Global Spray Polyurethanes Foam Market

Market Size in USD Billion

CAGR :

%

USD

1.84 Billion

USD

2.81 Billion

2024

2032

USD

1.84 Billion

USD

2.81 Billion

2024

2032

| 2025 –2032 | |

| USD 1.84 Billion | |

| USD 2.81 Billion | |

|

|

|

|

Spray Polyurethane Foam Market Size

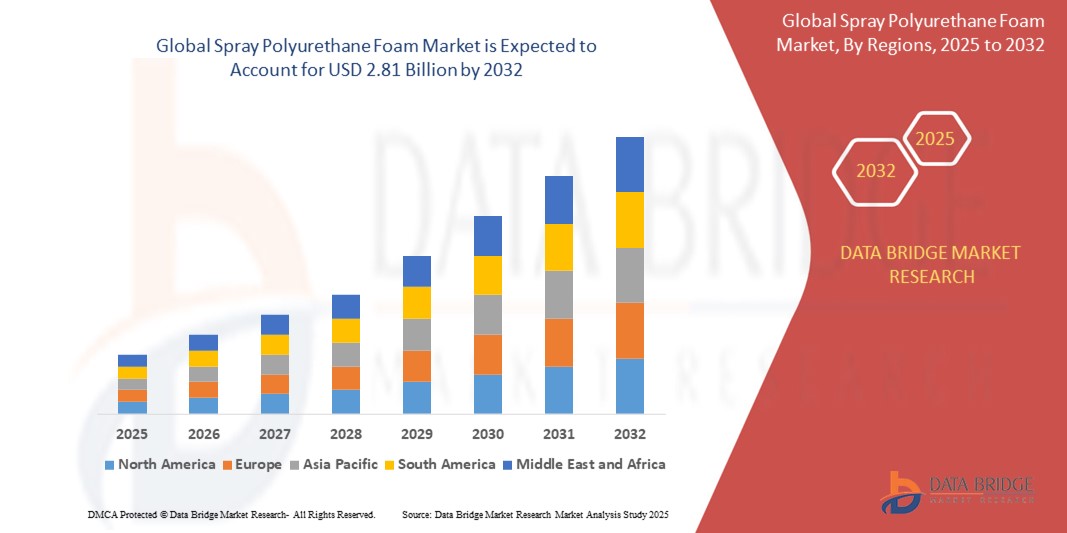

- The global spray polyurethane foam market size was valued at USD 1.84 billion in 2024 and is expected to reach USD 2.81 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is driven by increasing demand for energy-efficient insulation solutions in residential, commercial, and industrial construction, coupled with advancements in foam application technologies

- Rising awareness of sustainable building materials and stringent regulations on energy conservation are further propelling the adoption of spray polyurethane foam as a preferred insulation and sealing solution

Spray Polyurethane Foam Market Analysis

- Spray polyurethane foam (SPF) is a versatile material used for insulation, waterproofing, and sealing, offering superior thermal resistance, air sealing, and durability compared to traditional materials

- The demand for SPF is fueled by the global push for green building certifications, growing construction activities, and the need for retrofitting older buildings to improve energy efficiency

- North America dominated the spray polyurethane foam market with the largest revenue share of 38.5% in 2024, driven by robust construction activity, high adoption of energy-efficient materials, and the presence of leading manufacturers. The U.S. leads due to widespread use in residential and commercial buildings

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing infrastructure investments, and rising disposable incomes in countries such as China and India

- The open-cell foam segment held the largest market revenue share of 65% in 2024, driven by its cost-effectiveness, flexibility, and superior soundproofing and moisture resistance properties, making it ideal for residential and commercial interior applications such as wall cavities and crawl spaces

Report Scope and Spray Polyurethane Foam Market Segmentation

|

Attributes |

Spray Polyurethane Foam Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Spray Polyurethane Foam Market Trends

“Increasing Integration of Advanced Technologies”

- The global spray polyurethane foam (SPF) market is experiencing a notable trend toward the integration of advanced technologies, such as smart application systems and IoT-enabled monitoring

- These technologies enable precise application, real-time performance monitoring, and enhanced quality control, ensuring optimal foam performance and energy efficiency

- Smart spray foam systems leverage sensors and automation to adjust application parameters, reducing waste and improving consistency in insulation and sealing tasks

- For instance, some manufacturers are developing IoT-driven platforms that monitor foam curing times, environmental conditions, and application thickness to ensure compliance with building codes and energy standards

- This trend is increasing the appeal of SPF solutions for both residential and commercial applications, offering improved sustainability and cost-effectiveness

- Advanced analytics can also track foam performance metrics, such as thermal resistance and air leakage, enabling proactive maintenance and energy optimization

Spray Polyurethane Foam Market Dynamics

Driver

“Rising Demand for Energy-Efficient and Sustainable Building Solutions”

- The growing demand for energy-efficient construction materials, driven by stringent building codes and green building initiatives, is a key driver for the global SPF market

- SPF enhances building energy efficiency through superior thermal insulation, air sealing, and moisture control, reducing heating and cooling costs

- Government regulations, such as those promoting net-zero energy buildings in regions such as Europe and North America, are accelerating the adoption of SPF in construction

- The advancement of low-global-warming-potential (GWP) blowing agents and bio-based foam formulations is further supporting market growth by aligning with sustainability goals

- Construction companies and developers are increasingly specifying SPF for insulation, roofing, and waterproofing to meet consumer expectations and regulatory requirements

Restraint/Challenge

“High Initial Costs and Regulatory Compliance Issues”

- The high upfront costs associated with SPF systems, including specialized equipment, trained labor, and raw materials, can be a significant barrier to adoption, particularly in cost-sensitive markets

- Applying SPF requires skilled professionals and precise equipment, increasing installation complexity and costs compared to traditional insulation materials

- In addition, regulatory compliance and environmental concerns pose challenges. SPF production and application must adhere to strict regulations regarding volatile organic compounds (VOCs) and blowing agents, which vary across regions

- The transition to low-GWP blowing agents, such as hydrofluoroolefins (HFOs), can increase production costs and require retraining for applicators

- These factors may limit market growth in regions with stringent environmental regulations or where awareness of SPF benefits is low

Spray Polyurethane Foam market Scope

The market is segmented on the basis of structure, product, density, product type, and application.

- By Structure

On the basis of structure, the market is segmented into open cell and closed cell. The open-cell foam segment held the largest market revenue share of 65% in 2024, driven by its cost-effectiveness, flexibility, and superior soundproofing and moisture resistance properties, making it ideal for residential and commercial interior applications such as wall cavities and crawl spaces. Open-cell foam’s sponge-such as structure allows air and water vapor permeability, enhancing its suitability for mixed and warm climates.

The closed-cell foam segment is expected to witness the fastest growth rate of 7% from 2025 to 2032, fueled by its higher R-value (6.5–7 per inch), moisture resistance, and structural reinforcement capabilities, making it preferred for exterior insulation and high-performance applications in construction and industrial settings.

- By Product

On the basis of product, the market is segmented into flexible foam, rigid foam, and spray foam. The rigid foam segment dominated the market with a revenue share of 40% in 2024, owing to its widespread use in insulation for building and construction, as well as automotive applications, due to its high thermal resistance and structural integrity. Rigid foam’s ability to reduce energy consumption aligns with global sustainability goals.

The spray foam segment is projected to experience the fastest growth from 2025 to 2032, driven by its versatility, seamless application, and ability to provide air sealing, waterproofing, and thermal insulation in residential, commercial, and industrial projects. Increasing demand for energy-efficient building materials further accelerates adoption.

- By Density

On the basis of density, the market is segmented into low density, medium density, and high density. The low-density segment held the largest market revenue share of 45% in 2024, attributed to its cost-effectiveness and widespread use in open-cell foam applications for soundproofing and insulation in residential interiors. Low-density foam’s lightweight nature makes it ideal for non-structural applications.

The high-density segment is anticipated to register the fastest growth rate from 2025 to 2032, driven by its use in closed-cell foam for high-performance insulation and structural reinforcement in demanding environments such as roofing, foundations, and industrial applications, where durability and moisture resistance are critical.

- By Product Type

On the basis of product type, the market is segmented into two-component high-pressure spray foam, two-component low-pressure spray foam, one-component foam (OCF), and others. The two-component high-pressure spray foam segment accounted for the largest market revenue share of 50% in 2024, driven by its superior efficiency and performance in large-scale commercial and industrial applications, such as insulating walls and roofs in new constructions and major renovations. Its fast application and uniform coverage enhance energy efficiency.

The two-component low-pressure spray foam segment is expected to witness the fastest growth rate of 8.5% from 2025 to 2032, fueled by its ease of use, cost-effectiveness, and precise application in residential settings for wall, roof, and ceiling insulation. Its compatibility with environmentally friendly solutions and low-pressure application methods boosts adoption.

- By Application

On the basis of application, the market is segmented into insulation, waterproofing, asbestos encapsulation, sealant, and others. The insulation segment dominated the market with a revenue share of 55% in 2024, driven by its critical role in meeting stringent energy efficiency standards in residential, commercial, and industrial construction. SPF’s ability to seal air leaks and provide high thermal resistance reduces energy consumption and enhances building durability.

The waterproofing segment is projected to experience the fastest growth from 2025 to 2032, driven by SPF’s seamless, fully bonded, and waterproof barrier properties, making it ideal for roofing, foundations, and basements in humid or rainy environments. Increasing demand for moisture-resistant solutions in construction further fuels this segment’s growth.

Spray Polyurethane Foam Market Regional Analysis

- North America dominated the spray polyurethane foam market with the largest revenue share of 38.5% in 2024, driven by robust construction activity, high adoption of energy-efficient materials, and the presence of leading manufacturers. The U.S. leads due to widespread use in residential and commercial buildings

- Consumers prioritize spray polyurethane foam for its superior thermal insulation, air-sealing capabilities, and energy cost savings, particularly in regions with extreme climatic conditions.

- Growth is supported by advancements in eco-friendly formulations, such as low-GWP blowing agents, and increasing adoption in both new construction and retrofit projects

U.S. Spray Polyurethane Foam Market Insight

The U.S. spray polyurethane foam market captured the largest revenue share of 83% in 2024 within North America, fueled by robust demand in the construction sector and growing awareness of energy-efficient insulation benefits. The trend towards sustainable building practices and government incentives promoting energy conservation further boost market expansion. The presence of a skilled workforce and advanced application technologies supports the widespread use of spray polyurethane foam in both OEM and aftermarket applications.

Europe Spray Polyurethane Foam Market Insight

The European spray polyurethane foam market is expected to witness a significant growth rate, driven by strict sustainability regulations and a focus on energy-efficient construction. Consumers seek foams that provide thermal insulation and soundproofing while meeting environmental standards. Growth is prominent in both new construction and renovation projects, with countries such as Germany and France showing strong adoption due to rising environmental concerns and urban development.

U.K. Spray Polyurethane Foam Market Insight

The U.K. market for spray polyurethane foam is anticipated to experience rapid growth, driven by demand for energy-efficient insulation and soundproofing in urban and suburban settings. Increasing awareness of the benefits of spray polyurethane foam, such as reduced energy costs and improved building durability, encourages adoption. Evolving building codes emphasizing energy efficiency and sustainability further influence consumer preferences, balancing performance with compliance.

Germany Spray Polyurethane Foam Market Insight

Germany is expected to witness a high growth rate in the spray polyurethane foam market, attributed to its advanced construction sector and strong consumer focus on energy efficiency and building comfort. German consumers prefer technologically advanced foams, such as closed-cell spray polyurethane foam, for their superior insulation properties and contribution to lower energy consumption. Integration in premium construction projects and aftermarket applications supports sustained market growth.

Asia-Pacific Spray Polyurethane Foam Market Insight

The Asia-Pacific region is projected to experience the fastest growth rate in the global spray polyurethane foam market, driven by rapid urbanization, expanding construction activities, and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of energy efficiency, thermal insulation, and sustainable building practices boosts demand. Government initiatives promoting green building certifications and energy-efficient infrastructure further accelerate the adoption of advanced spray polyurethane foam solutions.

Japan Spray Polyurethane Foam Market Insight

Japan’s spray polyurethane foam market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced insulation solutions that enhance building comfort and energy efficiency. The presence of major construction and manufacturing industries, along with the integration of spray polyurethane foam in new and retrofit projects, accelerates market penetration. Growing interest in sustainable construction practices also contributes to market expansion.

China Spray Polyurethane Foam Market Insight

China holds the largest share of the Asia-Pacific spray polyurethane foam market, propelled by rapid urbanization, increasing construction activities, and growing demand for energy-efficient insulation solutions. The country’s expanding middle class and focus on sustainable infrastructure support the adoption of advanced spray polyurethane foam products. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, driving widespread use in residential, commercial, and industrial applications.

Spray Polyurethane Foam Market Share

The spray polyurethane foam industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Lapolla Industries, Inc. (U.S.)

- Bayer AG (Germany)

- NCFI Polyurethanes (U.S.)

- ICYNENE (Canada)

- Demilec (USA) Inc. (U.S.)

- Rhino Linings Corporation (U.S.)

- Dow (U.S.)

- CERTAINTEED (U.S.)

- Specialty Products Inc. (U.S.)

- Covestro AG (Germany)

- Foam Supplies, Inc. (U.S.)

- Mitex International (Hong Kong) Ltd (Hong Kong)

- INTERNATIONAL CELLULOSE CORPORATION (U.S.)

What are the Recent Developments in Global Spray Polyurethane Foam Market?

- In May 2024, Huntsman Building Solutions unveiled the Icynene Series spray foam insulation at the SprayFoam 2024 Convention & Expo in Las Vegas. This innovative product line features open- and closed-cell spray foam solutions, delivering exceptional sprayability, energy efficiency, and high-performance insulation. The Icynene Series includes premium service and support packages, offering technical assistance, marketing support, and job referrals to contractors. Huntsman also hosted educational breakout sessions at the event, highlighting advancements in spray polyurethane foam technology

- In April 2024, BASF introduced its innovative Designed-for-Recycling polyurethane (PU) foam technology, enabling simplified and scalable recycling of PU foam. This next-generation flexible PU foam is 100% recyclable, allowing it to be repurposed as a raw material for new foams across industries such as footwear, automotive, and furniture. BASF’s breakthrough ensures mechanical recyclability, maintaining performance even after multiple recycling cycles. The technology supports circular economy principles, reducing waste and environmental impact while enhancing sustainability in polyurethane applications

- In February 2024, Pregis introduced an advanced foam technology, incorporating certified circular polyethylene resins through a collaboration with ExxonMobil, a leader in advanced recycling technology. This innovation enhances sustainability in protective packaging, helping brands meet plastics circularity goals while maintaining high-performance foam properties. The foam is produced at Pregis’ ISCC PLUS-certified facilities, ensuring responsible sourcing and environmental impact reduction. ExxonMobil’s Exxtend technology plays a key role in enabling more circular plastic solutions. This partnership underscores their commitment to eco-friendly packaging advancements

- In January 2024, Lutz Group collaborated with Stora Enso to explore bio-based foam solutions aimed at transforming the furniture packaging industry. This partnership focuses on sustainable alternatives to conventional polymeric foams, introducing Papira® and Fibrease®, lightweight wood-based materials that offer recyclability and reduced CO₂ emissions. These innovative foams provide shock absorption and insulation, making them ideal for eco-conscious packaging applications. The initiative aligns with industry efforts to reduce environmental impact while maintaining high-performance protective packaging

- In November 2023, DAP revolutionized spray foam application with the launch of Wall & Cavity Foam with Wide Spray Applicator, the first 1-component broadcast spray foam. This innovative product delivers the performance of 2-component foams while eliminating mix ratio concerns, making air-sealing and insulating effortless. The patent-pending wide spray applicator ensures broad coverage, ideal for wall cavities, rim joists, and attics. Featuring Class A fire rating, high closed-cell structure, and a wide temperature range (40°F - 120°F), it enhances energy efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Spray Polyurethanes Foam Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Spray Polyurethanes Foam Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Spray Polyurethanes Foam Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.