Global Spinal Fusion Market

Market Size in USD Billion

CAGR :

%

USD

11.29 Billion

USD

16.80 Billion

2025

2033

USD

11.29 Billion

USD

16.80 Billion

2025

2033

| 2026 –2033 | |

| USD 11.29 Billion | |

| USD 16.80 Billion | |

|

|

|

|

Spinal Fusion Market Size

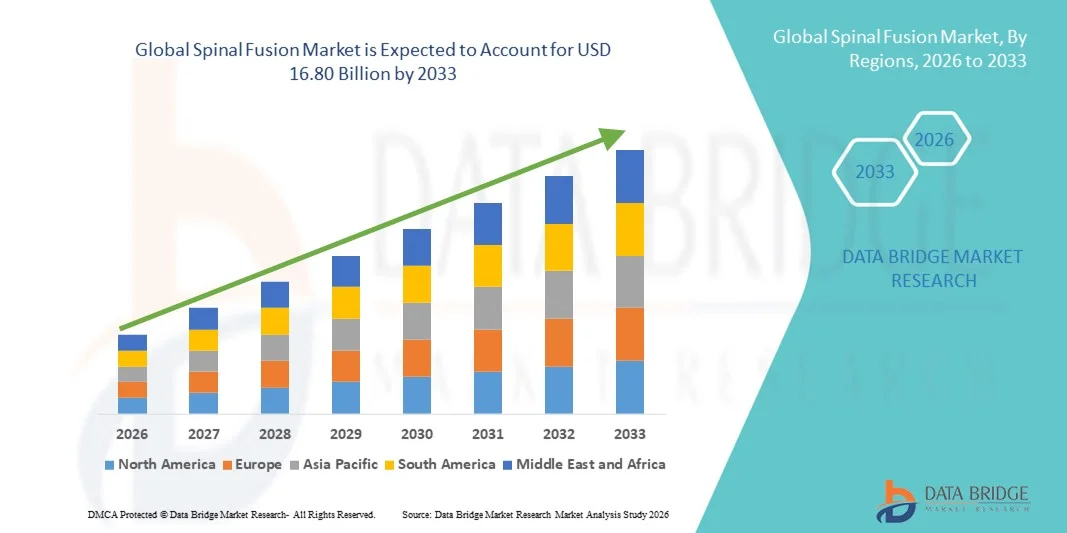

- The global Spinal Fusion market size was valued at USD 11.29 billion in 2025 and is expected to reach USD 16.80 billion by 2033, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of spinal disorders, advancements in minimally invasive surgical techniques, and the rising adoption of advanced spinal implants and instrumentation, leading to improved patient outcomes and faster recovery times

- Furthermore, growing awareness among patients and healthcare providers about the benefits of spinal fusion procedures, coupled with increasing investment in orthopedic healthcare infrastructure, is accelerating the uptake of spinal fusion solutions, thereby significantly boosting the industry's growth

Spinal Fusion Market Analysis

- Spinal fusion procedures are increasingly vital in treating degenerative spinal disorders, fractures, deformities, and injuries, offering improved patient outcomes and enhanced spinal stability

- The escalating demand for spinal fusion is primarily fueled by the rising prevalence of spinal disorders, an aging population, increasing awareness of advanced surgical options, and technological innovations in surgical implants and instrumentation

- North America dominated the spinal fusion market with the largest revenue share of 42.5% in 2025, attributed to the presence of well-established healthcare infrastructure, high adoption of advanced spinal implants and instrumentation, and strong R&D investment by leading medical device manufacturers such as Medtronic, Stryker, and DePuy Synthes. The U.S. continues to experience substantial growth in spinal fusion procedures due to increasing awareness of spinal disorders, favorable reimbursement policies, and rising demand for minimally invasive surgeries

- Asia-Pacific is expected to be the fastest-growing region in the spinal fusion market during the forecast period, with a market share of 27.8% in 2025, driven by improving healthcare access, growing healthcare expenditure, increasing prevalence of spinal disorders, and rising awareness of advanced surgical options in countries such as China, India, and Japan

- The interbody fusion segment dominated the largest market revenue share of 51.2% in 2025, attributed to its superior biomechanical stability, effective decompression, and higher fusion rates

Report Scope and Spinal Fusion Market Segmentation

|

Attributes |

Spinal Fusion Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Spinal Fusion Market Trends

Technological Advancements and Minimally Invasive Procedures

- A significant and accelerating trend in the global spinal fusion market is the rising adoption of minimally invasive surgical techniques, advanced implants, and navigation-assisted procedures. These innovations are significantly enhancing surgical precision, reducing patient recovery times, and improving clinical outcomes

- For instance, the use of 3D-printed spinal implants and computer-assisted navigation systems allows surgeons to achieve higher accuracy in vertebral alignment and fusion, minimizing complications and revision surgeries. Similarly, novel interbody fusion devices combined with biologics are increasingly used to promote faster and more reliable bone healing

- Navigation-assisted and robotic-supported spinal fusion procedures enable surgeons to plan trajectories with precision, reduce radiation exposure, and optimize the placement of screws and implants. These technologies enhance intraoperative visualization and provide real-time feedback, improving patient safety and reducing operative time

- Integration of biologics, such as bone morphogenetic proteins (BMPs) and autologous stem cells, into spinal implants is further improving fusion rates and long-term stability. Such approaches support personalized treatment plans tailored to the patient’s anatomy and condition

- The shift toward outpatient and minimally invasive spinal procedures is also expanding accessibility to spinal fusion surgeries, reducing hospitalization costs, and enabling faster rehabilitation

- Continuous innovation in implant materials, surgical instruments, and perioperative care protocols is reshaping the overall market dynamics. Surgeons and healthcare providers are increasingly adopting advanced solutions to achieve optimal patient outcomes

- Companies such as Medtronic, NuVasive, and Globus Medical are developing specialized instrumentation, biologics, and implant systems to meet the growing demand for minimally invasive and precision-guided spinal fusion procedures

- The demand for technologically advanced, efficient, and patient-centric spinal fusion solutions is growing rapidly across both hospitals and specialized orthopedic and neurosurgical centers

Spinal Fusion Market Dynamics

Driver

Rising Prevalence of Spinal Disorders and Aging Population

- The increasing incidence of spinal disorders, degenerative diseases, trauma-related injuries, and age-related spinal conditions is a significant driver for the heightened demand for spinal fusion procedures

- For instance, in 2025, the rising number of spinal deformities and degenerative disc disorders in elderly patients is boosting hospital adoption of spinal fusion surgeries. Such trends are expected to propel market growth during the forecast period

- Patients are increasingly seeking surgical interventions to alleviate chronic back pain, restore spinal stability, and improve quality of life

- Minimally invasive techniques and advancements in surgical instrumentation are enabling earlier interventions and higher surgical success rates

- Growing healthcare expenditure, favorable reimbursement policies, and the availability of specialized spine centers further support market adoption

- Hospitals and specialized orthopedic centers are expanding spine surgery programs to accommodate increasing patient volumes

- Rising awareness among patients and clinicians about effective spinal fusion therapies is driving procedure adoption

- The prevalence of spinal trauma cases due to accidents, sports injuries, and occupational hazards is increasing the need for corrective surgeries

- Investments in research and development for improved spinal implants, biologics, and navigation systems contribute to robust market growth

- Emerging economies are witnessing rising demand as healthcare infrastructure and access to specialized spine care improve

- The focus on enhanced post-operative recovery and reduced hospitalization duration boosts patient preference for advanced spinal fusion techniques

- These combined factors are expected to significantly propel the spinal fusion market growth globally over the forecast period

Restraint/Challenge

High Procedure Costs and Surgical Complexity

- The relatively high cost of spinal fusion procedures, including implants, surgical instrumentation, and hospitalization, poses a significant challenge to broader market penetration

- In addition, complex surgical planning and the need for skilled surgeons limit procedure availability, especially in developing regions

- For instance, in 2025, a report by the American Spine Society highlighted that the high average cost of lumbar spinal fusion in U.S. hospitals—ranging from USD 30,000 to USD 50,000 per procedure—has limited accessibility for some patients despite high clinical demand

- Post-operative complications, such as infection, non-union, or implant failure, increase concerns regarding procedure efficacy and safety

- The need for specialized operating rooms and advanced imaging equipment contributes to high capital investment for healthcare providers

- Extended recovery periods and post-operative rehabilitation requirements may discourage some patients from opting for surgery

- Insurance coverage limitations and out-of-pocket expenses remain barriers for certain patient populations

- Hospitals and clinics must continuously invest in surgeon training and staff education to maintain high surgical success rates

- Concerns about revision surgeries and potential adverse events influence patient decision-making

- Cost-sensitive regions may prefer conservative treatment approaches, slowing adoption of surgical fusion

- Managing patient expectations and ensuring adherence to post-operative care protocols require additional resources

- Addressing these challenges through cost-effective surgical solutions, optimized procedural workflows, and broader insurance coverage will be critical for sustained market growth

- Advancements in minimally invasive techniques and improved implant technologies are gradually mitigating procedural risks and enhancing adoption, providing a long-term growth outlook

Spinal Fusion Market Scope

The market is segmented on the basis of product type, procedure type, end-user, and type.

- By Product Type

On the basis of product type, the Spinal Fusion market is segmented into interbody cages, pedicle screws & rods, and spinal fusion plates. The pedicle screws & rods segment dominated the largest market revenue share of 44.5% in 2025, driven by its established role in stabilizing the spine and enabling successful fusion in various spinal disorders. Pedicle screws provide robust fixation, allowing controlled vertebral motion correction, and are preferred in complex multi-level procedures. Surgeon familiarity and the availability of modular rod systems enhance adoption across lumbar, thoracic, and cervical regions. High demand in hospitals and specialty clinics, coupled with reimbursement support in developed markets, reinforces dominance. Material advancements, including titanium and PEEK, enhance biocompatibility and reduce postoperative complications. The segment also benefits from extensive clinical data supporting fusion success rates and reduced reoperation risks. Its compatibility with minimally invasive techniques further drives usage. Global adoption is reinforced by growing spinal deformity cases and an aging population. Surgeons increasingly prefer pedicle systems due to predictable outcomes in both degenerative and traumatic conditions. In addition, integration with navigation and robotic-assisted systems improves procedural precision. The segment’s growth is supported by ongoing product innovation and training programs for surgeons, solidifying its market leadership.

The interbody cages segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, fueled by rising adoption of minimally invasive spinal fusion procedures. Interbody cages provide disc height restoration, spinal alignment correction, and enhanced fusion efficiency, which are critical for patient recovery. Growing preference for anterior lumbar interbody fusion (ALIF) and lateral lumbar interbody fusion (LLIF) procedures contributes to demand. Technological innovations in expandable cages and 3D-printed implants are accelerating adoption. Surgeons favor cages for reduced surgical complications, improved biomechanical stability, and shorter hospitalization. Increasing geriatric populations and spinal disorder prevalence in emerging regions support growth. Interbody cages are widely used in degenerative disc disease, spondylolisthesis, and scoliosis correction procedures. Rising awareness about patient recovery benefits and minimally invasive outcomes further propels market expansion. Hospitals and specialty clinics are increasingly investing in interbody cage systems. Growth is enhanced by government initiatives supporting advanced spinal surgeries. Continuous R&D in cage materials and designs is driving better fusion rates. Overall, market penetration is expected to rise steadily due to favorable clinical outcomes and patient preference for less invasive options.

- By Procedure Type

On the basis of procedure type, the market is segmented into posterolateral fusion and interbody fusion. The interbody fusion segment dominated the largest market revenue share of 51.2% in 2025, attributed to its superior biomechanical stability, effective decompression, and higher fusion rates. It is widely applied in lumbar degenerative disc disease, spondylolisthesis, and scoliosis, making it a preferred surgical approach. Surgeons favor interbody fusion due to reduced reoperation rates and predictable clinical outcomes. Advanced imaging guidance and navigation systems enhance precision and safety. The segment benefits from strong adoption in hospitals and specialty clinics with high patient volumes. Reimbursement support and government policies in developed regions facilitate growth. Clinical studies show improved functional outcomes and pain reduction post-interbody fusion. It also supports multilevel fusions efficiently. Interbody fusion procedures integrate well with minimally invasive techniques. The increasing focus on early intervention for spinal disorders further reinforces demand. Patient preference for faster recovery and better postoperative mobility drives market share. Continuous innovation in implants and instrumentation maintains segment leadership.

The posterolateral fusion segment is projected to witness the fastest CAGR of 8.6% from 2026 to 2033, driven by its cost-effectiveness and applicability for multilevel fusions. Posterolateral fusion is preferred in developing regions due to lower procedural complexity and minimal infrastructure requirements. Rising prevalence of degenerative spinal disorders in aging populations fuels demand. Advancements in bone graft substitutes and biologics enhance fusion success rates. The segment supports effective stabilization for both primary and revision surgeries. Surgeons appreciate the technique’s versatility and familiarity. Expanding healthcare infrastructure in emerging markets encourages adoption. Posterolateral fusion is widely used in outpatient and ambulatory surgical settings. Insurance coverage and government healthcare programs improve accessibility. Ongoing education and training for surgeons in this procedure boost confidence and usage. Clinical evidence supporting low complication rates further strengthens growth. The segment benefits from patient demand for minimally invasive and cost-effective solutions.

- By End-User

On the basis of end-user, the market is segmented into hospitals, specialty clinics, and ambulatory surgical centers (ASCs). The hospital segment dominated the largest market revenue share of 61.5% in 2025, supported by advanced infrastructure, high patient volumes, and the availability of skilled spine surgeons. Hospitals manage complex and multilevel procedures, offering postoperative care and rehabilitation. They benefit from strong reimbursement policies, access to advanced navigation and robotic systems, and multidisciplinary teams. High adoption of pedicle screw systems, interbody cages, and spinal plates reinforces dominance. Established hospital networks facilitate referral and patient inflow. Hospitals provide training platforms for surgeons and support research initiatives. Favorable government policies in developed regions enhance hospital capabilities. Hospitals are equipped for high-risk procedures and revision surgeries. The presence of key market players’ distribution channels strengthens hospital procurement. Hospitals also invest in advanced imaging and diagnostic tools for preoperative planning. Patient preference for centralized care and comprehensive post-surgical management contributes to market share.

The specialty clinics segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, driven by focused expertise in spine care, minimally invasive procedures, and higher procedural efficiency. Specialty clinics are expanding in emerging markets, leveraging partnerships with global implant manufacturers. Adoption of advanced spinal implants and navigation systems enhances service quality. Clinics offer patient-centric care, reduced waiting times, and streamlined procedures. Increased awareness among patients and referrals from general practitioners promote growth. Rising demand for outpatient and same-day procedures contributes to adoption. Clinics benefit from technological advancements and procedural standardization. Insurance and reimbursement schemes increasingly cover outpatient procedures, supporting expansion. Clinics also offer targeted post-operative rehabilitation services. Focus on patient satisfaction and outcomes accelerates market penetration. The segment is attracting investments for facility modernization. Government initiatives to support specialized care centers further fuel growth. Collaboration with academic institutions for training and research strengthens expertise.

- By Type

On the basis of type, the market is segmented into traditional spinal fusion procedure, posterior lumbar interbody fusion (PLIF), anterior lumbar interbody fusion (ALIF), and others. The posterior lumbar interbody fusion segment dominated the largest market revenue share of 46.8% in 2025, due to its clinical reliability, extensive surgeon experience, and strong outcomes in lumbar degenerative conditions. PLIF provides excellent fusion rates and is widely used in both single-level and multilevel surgeries. Surgeon familiarity, established procedural protocols, and predictable results reinforce dominance. The segment is preferred in hospitals with high surgical volumes. Advanced instrumentation and imaging guidance improve outcomes. PLIF is effective in restoring disc height and lordosis. It is commonly used in spondylolisthesis and degenerative disc disease. Reimbursement support and insurance coverage facilitate adoption. Long-term clinical studies demonstrate low complication and revision rates. PLIF is compatible with minimally invasive approaches. Surgeon training programs further boost market penetration. The segment benefits from established supply chains for implants and instrumentation.

The anterior lumbar interbody fusion segment is anticipated to witness the fastest CAGR of 9.5% from 2026 to 2033, propelled by minimally invasive approaches, reduced blood loss, and faster patient recovery. ALIF procedures are increasingly preferred for complex spinal deformities and multilevel fusion requirements. Hospitals and specialty clinics adopt ALIF for improved functional outcomes. Advancements in cage design and instrumentation improve fusion rates. Patient demand for minimally invasive surgery accelerates growth. Insurance coverage and reimbursement policies in developed countries support adoption. ALIF is widely used in degenerative disc disease, scoliosis, and spondylolisthesis. Surgeons appreciate enhanced visualization and surgical control. The segment benefits from increasing awareness of postoperative recovery advantages. Hospitals invest in specialized training and instrumentation for ALIF. Expansion in emerging markets with growing spinal disorder prevalence supports growth. Ongoing research and clinical studies continue to validate ALIF efficacy.

Spinal Fusion Market Regional Analysis

- North America dominated the spinal fusion market with the largest revenue share of 42.5% in 2025

- Attributed to well-established healthcare infrastructure, high adoption of advanced spinal implants and instrumentation, and strong R&D investment by leading medical device manufacturers such as Medtronic, Stryker, and DePuy Synthes

- The market continues to experience substantial growth due to rising awareness of spinal disorders, favorable reimbursement policies, and increasing demand for minimally invasive surgeries

U.S. Spinal Fusion Market Insight

The U.S. spinal fusion market captured the largest revenue share of 84% in 2025 within North America, fueled by increasing prevalence of spinal disorders, high adoption of advanced implants, and rising preference for minimally invasive and robotic-assisted procedures. Robust clinical research programs and favorable reimbursement frameworks are further supporting market growth.

Europe Spinal Fusion Market Insight

The Europe spinal fusion market held a revenue share of 19.7% in 2025. Growth is driven by strong healthcare infrastructure, increasing adoption of minimally invasive spinal surgeries, and rising awareness of degenerative spinal conditions. Investments in advanced surgical devices and instrumentation by key players are promoting market expansion.

UK Spinal Fusion Market Insight

The UK spinal fusion market accounted for 6.3% of Europe’s Spinal Fusion market in 2025. Growth is primarily due to increased awareness of spinal disorders, adoption of minimally invasive techniques, and government healthcare initiatives promoting access to advanced spinal treatments.

Germany Spinal Fusion Market Insight

Germany spinal fusion market held 7.2% of the Europe Spinal Fusion market in 2025, supported by advanced healthcare infrastructure, strong adoption of robotic-assisted spinal procedures, and high patient demand for minimally invasive spinal fusions. Focus on innovation and quality healthcare delivery drives continued growth.

Asia-Pacific Spinal Fusion Market Insight

The Asia-Pacific spinal fusion market is expected to be the fastest-growing region with a market share of 27.8% in 2025. Growth is fueled by improving healthcare access, increasing healthcare expenditure, rising prevalence of spinal disorders, and greater awareness of advanced surgical options in countries such as China, India, and Japan. Expansion of hospitals and specialty clinics, along with government healthcare initiatives, is further propelling market adoption.

Japan Spinal Fusion Market Insight

Japan spinal fusion market is witnessing increasing adoption of advanced spinal procedures due to high healthcare standards, an aging population, and rising incidence of degenerative spinal conditions. Minimally invasive and instrumented fusion procedures are driving market growth. In addition, the country is seeing growing integration of robotic-assisted surgical systems and navigation technologies, enhancing surgical precision and patient outcomes.

China Spinal Fusion Market Insight

China spinal fusion market accounted for the largest market revenue share within Asia-Pacific in 2025, supported by substantial investments in healthcare infrastructure, growing patient awareness, and increasing adoption of advanced spinal implants and instrumentation. Furthermore, the expansion of specialty spine centers and government initiatives to improve access to advanced spinal treatments are further accelerating market growth.

Spinal Fusion Market Share

The Spinal Fusion industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Stryker (U.S.)

• Zimmer Biomet (U.S.)

• NuVasive (U.S.)

• Globus Medical (U.S.)

• Johnson & Johnson (U.S.)

• SeaSpine (U.S.)

• Orthofix (U.S.)

• K2M (U.S.)

• B. Braun (Germany)

• Alphatec Spine (U.S.)

• Life Spine (U.S.)

• RTI Surgical (U.S.)

• SpineFrontier (U.S.)

• Carestream Health (U.S.)

Latest Developments in Global Spinal Fusion Market

- In November 2023, Orthofix Medical Inc. announced the full commercial launch of its WaveForm L Lateral Lumbar Interbody System, a 3D‑printed implant designed to enhance lateral lumbar fusion procedures. The system provides improved anatomical fit, promotes bone growth, and aims to reduce complications, reflecting Orthofix’s commitment to advancing spinal fusion solutions

- In November 2023, Spinal Elements released its Ventana® 3D‑Printed Interbody Portfolio, which includes anterior cervical, posterior lumbar, and lateral lumbar systems under its MIS Ultra® platform. This launch is aimed at improving surgical efficiency, patient outcomes, and adoption of minimally invasive spinal procedures

- In August 2024, NanoHive secured USD 7 million in funding to accelerate the commercialization of its 3D‑printed titanium spinal interbody fusion devices. The investment is intended to expand production capabilities, enhance R&D for next-generation implants, and enable entry into international markets, supporting broader adoption of advanced spinal fusion solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.