Global Spinal Imaging Market

Market Size in USD Billion

CAGR :

%

USD

54.40 Billion

USD

85.40 Billion

2025

2033

USD

54.40 Billion

USD

85.40 Billion

2025

2033

| 2026 –2033 | |

| USD 54.40 Billion | |

| USD 85.40 Billion | |

|

|

|

|

Spinal Imaging Market Size

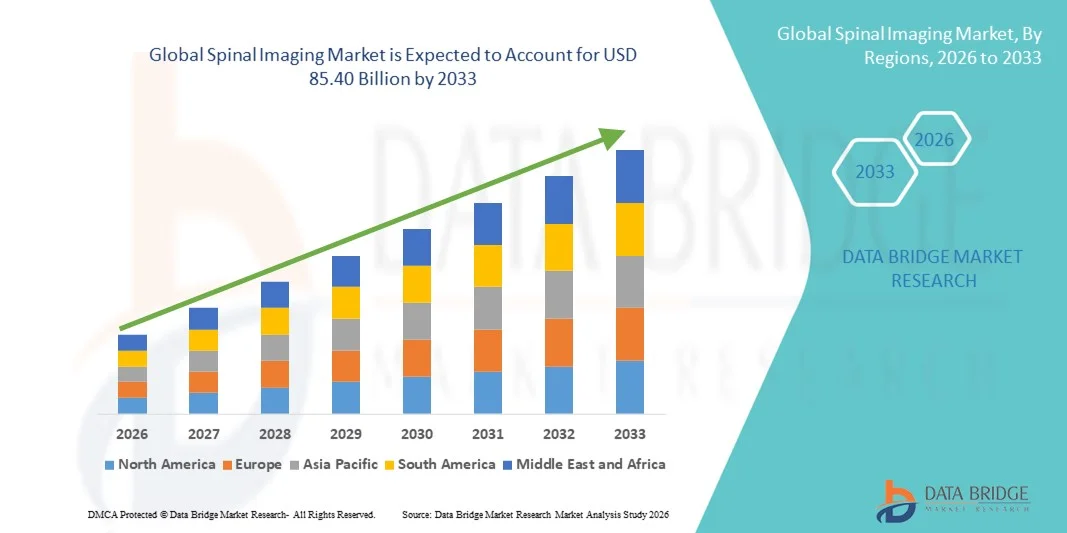

- The global spinal imaging market size was valued at USD 54.40 billion in 2025 and is expected to reach USD 85.40 billion by 2033, at a CAGR of 5.80% during the forecast period

- The market growth is primarily driven by the rising prevalence of spinal disorders, increasing geriatric population, and continuous technological advancements in imaging modalities such as MRI, CT, and X-ray systems, supporting improved diagnostic accuracy and workflow efficiency

- Furthermore, growing demand for early diagnosis, minimally invasive treatment planning, and advanced imaging solutions across hospitals and diagnostic centers is positioning spinal imaging as a critical component of modern healthcare infrastructure, thereby significantly boosting overall market growth

Spinal Imaging Market Analysis

- Spinal imaging, encompassing diagnostic modalities such as X-ray, MRI, CT, and advanced imaging systems for evaluating spinal anatomy and disorders, has become a critical component of modern diagnostic and treatment planning workflows in hospitals and diagnostic centers due to its role in accurate detection, disease monitoring, and surgical guidance

- The growing demand for spinal imaging is primarily driven by the rising prevalence of degenerative spine disorders, spinal injuries, and chronic back pain, along with an aging global population and increasing preference for early and precise diagnosis

- North America dominated the global spinal imaging market with the largest revenue share of 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of technologically advanced imaging systems, and strong reimbursement frameworks, with the U.S. witnessing significant utilization across hospitals and specialized orthopedic and neurology centers

- Asia-Pacific is expected to be the fastest growing region in the spinal imaging market during the forecast period, owing to expanding healthcare infrastructure, increasing patient volumes, rising awareness of spine-related conditions, and growing investments in advanced diagnostic technologies

- MRI segment dominated the spinal imaging market with a market share of 41.8% in 2025, driven by its superior soft-tissue contrast, non-invasive nature, and widespread use in diagnosing complex spinal and neurological conditions

Report Scope and Spinal Imaging Market Segmentation

|

Attributes |

Spinal Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Spinal Imaging Market Trends

Integration of AI-Driven Image Analysis and Advanced Imaging Technologies

- A significant and accelerating trend in the global spinal imaging market is the integration of artificial intelligence (AI) and advanced image-processing algorithms into MRI, CT, and X-ray systems to enhance diagnostic accuracy, workflow efficiency, and clinical decision-making

- For instance, leading imaging system manufacturers are embedding AI-based software into MRI and CT platforms to assist radiologists in automatically detecting spinal abnormalities such as disc herniation, spinal stenosis, and vertebral fractures, thereby reducing interpretation time

- AI integration in spinal imaging enables automated segmentation, anomaly detection, and prioritization of critical cases, supporting faster diagnosis and improved patient outcomes. For instance, AI-powered spinal MRI tools can highlight suspicious regions and quantify degenerative changes, aiding clinicians in treatment planning

- The seamless integration of advanced spinal imaging systems with hospital information systems (HIS) and picture archiving and communication systems (PACS) facilitates centralized data management and smoother clinical workflows across radiology departments

- This trend toward more intelligent, precise, and interconnected imaging solutions is reshaping expectations for spinal diagnostics. Consequently, companies such as Siemens Healthineers and GE HealthCare are advancing AI-enabled spinal imaging platforms focused on improved image quality and operational efficiency

- Increasing adoption of cloud-based spinal imaging platforms is enabling remote image access, collaborative diagnostics, and teleradiology services, particularly benefiting multi-site hospital networks and underserved regions

- The demand for spinal imaging systems offering AI-assisted diagnostics and enhanced visualization capabilities is growing rapidly across hospitals and diagnostic centers, as healthcare providers increasingly prioritize accuracy, speed, and productivity

Spinal Imaging Market Dynamics

Driver

Rising Burden of Spinal Disorders and Demand for Early Diagnosis

- The increasing prevalence of spinal disorders, including degenerative disc disease, scoliosis, and spinal injuries, coupled with the growing emphasis on early and accurate diagnosis, is a major driver fueling demand for spinal imaging solutions

- For instance, in March 2025, Philips Healthcare announced advancements in its MRI technology portfolio aimed at improving musculoskeletal and spinal imaging efficiency, supporting faster scans and enhanced diagnostic confidence

- As awareness of spine-related health issues increases among patients and clinicians, spinal imaging plays a critical role in disease detection, monitoring progression, and guiding surgical or non-surgical interventions

- Furthermore, the aging global population and rising incidence of chronic back pain are driving higher utilization of spinal imaging across hospitals, orthopedic clinics, and neurology centers

- The expanding adoption of minimally invasive spine surgeries and personalized treatment approaches relies heavily on precise preoperative and postoperative imaging, further propelling demand

- Growing investments by governments and private healthcare providers in diagnostic imaging infrastructure are accelerating the deployment of advanced spinal imaging systems across emerging and developed markets

- Increasing participation in sports and physically demanding occupations is contributing to a higher incidence of spinal injuries, further driving the need for timely and accurate spinal imaging diagnostics

- The growing availability of advanced imaging modalities and improved reimbursement frameworks in developed healthcare systems continue to support sustained market growth

Restraint/Challenge

High Equipment Costs and Radiation Exposure Concerns

- Concerns related to the high capital cost of advanced spinal imaging systems, particularly MRI and CT scanners, pose a significant challenge to market expansion, especially in cost-sensitive and resource-limited healthcare settings

- For instance, smaller hospitals and diagnostic centers often delay upgrading imaging infrastructure due to the substantial investment required for equipment procurement, installation, and maintenance

- In addition, concerns about radiation exposure associated with repeated spinal CT and X-ray imaging can limit utilization, particularly for pediatric and long-term monitoring patients, prompting cautious clinical use

- Addressing these challenges through the development of cost-effective imaging systems, low-dose imaging technologies, and optimized scanning protocols is essential for broader adoption

- Regulatory requirements related to radiation safety, equipment approval, and quality standards can also extend product development timelines and increase compliance costs for manufacturers

- Limited availability of skilled radiologists and trained imaging professionals in certain regions can restrict effective utilization of advanced spinal imaging systems, impacting diagnostic throughput

- Infrastructure constraints such as inadequate power supply, space requirements, and cooling systems can hinder the installation and operation of high-end spinal imaging equipment in smaller healthcare facilities

- Overcoming these barriers through technological innovation, improved safety measures, and flexible financing models will be critical for ensuring sustained growth in the global spinal imaging market

Spinal Imaging Market Scope

The market is segmented on the basis of product, application, and end user.

- By Product

On the basis of product, the global spinal imaging market is segmented into X-ray, CT, MRI, and Ultrasound. The MRI segment dominated the market with the largest revenue share of 41.8% in 2025, driven by its superior soft-tissue contrast and non-invasive nature, making it the preferred modality for detailed evaluation of spinal cord, discs, nerves, and soft tissues. MRI is widely used for diagnosing degenerative spine disorders, spinal tumors, and nerve compressions, supporting both initial diagnosis and treatment planning. Its ability to provide multi-planar imaging without radiation exposure further strengthens its adoption, particularly for chronic and repeat imaging cases. Increasing availability of high-field MRI systems and advanced sequences has enhanced diagnostic confidence among clinicians. In addition, strong reimbursement support in developed markets has reinforced MRI utilization. The growing demand for precision diagnostics in neurology and orthopedics continues to sustain MRI’s dominance.

The CT segment is expected to witness the fastest growth rate during the forecast period, fueled by its rapid imaging capabilities and high-resolution visualization of bony structures. CT scans are increasingly preferred in emergency and trauma settings for quick assessment of vertebral fractures and spinal injuries. Technological advancements such as low-dose CT and AI-assisted reconstruction are improving safety and image quality, encouraging broader adoption. The expanding use of CT in preoperative planning for complex spinal surgeries further supports growth. Increasing trauma cases and road accidents globally are boosting demand for fast and accurate spinal imaging. Moreover, rising installation of advanced CT systems in emerging economies is accelerating segment expansion.

- By Application

On the basis of application, the market is segmented into spinal infection, vertebral fractures, spinal cancer, and spinal cord and nerve compressions. The spinal cord and nerve compressions segment dominated the market in 2025, driven by the high prevalence of conditions such as herniated discs, spinal stenosis, and degenerative disc disease. These conditions commonly require advanced imaging, particularly MRI, for accurate diagnosis and treatment planning. Increasing sedentary lifestyles and aging populations have significantly raised the incidence of nerve-related spinal disorders. Early diagnosis through imaging is critical to prevent permanent neurological damage, further supporting demand. Hospitals and specialty clinics rely heavily on spinal imaging for monitoring disease progression and post-treatment evaluation. Continuous growth in outpatient spinal care also contributes to this segment’s dominance.

The vertebral fractures segment is anticipated to grow at the fastest rate over the forecast period, primarily due to rising cases of osteoporosis-related fractures and traumatic injuries. The growing elderly population is particularly susceptible to compression fractures, increasing imaging demand. CT and X-ray are widely used for rapid fracture detection, especially in emergency settings. Increased awareness regarding early fracture diagnosis is driving higher imaging utilization. Expanding access to imaging facilities in developing regions further supports growth. In addition, rising sports injuries and occupational hazards are contributing to the accelerating adoption of spinal imaging for fracture assessment.

- By End User

On the basis of end user, the market is segmented into hospitals, diagnostic imaging centers, and ambulatory care centers. The hospital segment dominated the spinal imaging market with the highest revenue share in 2025, supported by the availability of advanced imaging infrastructure and specialized medical professionals. Hospitals handle a large volume of complex spinal cases, including trauma, cancer, and surgical planning, necessitating comprehensive imaging capabilities. Integrated care models within hospitals promote frequent use of MRI and CT for multidisciplinary decision-making. High patient inflow and emergency admissions further drive imaging volumes. Strong capital investment capacity enables hospitals to adopt cutting-edge imaging technologies. In addition, favorable reimbursement policies support sustained utilization in hospital settings.

The diagnostic imaging centers segment is expected to register the fastest growth during the forecast period, driven by the shift toward outpatient and cost-effective diagnostic services. These centers offer faster appointment scheduling and specialized imaging services, attracting a growing patient base. Increasing preference for standalone imaging facilities reduces the burden on hospitals and improves accessibility. Technological advancements have enabled imaging centers to deploy high-quality MRI and CT systems. Growth in preventive diagnostics and early disease detection is further boosting demand. Expansion of private diagnostic chains across emerging markets is accelerating segment growth.

Spinal Imaging Market Regional Analysis

- North America dominated the global spinal imaging market with the largest revenue share of 38.6% in 2025, supported by advanced healthcare infrastructure, high adoption of technologically advanced imaging systems, and strong reimbursement frameworks

- Healthcare providers in the region place significant emphasis on accurate and early diagnosis, supported by widespread availability of MRI, CT, and X-ray systems across hospitals and diagnostic imaging centers

- This strong market position is further reinforced by favorable reimbursement frameworks, high healthcare expenditure, and the presence of leading imaging technology manufacturers, establishing spinal imaging as a critical diagnostic tool across both acute and outpatient care settings

The U.S. Spinal Imaging Market Insight

The U.S. spinal imaging market captured the largest revenue share within North America in 2025, driven by the high prevalence of spinal disorders, strong healthcare spending, and widespread adoption of advanced diagnostic imaging technologies. Healthcare providers increasingly prioritize early and accurate diagnosis of spinal conditions using MRI and CT systems. The growing number of aging patients, coupled with rising cases of chronic back pain and spinal injuries, further supports market expansion. Moreover, the presence of leading imaging technology manufacturers and favorable reimbursement policies continues to strengthen the U.S. spinal imaging market.

Europe Spinal Imaging Market Insight

The Europe spinal imaging market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by rising incidence of degenerative spine disorders and well-established healthcare systems. Increasing demand for early diagnosis and preventive healthcare is supporting higher utilization of spinal imaging across hospitals and diagnostic centers. European countries are witnessing growing adoption of advanced MRI and CT technologies for spinal assessments. The region also benefits from strong regulatory frameworks promoting quality diagnostics. Expansion of outpatient imaging services is further contributing to market growth.

U.K. Spinal Imaging Market Insight

The U.K. spinal imaging market is anticipated to grow at a notable CAGR during the forecast period, driven by increasing awareness of spinal health and rising demand for accurate diagnostic solutions. The growing elderly population and higher incidence of musculoskeletal disorders are boosting imaging volumes. The National Health Service’s focus on early diagnosis and improved patient outcomes supports the adoption of advanced spinal imaging technologies. In addition, increasing investments in diagnostic infrastructure are enhancing access to MRI and CT services across the country.

Germany Spinal Imaging Market Insight

The Germany spinal imaging market is expected to expand at a considerable CAGR during the forecast period, supported by advanced healthcare infrastructure and strong emphasis on technological innovation. High utilization of MRI and CT systems for spinal diagnostics reflects Germany’s focus on precision medicine and early disease detection. The rising burden of degenerative spinal conditions and trauma cases is driving demand. Germany’s strong reimbursement environment and skilled healthcare workforce further promote the adoption of advanced spinal imaging solutions across hospitals and diagnostic centers.

Asia-Pacific Spinal Imaging Market Insight

The Asia-Pacific spinal imaging market is poised to grow at the fastest CAGR during the forecast period, driven by rapidly expanding healthcare infrastructure, rising patient volumes, and increasing awareness of spinal disorders. Countries such as China, Japan, and India are witnessing growing demand for advanced imaging technologies to support early diagnosis and treatment planning. Rising healthcare investments and improving access to diagnostic services are accelerating market growth. In addition, increasing incidence of spinal injuries and age-related conditions is contributing to higher imaging utilization across the region.

Japan Spinal Imaging Market Insight

The Japan spinal imaging market is gaining momentum due to the country’s aging population and strong emphasis on advanced medical technology. High prevalence of degenerative spine disorders among elderly patients is driving demand for MRI and CT imaging. Japan’s healthcare system prioritizes accurate diagnosis and minimally invasive treatment planning, supporting sustained imaging adoption. Integration of advanced imaging technologies and AI-based tools is further enhancing diagnostic efficiency. Growing outpatient diagnostic services are also contributing to market growth.

India Spinal Imaging Market Insight

The India spinal imaging market accounted for a significant revenue share within Asia-Pacific in 2025, driven by rapid expansion of healthcare infrastructure and increasing access to diagnostic imaging services. Rising incidence of spinal disorders, trauma cases, and chronic back pain is boosting demand for spinal imaging. Growing investments in private hospitals and diagnostic centers are improving availability of MRI and CT systems. Government initiatives to strengthen healthcare access and early diagnosis are further supporting market expansion. In addition, increasing awareness of spine-related health issues is driving higher utilization of imaging services across urban and semi-urban areas.

Spinal Imaging Market Share

The Spinal Imaging industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Carestream Health, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- FUJIFILM Holdings Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Shimadzu Corporation (Japan)

- Samsung Medison Co., Ltd. (South Korea)

- Agfa-Gevaert N.V. (Belgium)

- Mindray Medical International Limited (China)

- Esaote S.p.A. (Italy)

- Planmed Oy (Finland)

- Hologic, Inc. (U.S.)

- Konica Minolta, Inc. (Japan)

- Neusoft Medical Systems Co., Ltd. (China)

- Varex Imaging Corporation (U.S.)

- CurveBeam Inc. (U.S.)

- Shanghai United Imaging Healthcare Co., Ltd. (China)

- Bruker (U.S.)

What are the Recent Developments in Global Spinal Imaging Market?

- In July 2025, RIVANNA’s next-generation ultrasound guidance platform and AI-driven imaging software received FDA 510(k) clearance, marking a significant advancement in spinal imaging by authorizing the use of the Accuro 3S portable ultrasound system with integrated SpineNav-AI guidance during neuraxial procedures, enhancing visualization and procedural accuracy for spinal interventions

- In February 2025, Royal Philips launched the AI-enabled CT 5300 system at the 23rd Asian Oceanian Congress of Radiology (AOCR) 2025, featuring advanced AI reconstruction and workflow tools designed to enhance diagnostic accuracy and streamline operations for CT imaging, supporting improved detection of spinal conditions and broader clinical use

- In February 2025, Esaote Group unveiled its new AI-powered “e-SPADES” MRI platform at the European Congress of Radiology (ECR) 2025, significantly reducing MRI scan times by up to 60% while preserving image quality a breakthrough expected to improve spinal MRI throughput and diagnostic efficiency globally

- In November 2024, Medtronic expanded its AiBLE™ spine surgery ecosystem with multiple imaging and AI enhancements, including AI-integrated intraoperative imaging (O-arm™ 4.3) with extended 3D scan capability and lower radiation dose, and integrated MRI Vision software that automates lumbar MRI analysis for surgical planning

- In November 2024, the U.S. FDA cleared the RAI AI-powered spine MRI software developed by Remedy Logic, designed to automate segmentation and measurement in spine MRIs, reducing interpretation time for radiologists while enhancing detection of degenerative pathologies marking a significant regulatory milestone for AI in spinal imaging.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.