Global Sports Technology Market

Market Size in USD Billion

CAGR :

%

USD

19.08 Billion

USD

81.52 Billion

2024

2032

USD

19.08 Billion

USD

81.52 Billion

2024

2032

| 2025 –2032 | |

| USD 19.08 Billion | |

| USD 81.52 Billion | |

|

|

|

|

Sports Technology Market Size

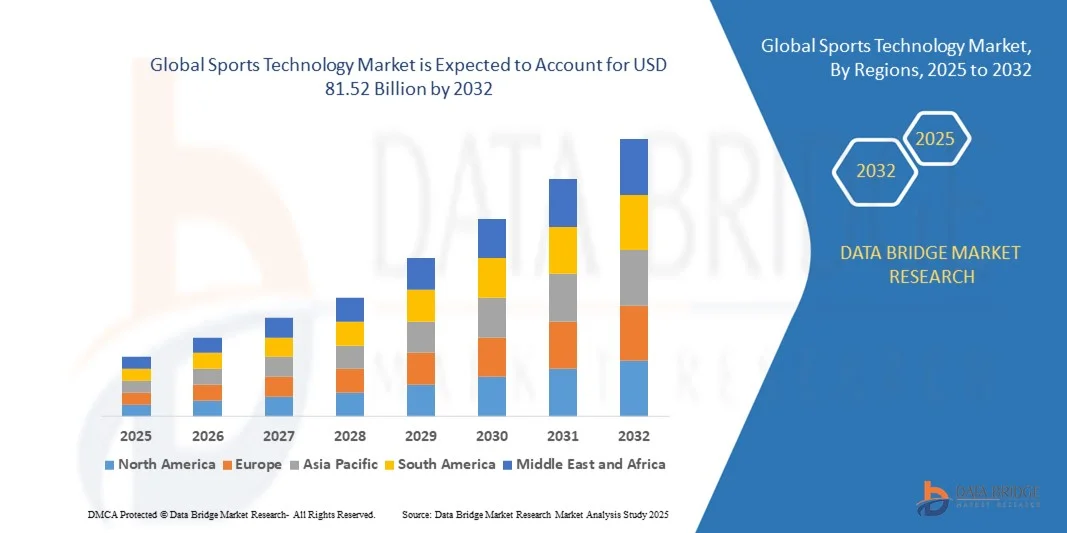

- The global sports technology market size was valued at USD 19.08 billion in 2024 and is expected to reach USD 81.52 billion by 2032, at a CAGR of 19.90% during the forecast period

- The market growth is largely fuelled by the increasing adoption of advanced analytics, wearable devices, and digital platforms that enhance athlete performance, fan engagement, and operational efficiency

- Growing investments from sports organizations and tech companies are further accelerating innovation in areas such as virtual reality, AI-driven coaching tools, and real-time performance monitoring

Sports Technology Market Analysis

- The sports technology market is experiencing robust growth as teams, leagues, and organizations increasingly rely on digital transformation to improve competitiveness and fan interaction. The integration of AI, IoT, and cloud solutions is streamlining training, injury prevention, and broadcasting, reshaping how sports are played and consumed

- Strategic partnerships between technology providers and sports associations are fueling rapid product development and deployment, ensuring wider accessibility. As both professional and grassroots sports embrace innovation, the market is positioned for sustained growth, with opportunities spanning performance enhancement, entertainment, and operational management

- North America dominated the sports technology market with the largest revenue share of 38.5% in 2024, driven by the strong adoption of advanced digital solutions, widespread popularity of professional leagues, and rising investments in data analytics and immersive fan experiences

- Asia-Pacific region is expected to witness the highest growth rate in the global sports technology market, driven by urbanization, rising disposable incomes, government initiatives supporting sports digitalization, and expanding interest in both traditional sports and esports across countries such as China, Japan, and India

- The Sports Analytics segment held the largest market revenue share in 2024, driven by the rising adoption of data-driven insights for player performance, injury prevention, and tactical decision-making. Analytics platforms are increasingly integrated with AI and machine learning, making them vital tools for teams and leagues

Report Scope and Sports Technology Market Segmentation

|

Attributes |

Sports Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Sports Technology Market Trends

Integration Of Wearable Devices And Real-Time Analytics

- The increasing adoption of wearable devices in sports is revolutionizing performance tracking by offering real-time data on player health, endurance, and biomechanics. These insights allow coaches and athletes to make precise, data-driven adjustments, enhancing training efficiency, reducing recovery time, and lowering the risk of injury

- The demand for advanced analytics platforms is accelerating, enabling teams to leverage big data for player evaluation, tactical strategies, and predictive modeling. The ability to process vast datasets in seconds provides actionable insights, driving performance optimization and creating measurable advantages during competitive play

- The affordability and accessibility of wearable tech and mobile apps are making these solutions increasingly popular among amateur athletes, fitness enthusiasts, and semi-professional players. By breaking barriers of cost and availability, these devices democratize sports technology, allowing broader participation and enhanced training outcomes

- For instance, in 2023, several European football clubs reported improved injury prevention outcomes after deploying AI-powered wearable trackers. These trackers analyzed player movements in detail, detected early signs of fatigue, and suggested workload adjustments that significantly lowered long-term healthcare costs

- While wearable devices and analytics are accelerating growth, their long-term impact depends on continued innovation, affordability, and seamless integration into existing sports ecosystems. Companies must also prioritize robust data security and user-friendly designs to build trust and ensure widespread adoption across diverse markets

Sports Technology Market Dynamics

Driver

Rising Demand For Enhanced Fan Engagement And Immersive Experiences

- The growing emphasis on fan experience is pushing organizations to adopt technologies such as augmented reality (AR), virtual reality (VR), and AI-driven platforms. These solutions provide immersive experiences, making fans feel closer to the action while enhancing live and virtual stadium attendance

- Sports franchises are recognizing the financial potential of engaging fans through digital platforms, from multi-angle live streaming to gamified experiences. By delivering interactive content, they increase brand loyalty, extend viewing time, and strengthen commercial partnerships across media and merchandise channels

- Partnerships between technology providers and sports organizations are driving new revenue models by combining innovation with sponsorships, merchandising, and content monetization. This collaborative approach ensures fans benefit from engaging experiences while organizations diversify income streams

- For instance, in 2022, the NBA launched enhanced VR game viewing options, offering fans immersive courtside experiences from their homes. This initiative boosted audience engagement, increased digital subscriptions, and drove merchandise sales, highlighting the commercial value of immersive sports technologies

- While fan engagement technologies drive growth, ensuring accessibility, affordability, and reliable connectivity is essential for global scalability. Widespread adoption will depend on bridging the digital divide and offering inclusive experiences that cater to both developed and emerging markets

Restraint/Challenge

High Implementation Costs And Unequal Access To Technology

- The high cost of advanced sports technologies such as motion capture systems, AI-driven analytics, and immersive fan experience tools remains a barrier for small clubs, emerging leagues, and underfunded sports bodies. These organizations often lack financial resources, slowing adoption and widening the technology gap

- Limited infrastructure and shortage of skilled personnel in developing regions further restrict widespread adoption. Without access to training programs or technical expertise, many organizations struggle to maintain or fully utilize complex sports technologies, resulting in inefficiencies

- Unequal access to technology creates a growing performance and commercial divide between wealthier franchises and smaller, local teams. This disparity not only limits player development in emerging markets but also impacts global competitiveness and overall market expansion

- For instance, in 2023, amateur leagues across Latin America reported difficulties in adopting real-time performance tracking solutions. High equipment costs and lack of technical knowledge prevented widespread usage, forcing reliance on traditional training methods that limited player potential

- While sports technology continues to evolve, addressing affordability and accessibility challenges remains critical for sustainable growth. Market stakeholders must focus on developing scalable, cost-effective tools and building global partnerships that ensure inclusive participation across all levels of sport

Sports Technology Market Scope

The market is segmented on the basis of technology, sports, and end user.

- By Technology

On the basis of technology, the sports technology market is segmented into Device, Smart Stadium, Esports, and Sports Analytics. The Sports Analytics segment held the largest market revenue share in 2024, driven by the rising adoption of data-driven insights for player performance, injury prevention, and tactical decision-making. Analytics platforms are increasingly integrated with AI and machine learning, making them vital tools for teams and leagues.

The Smart Stadium segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by investments in digital infrastructure, connectivity, and immersive technologies. Smart stadiums enhance fan experiences through AR/VR, mobile ticketing, and real-time engagement features, driving new revenue opportunities for sports organizations.

- By Sports

On the basis of sports, the market is segmented into Soccer, Baseball, Basketball, Ice Hockey, American Football/Rugby, Tennis, Cricket, Golf, Esports, and Others. The Soccer segment accounted for the largest revenue share in 2024, owing to its global popularity and widespread adoption of technologies such as wearable trackers, VAR systems, and performance analytics in professional leagues.

The Esports segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing global viewership, sponsorship deals, and monetization of gaming platforms. Advancements in streaming technologies and rising investments from gaming companies and sports franchises are further accelerating this growth.

- By End User

On the basis of end user, the market is segmented into Sports Association, Club, and Leagues. The Leagues segment dominated the market in 2024, as professional leagues invest heavily in advanced technologies for fan engagement, broadcast enhancement, and player development. Their large-scale budgets and partnerships with tech providers strengthen this leadership.

The Sports Association segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their increasing focus on standardizing technology adoption across tournaments and training programs. Associations play a critical role in promoting fairness, safety, and performance through regulated use of sports technology.

Sports Technology Market Regional Analysis

- North America dominated the sports technology market with the largest revenue share of 38.5% in 2024, driven by the strong adoption of advanced digital solutions, widespread popularity of professional leagues, and rising investments in data analytics and immersive fan experiences

- Consumers and organizations in the region are rapidly adopting wearable devices, performance-tracking platforms, and AR/VR technologies to enhance both athlete outcomes and audience engagement

- The region’s established sports infrastructure, high spending power, and continuous innovation by technology providers make North America a global leader in integrating technology into sports

U.S. Sports Technology Market Insight

The U.S. sports technology market captured the largest revenue share in 2024 within North America, supported by the dominance of major leagues such as the NFL, NBA, and MLB that heavily invest in real-time analytics, smart stadiums, and digital fan engagement platforms. The growing popularity of fantasy sports, esports, and AI-driven performance tracking further fuels market expansion. In addition, partnerships between technology companies and sports organizations are setting new standards for immersive viewing and data-driven decision-making.

Europe Sports Technology Market Insight

The Europe sports technology market is expected to witness the fastest growth rate from 2025 to 2032, driven by the region’s strong sports culture and stringent focus on player safety and performance optimization. European football clubs are leading adopters of wearables, analytics, and stadium technology, ensuring both player development and improved spectator experiences. With increased digitization across sports organizations, the region is also witnessing the rapid expansion of esports and streaming platforms, making technology a cornerstone of its sports ecosystem.

U.K. Sports Technology Market Insight

The U.K. sports technology market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for advanced analytics and immersive fan engagement tools across football, rugby, and cricket. The country’s long-standing sports tradition, combined with strong investments in smart stadiums and digital broadcasting, is propelling adoption. The integration of AI, VR, and wearable technology is further enhancing player training programs and improving the viewing experience, both in stadiums and through digital platforms.

Germany Sports Technology Market Insight

The Germany sports technology market is expected to witness the fastest growth rate from 2025 to 2032, supported by the nation’s focus on innovation, sustainability, and digital transformation in sports. German football clubs are pioneers in adopting data-driven performance analysis and player wellness technologies. The country is also seeing rapid adoption of esports platforms and smart infrastructure in arenas, aligning with consumer demand for connected, secure, and tech-enabled experiences.

Asia-Pacific Sports Technology Market Insight

The Asia-Pacific sports technology market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and strong government initiatives supporting digital transformation. Countries such as China, Japan, and India are at the forefront of adoption, leveraging wearable devices, esports platforms, and smart stadium technologies. The region’s growing interest in both traditional sports and esports, combined with local manufacturing capabilities, is broadening affordability and accessibility.

Japan Sports Technology Market Insight

The Japan sports technology market is expected to witness the fastest growth rate from 2025 to 2032, underpinned by the country’s high-tech culture, smart city initiatives, and growing demand for connected sports ecosystems. Wearables, IoT-enabled devices, and immersive training platforms are widely adopted by professional teams and athletes. In addition, esports is emerging as a mainstream segment, with government backing and private investments accelerating growth. The nation’s aging population is also encouraging the use of sports technology for wellness and fitness monitoring, further driving adoption.

China Sports Technology Market Insight

The China sports technology market held the largest revenue share in Asia-Pacific in 2024, supported by rapid digitalization, strong government push for smart infrastructure, and the rising popularity of both traditional sports and esports. Affordable wearable devices, smart stadium deployments, and mobile-based fan engagement platforms are expanding adoption across consumer segments. China’s growing middle class, combined with domestic tech giants entering the sports sector, is further solidifying its position as a leading hub for sports technology innovation.

Sports Technology Market Share

The Sports Technology industry is primarily led by well-established companies, including:

- Fitbit LLC (U.S.)

- IBM (U.S.)

- TTelefonaktiebolaget LM Ericsson (Sweden)

- Cisco Systems, Inc. (U.S.)

- FUJITSU (Japan)

- SAP SE (Germany)

- Oracle (U.S.)

- LG Electronics (South Korea)

- SAMSUNG (South Korea)

- Apple Inc. (U.S.)

- Garmin Ltd. (U.S.)

- SONY INDIA (India)

- Panasonic Corporation (Japan)

- Catapult (Australia)

- NEC Corporation (Japan)

- SHARP CORPORATION (Japan)

- MODERN TIMES GROUP (Sweden)

- Activision Publishing, Inc. (U.S.)

- Tencent Holdings Ltd. (China)

- CJ CHEILJEDANG CORP. (South Korea)

- HCL Technologies Limited (India)

Latest Developments in Global Sports Technology Market

- In January 2023, Panasonic Connect North America, a division of Panasonic Corporation, introduced the next generation of its KAIROS live production platform with the launch of KC200 and KC2000 mainframes along with software upgrades. This development expands scalability, supports larger and more complex productions, and strengthens Panasonic’s position in the professional broadcasting market by offering advanced flexibility to production teams

- In November 2022, Sportradar launched Sportradar Virtual Stadium, an AI and machine learning-powered engagement platform during the Qatar World Football Tournament. The tool enables bookmakers to enhance interaction with bettors, improving the customer experience and fostering stronger connections. This innovation highlights Sportradar’s role in transforming sports betting into a more interactive and socially engaging ecosystem

- In November 2022, Catapult rolled out a baseball performance analytics solution featuring an advanced algorithm to analyze swing, pitch, and throw actions. The solution is designed to mitigate injuries and accelerate decision-making by providing detailed biomechanical insights. This strengthens Catapult’s presence in performance tracking technology and supports the growing demand for player safety and optimized performance in sports

- In October 2021, Hudl released the latest version of Hudl Sportscode, introducing improved chart creation directly within Code Windows linked to video footage. This upgrade streamlines the reporting process for coaches, analysts, and players, enabling more efficient performance evaluation. The development enhances Hudl’s analytics ecosystem and reinforces its importance as a key provider of advanced sports performance solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.