Global Spin On Carbon Market

Market Size in USD Million

CAGR :

%

USD

247.38 Million

USD

2,042.92 Million

2024

2032

USD

247.38 Million

USD

2,042.92 Million

2024

2032

| 2025 –2032 | |

| USD 247.38 Million | |

| USD 2,042.92 Million | |

|

|

|

|

What is the Global Spin On Carbon Market Size and Growth Rate?

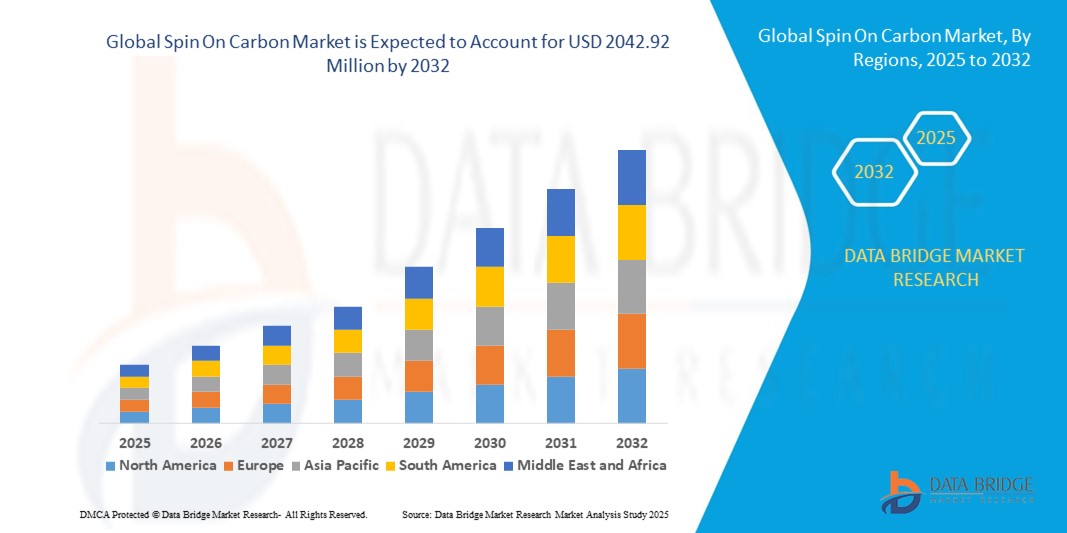

- The global spin on carbon market size was valued at USD 247.38 million in 2024 and is expected to reach USD 2042.92 million by 2032, at a CAGR of 30.20% during the forecast period

- The spin on carbon market encompasses the buying and selling of carbon credits, allowing businesses and countries to offset their carbon emissions. It operates on a system of supply and demand, with credits representing the right to emit a certain amount of carbon dioxide

- Through this market, participants can invest in emission reduction projects or purchase credits to comply with regulations or voluntary commitments. As the world seeks solutions to mitigate climate change, the carbon market plays a crucial role in incentivizing carbon reduction efforts on a global scale

What are the Major Takeaways of Spin On Carbon Market?

- National and international policies play a crucial role in carbon markets by imposing emissions targets, implementing cap-and-trade mechanisms, and encouraging initiatives for reducing carbon footprints. These regulations provide a framework for businesses to operate within, influencing their carbon-related decisions and investments

- Ongoing innovations in renewable energy, carbon capture and storage technologies, and energy efficiency solutions significantly impact the dynamics of carbon markets. These advancements alter the supply and demand landscape, driving investment patterns towards cleaner technologies and influencing market behaviors

- Asia-Pacific dominated the spin on carbon market with the largest revenue share of 32.5% in 2024, driven by rapid urbanization, technological adoption, and growing demand for smart homes and connected buildings

- North America is projected to register the fastest CAGR of 11.2% from 2025 to 2032, driven by widespread adoption of smart home technology, high consumer awareness, and growing demand for AI- and voice-integrated spin on carbons

- The Logic Devices segment dominated the spin on carbon market with the largest market revenue share of 36.8% in 2024, driven by its critical role in high-performance microprocessors, GPUs, and SoC applications

Report Scope and Spin On Carbon Market Segmentation

|

Attributes |

Spin On Carbon Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Spin On Carbon Market?

Advanced Semiconductor Integration and AI-Optimized Materials

- A key trend driving the global spin on carbon market is the increasing use of advanced materials optimized for semiconductor applications, coupled with AI-assisted design and process optimization. These technologies are enabling manufacturers to improve performance, reliability, and scalability of semiconductor devices.

- For instance, Brewer Science, Inc. introduced high-performance spin on carbon formulations at SEMICON Taiwan 2023, focusing on enhanced adhesion, uniformity, and thermal stability for advanced packaging applications, highlighting the growing importance of material innovation.

- AI integration in spin on carbon processes is facilitating predictive quality control, optimized deposition parameters, and improved defect reduction, ensuring high yields and consistent performance in semiconductor manufacturing. Leading suppliers are leveraging machine learning to fine-tune formulations for photonics, power devices, and memory applications.

- The seamless incorporation of spin on carbon materials into complex semiconductor stacks, such as Logic, Memory, and Power devices, allows for miniaturization, high-density packaging, and improved electrical performance, creating a unified and efficient device architecture.

- This trend towards more intelligent, high-performance, and application-specific spin on carbon materials is reshaping semiconductor fabrication processes. Companies such as JSR Micro and Merck KGaA are developing next-generation formulations with higher thermal tolerance and compatibility with AI-driven semiconductor assembly processes.

- The demand for spin on carbon materials optimized for advanced packaging, AI-enhanced design, and high-density integration is growing rapidly across semiconductor foundries, IDMs, and OSAT providers, as device complexity and performance requirements increase globally

What are the Key Drivers of Spin On Carbon Market?

- The growing adoption of advanced packaging technologies, including 3D ICs, wafer-level packaging, and high-density interconnects, is a primary driver for the spin on carbon market

- For instance, in August 2023, Brewer Science unveiled novel spin on carbon solutions targeting superior adhesion and uniformity in advanced packaging, driving adoption across semiconductor manufacturers

- The increasing demand for miniaturized, high-performance devices in consumer electronics, automotive electronics, and data centers is further propelling the need for optimized spin on carbon materials

- Furthermore, the rise of AI-assisted semiconductor fabrication and predictive material engineering is improving process efficiency, yield, and device reliability, thereby encouraging wider integration of spin on carbon

- Strong growth in semiconductor manufacturing across Asia-Pacific and North America, supported by investments in foundries, IDMs, and OSATs, is driving sustained demand for high-quality spin on carbon materials

Which Factor is Challenging the Growth of the Spin On Carbon Market?

- One of the main challenges in the spin on carbon market is the high cost and technical complexity associated with production, especially for high-temperature and advanced formulations used in specialized semiconductor applications

- Supply chain constraints for raw materials and chemicals required for spin on carbon deposition can create volatility and limit scalability, particularly during geopolitical disruptions or manufacturing bottlenecks

- In addition, process sensitivity and compatibility issues with diverse semiconductor stacks may require extensive R&D and customization, posing barriers for new entrants or smaller manufacturers

- The need for skilled personnel and AI-driven process control for defect-free deposition adds operational complexity and costs, which can limit adoption in cost-sensitive segments

- Despite efforts by major players such as Merck KGaA, JSR Micro, and Brewer Science to streamline processes and enhance material performance, the niche nature of spin on carbon applications restricts rapid market penetration

- Addressing these challenges through process innovation, cost optimization, and collaboration with semiconductor manufacturers will be critical for long-term growth in the spin on carbon market

How is the Spin On Carbon Market Segmented?

The market is segmented on the basis of application, end user, and material type.

- By Application

On the basis of application, the spin on carbon market is segmented into Logic Devices, Memory Devices, Power Devices, MEMS, Photonics, and Advanced Packaging. The Logic Devices segment dominated the spin on carbon market with the largest market revenue share of 36.8% in 2024, driven by its critical role in high-performance microprocessors, GPUs, and SoC applications. Strong demand for miniaturized and high-speed logic circuits in consumer electronics and computing is fueling adoption, while the segment benefits from ongoing innovation in AI and cloud computing technologies.

The Memory Devices segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by rapid growth in NAND, DRAM, and emerging non-volatile memory technologies. Increasing storage needs for data centers, mobile devices, and enterprise applications are driving demand for spin on carbon materials optimized for memory fabrication.

- By End User

On the basis of end user, the spin on carbon market is segmented into Foundries, Integrated Device Manufacturers (IDMs), and Outsourced Semiconductor Assembly and Test (OSAT). The IDMs segment held the largest market revenue share in 2024, supported by companies designing and manufacturing their own semiconductor devices. Vertical integration allows IDMs to streamline Spin On Carbon usage in fabrication processes while maintaining performance consistency and quality standards.

The OSAT segment is expected to register the fastest CAGR from 2025 to 2032, driven by increasing outsourcing of semiconductor assembly and testing services, especially in Asia-Pacific, where cost-effective manufacturing and rapid turnaround times are critical.

- By Material Type

On the basis of material type, the spin on carbon market is segmented into Hot-Temperature Spin On Carbon and Normal-Temperature Spin On Carbon. The Hot-Temperature Spin On Carbon segment dominated the market with the largest revenue share of 54.2% in 2024, attributed to its superior thermal stability and compatibility with advanced semiconductor fabrication processes. Its ability to withstand high-temperature annealing and etching steps makes it essential for high-performance logic and memory devices.

The Normal-Temperature spin on carbon segment is anticipated to witness the fastest growth from 2025 to 2032, favored for cost-sensitive applications and emerging semiconductor packaging technologies that do not require extreme thermal resistance.

Which Region Holds the Largest Share of the Spin On Carbon Market?

- Asia-Pacific dominated the spin on carbon market with the largest revenue share of 32.5% in 2024, driven by rapid urbanization, technological adoption, and growing demand for smart homes and connected buildings. Countries such as China, Japan, and India are leading the integration of spin on carbons in both residential and commercial properties

- Consumers in the region increasingly prefer keyless, AI-enabled entry systems that can integrate with smart lighting, thermostats, and other IoT devices, providing enhanced security and convenience

- The dominance of Asia-Pacific is further supported by large-scale manufacturing of spin on carbon components, rising disposable incomes, and supportive government initiatives promoting digitalization and smart city development

China Spin On Carbon Market Insight

China spin on carbon market accounted for the largest share in Asia-Pacific in 2024, fueled by the expanding middle class, high urbanization, and increasing interest in home automation. The country’s emphasis on smart cities and domestic production capabilities is enhancing the availability and affordability of spin on carbons for both residential and commercial users.

Japan Spin On Carbon Market Insight

Japan spin on carbon market is witnessing steady growth, driven by the country’s high-tech culture, aging population, and demand for convenient, secure access solutions. Integration with IoT ecosystems in homes and office buildings is supporting adoption, particularly for AI-enabled and voice-controlled systems.

India Spin On Carbon Market Insight

India spin on carbon market is growing rapidly due to urbanization, rising disposable incomes, and an increasing preference for smart home technologies. Government initiatives supporting digital infrastructure and smart city projects are further accelerating market expansion, while local manufacturers are expanding production to meet demand.

Which Region is the Fastest Growing Region in the Spin On Carbon Market?

North America is projected to register the fastest CAGR of 11.2% from 2025 to 2032, driven by widespread adoption of smart home technology, high consumer awareness, and growing demand for AI- and voice-integrated spin on carbons. The U.S. is the primary growth engine, supported by robust R&D, strong e-commerce penetration, and a large consumer base focused on convenience and home security.

U.S. Spin On Carbon Market Insight

U.S. spin on carbon market captured the largest revenue share in North America in 2024, bolstered by the adoption of connected devices, DIY smart home setups, and integration with Alexa, Google Assistant, and Apple HomeKit. Consumers increasingly value the convenience and security offered by AI- and voice-enabled spin on carbons.

Canada Spin On Carbon Market Insight

Canada spin on carbon market is expanding steadily, supported by government incentives, awareness campaigns for smart home technologies, and rising adoption of digital security solutions in residential and commercial properties. The preference for energy-efficient and AI-integrated devices is driving growth in both urban and suburban areas.

Which are the Top Companies in Spin On Carbon Market?

The spin on carbon industry is primarily led by well-established companies, including:

- Samsung SDI Co., Ltd. (South Korea)

- Merck KGaA, Darmstadt (Germany)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- YCCHEM Co., Ltd. (South Korea)

- Brewer Science, Inc. (U.S.)

- JSR Micro, Inc. (U.S.)

- KOYJ Co., Ltd. (South Korea)

- Irresistible Materials Ltd. (U.K.)

- Nano-C, Inc. (U.S.)

- DNF Co., Ltd. (South Korea)

What are the Recent Developments in Global Spin On Carbon Market?

- In September 2023, Samsung Electronics announced a strategic collaboration with AMD to advance 5G virtualized RAN (VRAN) technologies for network transformation, reinforcing Samsung’s commitment to enhancing VRAN and Open RAN ecosystems and driving next-generation connectivity solutions

- In August 2023, Brewer Science, Inc. introduced innovative advanced packaging solutions at SEMICON Taiwan and the Advanced Packaging Summit 2023, showcasing material improvements for high-density substrates, optimized adhesion, high-temperature stability, and surface modification innovations, positioning the company as a leader in semiconductor packaging advancements

- In February 2023, Merck KGaA expanded its semiconductor solutions presence with a new production facility in Kaohsiung, Taiwan, to be developed in multiple stages, strengthening the company’s manufacturing capabilities and supporting long-term growth in semiconductor materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Spin On Carbon Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Spin On Carbon Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Spin On Carbon Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.