, Industrial Manufacturing, Consumer Electronics, Healthcare, and Others. The Automotive segment held the largest market share of 38.7% in 2024, driven by the increasing integration of speed sensors in vehicle safety systems such as ABS, ESC, and ADAS. The push toward EV adoption and autonomous driving technologies is further expanding the need for advanced speed sensing components.

The Industrial Manufacturing segment is projected to grow at the fastest rate, owing to the rising implementation of Industry 4.0, predictive maintenance systems, and real-time equipment monitoring across production lines.

• By Type

On the basis of type, the speed sensors market is segmented into Wheel Speed Sensor, Engine Speed Sensor, Proximity Speed Sensor, Transmission Speed Sensor, and Others. The Wheel Speed Sensor segment dominated the market with the largest revenue share of 29.4% in 2024, supported by its critical role in vehicle braking and stability control systems. Demand is high in both passenger and commercial vehicles, especially in light of global safety regulations.

The Transmission Speed Sensor segment is expected to witness the fastest CAGR from 2025 to 2032, due to its increasing use in optimizing fuel efficiency, shift timing, and powertrain performance, particularly in modern hybrid and electric drivetrains.

Which Region Holds the Largest Share of the Speed Sensors Market?

- North America dominated the speed sensors market with the largest revenue share of 33.25% in 2024, propelled by robust demand across the automotive and industrial sectors

- The region's early adoption of advanced vehicle technologies, including ADAS and EVs, alongside widespread use in manufacturing automation, significantly supports growth

- The presence of major automakers, industrial automation firms, and sensor technology providers ensures constant innovation and high-volume demand. In addition, stringent safety and emissions regulations in the U.S. and Canada continue to drive integration of speed sensors into key systems across vehicles and machinery

U.S. Speed Sensors Market Insight

The U.S. speed sensors market accounted for 81% of North America's total revenue in 2024, driven by extensive automotive manufacturing, smart factory investments, and strong R&D in sensor technologies. With regulatory pressure on fuel efficiency and emissions, speed sensors are being increasingly integrated into transmission, ABS, and engine management systems. Growth is also fueled by the expansion of EV infrastructure and partnerships between tech firms and OEMs to develop next-gen vehicles equipped with precision sensor arrays.

Europe Speed Sensors Market Insight

The Europe speed sensors market is projected to expand steadily over the forecast period, supported by electrification of the automotive sector and industrial automation in countries such as Germany, France, and Italy. With EU regulations favoring clean mobility and mandatory safety features such as ABS and ESC, the demand for speed sensors remains high. Moreover, smart manufacturing initiatives across the region are increasing demand for motion sensing in machinery and robotics.

U.K. Speed Sensors Market Insight

The U.K. speed sensors market is expected to grow at a notable CAGR through 2032, driven by investments in autonomous mobility trials and the rollout of smart infrastructure. Emphasis on sustainable transport, combined with incentives for electric vehicle adoption and green manufacturing, is fostering the integration of intelligent sensor technologies, including speed sensors, across various applications.

Germany Speed Sensors Market Insight

The Germany speed sensors market remains one of the strongest in Europe due to the country’s leadership in automotive manufacturing and industrial engineering. Speed sensors are integral to advanced drivetrains, robotic systems, and machinery, with demand growing across sectors such as aerospace, healthcare, and renewable energy. Germany’s focus on innovation and precision engineering is expected to support sustained adoption through the forecast period.

Which Region is the Fastest Growing in the Speed Sensors Market?

Asia-Pacific is projected to be the fastest-growing region in the speed sensors market, with a CAGR of 11.54% from 2025 to 2032, driven by rising automotive production, industrial digitization, and expanding electronics manufacturing in China, India, and Japan. Rapid infrastructure development, favorable government policies, and increasing local production capabilities are making speed sensors more accessible and affordable. The push towards electric vehicles and autonomous systems is further fueling demand across the region.

Japan Speed Sensors Market Insight

The Japan speed sensors market is gaining traction due to its advanced automotive ecosystem and strong presence in semiconductor manufacturing. Speed sensors are extensively used in high-tech applications including robotics, mobility solutions for the elderly, and automated transport systems. Continuous innovation and consumer preference for precision and reliability are key growth drivers.

China Speed Sensors Market Insight

The China speed sensors market held the largest revenue share in Asia-Pacific in 2024, supported by government-led smart city initiatives and dominance in global electronics and automotive production. Domestic sensor manufacturers are scaling rapidly, offering cost-effective solutions across multiple sectors including e-mobility, industrial IoT, and consumer electronics. China's focus on tech self-reliance is further expected to boost sensor demand and innovation.

Which are the Top Companies in Speed Sensors Market?

The speed sensors industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Honeywell International Inc. (U.S.)

- Allegro Microsystems, LLC (U.S.)

- Infineon Technologies AG (Germany)

- Delphi Technologies (U.K.)

- NXP Semiconductors (Netherlands)

- Sensata Technologies, Inc. (U.S.)

- STMicroelectronics (Switzerland)

- Texas Instruments Incorporated (U.S.)

What are the Recent Developments in Global Speed Sensors Market?

- In May 2023, ON Semiconductor (U.S.) introduced its Hyperlux automotive image sensor family, which boasts an industry-leading 150dB ultra-high dynamic range (HDR) and LED flicker mitigation (LFM). This innovation is aimed at enhancing visibility and performance in next-generation ADAS and autonomous driving systems

- In June 2022, Allegro MicroSystems, Inc. (U.S.) unveiled two new magnetic position sensors, the A33110 and A33115, specifically designed to support the precision demands of advanced driver-assistance systems (ADAS). This launch reinforces the company's commitment to delivering reliable sensor solutions for vehicle safety and automation

- In May 2022, Infineon Technologies AG (Germany) launched its XENSIV 60 GHz radar sensor, tailored for automotive in-cabin applications such as passenger presence detection and child safety alerts. This product strengthens Infineon’s role in advancing smart sensing in connected and autonomous vehicles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Speed Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Speed Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Speed Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.