Global Sports Optic Market

Market Size in USD Billion

CAGR :

%

USD

2.85 Billion

USD

4.13 Billion

2024

2032

USD

2.85 Billion

USD

4.13 Billion

2024

2032

| 2025 –2032 | |

| USD 2.85 Billion | |

| USD 4.13 Billion | |

|

|

|

|

Sports Optic Market Size

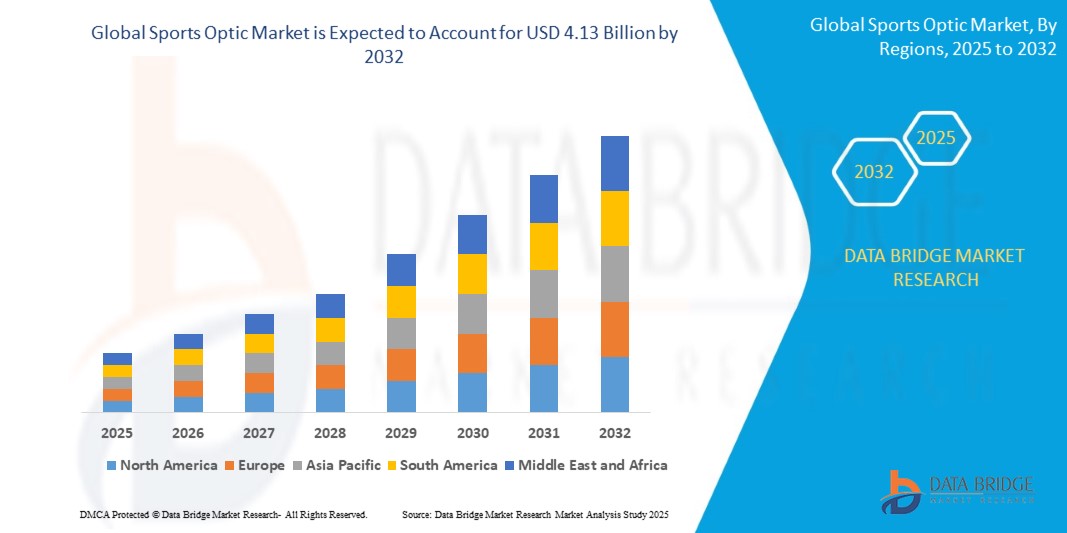

- The Global Sports Optic Market size was valued at USD 2.85 billion in 2024 and is expected to reach USD 4.13 billion by 2032, at a CAGR of 4.74% during the forecast period

- This growth is primarily driven by the rising popularity of outdoor recreational activities and live sports events, including birdwatching, hunting, shooting sports, and professional sporting leagues, which demand precision viewing and tracking solutions.

- In addition, technological advancements in optical designs, such as high-definition (HD) lenses, improved magnification, laser range-finding integration, and anti-reflective coatings, are making sports optics more appealing to consumers across various segments including sports enthusiasts, military personnel, and wildlife photographers.

Sports Optic Market Analysis

- Sports Optics, including binoculars, riflescopes, rangefinders, and spotting scopes, are becoming increasingly essential tools across recreational, professional, and defense sectors. These optical instruments are engineered for enhanced clarity, precision targeting, and long-range visibility—making them indispensable for activities like hunting, birdwatching, shooting sports, golf, and spectator sports.

- The growing consumer inclination toward outdoor sports and nature-based hobbies, combined with rising disposable incomes, is driving the demand for high-performance, easy-to-use optical products. Additionally, the integration of advanced technologies, such as laser rangefinders, night vision compatibility, image stabilization, and digital connectivity, is significantly elevating user experience and expanding market reach.

- North America dominates the Sports Optic Market with the largest revenue share of 34.22.% in 2024, driven by a strong consumer demand for smart home solutions, advanced security preferences, and widespread digital adoption across both residential and commercial sectors.

- Europe holds the significant market share and is projected to grow at a significant CAGR due to rising concerns over safety, particularly in urban areas and multi-dwelling buildings.

- The binoculars segment held the largest market revenue share in 2024, driven by their extensive use across multiple outdoor activities, including wildlife observation, birdwatching, sports events, and recreational activities.

Report Scope and Sports Optic Market Segmentation

|

Attributes |

Sports Optic Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sports Optic Market Trends

“Advancement in Optical Technologies Driving Performance-Oriented Demand”

- The continuous enhancement in optical technologies such as ultra-HD clarity, image stabilization, night vision, and laser-based rangefinding is significantly boosting the demand for high-performance sports optics.

- For instance, in March 2024, Vortex Optics introduced a new line of ultra-HD binoculars integrated with improved clarity and advanced lens coatings, designed for shooting and wildlife sports enthusiasts.

- These innovations not only improve user experience in low-light and long-range conditions but also cater to professional requirements across golf, shooting sports, and adventure sports.

- The superior performance and precision offered by technologically advanced optics are encouraging both amateur and professional users to invest in premium-grade products for enhanced accuracy.

- Furthermore, the growing consumer expectations for multifunctional, durable, and easy-to-operate optics are pushing manufacturers to continuously innovate and differentiate their offerings in a competitive market.

Sports Optic Market Dynamics

Driver

“Rising Outdoor and Shooting Sports Participation Worldwide”

- The growing popularity of outdoor recreational activities such as hunting, bird watching, water sports, and shooting sports is contributing substantially to the increased demand for sports optic equipment.

- For instance, as per the Outdoor Industry Association (OIA) 2024 report, over 165 million people in the U.S. participated in outdoor recreation, driving notable sales in outdoor optics.

- Enthusiasts and professionals alike are increasingly relying on advanced optics like rangefinders, binoculars, and rifle scopes to enhance their precision and experience in various outdoor settings.

- The rise in international shooting events, wildlife exploration tourism, and support for sporting infrastructure has created a favorable environment for market expansion.

- This increasing interest in high-engagement sports and leisure activities continues to stimulate consistent market demand across North America, Europe, and Asia-Pacific.

Restraint/Challenge

“High Product Cost and Maintenance Restricting Widespread Adoption”

- Despite growing interest, the relatively high cost of advanced sports optics remains a major challenge for broader consumer adoption, particularly among hobbyists and casual users.

- For instance, premium-grade rifle scopes and laser rangefinders can cost anywhere between USD 800 and USD 3,000, making them unaffordable for entry-level buyers.

- Moreover, high-end optics often require regular servicing and calibration to maintain precision, which adds to the long-term ownership cost.

- This cost sensitivity in price-driven markets and among non-professional users poses a restraint on the overall expansion of the sports optic market.

- Manufacturers face the challenge of balancing advanced features with cost-efficiency to cater to a broader audience without compromising quality and reliability.

Sports Optic Market Scope

The market is segmented on the basis of type, games covered, price range, and distribution channel.

- By Type

On the basis of type, the Sports Optic Market is segmented into telescopes, binoculars, rifle scopes, and rangefinders. The binoculars segment held the largest market revenue share in 2024, driven by their extensive use across multiple outdoor activities, including wildlife observation, birdwatching, sports events, and recreational activities. Binoculars are favored for their portability, user-friendly design, and wide field of view, making them the most accessible and versatile sports optics tool.

The rifle scopes segment is expected to witness the fastest CAGR from 2025 to 2032, owing to rising participation in shooting sports, hunting, and tactical training activities globally. Advancements in optical technologies, such as laser range integration and night vision compatibility, are further enhancing the performance and appeal of rifle scopes, especially among professionals and enthusiasts.

- By Games Covered

On the basis of games covered, the Sports Optic Market is segmented into golf, wheel sport, snow sport, water sport, shooting sports, horse racing, and other games. The golf segment dominated the market in 2024 due to the high demand for rangefinders and monocular devices that assist players in measuring distances and improving accuracy on the course. The integration of GPS and laser technology in golf optics is widely appreciated for enhancing performance and player experience.

The shooting sports segment is projected to register the highest CAGR during the forecast period, fueled by the increasing popularity of marksmanship and tactical training in civilian and defense applications. The precision and performance enhancements provided by optical sights and scopes are essential for competitive shooting and law enforcement training.

- By Price Range

On the basis of price range, the Sports Optic Market is segmented into low, mid, and high. The mid-range segment held the largest market revenue share in 2024, attributed to a strong balance between performance and affordability. Consumers in this segment demand reliable optical products with modern features like anti-reflective coatings, waterproof designs, and ergonomic builds.

The high-end segment is anticipated to witness the fastest growth from 2025 to 2032, driven by increased demand from professional athletes, military users, and tech-savvy consumers who prioritize durability, image clarity, and advanced functionality. Innovations in premium lenses, AI integration, and lightweight materials are key growth drivers in this categor.

- By Distribution Channel

On the basis of distribution channel, the Sports Optic Market is segmented into online and offline. The offline segment accounted for the largest market share in 2024, owing to the consumer preference for physically testing high-value optical devices before purchase. Specialty sporting goods stores, optical retailers, and outdoor equipment shops play a vital role in providing expert guidance and post-sale services.

The online segment is expected to grow at the fastest CAGR from 2025 to 2032, supported by the rising influence of e-commerce platforms, digital marketing, and virtual try-before-you-buy tools. Online retail enables manufacturers to reach a broader customer base and offers convenience, product comparisons, and competitive pricing, fueling rapid adoption.

Sports Optic Market Regional Analysis

- North America dominates the Sports Optic Market with the largest revenue share of 34.22% in 2024, driven by a strong consumer demand for smart home solutions, advanced security preferences, and widespread digital adoption across both residential and commercial sectors.

- Consumers in the region prioritize convenience, real-time access control, and seamless integration with smart devices such as voice assistants, thermostats, and surveillance systems.

- The region benefits from high per capita income, robust technology infrastructure, and early adoption of connected devices, fueling the growing demand for Sports Optics for both home and business applications.

U.S. Sports Optic Market Insight

The U.S. accounted for 81% of the North American market revenue in 2024, largely due to a tech-savvy population and increasing concerns about home security. Growing adoption of smart locks integrated with platforms like Amazon Alexa, Google Assistant, and Apple HomeKit is accelerating market penetration. The DIY installation trend, coupled with a preference for remote and mobile-controlled entry systems, makes the U.S. a strong growth engine for the market. Frequent upgrades in product design, biometric security, and wireless connectivity are supporting continued investment in Sports Optic solutions.

Europe Sports Optic Market Insight

Europe holds the significant market share and is projected to grow at a significant CAGR due to rising concerns over safety, particularly in urban areas and multi-dwelling buildings. Smart city initiatives and eco-conscious consumer preferences are promoting the adoption of digitally connected and energy-efficient Sports Optics. Demand is strong across both new constructions and renovations, especially in countries with stringent building and security regulations..

U.K. Sports Optic Market Insight

The U.K. market is expanding rapidly as home automation becomes a standard in modern housing. Consumer demand is supported by awareness around burglary risks and increased reliance on keyless, smartphone-enabled security systems. The growing smart retail and e-commerce ecosystem, combined with widespread internet penetration, supports market expansion.

Germany Sports Optic Market Insight

Germany’s market is driven by its tech-forward, environmentally conscious consumer base. Integration with broader home automation systems is gaining momentum, particularly in urban residential developments. Privacy and data protection remain key concerns, pushing manufacturers to offer GDPR-compliant, highly secure Sports Optics.

Asia-Pacific Sports Optic Market Insight

The Asia-Pacific region is projected to grow at the fastest CAGR of 24.55% from 2025 to 2032, owing to increasing urbanization, growing tech awareness, and rising disposable incomes in countries like China, India, and Japan. Smart home penetration is on the rise due to government digitalization efforts, cost-effective solutions, and a strong manufacturing base. As APAC develops into a global manufacturing hub for smart devices, the affordability and accessibility of Sports Optics are increasing significantly..

China Sports Optic Market Insight

China captured the largest market share in Asia-Pacific in 2024, fueled by rapid infrastructure development, rising middle-class income, and aggressive adoption of smart technologies. The government’s push for smart city projects and the presence of strong local manufacturers are major growth catalysts. The Sports Optic market is flourishing in residential complexes, commercial buildings, and even in rural areas due to increased security awareness.

Japan Sports Optic Market Insight

Japan’s market is thriving due to its urbanized population, tech-savvy culture, and high concern for safety. Integration of Sports Optics with IoT devices like security cameras and lighting is becoming a norm. The aging population is also fueling demand for simplified yet secure access solutions, particularly in senior living communities and healthcare facilities.

Sports Optic Market Share

The Sports Optic industry is primarily led by well-established companies, including:

- Nikon Corporation(Japan)

- ZEISS International(Germany)

- U.S. OPTICS(United States)

- LEUPOLD & STEVENS, INC.(United States)

- Trijicon, Inc.(United States)

- VISTA OUTDOOR OPERATIONS LLC.(United States)

- BERETTA HOLDING S.A. (Italy)

- Celestron, LLC. (United States)

- Leica Camera AG(Germany)

- SWAROVSKI GROUP(Austria)

- ATN (American Technologies Network) (United States)

- Schmidt & Bender GmbH & Co. KG(Germany)

- Vortex Optics(United States)

- Nightforce Optics, Inc.(United States)

- Athlon Optics(United States)

- Meopta – optika, s.r.o. (Czech Republic)

- FLIR Systems, Inc.(United States)

- L-3, EOTech Inc. (United States)

Latest Developments in Global Sports Optic Market

- In May 2024, Vortex Optics introduced its new Razor HD Pro Series Binoculars, engineered with upgraded lens coatings and rugged construction for enhanced clarity and durability in extreme outdoor conditions. This launch reaffirms Vortex’s commitment to delivering precision optics for serious hunters, shooters, and wildlife enthusiasts, while reinforcing its leadership in the premium sports optic segment through continuous innovation in optical performance and ergonomics.

- In April 2024, Leica Camera AG announced the launch of its Geovid Pro 32, a next-generation laser rangefinding binocular featuring integrated Bluetooth, ballistic data, and GPS mapping capabilities. Designed for high-precision targeting in hunting and shooting sports, the product showcases Leica’s strategic focus on integrating smart technologies with optical devices, appealing to tech-savvy professionals who seek real-time data and mobile connectivity in the field.

- In March 2024, Swarovski Optik, a global leader in premium sports optics, launched its AX Visio Smart Binoculars, combining traditional optical excellence with AI-powered species recognition. This revolutionary product allows users to instantly identify birds and wildlife via onboard sensors and data processing, emphasizing the company’s push towards smart, interactive optics tailored to nature exploration and educational experiences.

- In February 2024, Trijicon, Inc., a prominent player in rifle scopes and aiming systems, unveiled its new Credo HX 1-8x28 Tactical Riflescope, aimed at competitive shooters and hunters. The new scope offers enhanced illumination control and multi-coated optics for improved performance in low-light environments, underlining Trijicon’s continued focus on serving tactical and sporting applications with rugged, high-precision optics.

- In January 2024, ZEISS International partnered with Garmin to introduce the ZEISS Hunting App Integration, allowing users of ZEISS rangefinders to sync directly with Garmin GPS devices and smartwatches. This development marks a step forward in connected outdoor sports ecosystems, offering seamless data transfer for position tracking, ballistic data, and target range—enhancing decision-making and safety in hunting and adventure sports.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sports Optic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sports Optic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sports Optic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.