Global Sports Fishing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

5.16 Billion

USD

6.80 Billion

2024

2032

USD

5.16 Billion

USD

6.80 Billion

2024

2032

| 2025 –2032 | |

| USD 5.16 Billion | |

| USD 6.80 Billion | |

|

|

|

|

Sports Fishing Equipment Market Size

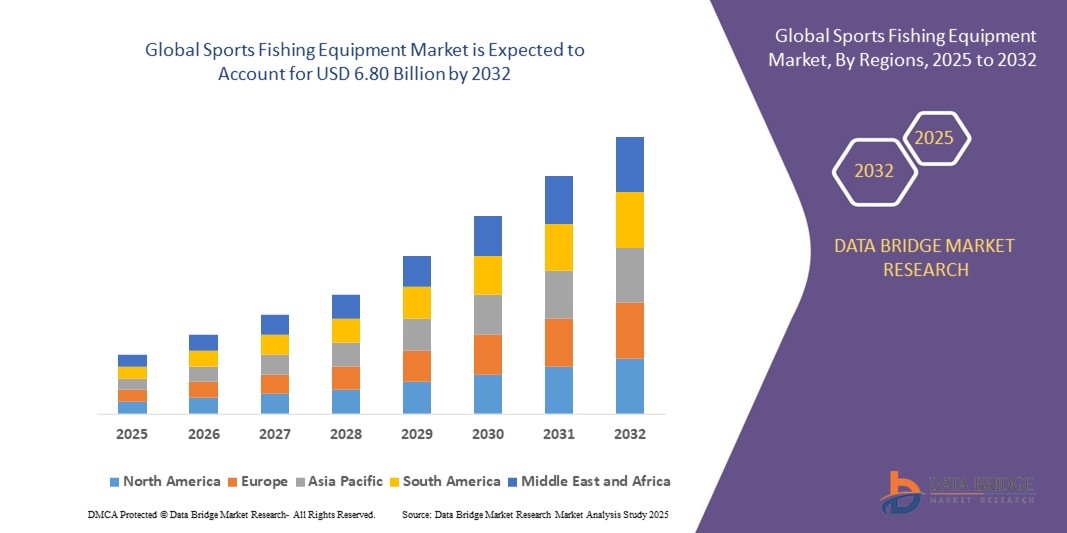

- The global sports fishing equipment market size was valued at USD 5.16 billion in 2024 and is expected to reach USD 6.80 billion by 2032, at a CAGR of 3.5% during the forecast period

- The market growth is driven by increasing participation in recreational fishing, growing interest in outdoor activities, and advancements in fishing equipment technology, such as lightweight rods and high-performance reels

- Rising consumer demand for durable, high-quality, and specialized fishing gear for both freshwater and saltwater applications is boosting the industry, with e-commerce platforms further accelerating market accessibility and growth

Sports Fishing Equipment Market Analysis

- Sports fishing equipment, including rods, reels, lures, and other accessories, is essential for recreational and competitive fishing, catering to both amateur and professional anglers across freshwater and saltwater environments

- The demand for sports fishing equipment is fueled by the growing popularity of fishing as a leisure activity, increased awareness of sustainable fishing practices, and the rise of fishing tourism in coastal and inland regions

- North America dominated the sports fishing equipment market with the largest revenue share of 38.5% in 2024, driven by a strong fishing culture, high disposable incomes, and the presence of leading manufacturers

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rising urbanization, increasing disposable incomes, and growing interest in recreational fishing in countries such as China, Japan, and Australia

- The rods segment dominated the largest market revenue share of approximately 33% in 2024, driven by their critical role in casting and reeling in fish, with advancements in lightweight and durable materials such as carbon fiber boosting demand

Report Scope and Sports Fishing Equipment Market Segmentation

|

Attributes |

Sports Fishing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sports Fishing Equipment Market Trends

Increasing Integration of Smart Technologies and Eco-Friendly Innovations

- The global sports fishing equipment market is experiencing a notable trend toward the integration of smart technologies and sustainable practices

- Advanced technologies, such as GPS-enabled fish finders and smartphone-connected sensors, are enhancing the fishing experience by providing real-time data on fish locations, water conditions, and optimal fishing spots

- These smart tools enable anglers to make data-driven decisions, improving efficiency and success rates in both freshwater and saltwater fishing

- For instance, companies are developing innovative products such as the Garmin Striker series, which offers GPS and sonar capabilities, and smart rods that sync with mobile apps to track fishing patterns and conditions

- In addition, there is a growing focus on eco-friendly materials, such as biodegradable lures and sustainable fishing lines, driven by increasing consumer awareness of environmental impacts and marine conservation

- These advancements are making sports fishing equipment more appealing to tech-savvy anglers and environmentally conscious consumers, boosting market growth

Sports Fishing Equipment Market Dynamics

Driver

Rising Popularity of Recreational Fishing and Competitive Tournaments

- The surge in recreational fishing as a leisure activity is a primary driver of the global sports fishing equipment market, fueled by its appeal as a stress-relieving and nature-connected hobby

- Features such as lightweight rods, corrosion-resistant reels for saltwater fishing, and advanced tackle boxes enhance the angling experience, catering to both novice and experienced anglers

- Government initiatives and fishing associations, such as the American Sportfishing Association, are promoting fishing through organized events and improved access to water bodies, further driving demand for high-quality equipment

- The rise of competitive fishing tournaments, such as the Bisbee Black and Blue in Mexico and the Annual White Marlin Open, is increasing the need for specialized gear, including high-performance rods, reels, and lures, to meet the demands of professional anglers

- The proliferation of e-commerce platforms, such as Amazon and Bass Pro Shops, and the expansion of 5G technology are enabling broader access to diverse fishing equipment and faster data transmission for smart fishing devices

- Manufacturers are increasingly offering advanced, customizable products to meet consumer expectations for precision and versatility in fishing gear

Restraint/Challenge

High Costs of Advanced Equipment and Environmental Concerns

- The high initial costs associated with advanced sports fishing equipment, such as GPS-enabled fish finders, carbon fiber rods, and smart reels, can be a significant barrier to adoption, particularly in cost-sensitive emerging markets

- Integrating smart technologies into fishing gear often requires complex and expensive manufacturing processes, increasing the overall cost for consumers

- Environmental concerns, particularly regarding the impact of non-biodegradable fishing gear such as lures and lines on marine ecosystems, pose a major challenge. Abandoned or lost equipment contributes to ocean pollution, raising scrutiny over sustainability practices

- Regulatory variations across countries regarding environmental standards and sustainable fishing practices complicate operations for manufacturers and distributors, requiring compliance with diverse guidelines

- In addition, the growing trend of purchasing pre-owned fishing gear through platforms such as eBay and Gumtree can reduce demand for new equipment, impacting market growth

- These factors may deter potential buyers, particularly in regions with high environmental awareness or limited disposable income, limiting market expansion

Sports Fishing Equipment market Scope

The market is segmented on the basis of product, application, distribution channel, and end users.

- By Product

On the basis of product, the global sports fishing equipment market is segmented into rods, reels, hooks, lures, lines, rigs, jig heads, and others. The rods segment dominated the largest market revenue share of approximately 33% in 2024, driven by their critical role in casting and reeling in fish, with advancements in lightweight and durable materials such as carbon fiber boosting demand.

The lures segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer demand for innovative and realistic designs that enhance fish attraction, coupled with the rise in competitive fishing tournaments and recreational fishing activities.

- By Application

On the basis of application, the global sports fishing equipment market is segmented into freshwater fishing and saltwater fishing. The freshwater fishing segment dominated with a market revenue share of approximately 60% in 2024, driven by its widespread accessibility in inland lakes, rivers, and ponds, appealing to a broad range of anglers from hobbyists to professionals. The saltwater fishing segment is anticipated to experience the fastest growth rate from 2025 to 2032, propelled by growing interest in marine recreational activities and the need for specialized, corrosion-resistant equipment to target larger fish species in challenging ocean environments.

- By Distribution Channel

On the basis of distribution channel, the global sports fishing equipment market is segmented into independent sports outlets, franchised sports outlets, modern trade channels, direct to consumer brand outlets, and direct to customer online channels. The independent sports outlets segment held the largest market revenue share of approximately 40% in 2024, driven by their specialized offerings and ability to cater to local angler preferences with personalized service.

The direct to customer online channels segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the convenience of e-commerce platforms such as Amazon and specialty fishing stores, which provide global access to diverse products and competitive pricing.

- By End Users

On the basis of end users, the global sports fishing equipment market is segmented into individual consumers, clubs, and sports organizers. The individual consumers segment dominated with a market revenue share of approximately 65% in 2024, driven by the large number of recreational anglers seeking high-quality gear for personal use, ranging from novice to experienced enthusiasts.

The sports organizers segment is expected to witness rapid growth from 2025 to 2032, fueled by the increasing number of competitive fishing tournaments, such as the Bisbee Black and Blue and the White Marlin Open, which drive demand for specialized equipment.

Sports Fishing Equipment Market Regional Analysis

- North America dominated the sports fishing equipment market with the largest revenue share of 38.5% in 2024, driven by a strong fishing culture, high disposable incomes, and the presence of leading manufacturers

- Consumers seek fishing equipment such as rods, reels, hooks, lures, lines, rigs, and jig heads to improve catch efficiency and enhance the fishing experience, especially in diverse aquatic environments

- Growth is driven by advancements in product technology, including carbon fiber rods and corrosion-resistant reels, alongside increasing participation in recreational fishing and competitive events such as the Bisbee Black and Blue and the White Marlin Open

U.S. Sports Fishing Equipment Market Insight

The U.S. sports fishing equipment market captured the largest revenue share of 76.9% in 2024 within North America, fueled by strong aftermarket demand and growing consumer awareness of advanced equipment benefits such as precision and durability. The trend toward recreational fishing and catch-and-release programs further boosts market expansion. Major manufacturers such as Shimano and Pure Fishing, Inc. complement aftermarket sales with innovative products, creating a robust product ecosystem.

Europe Sports Fishing Equipment Market Insight

The Europe sports fishing equipment market is expected to witness significant growth, supported by increasing participation in recreational fishing and emphasis on sustainable fishing practices. Consumers seek equipment that enhances catch efficiency while adhering to environmental regulations. Growth is prominent in both freshwater and saltwater applications, with countries such as the U.K. and Spain showing significant uptake due to rising interest in outdoor leisure and fishing tournaments.

U.K. Sports Fishing Equipment Market Insight

The U.K. market for sports fishing equipment is expected to witness notable growth, driven by demand for enhanced fishing experiences and eco-friendly gear in urban and coastal settings. Increased interest in recreational fishing and rising awareness of sustainable practices encourage adoption. Evolving regulations balancing equipment performance with environmental impact influence consumer choices, boosting demand for high-quality rods, reels, and lures.

Germany Sports Fishing Equipment Market Insight

Germany is expected to witness strong growth in the sports fishing equipment market, attributed to its advanced manufacturing sector and high consumer focus on precision and eco-friendly equipment. German anglers prefer technologically advanced products such as smart fish finders and lightweight rods that enhance fishing efficiency and contribute to sustainable practices. The integration of these products in competitive fishing and aftermarket options supports sustained market growth.

Asia-Pacific Sports Fishing Equipment Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding recreational fishing activities and rising disposable incomes in countries such as China, Japan, and India. Increasing awareness of fishing as a leisure activity and the adoption of advanced equipment such as corrosion-resistant reels and eco-friendly lures boost demand. Government initiatives promoting sustainable fishing and coastal tourism further encourage the use of innovative sports fishing equipment.

Japan Sports Fishing Equipment Market Insight

Japan’s sports fishing equipment market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced equipment that enhances fishing precision and comfort. The presence of major manufacturers such as Daiwa and Shimano accelerates market penetration through OEM and aftermarket channels. Rising interest in recreational and competitive fishing, supported by coastal access, contributes to market growth.

China Sports Fishing Equipment Market Insight

China holds the largest share of the Asia-Pacific sports fishing equipment market, propelled by rapid urbanization, rising recreational fishing participation, and increasing demand for advanced fishing gear. The country’s growing middle class and focus on outdoor leisure activities support the adoption of rods, reels, and lures. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, driving growth in both freshwater and saltwater applications.

Sports Fishing Equipment Market Share

The sports fishing equipment industry is primarily led by well-established companies, including:

- Eagle Claw (U.S.)

- Newell Brands (U.S.)

- OKUMA FISHING TACKLE CO., LTD. (China)

- Pure Fishing, Inc. (U.S.)

- St. Croix Rods (U.S.)

- SHIMANO INC. (Japan)

- MOONSHINE ROD COMPANY (U.S.)

- AFTCO (U.S.)

- TICA FISHING TACKLE (China)

- GLOBERIDE, Inc.(Japan)

- O. Mustad & Son AS (Norway)

- KISTLER Fishing (U.S.)

- Pride Rods (U.S.)

- Rapala VMC Corporation (Finland)

What are the Recent Developments in Global Sports Fishing Equipment Market?

- In July 2025, the sports fishing equipment market is projected to hit USD 26.02 billion by 2034, propelled by a surge in recreational fishing and ongoing technological innovation. Manufacturers are introducing lightweight composite rods, enhanced drag systems, and durable reels to meet evolving angler preferences. Simultaneously, there's growing demand for eco-friendly gear, including biodegradable baits and scent-infused lures, reflecting environmental awareness and performance needs. This strategic growth is supported by rising disposable incomes, outdoor tourism, and sustainability trends, positioning the market for robust expansion across freshwater and saltwater segments

- In June 2025, the global fishing rods market is projected to reach USD 1.25 billion in 2024, with strong growth ahead. This expansion is fueled by rising interest in telescopic rods, which offer portability and convenience, and increased participation from women and youth, reshaping product design and marketing. Carbon fiber continues to dominate due to its superior strength-to-weight ratio, enhancing performance and sensitivity. Meanwhile, casting rods are gaining popularity for their precision and control, especially among serious anglers. These trends reflect evolving consumer preferences and technological advancements in recreational fishing

- In April 2024, the global sports fishing equipment market is projected to grow by USD 3.25 billion between 2024 and 2028, driven by the increasing popularity of recreational fishing and rapid technological advancements. Innovations such as GPS-enabled systems, side-scanning sonar, and light-tackle lines made from high-performance materials such as Spectra and Dyneema are enhancing the angling experience. These developments cater to both casual and competitive anglers, boosting demand across freshwater and saltwater segments. The market’s expansion reflects a broader trend toward outdoor leisure and smart fishing gear

- In September 2023, AFTCO (American Fishing Tackle Company) unveiled a new collection of sustainable fishing apparel crafted from recycled materials, targeting environmentally conscious anglers. This initiative reflects a broader industry shift toward eco-friendly practices, combining performance with environmental responsibility. The line includes UPF sun protection shirts, outerwear, and boardshorts, all designed to reduce plastic waste while maintaining durability and comfort. AFTCO’s commitment to sustainability also supports marine conservation efforts, reinforcing its role as a leader in responsible fishing gear innovation

- In June 2023, Mustad, a global leader in hook innovation, unveiled its AlphaPoint® series, a new line of hooks tailored to specific fishing techniques across both freshwater and saltwater environments. These hooks feature AlphaPoint® 4.8 technology, offering a sharper, slimmer needlepoint for faster and deeper hooksets. Designed with Opti-Angle sharpening, they maximize penetration and durability. The series includes models for slow-pitch jigging, finesse bass fishing, and live bait presentations, reflecting Mustad’s commitment to performance-driven gear and angler efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.