Global Spring Water Market

Market Size in USD Billion

CAGR :

%

USD

76.82 Billion

USD

156.53 Billion

2025

2033

USD

76.82 Billion

USD

156.53 Billion

2025

2033

| 2026 –2033 | |

| USD 76.82 Billion | |

| USD 156.53 Billion | |

|

|

|

|

Spring Water Market Size

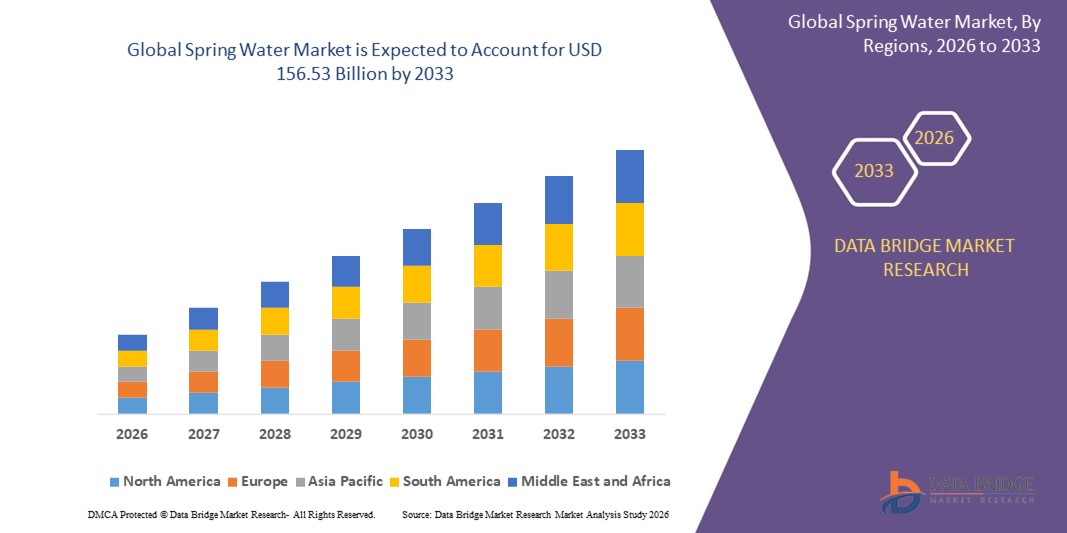

- The global spring water market size was valued at USD 76.82 billion in 2025 and is expected to reach USD 156.53 billion by 2033, at a CAGR of 9.85% during the forecast period

- The market growth is largely fuelled by the rising consumer preference for healthy and natural beverages, increasing awareness about hydration, and growing demand for packaged drinking water

- The expansion of retail and e-commerce channels, along with innovations in packaging such as eco-friendly bottles, is further supporting market growth

Spring Water Market Analysis

- The global spring water market is witnessing strong growth due to a shift towards natural and mineral-rich water as a preferred hydration source

- Factors such as rising disposable incomes, greater access to packaged beverages, and growing tourism and hospitality sectors are contributing to increased demand

- North America dominated the spring water market with the largest revenue share of 28.45% in 2025, driven by rising health awareness, growing urban populations, and increasing demand for convenient and safe hydration options

- Asia-Pacific region is expected to witness the highest growth rate in the global spring water market, driven by rapid population growth, rising disposable incomes, growing demand for safe and premium hydration options, and increasing penetration of organized retail and online channels

- The still bottled water segment held the largest market revenue share in 2025, driven by its high consumption in households, offices, and the hospitality sector. It is widely preferred for daily hydration due to its natural taste, convenience, and widespread availability

Report Scope and Spring Water Market Segmentation

|

Attributes |

Spring Water Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Spring Water Market Trends

Rise of Premiumization and Health-Oriented Consumption

- The growing preference for premium and natural spring water is transforming the beverage landscape by offering consumers perceived health benefits and superior taste. Bottled spring water, sourced from protected aquifers, provides mineral-rich hydration, catering to health-conscious consumers and premium beverage markets. This trend is also encouraging brands to differentiate themselves through labeling, certifications, and unique sourcing stories, increasing consumer trust and brand loyalty

- The increasing demand for convenient and on-the-go hydration is accelerating the adoption of single-serve and portable spring water packaging. These formats are particularly appealing in urban and semi-urban areas, supporting lifestyle trends and encouraging frequent consumption. Retailers and e-commerce platforms are responding by offering multipacks and subscription models, enhancing availability and ease of access for consumers

- The affordability, availability, and variety of flavored and enhanced spring water products are making them attractive for daily hydration. Consumers benefit from choices that align with taste preferences and wellness goals, while manufacturers capitalize on premium pricing and brand differentiation. In addition, marketing campaigns highlighting functional benefits such as detox, energy, and hydration boost consumer engagement and sales

- For instance, in 2023, several European and North American spring water brands reported higher sales volumes following the launch of mineral-rich and flavored water variants, reflecting consumer preference for functional hydration. These launches also fostered collaborations with fitness, wellness, and hospitality sectors, further expanding market reach

- While premiumization and convenience are driving market growth, continued innovation in packaging, flavor development, and sustainability practices will be key to sustaining long-term expansion. Investment in eco-friendly packaging, smart labeling, and fortified products will remain a differentiator for leading brands in competitive markets

Spring Water Market Dynamics

Driver

Rising Health Awareness and Increasing Urbanization

- Increasing health consciousness among consumers is pushing producers and retailers to prioritize natural and mineral-rich spring water products. Products supporting hydration, digestion, and overall wellness are driving strong demand globally. Consumers are also increasingly seeking verified certifications and quality assurances, which reinforces brand credibility and repeat purchases

- Rapid urbanization and busier lifestyles are creating a need for convenient, ready-to-consume bottled water, increasing penetration in retail, convenience stores, and online channels. The trend is supported by growing disposable incomes and expanding retail infrastructure, making premium bottled water more accessible to urban populations

- Beverage manufacturers are investing in product innovation, such as functional waters with added electrolytes or vitamins, to strengthen brand loyalty and attract health-conscious consumers. New product launches often leverage health claims, sustainable packaging, and premium branding to capture a larger share of the health-conscious consumer segment

- For instance, in 2022, several U.S. and European brands launched enhanced spring water variants enriched with minerals and electrolytes, boosting market uptake and reinforcing premium product positioning. Collaborative campaigns with wellness influencers and sports events further accelerated consumer adoption and brand visibility

- While health trends and convenience drive consumption, ensuring product quality, regulatory compliance, and sustainable sourcing is essential for sustained growth. Companies that integrate traceability, eco-certifications, and transparent marketing are likely to capture a larger share of the growing health-conscious market

Restraint/Challenge

High Cost of Premium Water and Environmental Concerns

- The higher price of premium spring water compared with tap water limits adoption among price-sensitive consumers, particularly in developing regions, restricting market penetration. Consumers in these regions may prioritize affordability over quality, creating challenges for premium brands looking to expand internationally

- Environmental concerns regarding plastic waste and carbon footprint of bottled water production and distribution are pressuring companies to adopt sustainable packaging and eco-friendly practices. Brands that fail to innovate in biodegradable, recyclable, or reusable packaging risk reputational damage and regulatory penalties, impacting sales and profitability

- Supply chain challenges, including sourcing from protected springs and managing distribution logistics, can impact availability and consistent product quality. Natural variations in water mineral composition and transportation bottlenecks can create supply inconsistencies, affecting brand reliability and customer trust

- For instance, in 2023, several brands in Asia-Pacific faced increased scrutiny and consumer backlash over single-use plastic packaging, prompting investment in recyclable and biodegradable bottles. In addition, some regions implemented stricter regulations on spring water sourcing, adding compliance costs and operational complexities

- While consumer demand for premium water is strong, addressing cost, sustainability, and supply chain efficiency remains critical to unlocking the market’s full potential. Companies investing in innovative water sourcing, energy-efficient production, and circular packaging models are likely to lead the market in the coming years

Spring Water Market Scope

The spring water market is segmented into several notable categories based on category, product, quality, origin of product, raw material, pack size, distribution channel, and end user packaging

- By Product

On the basis of product, the market is segmented into still bottled water, packaged drinking water, functional water bottle, flavored bottled water, distilled bottled water, and carbonated bottled water. The still bottled water segment held the largest market revenue share in 2025, driven by its high consumption in households, offices, and the hospitality sector. It is widely preferred for daily hydration due to its natural taste, convenience, and widespread availability.

The functional water bottle segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer interest in health-oriented beverages enriched with electrolytes, minerals, and vitamins. Functional water products appeal to active and health-conscious consumers seeking enhanced hydration and wellness benefits.

- By Quality

On the basis of quality, the market is segmented into premium and non-premium. The premium segment held the largest market revenue share in 2025, fueled by rising consumer preference for mineral-rich and high-quality bottled water. Premium water products are associated with better taste, purity, and health benefits, making them popular among affluent and health-conscious consumers.

The non-premium segment is expected to witness the fastest growth rate from 2026 to 2033, driven by affordability and increasing availability in mass retail channels. Non-premium water is particularly popular in emerging markets where cost and accessibility are key factors for consumers.

- By Origin of Product

On the basis of origin, the market is segmented into imported and domestic. The domestic segment held the largest market revenue share in 2025 due to lower transportation costs, easier regulatory compliance, and strong brand presence. Consumers prefer locally sourced spring water for its availability and reliability in quality.

The imported segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising consumer perception of superior quality and exotic sourcing. Imported spring water is gaining traction in premium segments and urban markets with high disposable incomes.

- By Raw Material

On the basis of raw material, the market is segmented into polyethylene terephthalate (PET) and glass. The PET segment held the largest market revenue share in 2025 due to its lightweight, cost-effectiveness, and convenience for on-the-go consumption. PET bottles are widely used across retail and vending channels.

The glass segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for eco-friendly, reusable, and premium packaging. Glass bottles appeal to environmentally conscious consumers and enhance brand perception in the premium water segment.

- By Pack Size

On the basis of pack size, the market is segmented into 1501 ml and above, 1001 ml - 1500 ml, 501 ml - 1000 ml, 331 ml - 500 ml, and 330 ml. The 501 ml - 1000 ml segment held the largest market revenue share in 2025 due to its convenience for individual consumption and suitability for daily use at home, office, and schools.

The 330 ml segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for on-the-go hydration, travel-friendly packaging, and growing sales in convenience stores and vending machines.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into store-based and non-store-based. The store-based segment held the largest market revenue share in 2025, driven by the presence of supermarkets, hypermarkets, and convenience stores offering wide brand selections and easy access to consumers.

The non-store-based segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising e-commerce penetration, online grocery shopping, and home delivery services. Non-store channels are increasingly preferred for convenience and subscription-based purchases.

- By End User Packaging

On the basis of end user packaging, the market is segmented into plastic bottle, glass bottle, drum (bulk), and can. The plastic bottle segment held the largest market revenue share in 2025 due to convenience, affordability, and high consumer adoption across all age groups.

The glass bottle segment is expected to witness the fastest growth rate from 2026 to 2033, driven by premium positioning, sustainability benefits, and increasing consumer preference for reusable and eco-friendly packaging in high-end markets.

Spring Water Market Regional Analysis

- North America dominated the spring water market with the largest revenue share of 28.45% in 2025, driven by rising health awareness, growing urban populations, and increasing demand for convenient and safe hydration options

- Consumers in the region highly value premium and natural spring water, with preferences for mineral-rich, functional, and flavored variants. The availability of diverse packaging formats and single-serve options further supports consumption

- This widespread adoption is supported by high disposable incomes, well-established retail and e-commerce channels, and growing interest in sustainable packaging, establishing spring water as a preferred beverage choice across residential and commercial segments.

U.S. Spring Water Market Insight

The U.S. spring water market captured the largest revenue share in 2025 within North America, fueled by the rapid adoption of premium, functional, and flavored water products. Consumers increasingly prioritize health and wellness benefits, such as hydration, mineral intake, and enhanced electrolytes. The popularity of on-the-go packaging formats and online distribution channels further propels market growth. Moreover, the integration of sustainability initiatives, including recyclable and eco-friendly bottles, is significantly contributing to market expansion.

Europe Spring Water Market Insight

The Europe spring water market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by high consumer preference for natural and premium bottled water, coupled with stringent food safety and labeling regulations. Urbanization and increased disposable income are fostering higher consumption. European consumers are also attracted to functional and flavored water variants. The market is experiencing growth across retail, convenience stores, and online channels, with an emphasis on sustainable and recyclable packaging.

U.K. Spring Water Market Insight

The U.K. spring water market is expected to witness strong growth from 2026 to 2033, driven by the rising trend of health-conscious consumption and convenience-oriented lifestyles. Concerns about hydration, wellness, and sugar intake are pushing consumers toward bottled spring water. The adoption of sustainable packaging and innovative formats, including single-serve bottles and flavored options, is further stimulating demand. Robust retail infrastructure and e-commerce penetration are key factors supporting market expansion.

Germany Spring Water Market Insight

The Germany spring water market is expected to witness notable growth from 2026 to 2033, fueled by increasing awareness of health and wellness, environmental concerns, and demand for premium and functional water products. Germany’s well-established retail networks, combined with strong government emphasis on sustainable practices, promote the adoption of recyclable and eco-friendly packaging. Consumers are increasingly opting for mineral-rich and flavored water, with a preference for quality and safety.

Asia-Pacific Spring Water Market Insight

The Asia-Pacific spring water market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and growing health awareness in countries such as China, India, and Japan. The expanding middle class, coupled with the popularity of on-the-go and single-serve packaging formats, is driving adoption. Government initiatives promoting safe drinking water and the growing presence of domestic and international brands are further supporting market expansion.

Japan Spring Water Market Insight

The Japan spring water market is expected to witness strong growth from 2026 to 2033 due to the country’s health-conscious population, aging demographics, and increasing preference for convenient hydration. Consumers prioritize functional, mineral-rich, and flavored water options. The adoption of compact, single-serve packaging and eco-friendly materials is also rising. Moreover, the integration of bottled spring water into retail, vending, and e-commerce channels is fueling market growth.

China Spring Water Market Insight

The China spring water market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly growing middle class, urbanization, and high rates of health and wellness awareness. Spring water consumption is increasing across residential, commercial, and institutional segments. The demand for premium, flavored, and functional bottled water is rising, supported by government emphasis on safe drinking water and the availability of domestic brands offering affordable and sustainable packaging options.

Spring Water Market Share

The Spring Water industry is primarily led by well-established companies, including:

- Nestlé (Switzerland)

- PepsiCo, Inc. (U.S.)

- The Coca-Cola Company (U.S.)

- DANONE (France)

- Primo Water Corporation (U.S.)

- FIJI Water Company LLC (U.S.)

- GEROLSTEINER BRUNNEN GMBH & CO. KG (Germany)

- VOSS WATER (Norway)

- RHODIUS Mineralquellen und Getränke GmbH & Co. KG (Germany)

- CG Roxane, LLC (U.S.)

- Vichy Catalan Corporation (Spain)

- Himalayan (India)

- Mountain Valley Spring Water (U.S.)

- Bisleri International Pvt. Ltd. (India)

- SANPELLEGRINO (Italy)

- LaCroix Beverages, Inc. (U.S.)

- SUNTORY HOLDINGS LIMITED (Japan)

- A.G. Barr (U.K.)

- Ferrarelle (Italy)

- Keurig Dr Pepper Inc. (U.S.)

Latest Developments in Global Spring Water Market

- In April 2025, RAIN Pure Mountain Spring Water, a U.S.-based brand, launched a 24-pack of aluminum-bottled spring water aimed at eco-conscious consumers. This initiative expands the brand’s presence across major U.S. retailers, including Kroger, Smart & Final, and West Marine, promoting sustainable packaging while meeting growing demand for environmentally friendly hydration options. The move strengthens market positioning by combining convenience with eco-responsibility, appealing to health- and sustainability-focused consumers

- In October 2024, Water Almighty, a North American beverage company, unveiled two new aluminum-bottled spring water products: Mighty Pure, a triple-purified spring water, and Mighty Minerals, enriched with seven essential minerals. These offerings emphasize sustainability and functional benefits, targeting consumers seeking both health and environmentally responsible packaging. The launch enhances brand differentiation and drives growth in the premium spring water segment

- In October 2024, Flow Beverage Corp., a Canadian company, introduced Flow Sparkling Mineral Spring Water in 300ml aluminum bottles with flavors such as OG, Blackberry + Hibiscus, Lemon + Ginger, and Cucumber + Mint. The bottles use 70% recycled aluminum, supporting eco-friendly initiatives while offering flavorful, convenient hydration options. This launch strengthens Flow’s market appeal among sustainability-conscious and flavor-driven consumers, expanding its footprint in the premium bottled water segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.