Global Sports Gun Market

Market Size in USD Billion

CAGR :

%

USD

2.39 Billion

USD

4.43 Billion

2024

2032

USD

2.39 Billion

USD

4.43 Billion

2024

2032

| 2025 –2032 | |

| USD 2.39 Billion | |

| USD 4.43 Billion | |

|

|

|

|

Sports Gun Market Size

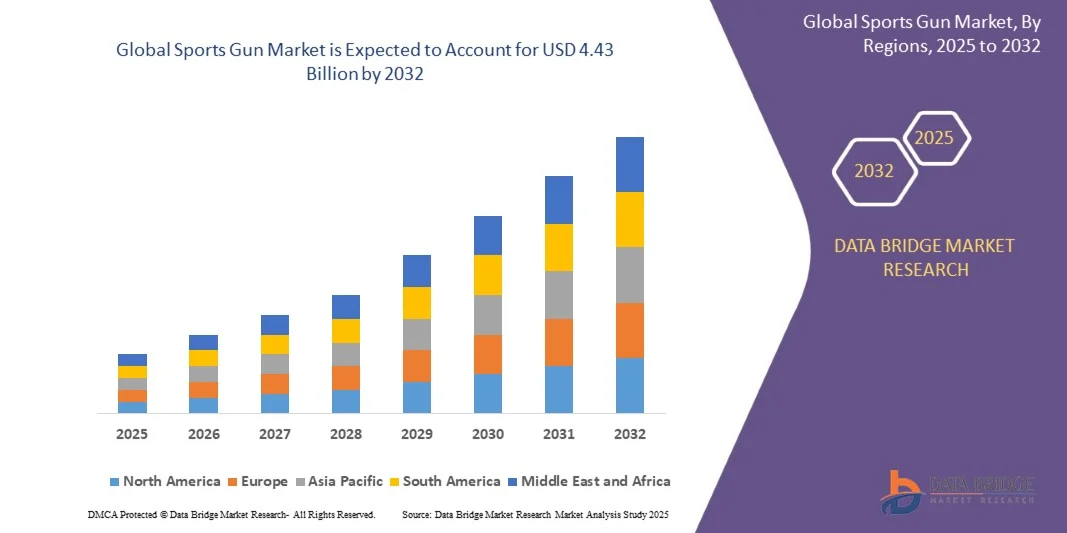

- The global sports gun market size was valued at USD 2.39 billion in 2024 and is expected to reach USD 4.43 billion by 2032, at a CAGR of 8.04% during the forecast period

- The market growth is largely fueled by increasing participation in recreational shooting, competitive shooting events, and hunting activities, driving demand for precision, reliable, and technologically advanced firearms across global markets

- Furthermore, rising consumer preference for compact, ergonomic, and safe firearms, alongside the growing availability of specialized shooting ranges, training programs, and online retail platforms, is establishing sports guns as a favored choice for both enthusiasts and professional shooters. These converging factors are accelerating the adoption of sports guns, thereby significantly boosting the industry's growth

Sports Gun Market Analysis

- Sports guns are firearms designed for recreational, competitive, and hunting applications, encompassing rifles, handguns, shotguns, and specialized firearms. These products are increasingly integrated with modern safety mechanisms, ergonomic designs, and advanced materials to enhance accuracy, handling, and user experience

- The escalating demand for sports guns is primarily fueled by rising disposable incomes, growing awareness of shooting sports, expanding infrastructure for recreational and competitive shooting, and increasing e-commerce penetration, which collectively contribute to market expansion globally

- North America dominated sports gun market with a share of 37.30% in 2024, due to growing recreational shooting activities, hunting culture, and competitive shooting events

- Asia-Pacific is expected to be the fastest growing region in the sports gun market during the forecast period due to rising disposable incomes, urbanization, and increasing participation in competitive shooting and recreational hunting in countries such as China, Japan, and India

- Rifle segment dominated the market with a market share of 40.95% in 2024, due to its high accuracy, long-range capabilities, and versatility across competitive shooting, hunting, and recreational applications. Rifles are widely preferred by professional shooters and hunting enthusiasts for their precision and reliability under varied environmental conditions. The availability of advanced features such as adjustable stocks, improved optics, and customizable triggers has further fueled the adoption of rifles. Growing participation in competitive shooting sports and increasing hunting activities across North America and Europe also support the dominance of this segment

Report Scope and Sports Gun Market Segmentation

|

Attributes |

Sports Gun Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sports Gun Market Trends

“Rising Popularity of Recreational and Competitive Shooting”

- The sports gun market is evolving rapidly as recreational and competitive shooting gain traction worldwide. Growing participation in target shooting, clay pigeon shooting, and hunting sports is stimulating demand for specialized and precision-engineered firearms that cater to both amateur and professional shooters. The expansion of shooting clubs, sports academies, and organized tournaments is further fueling interest in the segment among younger populations

- For instance, companies such as Beretta Holding S.p.A. and Browning Arms Company have expanded their ranges of competition-grade shotguns and rifles designed for professional sporting events such as skeet and trap shooting. Similarly, Smith & Wesson Brands, Inc. continues to enhance its product portfolio with precision handguns targeting shooting enthusiasts participating in competitive leagues and recreational training programs across North America and Europe

- The growing cultural acceptance of shooting sports as a structured recreational activity is contributing to the sector’s modernization. Manufacturers are introducing lightweight, customizable, and technologically advanced firearms equipped with ergonomic features, improved barrel stability, and enhanced optics compatibility to enhance user comfort and performance

- In addition, the rise of international sporting events such as the Olympics, ISSF championships, and regional competitions has increased the visibility of shooting sports. This surge in media exposure is inspiring new enthusiasts and expanding participation in shooting as a skill-oriented sport

- Advancements in firearm safety designs, including enhanced trigger mechanisms and improved recoil management systems, are encouraging new entrants into the sport while maintaining stringent safety standards. These developments ensure that sports shooting remains accessible and engaging for both experienced users and beginners

- As shooting continues to evolve as a mainstream recreational pursuit, the demand for specialized sports guns emphasizing precision, safety, and comfort is expected to grow consistently. The trend highlights a long-term cultural and commercial shift, where shooting is increasingly positioned as a competitive and recreational discipline rather than solely a defense-related activity

Sports Gun Market Dynamics

Driver

“Increasing Demand for Safe and Ergonomic Firearms”

- The expanding emphasis on firearm safety and ergonomics is a primary factor driving the growth of the sports gun market. Manufacturers are developing weapons that combine performance precision with advanced user safety systems to meet the expectations of both recreational shooters and professional competitors

- For instance, Sturm, Ruger & Co. and SIG Sauer have introduced sports firearms featuring advanced safety locks, adjustable stocks, and recoil absorption technologies to enhance stability and shooter comfort. These design advancements reduce fatigue and improve target accuracy, making firearms more appealing across skill levels

- The focus on ergonomic designs allows improved handling and control, especially during long practice sessions or competitions. Adjustable grips, modular components, and lightweight materials support personalized configurations, enabling shooters to tailor firearms to individual preferences and shooting styles

- In addition, rising global participation in shooting clubs and training academies is reinforcing the demand for user-friendly firearms with enhanced safety features. Manufacturers are investing in training-focused product lines that incorporate intuitive operation systems to ensure safer learning environments for new participants

- As firearm technology continues to advance, the combination of ergonomic engineering and built-in safety mechanisms is shaping modern sports guns. This progression reflects a broader industry move toward precision-built firearms that prioritize comfort, safety, and overall shooting experience for long-term market sustainability

Restraint/Challenge

“Strict Firearm Regulations in Key Markets”

- The sports gun market faces persistent challenges due to stringent firearm regulations across key economies. Government-imposed restrictions on weapon ownership, licensing, and import-export limits often delay new product introductions and constrain market expansion, especially in regions with strict public safety controls

- For instance, sports firearm manufacturers such as Heckler & Koch GmbH and Colt’s Manufacturing Company face regulatory barriers in countries such as the United Kingdom, Japan, and Australia, where stringent licensing prerequisites and limited ownership rights significantly restrict civilian access to shooting equipment. These factors lead to limited distribution opportunities and reduced consumer reach compared to markets with more lenient frameworks

- Complex legal procedures surrounding firearm purchase, storage, and transportation also increase operational burdens for dealers and sports federations. Compliance with distinct national standards—including background checks and certification requirements—adds significant time to sales cycles and reduces market efficiency

- In addition, variations in import duties and regional classifications of sporting firearms create uncertainty for international manufacturers seeking consistent market strategies. Such disparities discourage small and mid-sized producers from entering regulated markets due to high administrative and compliance costs

- Although some regions are reforming policies to support sports-related firearm use under controlled environments, extensive regulatory scrutiny will continue to challenge industry scalability. Balanced legislative approaches and international harmonization of sporting firearm standards will be essential to support sustainable growth and responsible participation in shooting sports globally

Sports Gun Market Scope

The market is segmented on the basis of gun type, metal type, application, and distribution channel.

• By Gun Type

On the basis of gun type, the sports gun market is segmented into rifle, handguns, shotgun, and others. The rifle segment dominated the market with the largest revenue share of 40.95% in 2024, driven by its high accuracy, long-range capabilities, and versatility across competitive shooting, hunting, and recreational applications. Rifles are widely preferred by professional shooters and hunting enthusiasts for their precision and reliability under varied environmental conditions. The availability of advanced features such as adjustable stocks, improved optics, and customizable triggers has further fueled the adoption of rifles. Growing participation in competitive shooting sports and increasing hunting activities across North America and Europe also support the dominance of this segment.

The handgun segment is expected to witness the fastest CAGR from 2025 to 2032, owing to its compact size, portability, and ease of handling. Handguns are increasingly adopted for recreational shooting and short-range hunting, and their enhanced safety mechanisms, ergonomic designs, and integration with modern materials contribute to rising consumer preference. Rising interest among new shooters and increasing urban recreational shooting clubs are projected to accelerate growth in this segment.

• By Metal Type

On the basis of metal type, the sports gun market is segmented into copper, tin, zinc, and others. The copper segment dominated the largest market revenue share in 2024, driven by its superior conductivity, corrosion resistance, and widespread use in high-performance ammunition. Copper-based components provide enhanced durability and reliability, making them ideal for competitive shooting and hunting applications. The segment benefits from advanced manufacturing techniques that optimize weight, strength, and ballistic performance, which are key factors for professional and recreational users. The growing preference for environmentally safe and efficient metals in ammunition also strengthens copper’s market position.

The zinc segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by its cost-effectiveness, ease of molding, and growing adoption in entry-level and recreational sports guns. Zinc alloys allow manufacturers to produce lightweight yet durable guns and accessories, making them attractive for beginner shooters and budget-conscious consumers. Expanding awareness of lightweight gun options and increasing online availability are further expected to drive the adoption of zinc-based products.

• By Application

On the basis of application, the sports gun market is segmented into competitive shooting, recreation, hunting, and others. The competitive shooting segment dominated the market with the largest revenue share in 2024, driven by increasing participation in international shooting events, local leagues, and shooting clubs. Competitive shooters prioritize precision, consistency, and advanced gun technology, which boosts demand for specialized firearms. The rising popularity of shooting sports in North America and Europe and growing youth engagement in marksmanship programs further reinforce this segment’s dominance. In addition, investment in safety and training facilities contributes to sustained growth in competitive shooting applications.

The recreational segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising interest in shooting as a leisure activity, expanding indoor and outdoor shooting ranges, and increased urban recreational programs. Recreational shooters often seek easy-to-handle guns with safety features, affordability, and moderate performance specifications. Marketing campaigns, online sales, and awareness programs about responsible shooting practices are projected to accelerate the growth of the recreational segment globally.

• By Distribution Channel

On the basis of distribution channel, the sports gun market is segmented into online and offline channels. The offline segment dominated the market with the largest revenue share in 2024, driven by the established network of gun stores, specialty outlets, and shooting clubs offering personalized services, product demonstrations, and post-purchase support. Offline sales provide buyers the advantage of physically inspecting firearms, receiving expert guidance, and complying with strict regional regulations on gun purchases. Strong relationships between manufacturers and offline retailers also support high-volume sales and brand loyalty.

The online segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the growing preference for e-commerce, ease of product comparison, home delivery options, and expanding digital marketing by manufacturers. Online platforms are increasingly providing verified safety information, instructional content, and curated product bundles, attracting younger and tech-savvy consumers. The convenience of browsing a wide range of models and the gradual relaxation of regional online purchase regulations are expected to accelerate the growth of online sales channels.

Sports Gun Market Regional Analysis

- North America dominated the sports gun market with the largest revenue share of 37.30% in 2024, driven by growing recreational shooting activities, hunting culture, and competitive shooting events

- Consumers in the region highly value precision, durability, and technological advancements in firearms, including ergonomic designs and enhanced safety features

- This widespread adoption is further supported by high disposable incomes, well-established shooting ranges, and favorable regulations for recreational and competitive gun use, making sports guns a preferred choice for enthusiasts and professionals alike

U.S. Sports Gun Market Insight

The U.S. sports gun market captured the largest revenue share within North America in 2024, fueled by a strong culture of hunting, recreational shooting, and participation in shooting sports competitions. Consumers are increasingly seeking rifles and handguns with advanced safety features, lightweight materials, and customizable components. The growing trend of online gun purchases, alongside specialized sporting events and training programs, further drives market growth. In addition, the U.S. market benefits from robust infrastructure for shooting ranges, gun clubs, and hunting grounds, encouraging the adoption of high-performance firearms.

Europe Sports Gun Market Insight

The Europe sports gun market is projected to expand at a substantial CAGR during the forecast period, driven by stringent hunting regulations, rising interest in recreational shooting, and growing participation in competitive shooting events. Urbanization and the increasing demand for technologically advanced firearms are fostering adoption in both professional and amateur segments. European consumers are drawn to precision, safety, and reliability, with an emphasis on eco-friendly ammunition and responsibly sourced materials. The market is experiencing growth across hunting, recreational, and sporting applications, supported by organized shooting clubs and government-approved training programs.

U.K. Sports Gun Market Insight

The U.K. sports gun market is expected to grow at a noteworthy CAGR, driven by recreational shooting popularity and hunting traditions, alongside stringent safety and licensing requirements. Consumers prioritize reliable, easy-to-handle firearms for recreational and sporting use, while competitive shooting events and gun clubs stimulate demand. E-commerce and specialized offline stores provide access to a wide range of guns and accessories, further enhancing market growth. Awareness campaigns on safe handling and proper training also contribute to the rising adoption of sports guns.

Germany Sports Gun Market Insight

The Germany sports gun market is anticipated to expand at a considerable CAGR, fueled by the country’s strong culture of precision shooting, hunting, and recreational sports. Consumers emphasize high-quality, safe, and technologically advanced firearms, with increasing interest in lightweight materials and ergonomic designs. Germany’s well-developed shooting infrastructure, regulatory compliance, and adoption of innovative firearm technologies support the market. Integration of modern features such as modular designs and safety systems is becoming increasingly common in competitive and recreational segments.

Asia-Pacific Sports Gun Market Insight

The Asia-Pacific sports gun market is poised to grow at the fastest CAGR during the forecast period, driven by rising disposable incomes, urbanization, and increasing participation in competitive shooting and recreational hunting in countries such as China, Japan, and India. The region’s growing interest in leisure sports, supported by government initiatives promoting outdoor activities and regulated firearm use, is driving adoption. In addition, the emergence of domestic manufacturers offering cost-effective, high-quality firearms is making sports guns more accessible to a wider consumer base.

Japan Sports Gun Market Insight

The Japan sports gun market is gaining momentum due to the country’s emphasis on precision sports, recreational shooting culture, and high safety standards. The adoption of rifles and handguns is driven by competitive shooting clubs, hunting activities, and demand for compact, ergonomic firearms. Integration with training programs and simulator technologies further fuels market growth. Moreover, Japan’s aging population encourages the development of user-friendly firearms suitable for safe handling in both competitive and recreational settings.

China Sports Gun Market Insight

The China sports gun market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rising interest in shooting sports, expanding recreational clubs, and increasing participation in competitive events. Consumers are drawn to affordable, high-quality firearms, with a growing focus on safety, precision, and technological enhancements. Government-backed initiatives for outdoor sports and regulated firearm use, coupled with strong domestic manufacturing capabilities, are key factors propelling the market in China.

Sports Gun Market Share

The sports gun industry is primarily led by well-established companies, including:

- DICK'S Sporting Goods (U.S.)

- American Outdoor Brands (U.S.)

- Beretta Holding (Luxembourg)

- BROWNING INTERNATIONAL S.A. (Belgium)

- Colt’s Manufacturing Company, LLC (U.S.)

- Crosman Corporation (U.S.)

- Howa Machinery, Ltd. (Japan)

- Miroku Firearms Mfg. Co. (Japan)

- GLOCK, Inc. (U.S.)

- O.F. Mossberg & Sons, Inc. (U.S.)

- HATSAN (Turkey)

- Remington Arms Company, LLC (U.S.)

- Savage (U.S.)

- Shaoxing Snowpeak Air Gun Factory (China)

- SIG SAUER (U.S.)

- Sturm, Ruger & Co., Inc. (U.S.)

- TAURUS INTERNATIONAL MANUFACTURING, INC. (U.S.)

- Umarex GmbH & Co. KG (Germany)

- Kahr (U.S.)

- Webley & Scott (U.K.)

- Walther Arms, Inc. (U.S.)

- Creedmoor Sports Inc. (U.S.)

- German Sport Guns GmbH (Germany)

- J.G. ANSCHÜTZ GmbH & Co. KG (Germany)

- Olympic Arms (U.S.)

- Legacy Sports International (U.S.)

Latest Developments in Sports Gun Market

- In June 2025, online firearms retailer GrabAGun entered a USD 250.54 million merger agreement with Colombier Acquisition Corp. II, forming GrabAGun Digital Holdings Inc., which will trade as "PEW" by summer 2025. This strategic merger significantly strengthens GrabAGun’s digital and e-commerce presence, enabling a broader reach to consumers across North America. The combined entity is expected to drive increased online firearm sales, enhance distribution efficiency, and offer more diverse product offerings. This consolidation also positions GrabAGun to better compete with traditional retailers while capitalizing on the growing trend of online purchases for sports and recreational guns

- In October 2024, Bushmaster launched the V-Radicator series of varmint rifles, featuring fluted stainless-steel barrels in 18-inch, 20-inch, and 24-inch lengths, chambered in .223 Wylde, and equipped with enhanced trigger systems, M-LOK handguards, and Magpul components. This new product line strengthens Bushmaster’s position in the recreational long-range shooting segment by catering to enthusiasts seeking precision, reliability, and advanced firearm features. The launch is likely to drive demand in the rifle segment, reinforce brand loyalty, and attract both amateur and professional shooters, contributing to overall market growth in North America and globally

- In December 2022, Sturm, Ruger & Company, Inc. introduced the Ruger Security-380, a compact, fully featured, and reasonably priced pistol within its Lite Rack Pistols collection. By offering an affordable yet technologically advanced firearm, Ruger is enhancing its appeal in the handgun segment, especially among new shooters and recreational users. The product launch addresses increasing consumer demand for safe, user-friendly firearms suitable for personal use and recreational shooting, helping Ruger capture a larger share of the growing handgun market

- In November 2022, Beretta Holdings S.A. announced a USD 60 million expansion of its manufacturing facility in Savannah, Georgia, following its acquisition of Norma Precision. This expansion enables Beretta to enhance production capacity, improve operational efficiency, and strengthen its supply chain in the U.S. market. By investing in a cutting-edge ammunition manufacturing and distribution plant, Beretta consolidates its market presence, meets rising consumer demand, and supports growth across both recreational and competitive shooting segments

- In February 2021, Beretta Holding acquired 100% of Holland & Holland Ltd., a renowned British gunmaker specializing in handmade shotguns and rifles. This strategic acquisition allowed Beretta to expand its geographic footprint and strengthen its portfolio in the luxury firearms segment, particularly in the U.K. and international markets. The integration of Holland & Holland’s premium offerings enhances Beretta’s competitiveness, addresses demand for high-end, bespoke firearms, and supports growth in niche luxury and professional shooting markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.